Looking to build a dividend stock portfolio? You’ve come to the right place! In this article, we will walk you through the process of building a successful portfolio that generates consistent dividend income. Whether you’re a seasoned investor or just starting out, we’ve got you covered. We’ll explore key strategies, important considerations, and actionable steps to help you construct a portfolio that aligns with your financial goals. So, let’s dive in and discover how to build a dividend stock portfolio that sets you on the path to financial success.

How to Build a Dividend Stock Portfolio

What is a Dividend Stock Portfolio?

A dividend stock portfolio is a collection of stocks in which the focus is on selecting companies that pay regular dividends. Dividends are payments made by a company to its shareholders, typically as a share of the company’s profits. By investing in dividend stocks, investors can generate a steady income stream in addition to potential capital appreciation.

Why Build a Dividend Stock Portfolio?

Building a dividend stock portfolio can offer several advantages, including:

1. Passive Income: Dividend stocks provide a reliable source of passive income, allowing investors to earn money even when the market is volatile.

2. Stability and Security: Dividend-paying companies are often well-established and financially stable. Dividends can provide a cushion during market downturns, reducing the impact of price volatility.

3. Long-Term Growth: Dividend stocks have the potential for long-term growth, as companies that consistently pay dividends often have strong fundamentals and sustainable business models.

4. Diversification: Including a variety of dividend-paying stocks in a portfolio can help spread risk and diversify investments across different sectors and industries.

Steps to Build a Dividend Stock Portfolio

1. Set Financial Goals

Before building a dividend stock portfolio, it’s essential to establish clear financial goals. Consider your investment objectives, time horizon, risk tolerance, and desired income stream. Setting specific and realistic goals will help guide the selection process and ensure your portfolio aligns with your needs.

2. Research Dividend Stocks

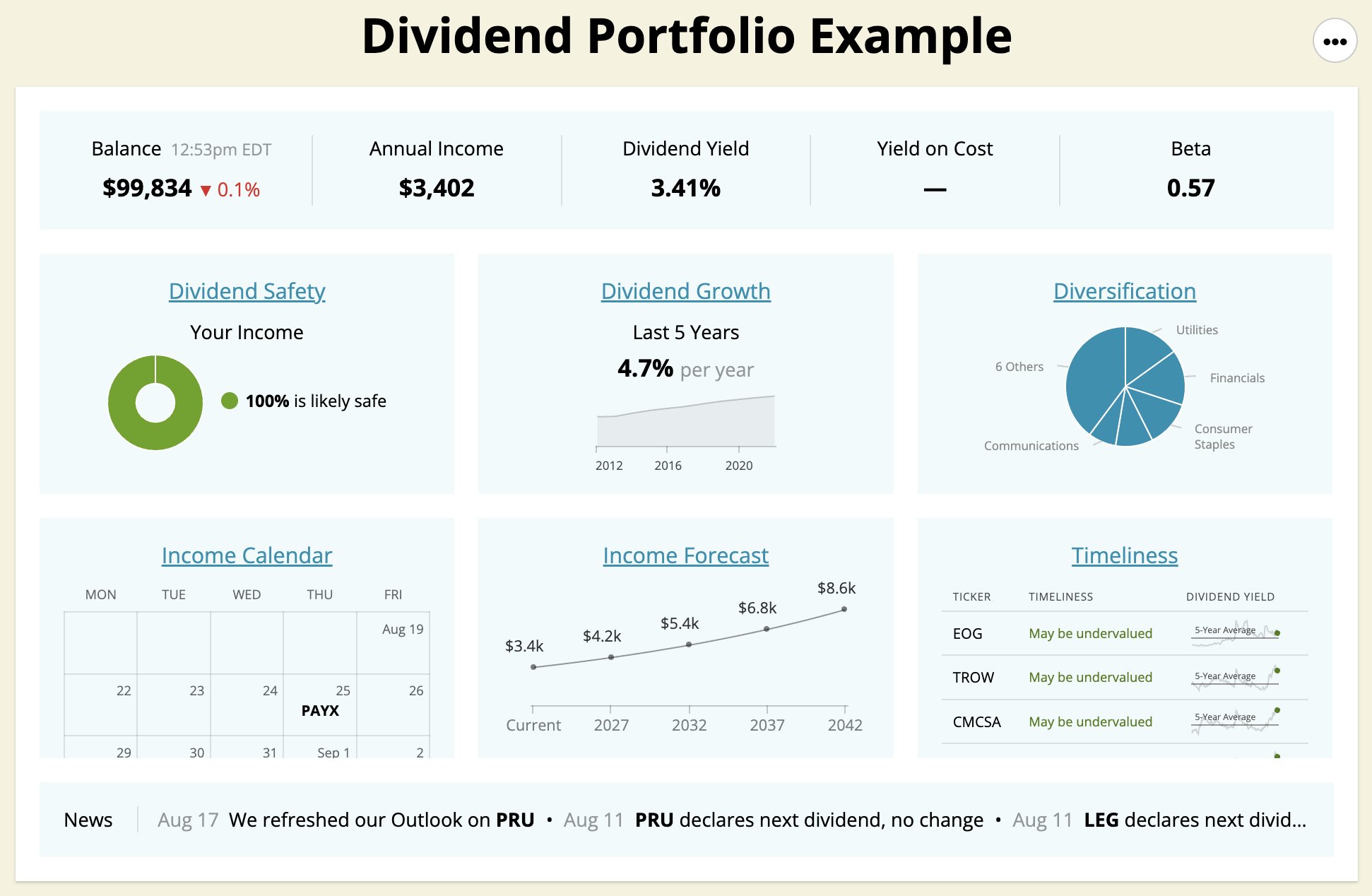

Thorough research is crucial for identifying suitable dividend stocks. Consider factors such as dividend yield, dividend growth rate, payout ratio, and the company’s financial health. Look for companies with a history of consistently paying dividends and increasing them over time.

3. Evaluate the Dividend Yield

Dividend yield is an important metric to consider when selecting dividend stocks. It represents the annual dividend payment relative to the stock’s price. A higher dividend yield indicates a higher return on investment. However, it’s important to assess the sustainability of the dividend yield and consider other factors in conjunction with it.

4. Assess Dividend Growth Rate

The dividend growth rate measures how quickly a company increases its dividend payouts over time. It is an indicator of a company’s financial health and management’s commitment to rewarding shareholders. Look for companies with a consistent and sustainable dividend growth rate.

5. Analyze Payout Ratio

The payout ratio is the percentage of a company’s earnings paid out as dividends. A lower payout ratio suggests that a company has the capacity to sustain and potentially increase its dividends in the future. Avoid companies with excessively high payout ratios, as they may not be able to maintain their dividend payments.

6. Consider Dividend Aristocrats

Dividend Aristocrats are companies that have consistently increased their dividends for at least 25 consecutive years. These companies are known for their stability and long-term dividend growth. Including Dividend Aristocrats in your portfolio can provide a solid foundation.

7. Diversify Across Sectors

To reduce the risk associated with investing in individual stocks, diversify your dividend stock portfolio across different sectors and industries. This helps safeguard against company-specific risks and market fluctuations. Invest in sectors that align with your investment goals and have a history of stable dividend payments.

8. Balance Risk and Return

It’s important to strike a balance between risk and return when building a dividend stock portfolio. Consider the stability and track record of each company, as well as the potential for future growth. Additionally, diversify your holdings across large-cap, mid-cap, and small-cap stocks to further mitigate risk.

9. Monitor and Review

Once your dividend stock portfolio is established, it requires ongoing monitoring and periodic review. Stay updated with company news, earnings reports, and economic trends that may impact your investments. Regularly reassess your holdings and make necessary adjustments to ensure your portfolio remains aligned with your financial goals.

Conclusion

Building a dividend stock portfolio can provide investors with a reliable income stream and potential long-term growth. By following a structured approach and considering factors such as dividend yield, dividend growth rate, and diversification, investors can construct a portfolio that meets their financial objectives. Remember to regularly monitor and review your portfolio to ensure it continues to align with your goals and adapt to changing market conditions. With careful research and thoughtful selection, you can build a dividend stock portfolio that generates consistent returns and helps you achieve financial success.

How to Build a Dividend Stock Portfolio With $100 (Free Course)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. What is a dividend stock portfolio?

A dividend stock portfolio is a collection of stocks that specifically focuses on including dividend-paying companies. Dividends are regular payments made by companies to their shareholders as a share of the company’s profits. A dividend stock portfolio aims to generate a steady stream of income for investors through these dividend payments.

2. How do I start building a dividend stock portfolio?

To start building a dividend stock portfolio, you need to follow a few steps:

– Research and select dividend-paying companies: Look for companies with a history of consistent dividend payments and a strong financial position.

– Diversify your portfolio: Invest in companies from different sectors to spread the risk and maximize potential returns.

– Set investment goals: Determine your investment goals, such as income generation or long-term growth, to guide your portfolio construction.

– Regularly review and adjust: Monitor the performance of your portfolio and make adjustments as needed to align with your goals and market conditions.

3. Are dividend stocks a safe investment?

Dividend stocks can be considered relatively safer than non-dividend-paying stocks in terms of generating income. However, like any investment, there are risks involved. It’s crucial to conduct thorough research on the companies you are investing in and ensure their financial stability, dividend track record, and overall market conditions.

4. How can I identify reliable dividend-paying companies?

To identify reliable dividend-paying companies, consider the following factors:

– Dividend history: Look for companies that have a consistent track record of paying dividends, preferably with a history of increasing dividends over time.

– Financial health: Assess the financial stability of the company by reviewing key financial indicators such as profitability, debt levels, and cash flow.

– Industry analysis: Analyze the company’s position within its industry and evaluate the potential for future growth and sustainability.

– Dividend yield: Evaluate the dividend yield (dividend per share divided by the stock price) to determine the income potential.

5. What is the ideal dividend yield to target?

The ideal dividend yield to target can vary depending on various factors such as market conditions, personal financial goals, and risk tolerance. Typically, investors often consider stocks with a dividend yield higher than the average yield of the broader market. However, it’s essential to strike a balance between yield and the overall financial health and stability of the company.

6. Should I focus only on high-yield dividend stocks?

While high-yield dividend stocks may seem attractive due to their potential for higher income, it is advisable not to focus solely on high-yield stocks. High yields can sometimes indicate underlying issues, such as an unsustainably high payout ratio or a declining stock price. It’s crucial to consider a company’s overall financial health, dividend history, and growth potential alongside the dividend yield.

7. How often are dividends paid?

Dividends are typically paid on a regular basis, although the frequency can vary among companies. Most companies pay dividends quarterly, while some may choose to distribute dividends on a monthly, semi-annual, or annual basis. The dividend payment schedule is usually announced by the company and can be found in their investor relations information.

8. Can a dividend stock portfolio provide capital appreciation?

Yes, a dividend stock portfolio can provide capital appreciation in addition to regular dividend income. Some dividend-paying companies also experience stock price growth over time, which can contribute to the overall return on investment. It’s important to consider a balance between dividend income and potential capital appreciation when constructing a dividend stock portfolio.

Final Thoughts

In conclusion, building a dividend stock portfolio requires careful consideration and strategic planning. Start by setting clear investment goals and determining your risk tolerance. Conduct thorough research to identify high-quality dividend-paying stocks from various sectors. Diversify your portfolio to reduce risk and enhance potential returns. Regularly review and adjust your holdings as market conditions change. Invest for the long term and resist the temptation to chase short-term gains. By consistently following these principles and staying disciplined, you can build a dividend stock portfolio that generates reliable income and helps you achieve your financial goals. So, if you are looking to build a dividend stock portfolio, these steps will guide you in making informed investment decisions.