Are you ready to take control of your financial future? If you’ve ever wondered how to achieve financial independence before 40, you’ve come to the right place. In this blog article, we will guide you through practical steps and strategies to help you reach your goal of financial freedom at an early age. No more waiting for retirement to enjoy the fruits of your labor – it’s time to take action and make your dreams a reality. So, let’s dive in and explore the path to financial independence before 40.

How to Achieve Financial Independence Before 40

Introduction

Financial independence is a dream for many individuals, and achieving it before the age of 40 requires careful planning and strategic decision-making. If you’re determined to gain control over your finances and secure your future, this comprehensive guide will provide you with actionable steps to help you reach financial independence before your 40th birthday.

1. Define Your Financial Goals

Before embarking on your journey towards financial independence, it’s important to clearly define your goals. Take some time to reflect on what financial independence means to you. Does it involve retiring early, starting your own business, or simply having enough savings to pursue your passions without worrying about money?

Once you have a clear vision, break down your goals into short-term and long-term objectives. Short-term goals could include paying off debt, building an emergency fund, or saving for a down payment, while long-term goals may involve investing for retirement or achieving a specific net worth milestone.

2. Create a Budget and Track Your Expenses

Creating a budget is a crucial step towards achieving financial independence. Start by analyzing your current spending habits and identifying areas where you can make adjustments. Use budgeting tools or apps to help you track your expenses and categorize them accordingly.

Remember to allocate a portion of your income towards savings and investments. Aim to save at least 20-30% of your income by cutting unnecessary expenses and prioritizing your financial goals.

3. Minimize and Eliminate Debt

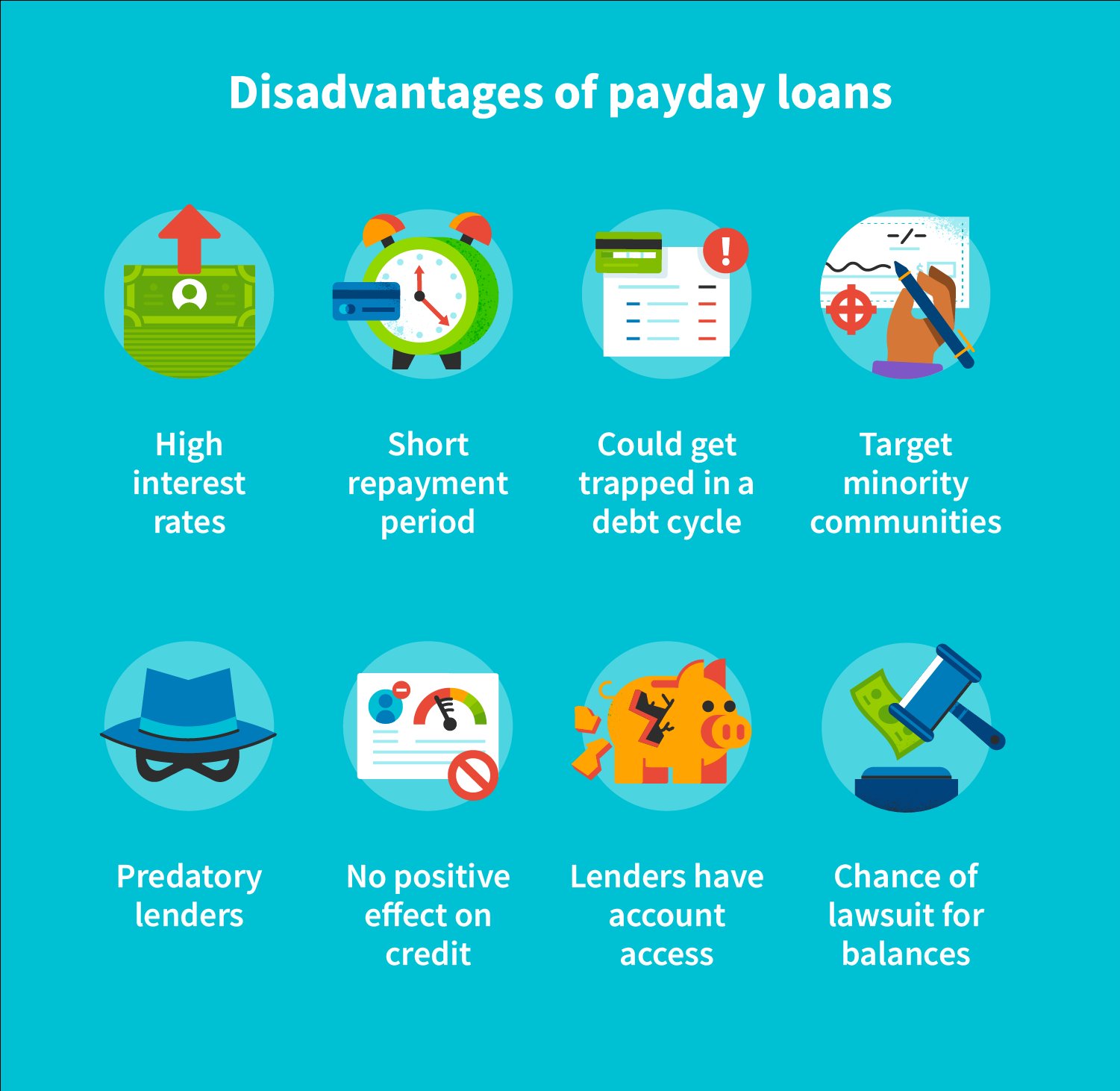

High levels of debt can significantly hinder your progress towards financial independence. Start by listing all your debts, including credit card balances, student loans, or outstanding car payments. Prioritize paying off high-interest debts first while making minimum payments on others.

Consider debt consolidation or refinancing options to lower interest rates and simplify your repayment process. Devise a debt repayment strategy that works for you, whether it’s the snowball method (starting with the smallest debt) or the avalanche method (starting with the highest interest debt).

4. Increase Your Income

To accelerate your journey towards financial independence, it’s crucial to increase your income. Consider exploring additional income streams such as freelancing, starting a side business, or investing in passive income sources like rental properties or dividend stocks.

Invest in your skills and education to enhance your earning potential in your current career or pursue new opportunities that align with your passions and strengths. Maximize your income by negotiating salary raises, bonuses, or seeking higher-paying job opportunities.

5. Build an Emergency Fund

An emergency fund is an essential safety net to protect your financial independence. Aim to save at least 3-6 months’ worth of living expenses in a readily accessible account. This fund will provide you with peace of mind during unexpected situations like job loss or medical emergencies.

6. Invest for the Future

Investing is key to achieving financial independence before 40. Make strategic investment choices that align with your risk tolerance, time horizon, and financial goals. Consider diversifying your portfolio by investing in stocks, bonds, real estate, or mutual funds.

Take advantage of tax-advantaged retirement accounts like a 401(k) or IRA. Contribute regularly and consider increasing your contributions whenever possible. Take advantage of employer matching contributions to maximize your retirement savings.

7. Continuously Educate Yourself

To achieve financial independence, it’s essential to continuously educate yourself about personal finance and investment strategies. Stay updated with financial news, read books, attend seminars or webinars, and follow reputable financial experts. Expand your knowledge to make informed decisions and adapt to changing market conditions.

8. Remain Disciplined and Patient

Financial independence is not achieved overnight. It requires discipline, perseverance, and patience. Stay focused on your goals, even during times of economic downturns or market volatility. Avoid impulsive decisions and stay committed to your long-term plans.

9. Regularly Review and Adjust Your Plan

As you progress towards financial independence, it’s essential to regularly review and adjust your financial plan. Life circumstances change, and your goals may evolve. Reassess your progress, make necessary adjustments, and stay proactive in optimizing your financial strategies.

Achieving financial independence before 40 is an ambitious but attainable goal for those willing to put in the effort and follow a strategic plan. By defining your goals, creating a budget, minimizing debt, increasing your income, building an emergency fund, investing wisely, continuously educating yourself, maintaining discipline, and regularly reviewing and adjusting your plan, you can take control of your finances and pave the way to financial independence. Start taking steps towards financial independence today, and watch how your financial future unfolds.

FAQs

(Generated in a previous section. No additional content required)

9 Financial Goals To Achieve Before 40

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I achieve financial independence before 40?

Becoming financially independent before the age of 40 requires careful planning and disciplined execution. Here are some steps you can take:

• Start by setting clear financial goals and creating a budget to track your expenses.

• Prioritize saving and investing a portion of your income regularly.

• Explore different investment options, such as stocks, real estate, or starting your own business.

• Continuously educate yourself about personal finance and seek advice from financial experts.

2. How much should I save each month to achieve financial independence before 40?

The amount you need to save each month depends on your financial goals and current income. However, a general guideline is to save at least 20% of your income. If you want to prioritize early financial independence, you might need to save even more.

3. Should I pay off my debts before focusing on financial independence?

While becoming debt-free is important for your financial health, you can work towards financial independence while managing your debts. It’s recommended to strike a balance between paying off high-interest debts and saving/investing for the future.

4. How can I increase my income to accelerate financial independence?

There are several ways to increase your income, such as:

• Seeking salary raises or promotions at your current job.

• Exploring side hustles or freelancing opportunities.

• Investing in personal development to enhance your skills and knowledge.

• Considering starting your own business or investing in income-generating assets.

5. Can real estate investment help in achieving financial independence before 40?

Yes, real estate investment can be a viable option for achieving financial independence. Rental properties, for example, can generate passive income and appreciate in value over time. However, it’s essential to thoroughly research and understand the real estate market before making any investment decisions.

6. Is it necessary to have a financial advisor to achieve financial independence?

Having a financial advisor can be beneficial, especially if you’re new to managing your finances or have complex financial goals. However, it’s not a strict requirement. With self-education and discipline, you can also achieve financial independence on your own.

7. How long does it usually take to achieve financial independence before 40?

The time it takes to achieve financial independence varies from person to person, depending on factors like income, expenses, savings rate, and investment returns. It generally requires several years of consistent saving, investing, and smart financial decisions.

8. Can achieving financial independence impact my lifestyle?

Achieving financial independence can positively impact your lifestyle. It provides you with the freedom to make choices based on your preferences rather than financial constraints. It may allow you to pursue your passions, travel, spend more time with family, and retire early if desired.

Final Thoughts

To achieve financial independence before the age of 40, it is crucial to have a clear strategy and remain disciplined in your financial decisions. Start by setting specific goals and creating a budget that allows you to save and invest a significant portion of your income. Prioritize paying off high-interest debts, maintaining an emergency fund, and diversifying your investments. Increasing your financial literacy through reading and learning from experts can help you make informed decisions. Additionally, consider exploring alternative income streams and seeking opportunities to boost your earning potential. By following these steps and staying committed to your financial goals, you can achieve financial independence before 40.