Are you searching for ways to navigate the complex world of estate planning and ensure a smooth transfer of assets to your loved ones? Look no further! In this article, we will explore a simple yet effective solution: avoiding probate through estate planning. By strategically organizing your assets and creating a comprehensive plan, you can minimize the time, costs, and potential disputes associated with the probate process. Let’s delve into the practical steps you can take to protect your legacy and provide for your beneficiaries seamlessly.

How to Avoid Probate through Estate Planning

What is Probate?

Probate is the legal process of administering a deceased person’s estate, which involves validating their will, inventorying assets, paying debts and taxes, and distributing remaining property to beneficiaries. However, probate can be a time-consuming and costly process. It can take months or even years to complete, and legal fees and court costs can quickly add up. Fortunately, with proper estate planning, you can take steps to avoid probate and make the transfer of assets smoother for your loved ones.

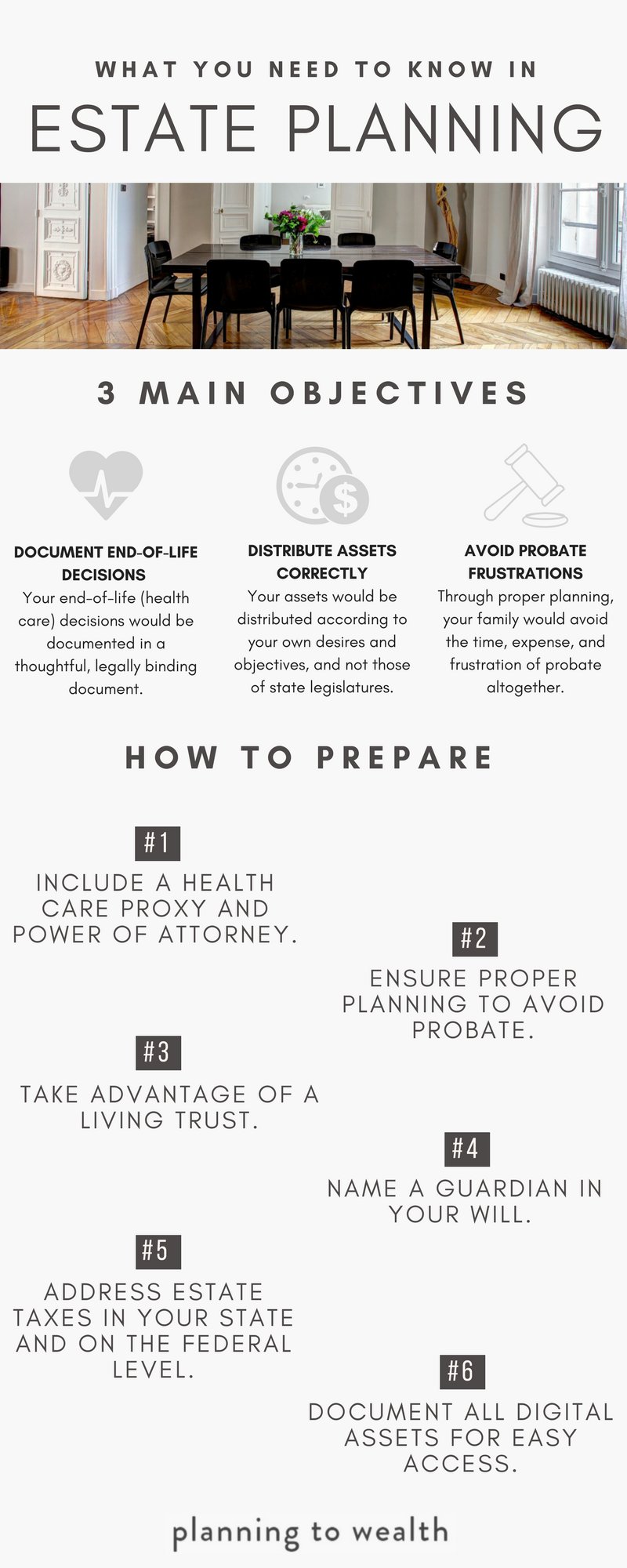

Understanding Estate Planning

Estate planning is the process of making decisions about how your assets will be managed and distributed after your death or incapacitation. It involves creating legal documents that outline your wishes and provide instructions for carrying them out. Proper estate planning ensures that your assets are protected, taxes are minimized, and your loved ones are taken care of according to your wishes. One of the primary goals of estate planning is to avoid probate whenever possible.

Methods to Avoid Probate

1. Establishing a Living Trust

A living trust is one of the most effective strategies to avoid probate. By transferring your assets into a trust, you technically no longer own them; instead, the trust becomes the legal owner. You can name yourself as the trustee, allowing you to maintain control over your assets during your lifetime. Upon your death, a successor trustee will distribute your assets to the beneficiaries you named in the trust document. Since the assets are not in your name, they do not go through probate.

2. Joint Ownership with Right of Survivorship

Holding assets jointly with right of survivorship is another way to avoid probate. When you own property, such as a house or bank account, with someone else, the ownership automatically passes to the surviving joint owner upon your death. This property transfer occurs outside of probate, as it is governed by the right of survivorship. However, this method requires careful consideration and planning to ensure that the joint ownership aligns with your estate planning goals.

3. Naming Beneficiaries

Certain assets, such as life insurance policies, retirement accounts, and payable-on-death bank accounts, allow you to designate beneficiaries. By naming specific individuals or organizations as beneficiaries, you ensure that these assets bypass the probate process and are directly transferred to your beneficiaries upon your death. Regularly review and update your beneficiary designations to ensure they align with your current wishes.

4. Gifting Assets

Another way to avoid probate is to gift your assets during your lifetime. By transferring ownership of assets to your intended beneficiaries, you can minimize the amount of property subject to probate. However, keep in mind that gifting assets may have tax implications, and it’s essential to consult with an attorney or tax professional to understand the potential consequences.

5. Payable-on-Death/Transfer-on-Death Accounts

Many financial institutions offer payable-on-death (POD) or transfer-on-death (TOD) accounts. These allow you to designate a specific beneficiary who will inherit the account upon your death. Similar to naming beneficiaries for retirement accounts, POD or TOD accounts avoid probate by transferring ownership directly to the designated individuals or organizations.

6. Small Estate Affidavit

In some jurisdictions, estates with relatively small values may qualify for a simplified probate procedure called a small estate affidavit. This process allows the heirs to claim the assets without going through a formal probate administration. The eligibility criteria and maximum estate value limits vary by state, so it’s crucial to consult local laws and regulations.

Consulting with an Estate Planning Attorney

While the above methods can be effective, it’s essential to consult with an experienced estate planning attorney to ensure your plans align with local laws and regulations. Estate planning is a complex process, and professional guidance can help you navigate the intricacies and make informed decisions. An attorney can review your assets, discuss your goals, and tailor a comprehensive plan that suits your needs.

Regularly Review and Update Your Estate Plan

As life circumstances change, it’s vital to review and update your estate plan. Major life events such as marriage, divorce, birth of a child, or the death of a loved one may require modifications to your plan. Regularly revisiting your estate plan ensures that it remains up to date and accurately reflects your wishes.

Through careful estate planning, you can reduce the stress, expenses, and delays associated with probate. Establishing a living trust, joint ownership with right of survivorship, beneficiary designations, gifting assets, utilizing payable-on-death/transfer-on-death accounts, and exploring small estate affidavits are all effective strategies to consider. However, it’s crucial to consult with an estate planning attorney to ensure that your plans align with legal requirements and any unique circumstances. By taking proactive steps and regularly reviewing your estate plan, you can provide peace of mind for yourself and your loved ones.

ESTATE PLANNING Basics: How To Avoid PROBATE And Why You Need One

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can estate planning help me avoid probate?

Estate planning allows you to transfer your assets to your beneficiaries outside of the probate process. By creating a comprehensive estate plan, including a will, trusts, and beneficiary designations, you can ensure that your assets are distributed according to your wishes without the need for probate.

2. What is probate, and why should I try to avoid it?

Probate is a legal process that occurs after someone passes away. It involves validating the deceased person’s will, settling outstanding debts, and distributing the assets to the beneficiaries. Avoiding probate is desirable because it can be time-consuming, expensive, and subject to public scrutiny.

3. Can a living trust help me avoid probate?

Yes, establishing a living trust is one of the most common estate planning strategies to avoid probate. By transferring your assets into a trust, you technically no longer own them personally, which means they do not have to go through probate. Instead, the trust assets can be distributed directly to your designated beneficiaries.

4. What is a payable-on-death (POD) designation, and how can it help me avoid probate?

A POD designation allows you to name beneficiaries for certain assets, such as bank accounts or investment accounts. Upon your death, these assets are automatically transferred to the designated beneficiaries without going through probate. This offers a simple and efficient way to avoid probate for those specific assets.

5. Are there any assets that cannot be included in a living trust?

While most assets can be included in a living trust, certain types, such as retirement accounts and life insurance policies, have their own beneficiary designations. These assets are distributed directly to the named beneficiaries outside of probate. It is important to review and update beneficiary designations regularly to ensure they align with your overall estate plan.

6. Can joint ownership with rights of survivorship help avoid probate?

Yes, joint ownership with rights of survivorship can help avoid probate for certain assets, such as real estate or bank accounts. When one co-owner passes away, the ownership automatically transfers to the surviving co-owner(s) without the need for probate.

7. What are some other estate planning strategies to avoid probate?

In addition to living trusts, POD designations, and joint ownership, other strategies include gifting assets during your lifetime, establishing a family limited partnership, and utilizing certain types of trusts like irrevocable life insurance trusts. Consulting with an estate planning attorney can help you determine the best strategies based on your specific circumstances.

8. Is avoiding probate always the best option?

Avoiding probate may not always be necessary or advantageous for everyone. In some situations, such as when the estate is small or the probate process is straightforward, the benefits of avoiding probate may not outweigh the costs or complexities of implementing certain strategies. It’s important to thoroughly assess your own circumstances and consult with a professional to make an informed decision.

Final Thoughts

In conclusion, estate planning is a crucial step in avoiding probate. By carefully crafting a comprehensive estate plan, individuals can ensure that their assets are distributed according to their wishes, minimizing the need for probate court involvement. Key strategies include establishing a revocable living trust, designating beneficiaries, and making use of joint ownership. Additionally, keeping estate planning documents up to date and regularly reviewing them is essential. By implementing these measures, individuals can effectively avoid probate and provide peace of mind for themselves and their loved ones. So, when it comes to avoiding probate through estate planning, following these steps is paramount.