Looking for a practical solution on how to allocate spending in a household budget? You’ve come to the right place! Managing your finances may seem daunting, but with the right approach, it can become a seamless part of your daily life. By understanding where your money is going and making thoughtful choices, you can ensure that your hard-earned income is being utilized effectively. In this article, we’ll dive into some essential tips and strategies to help you allocate your spending in a household budget. Let’s get started!

How to Allocate Spending in a Household Budget

Managing finances can sometimes be a challenging task, especially when it comes to budgeting. Allocating spending in a household budget requires careful planning and decision-making to ensure that you meet your financial goals while still enjoying a comfortable lifestyle. In this article, we will explore effective strategies and practical tips for allocating spending in a household budget, enabling you to make the most out of your hard-earned money.

1. Determine Your Income and Expenses

To effectively allocate spending in your household budget, start by identifying your income sources and tracking your expenses. This fundamental step will provide a clear overview of your financial situation and help you understand how much money you have available to allocate. Consider the following substeps:

1.1 Calculate Your Income

Take into account all sources of income, including salaries, wages, freelance work, investments, and any other reliable sources. Add up these amounts to determine your total monthly income.

1.2 Track Your Expenses

Create a detailed record of your monthly expenses. This includes bills, groceries, transportation costs, debt payments, entertainment, and any other regular expenses. Make use of financial tracking apps or spreadsheets to keep all your expenses organized.

1.3 Analyze Your Spending Habits

Review your expense records to identify spending patterns and areas where you can potentially cut back. Look for any unnecessary expenses or areas where you might be overspending. This analysis will help you make informed decisions when it comes to allocating your budget.

2. Set Financial Goals

Setting financial goals is a crucial step in effectively allocating your spending. By having clear objectives, you can prioritize your expenses and make intentional choices that align with your financial aspirations. Consider these substeps:

2.1 Determine Short-Term and Long-Term Goals

Identify both short-term and long-term financial goals. Short-term goals may include saving for a vacation or paying off a debt, while long-term goals could be creating an emergency fund, saving for retirement, or buying a home. Prioritize these goals based on their importance and urgency.

2.2 Assign a Monetary Value to Each Goal

Assign a monetary value to each of your financial goals and establish a timeline for achieving them. This step will help you understand how much money you need to allocate toward each goal and how long it will take to accomplish them.

2.3 Adjust Your Budget According to Your Goals

Review your budget and make necessary adjustments to accommodate your financial goals. Consider reallocating funds from lower-priority areas to effectively save or invest towards your goals. Regularly monitoring your progress will help you stay on track and make any necessary revisions.

3. Prioritize Essential Expenses

When allocating spending in your household budget, it’s important to prioritize essential expenses. These are the expenses that are necessary for your basic needs and cannot be easily eliminated. Follow these substeps to prioritize essential expenses:

3.1 Identify Your Non-Negotiable Expenses

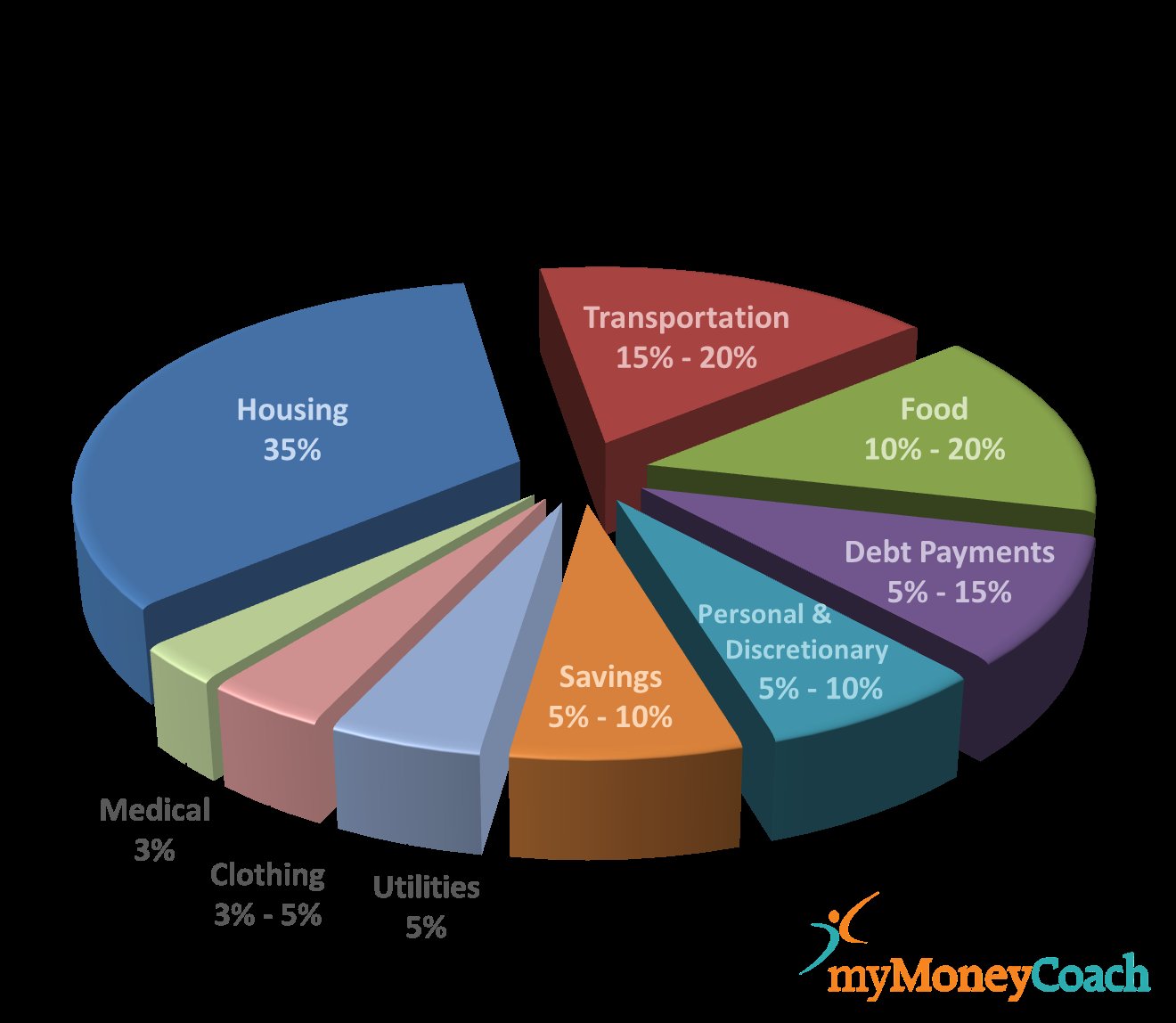

Identify expenses that are crucial for your well-being and cannot be compromised. This typically includes housing costs (rent or mortgage payments), utilities, food, transportation, healthcare, and insurance. These expenses should be prioritized first when allocating your budget.

3.2 Separate Fixed and Variable Expenses

Differentiate between fixed and variable expenses. Fixed expenses are recurring costs that remain relatively constant each month, such as rent or mortgage payments, while variable expenses fluctuate based on usage, such as groceries or utility bills. Understanding this distinction will allow you to allocate funds more effectively.

3.3 Consider Affordability and Necessity

Assess the affordability and necessity of each expense. While some costs may be essential, you may still have the opportunity to optimize and reduce them. For example, you can save on utility bills by conserving energy or reduce grocery expenses by meal planning and buying in bulk.

4. Allocate Funds for Debt Repayment

Debt repayment should be a priority in your budget allocation strategy. By effectively managing your debts, you can minimize interest charges and work towards your long-term financial goals. Follow these substeps to allocate funds for debt repayment:

4.1 List and Prioritize Your Debts

Make a comprehensive list of all your debts, including credit cards, loans, and outstanding balances. Prioritize your debts based on interest rates and outstanding balances. Start by allocating more funds towards high-interest debts to reduce their impact on your budget.

4.2 Create a Debt Repayment Plan

Develop a debt repayment plan that outlines how much money you will allocate towards each debt with each monthly payment. Consider utilizing the debt snowball or debt avalanche method to strategically pay off your debts. This enables you to stay focused and motivated as you see your debts being gradually eliminated.

4.3 Reassess Your Budget Regularly

As you make progress in repaying your debts, regularly reassess your budget to make sure your debt repayment plan aligns with your overall financial goals. Adjust your debt allocation as needed and celebrate each milestone along the way.

5. Allocate for Savings and Investments

Building savings and investments is essential for long-term financial stability. By allocating funds towards savings and investments, you can create an emergency fund, plan for retirement, or achieve other financial objectives. Consider these substeps:

5.1 Determine Your Savings Goals

Identify your savings goals, such as creating an emergency fund or saving for a down payment on a house. Determine the amount of money you need to save and the desired timeline for achieving these goals.

5.2 Automate Your Savings

Set up automatic transfers from your checking account to a designated savings account. Automating your savings helps you stay consistent and committed to building your savings over time.

5.3 Consider Different Investment Options

Explore various investment options based on your risk tolerance and long-term financial goals. Research stocks, bonds, mutual funds, or real estate investment opportunities. Consult with a financial advisor to determine the best investment strategy for your specific circumstances.

5.4 Monitor and Adjust Your Savings and Investments

Regularly monitor the progress of your savings and investments. Make adjustments as needed based on changes in your financial situation and market conditions. Reassess your goals periodically to ensure they remain relevant and achievable.

6. Allocate for Discretionary Spending

While essential expenses, debt repayment, and savings take priority in budget allocation, it is also important to allocate funds for discretionary spending. This category includes non-essential expenses that contribute to your overall well-being and enjoyment. Consider the following substeps:

6.1 Set a Realistic Discretionary Spending Limit

Determine a reasonable amount of money that you can allocate towards discretionary spending without jeopardizing your financial goals. This amount should be based on your income, essential expenses, debt repayment obligations, and savings targets.

6.2 Identify Your Discretionary Spending Categories

Categorize different areas of discretionary spending, such as entertainment, dining out, shopping, hobbies, or vacations. This will aid in managing and balancing your discretionary spending across various areas of interest.

6.3 Prioritize and Plan Discretionary Expenses

Prioritize your discretionary expenses based on personal preferences and their impact on your overall well-being. Consider planning for special occasions or events well in advance to avoid overspending or going over budget.

6.4 Regularly Review and Adjust Discretionary Spending

Regularly review your discretionary spending to ensure it aligns with your financial goals and priorities. Make adjustments as necessary to avoid overspending or falling into unnecessary debt.

By following these effective strategies and practical tips, you can allocate spending in your household budget in a way that aligns with your financial goals. Remember to regularly review and adjust your budget to accommodate changes in your income, expenses, and priorities. With discipline and careful planning, you can take control of your finances and ensure a secure and prosperous future.

How To Manage Your Money (50/30/20 Rule)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How do I allocate spending in a household budget?

To allocate spending in a household budget, follow these steps:

What are the key components to consider when allocating spending in a household budget?

When allocating spending in a household budget, it is important to consider the following key components:

How should I prioritize expenses in my household budget?

To prioritize expenses in your household budget, consider the following:

Can you provide some tips for managing discretionary spending in a household budget?

Here are some tips for managing discretionary spending in a household budget:

Should I set aside money for savings in my household budget?

Yes, setting aside money for savings is an important aspect of a household budget. Consider the following:

How can I track my spending in a household budget?

To track your spending in a household budget, you can use the following methods:

What should I do if I consistently exceed my budget in certain categories?

If you consistently exceed your budget in certain categories, try the following strategies:

Is it necessary to revisit and adjust my household budget regularly?

Yes, it is necessary to revisit and adjust your household budget regularly. Here’s why:

Final Thoughts

In conclusion, effectively managing a household budget requires careful allocation of spending. By prioritizing essential expenses, such as housing, transportation, and groceries, individuals can ensure their basic needs are met without overspending. Setting financial goals and creating a budget that aligns with those goals allows for proactive decision-making and smart spending choices. Additionally, tracking expenses and making adjustments as needed helps to maintain a balanced budget and avoid unnecessary debt. By following these strategies, individuals can successfully allocate their spending in a household budget.