Are you struggling to manage your annual subscription services within your budget? Look no further! In this article, we will guide you on how to effectively budget for annual subscription services without going overboard. With our simple yet practical tips, you’ll be able to gain control over your finances and enjoy the benefits of your favorite subscription services without any financial stress. So, let’s dive right in and discover how to budget for annual subscription services like a pro!

How to Budget for Annual Subscription Services

Introduction

In today’s digital age, annual subscription services have become increasingly popular. Whether it’s streaming platforms, online magazines, or software applications, subscribing to these services offers convenience and access to a wide range of content. However, managing multiple subscriptions can quickly become overwhelming, both financially and mentally. To avoid any surprises and keep your budget under control, it’s essential to plan and allocate funds for annual subscription services strategically. In this article, we will explore practical tips and strategies to help you budget effectively for these services.

1. Assess Your Current Subscriptions

Before diving into budgeting, it’s important to assess your current subscription services. Take stock of all the services you subscribe to and evaluate their value and usage. Ask yourself the following questions:

- Which subscriptions do you use frequently?

- Are there any subscriptions you rarely use?

- Do you have duplicate subscriptions that offer similar content?

- Can you downgrade or cancel any subscriptions without sacrificing essential services?

By understanding your existing subscriptions, you can make informed decisions about which ones to prioritize and where you can potentially cut back.

2. Set a Subscription Budget

Now that you have a clear picture of your current subscriptions, it’s time to set a budget specifically for annual subscription services. Follow these steps to create a realistic and effective budget:

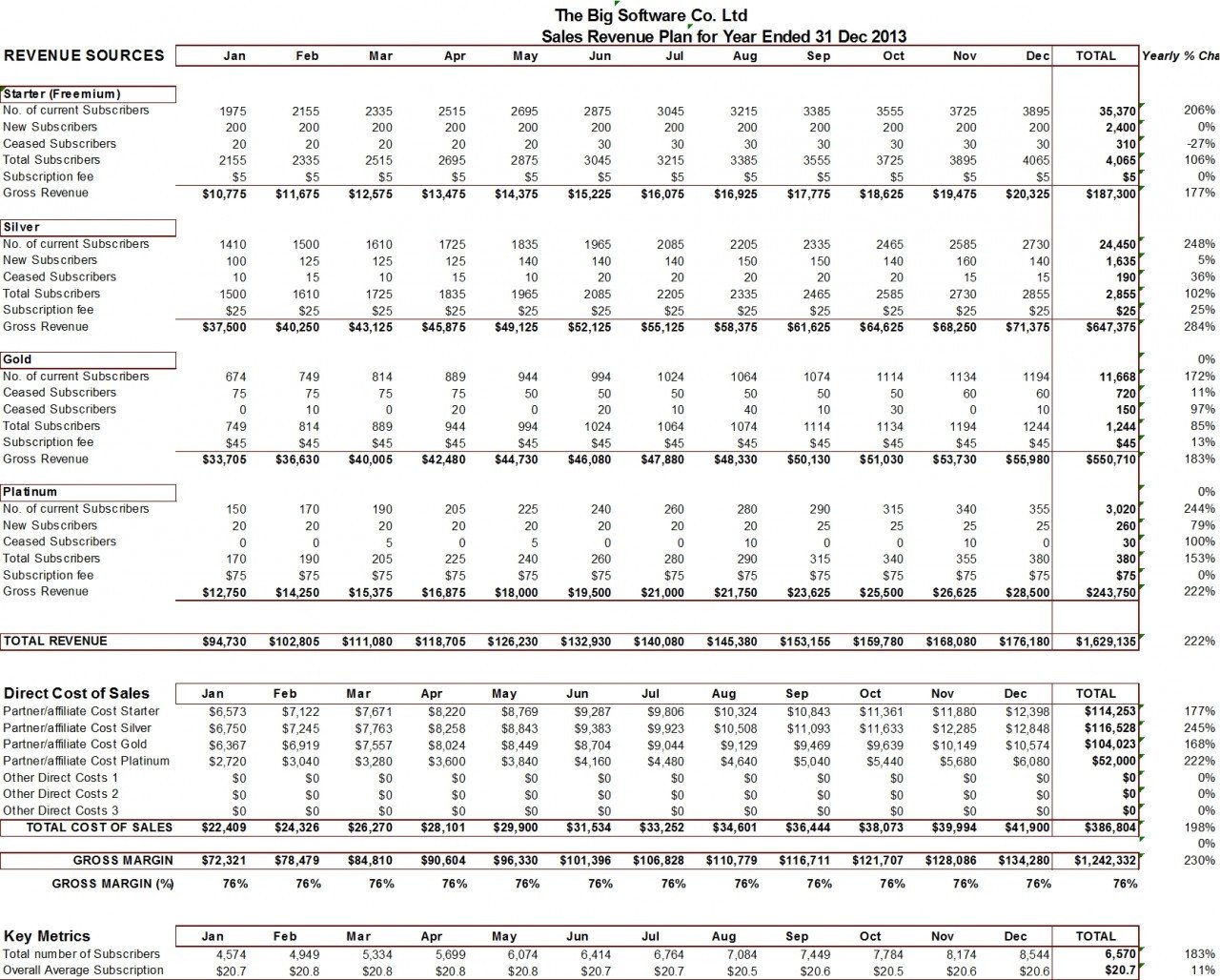

2.1 Calculate Your Current Subscription Costs

Start by calculating how much you currently spend on all your subscriptions in a year. Make a list of each service and its corresponding annual cost. This will give you a baseline to work with.

2.2 Determine Your Monthly Subscription Budget

Divide your total annual subscription costs by 12 to determine your monthly subscription budget. This amount will guide you in making decisions about new subscriptions or adjusting your existing ones.

2.3 Prioritize Your Subscriptions

Next, prioritize your subscriptions based on their importance and value to you. Allocate a portion of your monthly subscription budget to each service accordingly. Consider factors such as frequency of use, necessity, and overall satisfaction.

3. Research and Compare Subscription Options

When considering new subscription services, it’s crucial to research and compare options before committing. Follow these steps to ensure you make informed decisions:

3.1 Identify Your Needs and Interests

Define your specific needs and interests that can be met through subscription services. For example, if you are a movie enthusiast, streaming platforms might be a priority, while an avid reader may prefer online magazine subscriptions.

3.2 Explore Different Providers

Research the available providers that offer subscriptions in your areas of interest. Compare factors such as pricing, content offering, user reviews, and customer support. Look for providers that align with your budget and provide the best value for your money.

3.3 Take Advantage of Free Trials

Many subscription services offer free trial periods. Take advantage of these trials to assess the service’s features, user experience, and relevance to your needs. This way, you can make more informed decisions and avoid potential disappointments.

4. Negotiate and Explore Discounts

When it comes to annual subscription services, there’s often room for negotiation and discounts. Consider the following strategies to potentially lower your subscription costs:

4.1 Reach Out to Service Providers

Contact your existing subscription service providers and inquire about any available discounts or promotions. Sometimes, providers offer special rates for loyal customers or can provide insights on cost-saving options.

4.2 Bundle Services

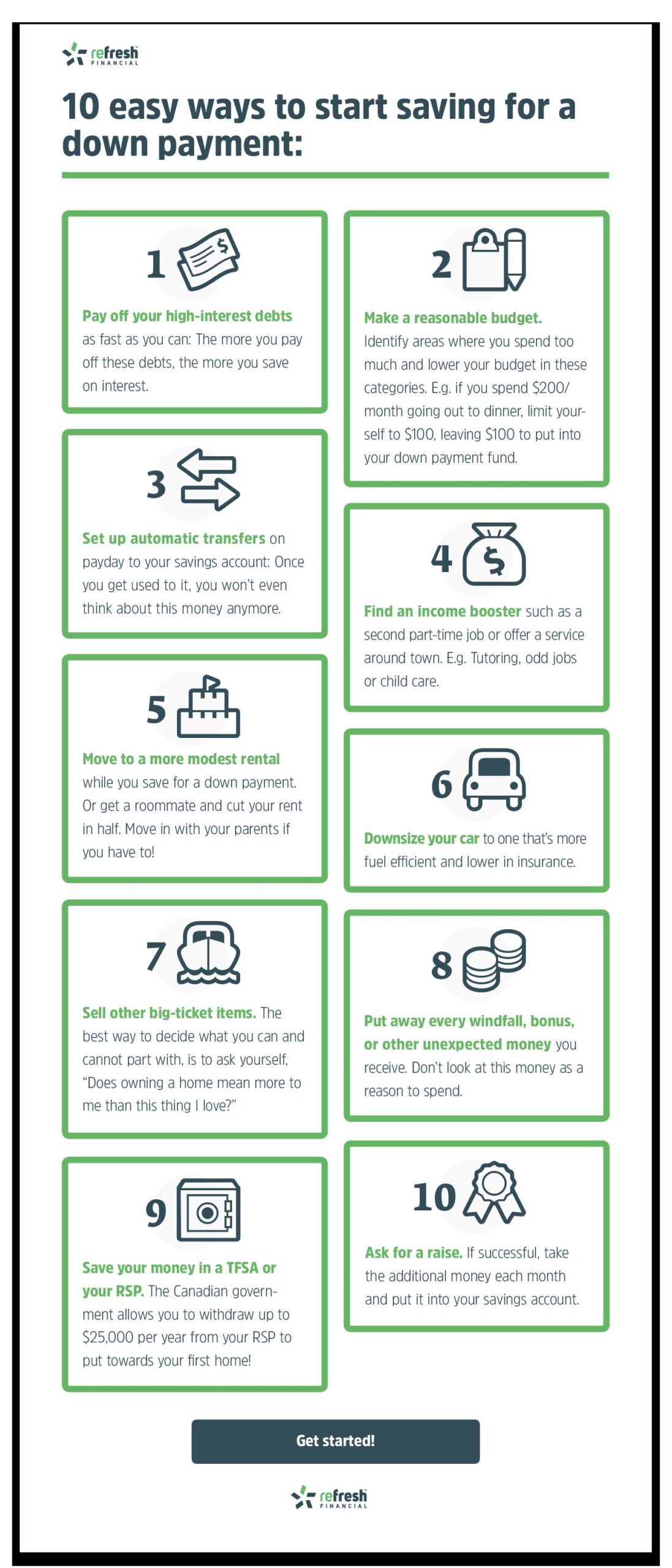

Look for opportunities to bundle multiple subscriptions into a single package. Many providers offer discounted rates when you combine services. However, ensure that the bundled services align with your interests and needs.

4.3 Timing Your Subscriptions

Keep an eye out for seasonal promotions, holiday discounts, or annual sales events. Timing your subscription renewals or new subscriptions strategically can help you secure better deals and save money.

4.4 Consider Family or Group Plans

If applicable, explore family or group plans offered by subscription services. These plans often allow multiple users to access the service at a lower cost per individual. Sharing with family or friends can help reduce expenses.

5. Regularly Review and Adjust Your Subscriptions

To maintain an effective annual subscription budget, it’s important to regularly review and adjust your subscriptions as needed. Here are some actions to take:

5.1 Monitor Your Usage

Periodically evaluate how frequently you use each subscription service. If you find that you’re not utilizing a particular service enough to justify its cost, consider downgrading or canceling it.

5.2 Seek Feedback

Engage with friends, family, or online communities to gather feedback on various subscription services. They may have insights or recommendations that can help you make informed decisions about your subscriptions.

5.3 Reallocate Your Budget

If you decide to cancel or downgrade a subscription, reallocate the saved funds to other areas of your budget or allocate them towards a subscription that provides more value.

5.4 Take Advantage of Trial Periods

When new subscriptions pique your interest, take advantage of trial periods to evaluate whether they are worth adding to your list. Be mindful of trial end dates to make informed decisions about continuing or canceling.

5.5 Regularly Check for Updates

Stay updated with any changes or updates to your existing subscriptions. Service providers may introduce new features, pricing plans, or limited-time offers that could impact your budgeting decisions.

6. Be Mindful of Automatic Renewals

Automatic renewals can catch you off guard and disrupt your budgeting efforts. Be sure to:

6.1 Track Renewal Dates

Maintain a calendar or use reminder apps to track subscription renewal dates. This way, you’ll be prepared to review and make decisions on renewals when the time comes.

6.2 Keep Payment Details Updated

Ensure that your payment details are up to date with each subscription service. This avoids unexpected interruptions in service and allows you to maintain control over your budget.

6.3 Set Renewal Reminders

Set reminders a few days before subscription renewals to give yourself time to review the service before making a payment. This ensures that you have the opportunity to assess the value and relevance of the subscription.

Budgeting for annual subscription services is essential to maintain control over your finances and ensure you get the most value out of your subscriptions. By assessing your current subscriptions, setting a budget, researching options, and regularly reviewing your subscriptions, you can make informed decisions and avoid overspending. Remember to negotiate and explore discounts, be mindful of automatic renewals, and always keep your budget in mind. With these strategies in place, you can enjoy the convenience and benefits of annual subscription services without breaking the bank.

Create an Annual Budget in 5 Minutes (Solution)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I budget for annual subscription services?

To budget for annual subscription services effectively, follow these steps:

- Identify the subscription services you need: Make a list of the essential subscription services you require for the year.

- Calculate the total cost: Find out the annual cost for each subscription service and add them up.

- Prioritize the subscriptions: Determine which subscriptions are necessary and which ones you can do without, if needed.

- Allocate funds: Allocate a specific amount in your budget for subscription services.

- Consider payment options: Evaluate whether paying upfront or monthly for each subscription is more affordable and convenient for your budget.

- Review and adjust: Regularly review your budget and make necessary adjustments to ensure you can cover all essential subscription services.

- Track expenses: Keep a record of all subscription service payments to monitor your spending.

- Explore alternatives: Look for free or less expensive alternatives to any non-essential subscriptions, saving money in the process.

How can I determine which subscription services are essential?

To determine which subscription services are essential:

- Assess your needs: Identify subscription services that directly support your personal or professional goals.

- Evaluate value: Consider how much you benefit from each subscription service in relation to its cost.

- Review usage frequency: Check how frequently you utilize each service and whether it justifies its cost over time.

- Consider alternatives: Explore if there are any similar free or lower-cost options available.

- Consider long-term commitments: Take into account any contracts or commitments you have with a service before considering its essentiality.

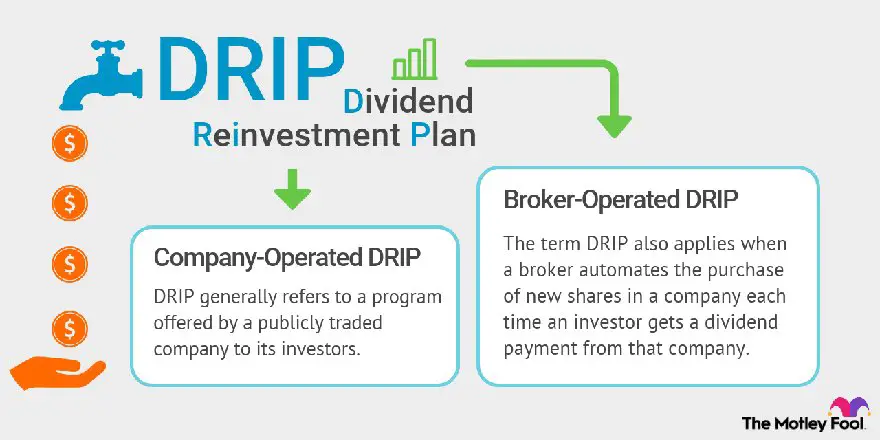

Should I pay for subscriptions annually or monthly?

Deciding whether to pay for subscriptions annually or monthly depends on your financial situation and preferences. Here are some factors to consider:

- Upfront cost: Paying annually usually has a higher upfront cost, while monthly payments spread the expense throughout the year.

- Budgeting convenience: Paying monthly can be more manageable if you prefer to distribute expenses evenly.

- Potential discounts: Some subscription services offer a discount for annual payments, so calculate if the discount justifies the upfront cost.

- Flexibility: Monthly payments provide more flexibility if you want to cancel or switch services without being locked in for a long period.

What should I do if I exceed my budget for subscription services?

If you exceed your budget for subscription services, consider taking the following steps:

- Review your expenses: Analyze where you overspent and identify any non-essential subscriptions.

- Eliminate non-essentials: Cancel or pause subscription services that are not crucial to your immediate needs or goals.

- Negotiate or switch plans: Contact service providers to negotiate lower rates or explore different subscription plans that better fit your budget.

- Find alternatives: Look for free or lower-cost alternatives to the subscription services you currently use.

- Adjust your budget: Reallocate funds from other categories in your budget to cover the excess subscription expenses.

- Create a repayment plan: If you accumulated debt due to overspending on subscriptions, create a repayment plan to gradually reduce it.

How can I track my subscription service expenses?

To track your subscription service expenses:

- Create a dedicated spreadsheet or use budgeting apps that allow you to input your subscription costs and track monthly payments.

- Set reminders for upcoming renewal dates to ensure you are prepared for the expense.

- Regularly review your bank or credit card statements to identify any unexpected charges or price increases.

- Consider using expense tracking tools that automatically categorize subscription expenses for easy monitoring.

- Keep a separate folder or email label for all subscription-related receipts or invoices.

Is it worth exploring free alternatives to subscription services?

Exploring free alternatives to subscription services can be worth it in certain situations:

- If the free alternative offers similar features and functionality to the paid subscription service.

- If the paid subscription service is not essential to your current goals or needs.

- If your budget is tight and prioritizing essential expenses is necessary.

- If you are open to testing out alternative services to find the most cost-effective option.

How can I find lower-cost subscription options?

To find lower-cost subscription options:

- Research competitors: Look for similar subscription services offered by different providers and compare their costs.

- Wait for discounts: Keep an eye out for promotional periods or special discounts offered by subscription services.

- Consider bundled packages: Some providers offer bundled subscriptions at a lower overall cost compared to standalone services.

- Join loyalty programs: Check if any loyalty programs or rewards are available for subscription services, providing potential cost savings.

- Read customer reviews: Look for reviews and feedback from other users to ensure the lower-cost options meet your needs and expectations.

Final Thoughts

In conclusion, budgeting for annual subscription services is a key component of financial planning. By following these simple steps, individuals can effectively manage their subscription expenses. Start by evaluating your current subscriptions and identifying the ones that are essential. Next, calculate the total cost of these subscriptions and allocate a specific budget for them. Consider alternative payment options such as annual plans or family bundles to save money. Regularly review and reassess your subscriptions to ensure they align with your needs and financial goals. By prioritizing and budgeting for annual subscription services, individuals can maintain control over their expenses and make informed decisions about which services to invest in.