Are you struggling to handle seasonal expenses and keep your budget on track? Fret not, because in this article, we will show you how to budget for seasonal expenses effectively. No more financial stress during holidays or special occasions – we’ve got you covered! Budgeting for seasonal expenses is crucial to ensure you can enjoy those special moments without breaking the bank. So, let’s dive in and learn how to budget for seasonal expenses like a pro. Whether it’s birthdays, anniversaries, or festive holidays, you’ll discover practical tips and strategies to manage your finances wisely. Let’s get started on your journey to financial freedom!

How to Budget for Seasonal Expenses

When it comes to managing your finances, budgeting is an essential tool. And while it’s important to have a general budget that covers your monthly expenses, it’s equally important to plan for those seasonal expenses that tend to sneak up on us throughout the year. Whether it’s the holidays, vacations, or other special occasions, having a budget in place can help you navigate these costs without breaking the bank. In this article, we’ll explore various strategies and tips to help you effectively budget for seasonal expenses.

1. Identify and Prioritize Seasonal Expenses

The first step in budgeting for seasonal expenses is to identify and prioritize the specific events or occasions that require extra spending. Take a moment to consider the different seasons and the associated expenses that come with them. Some common seasonal expenses include:

- Holidays: Christmas, Hanukkah, Thanksgiving, New Year’s, etc.

- Birthdays: Family members, friends, colleagues, etc.

- Vacations: Summer vacation, spring break, winter getaway, etc.

- Back-to-School: School supplies, clothes, shoes, etc.

- Weddings: Attending weddings, bridal showers, gifts, etc.

Once you have a list of the seasonal expenses that you typically encounter, prioritize them based on importance and approximate cost. This will help you allocate your budget accordingly and ensure that you’re adequately prepared for each expense.

2. Review and Adjust Your Monthly Budget

Now that you have a clear understanding of the seasonal expenses you need to budget for, it’s time to review your monthly budget. Take a close look at your current income and expenses to determine how much you can realistically set aside each month for these seasonal costs.

Consider making adjustments to your discretionary spending categories to free up additional funds. Cut back on non-essential expenses like dining out, entertainment, or subscriptions that you can temporarily live without. Redirecting these funds towards your seasonal budget will ensure you have enough money when those expenses arise.

Be sure to set aside a realistic amount each month to avoid financial stress when the time comes to pay for the seasonal expenses. It’s better to save a little each month than to scramble for funds at the last minute.

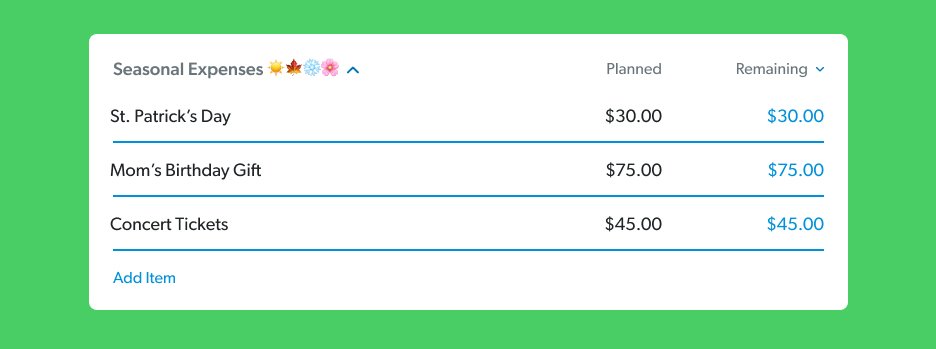

3. Create a Separate Savings Account or Envelope

To stay organized and track your progress, consider creating a separate savings account or envelope specifically for your seasonal expenses. This allows you to visually see the funds accumulating and avoids the temptation to dip into the money for other purposes.

If you prefer the traditional envelope system, label each envelope with the specific seasonal event or expense it represents. Allocate a set amount of money to each envelope each month according to your prioritized list. This method can help you physically see the available funds and ensure that you don’t overspend.

4. Research and Estimate Expenses

Before creating a detailed budget for each seasonal expense, it’s essential to research and estimate the costs associated with each event. This step will help you set realistic budget targets and avoid any surprises along the way.

Take the time to gather information about previous years’ expenses, current prices, and any additional costs that may arise. This might include travel expenses, gifts, decorations, food, or activities. By having a clear idea of how much each expense will likely cost, you can plan accordingly and make adjustments to your budget if necessary.

5. Break Down Each Seasonal Expense

Now that you have an estimate of the costs for each seasonal expense, it’s time to break them down into manageable chunks. This will help you incorporate these expenses seamlessly into your monthly budget and ensure that you save enough each month to cover them.

For example, if you’re budgeting for holiday expenses, consider dividing the estimated total cost by the number of months until the holiday season arrives. This will give you a monthly savings target. Adjust your budget accordingly to accommodate this monthly savings goal.

Repeat this process for each seasonal expense, breaking them down into monthly savings goals. This method will help you avoid feeling overwhelmed by large lump-sum payments and make it easier to save consistently throughout the year.

6. Consider Alternate Payment Methods

When budgeting for seasonal expenses, it’s important to consider alternate payment methods that can help you manage your cash flow effectively. Instead of relying solely on credit cards or dipping into your emergency fund, explore other options that may minimize financial stress.

For instance, some retailers offer layaway programs that allow you to reserve and pay for items over time. This can help you spread out the cost of your seasonal purchases without accumulating debt or draining your savings account.

Another option is to save up gift cards or rewards points throughout the year to use towards seasonal expenses. This can help reduce out-of-pocket costs and make your budgeting efforts more manageable.

7. Track and Adjust Your Budget as Needed

Once you’ve set your budget for seasonal expenses, it’s crucial to track your progress and make adjustments along the way. Life is unpredictable, and circumstances may change, requiring you to revisit your budget and make necessary tweaks.

Regularly review your spending, savings, and income to ensure that you’re on track to meet your savings goals. If you find that you’re consistently overspending in certain areas or not saving enough, reevaluate your budget and identify areas where you can cut back or reallocate funds.

Being flexible and adaptable with your budget will help you navigate unexpected expenses or changes in income. By regularly examining your financial situation, you can make informed decisions and have a solid plan in place to handle seasonal expenses.

Remember, budgeting is an ongoing process, and priorities can shift throughout the year. By maintaining a proactive approach and planning ahead, you can ensure that your seasonal expenses are well-managed without sacrificing your overall financial stability.

My Income Is Extremely Seasonal, How Do I Plan and Budget?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I budget for seasonal expenses?

To effectively budget for seasonal expenses, consider the following steps:

What are some common seasonal expenses to budget for?

Common seasonal expenses to budget for may include holiday gifts, travel expenses, home maintenance costs, winter heating bills, summer cooling bills, and school supplies.

Should I create a separate savings account for seasonal expenses?

Yes, it can be beneficial to create a separate savings account specifically for seasonal expenses. This allows you to set aside money throughout the year and have it readily available when these expenses arise.

How much money should I allocate for seasonal expenses?

The amount of money to allocate for seasonal expenses will depend on your personal circumstances, financial goals, and the specific expenses you anticipate. It is recommended to review your past spending patterns and estimate future expenses to determine a suitable amount to set aside.

Are there any tools or apps that can help with budgeting for seasonal expenses?

Yes, there are various budgeting tools and apps available that can assist with managing seasonal expenses. These tools can help track your spending, set savings goals, and even provide personalized recommendations based on your financial situation.

What strategies can I use to save money for seasonal expenses?

Some strategies to save money for seasonal expenses include setting a budget and sticking to it, reducing discretionary spending, finding ways to cut costs, looking for discounts or sales, and exploring alternative options for certain expenses.

Should I adjust my monthly budget to accommodate seasonal expenses?

Yes, it is generally advisable to adjust your monthly budget to account for seasonal expenses. By allocating a portion of your monthly income specifically for these expenses, you can avoid financial strain when they arise.

What if unforeseen seasonal expenses come up?

If unforeseen seasonal expenses come up, it is important to reassess your budget and prioritize your spending. Look for areas where you can make adjustments, consider alternative solutions, and try to avoid accumulating unnecessary debt.

Final Thoughts

In conclusion, effectively budgeting for seasonal expenses is crucial for financial stability throughout the year. By planning ahead and anticipating these expenses, you can avoid unnecessary debt and stress. Start by identifying the specific seasonal costs you will encounter and estimating their amounts. Then, allocate a portion of your monthly income to a separate savings account dedicated to these expenses. Regularly reassess your budget to ensure you are on track and make adjustments as needed. By following these strategies, you can successfully manage your finances and keep seasonal expenses under control. So, remember to prioritize budgeting for seasonal expenses to maintain financial well-being.