Are you wondering how to effectively budget for post-retirement medical expenses? Planning for healthcare costs in your golden years is crucial to ensure financial stability and peace of mind. In this article, we will explore the best strategies and practical tips on how to budget wisely for post-retirement medical expenses. From understanding your insurance options to setting aside a dedicated healthcare fund, we’ve got you covered. Let’s dive right in and pave the way for a secure and worry-free retirement.

How to Budget for Post-Retirement Medical Expenses

Planning for post-retirement medical expenses is an essential part of any comprehensive retirement plan. As we age, our healthcare needs tend to increase, and it’s important to be financially prepared for these expenses. In this article, we will delve into the key steps you can take to effectively budget for your post-retirement medical costs.

1. Understand Your Healthcare Needs

Before you can create a budget for post-retirement medical expenses, it’s crucial to have a clear understanding of your healthcare needs. Start by assessing your current health and consult with your healthcare provider to identify any potential future health concerns. Consider factors such as chronic conditions, prescription medications, and the likelihood of needing long-term care.

Once you have a comprehensive picture of your healthcare needs, you can estimate the associated costs more accurately. It’s important to remember that healthcare expenses can vary widely depending on factors such as your location, insurance coverage, and personal health choices.

2. Estimate Future Medical Expenses

After evaluating your healthcare needs, it’s time to estimate your future medical expenses. Keep in mind that these projections may not be 100% accurate, but they will provide a helpful baseline for budgeting purposes. Some key factors to consider when estimating expenses include:

- Health insurance premiums

- Co-pays and deductibles

- Prescription medication costs

- Vision and dental care expenses

- Medical equipment or assistive devices

- Potential long-term care costs

By considering these factors and researching average costs in your area, you can develop a more comprehensive estimate of your future medical expenses.

3. Review Your Retirement Savings and Income

With an estimate of your future medical expenses in hand, it’s time to review your retirement savings and income sources. Take a close look at your retirement accounts, such as 401(k)s, IRAs, and pensions. Evaluate your current savings and projected growth to determine if it will be sufficient to cover your medical expenses.

In addition to your retirement savings, consider any other potential sources of income during retirement. This could include Social Security benefits, rental properties, or part-time work. Having a clear understanding of your financial resources will help you determine how much you can allocate towards post-retirement medical expenses.

4. Explore Healthcare Insurance Options

One of the most critical aspects of budgeting for post-retirement medical expenses is understanding your healthcare insurance options. Medicare is available for individuals aged 65 and older, but it may not cover all your medical needs. Consider supplemental insurance plans, such as Medigap or Medicare Advantage, to bridge any gaps in coverage.

Research different insurance providers, compare premiums, deductibles, and coverage options. Understanding the intricacies of your insurance coverage will allow you to anticipate out-of-pocket expenses more accurately.

4.1 Medigap Insurance

Medigap policies are designed to supplement traditional Medicare coverage and help pay for costs such as deductibles, co-pays, and co-insurance. These policies are sold by private insurance companies and provide additional financial protection. Evaluate different Medigap plans and choose one that best suits your needs and budget.

4.2 Medicare Advantage Plans

Medicare Advantage plans, also known as Medicare Part C, are an alternative to traditional Medicare. These plans combine hospital insurance (Medicare Part A) and medical insurance (Medicare Part B), often including prescription drug coverage (Medicare Part D) as well. Research different Medicare Advantage plans available in your area and compare their costs and coverage options.

5. Consider Long-Term Care Insurance

Long-term care is a crucial aspect of planning for post-retirement medical expenses. It includes services such as nursing home care, assisted living, and home healthcare. These services can be costly and may not be covered by traditional health insurance or Medicare.

To ensure you are financially protected in the event of needing long-term care, consider purchasing long-term care insurance. Research different policies, understand the coverage limits, waiting periods, and the cost of premiums. By having long-term care insurance, you can alleviate some of the financial burdens associated with extended healthcare needs.

6. Create a Healthcare Budget

Now that you have gathered all the necessary information, it’s time to create a healthcare budget for your post-retirement years. Here’s a step-by-step approach to help you get started:

- List all your anticipated medical expenses, including insurance premiums, co-pays, prescription medications, and estimated long-term care costs.

- Break down these expenses on a monthly or annual basis.

- Review your retirement income sources, such as Social Security benefits, pensions, and investment accounts.

- Determine how much you can allocate towards healthcare expenses without compromising your overall financial stability.

- Adjust your budget as needed to align with your income and savings goals.

Creating a healthcare budget will provide you with a clear roadmap for managing your post-retirement medical expenses effectively.

7. Regularly Review and Update Your Budget

Budgeting for post-retirement medical expenses is an ongoing process. As you age, your healthcare needs may change, and so might your financial situation. It’s important to review and update your budget regularly to ensure it remains aligned with your current circumstances.

Monitor your healthcare costs, stay informed about any changes in insurance coverage, and adjust your budget accordingly. Regularly assessing and updating your healthcare budget will help you stay on track and make any necessary adjustments to your financial plans.

Budgeting for post-retirement medical expenses is a crucial aspect of ensuring a secure and comfortable retirement. By understanding your healthcare needs, estimating future expenses, reviewing your retirement savings, exploring insurance options, considering long-term care insurance, and creating a comprehensive healthcare budget, you can be better prepared to handle the financial demands of healthcare in your retirement years. Remember, early planning and ongoing evaluation are key to successfully budgeting for post-retirement medical expenses.

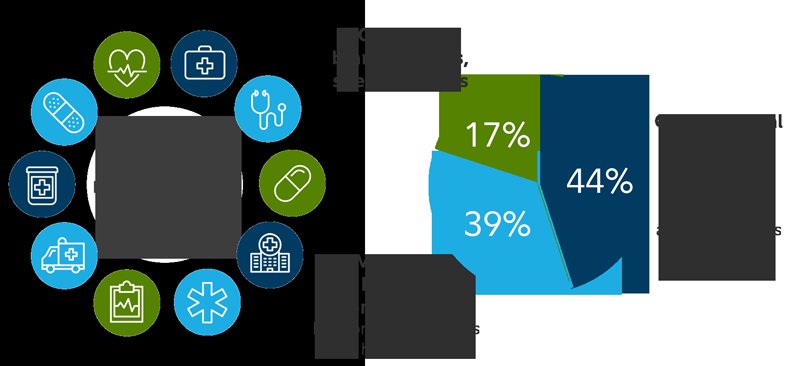

How Much Should You Budget For Healthcare In Retirement?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How do I budget for post-retirement medical expenses?

Planning for post-retirement medical expenses is crucial to ensure a financially stable future. Here are some frequently asked questions regarding budgeting for post-retirement medical expenses:

1. What should be included in my post-retirement medical budget?

In your post-retirement medical budget, you should consider expenses such as health insurance premiums, co-payments, prescription medications, routine check-ups, and any potential long-term care costs.

2. How can I estimate my post-retirement medical expenses?

To estimate your post-retirement medical expenses, review your current medical costs and consult with a financial advisor. They can help you analyze your health history, evaluate potential future expenses, and factor in inflation rates.

3. What steps can I take to reduce post-retirement medical expenses?

There are several steps you can take to reduce post-retirement medical expenses. These include staying healthy through exercise and a balanced diet, considering preventive care measures, comparing health insurance plans to find the most cost-effective option, and exploring programs like Medicare and Medicaid.

4. Should I consider long-term care insurance as part of my post-retirement budget?

Yes, considering long-term care insurance is important when budgeting for post-retirement medical expenses. It can help cover costs associated with assisted living facilities, nursing homes, or in-home care services that may not be covered by traditional health insurance plans.

5. How can I ensure that my post-retirement medical budget is flexible?

To make your post-retirement medical budget flexible, allocate funds for unexpected medical expenses and emergencies. Additionally, consider saving for a health savings account (HSA) or having an emergency fund specifically designated for medical costs.

6. When should I start budgeting for post-retirement medical expenses?

It is recommended to start budgeting for post-retirement medical expenses as early as possible. The earlier you start, the more time you have to save and invest, allowing your funds to grow and provide a stronger financial foundation for your retirement years.

7. Can I seek professional help to create a post-retirement medical budget?

Absolutely! Seeking professional help from a financial advisor or retirement planner can provide valuable guidance when creating a post-retirement medical budget. They can analyze your financial situation, recommend appropriate strategies, and help you navigate through complex insurance options.

8. What if unexpected medical expenses exceed my budget?

If unexpected medical expenses exceed your budget, it’s important to have a contingency plan. You can explore options like adjusting your budget, tapping into emergency savings, or reviewing your insurance coverage to check for any potential additional benefits or support.

Final Thoughts

In summary, budgeting for post-retirement medical expenses is crucial for maintaining financial stability and peace of mind. Start by creating a comprehensive plan that takes into account potential healthcare needs and costs. Utilize healthcare savings accounts and insurance options to minimize out-of-pocket expenses. Regularly review and adjust your budget as medical needs evolve. Consider incorporating healthy lifestyle choices to reduce the risk of future medical expenses. By proactively budgeting for post-retirement medical expenses, individuals can ensure their financial well-being and enjoy a worry-free retirement.