Are you worried about your retirement prospects? Wondering how to build a retirement fund from zero? Look no further! In this article, we will guide you through practical steps to help you secure a comfortable future. Building a retirement fund may seem daunting, but with a well-thought-out plan and some disciplined saving, you can set yourself on the path to financial freedom. Let’s dive in and explore actionable strategies that will empower you to take control of your financial future, step by step. Say goodbye to retirement worries as we show you how to build a retirement fund from zero.

How to Build a Retirement Fund from Zero

Introduction

Retirement is a phase in life that we all aspire to enjoy comfortably. However, it requires careful planning and diligent saving to build a retirement fund that can sustain us during those golden years. If you’re starting from zero, don’t worry because it’s never too late to begin. By following a systematic approach, leveraging various investment techniques, and making smart financial decisions, you can build a retirement fund that will provide you with financial security and peace of mind. In this article, we will guide you through the process of building your retirement fund from scratch.

Assess Your Financial Situation

Before embarking on your journey to building a retirement fund, it’s crucial to assess your current financial situation. This involves taking stock of your income, expenses, and existing assets. Here are a few steps to help you get started:

- Calculate your monthly income and expenses: Identifying your cash flow will give you a clear picture of how much you can save each month towards your retirement fund.

- Analyze your existing assets: Evaluate your current investments, savings accounts, and any other assets you may have. This will help you determine how much you already have set aside for retirement.

- Determine your risk tolerance: Understand your risk appetite and decide how much risk you are willing to take with your retirement investments. This will guide your investment strategy.

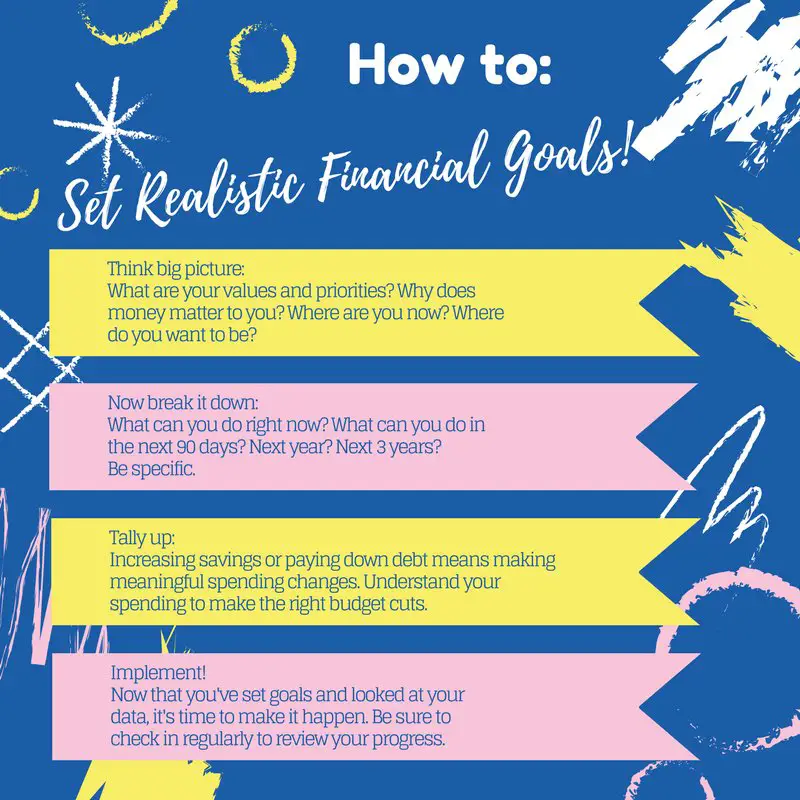

Set Clear Retirement Goals

Once you have assessed your financial situation, it’s time to set clear retirement goals. Having specific objectives will provide you with a target to work towards. Consider the following when setting your retirement goals:

- Retirement age: Determine the age at which you intend to retire. This will influence the duration of your savings and investment plan.

- Lifestyle expectations: Consider the type of lifestyle you desire during retirement. Do you plan to travel extensively or maintain a frugal lifestyle? Understanding your aspirations will help you estimate your retirement fund requirements.

- Healthcare expenses: Account for potential healthcare costs during retirement. As you age, medical expenses tend to increase, and factoring them in will ensure you have sufficient funds to cover them.

Create a Realistic Budget

Creating a realistic budget is essential in building your retirement fund. A budget will help you track your expenses, manage your cash flow, and allocate the necessary funds towards retirement savings. Follow these steps to create an effective budget:

- Track your expenses: Keep a record of your daily, monthly, and annual expenses. Categorize them to identify areas where you can cut costs and save more.

- Identify discretionary expenses: Differentiate between essential and non-essential expenses. Reduce unnecessary expenditures to free up additional funds for retirement savings.

- Automate your savings: Set up automatic transfers from your paycheck to a retirement savings account. This ensures consistent savings without the temptation to spend the funds elsewhere.

Explore Retirement Account Options

To maximize your retirement savings, it’s crucial to explore various retirement account options available to you. These accounts provide tax advantages and can accelerate the growth of your retirement fund. Consider the following common retirement accounts:

1. Individual Retirement Accounts (IRA)

An Individual Retirement Account (IRA) is a personal savings account that offers tax advantages for retirement savings. There are two main types of IRAs:

- Traditional IRA: Contributions are made with pre-tax dollars, and taxes are paid upon withdrawal during retirement.

- Roth IRA: Contributions are made with after-tax dollars, and qualified withdrawals during retirement are tax-free.

2. Employer-Sponsored Retirement Plans

Many employers offer retirement plans such as 401(k)s, 403(b)s, or 457 plans. These plans allow you to contribute a portion of your salary towards retirement savings. Employers may also match a percentage of your contributions, boosting your retirement fund even further.

3. Self-Employed Retirement Plans

If you’re self-employed or own a small business, you have options such as the Simplified Employee Pension (SEP) IRA or the Solo 401(k). These plans enable self-employed individuals to contribute to their retirement fund while enjoying tax benefits.

Invest Wisely

Building a retirement fund requires investing your savings in growth-oriented assets that can generate higher returns over time. Consider the following investment options:

1. Stocks

Investing in stocks offers the potential for significant long-term returns. However, it’s important to research and diversify your portfolio to mitigate risks. Consider investing in low-cost index funds or exchange-traded funds (ETFs) that offer broad market exposure.

2. Bonds

Bonds offer a more stable investment option compared to stocks. They provide a fixed income over a specified period, making them suitable for conservative investors. Consider investing in a mix of government, corporate, and municipal bonds to diversify your portfolio.

3. Real Estate

Investing in real estate can provide both income and potential appreciation. Consider purchasing rental properties or real estate investment trusts (REITs) to add diversification to your investment portfolio.

4. Mutual Funds

Mutual funds pool money from multiple investors to invest in various assets, providing instant diversification. Look for low-cost mutual funds with a solid track record and a good mix of asset classes.

5. Consult with a Financial Advisor

If you’re unsure about investment decisions, consider consulting with a financial advisor. They can assess your individual situation, risk tolerance, and goals to provide personalized investment advice.

Monitor and Adjust Your Retirement Plan

Building a retirement fund is an ongoing process that requires monitoring and adjustments along the way. Here are some tips to ensure your retirement plan stays on track:

- Regularly review your retirement portfolio: Assess the performance of your investments and rebalance your portfolio if necessary.

- Increase contributions: As your income increases or expenses decrease, strive to increase your retirement contributions.

- Stay informed: Keep up with changes in tax laws and retirement regulations that may impact your retirement savings strategy.

- Consider catch-up contributions: If you are nearing retirement age and haven’t saved enough, take advantage of catch-up contribution options available in retirement accounts.

Building a retirement fund from zero requires discipline, careful planning, and the right investment approach. By assessing your financial situation, setting clear goals, creating a budget, exploring retirement account options, and investing wisely, you can steadily build a retirement fund that will provide financial security in your golden years. Remember, it’s never too late to start saving for retirement, so take action today and secure a brighter future for yourself.

How to Retire in 7 Years Starting with $0

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I start building a retirement fund from zero?

Starting a retirement fund from scratch may seem daunting, but with a few simple steps, you can begin your journey towards a secure financial future. Firstly, create a budget to outline your income and expenses. Then, prioritize saving for retirement by setting aside a portion of your income each month. Consider opening a retirement account, such as an IRA or 401(k), and contribute consistently to benefit from compound interest. It’s never too late to start!

2. Is it possible to build a retirement fund on a tight budget?

Absolutely! Building a retirement fund is possible regardless of your budget. Start by analyzing your expenses and identifying areas where you can cut back and save. Look for ways to increase your income, such as taking on a side gig or freelancing. It’s crucial to be disciplined and make consistent contributions towards your retirement fund, no matter how small. Over time, even modest contributions can grow significantly.

3. What investment options should I consider for my retirement fund?

There are various investment options to consider when building a retirement fund from scratch. Some popular choices include stocks, bonds, mutual funds, and index funds. It’s important to diversify your investments to mitigate risk. If you’re unsure about making investment decisions, consulting with a financial advisor can provide valuable guidance tailored to your specific needs and goals.

4. How much should I aim to save for retirement?

The amount you should save for retirement depends on several factors, such as your desired lifestyle in retirement, current age, and expected lifespan. While there is no one-size-fits-all answer, a general guideline suggests aiming to replace about 70-80% of your pre-retirement income. It’s advisable to use retirement calculators or seek professional advice to determine a more accurate savings target for your specific circumstances.

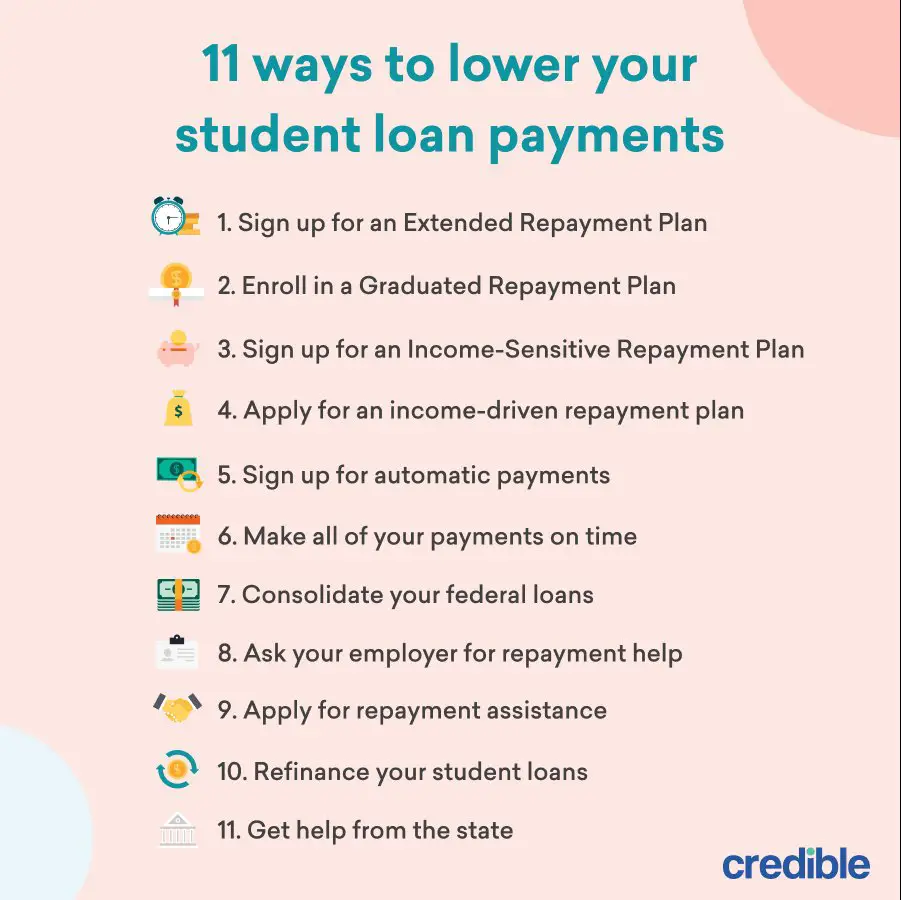

5. Can I start building a retirement fund with debt?

While it’s not ideal, it is possible to start building a retirement fund even if you have debt. However, it’s essential to manage your debt effectively to avoid hampering your retirement savings. Prioritize paying off high-interest debt while still making consistent contributions to your retirement fund. Balancing debt repayment and retirement savings is crucial, and seeking financial advice can help you create a suitable plan.

6. How can I make my retirement fund grow faster?

To make your retirement fund grow faster, consider the following strategies:

- Increasing your savings rate by allocating more of your income towards retirement

- Investing in higher-yield assets, such as stocks or real estate, after careful consideration of associated risks

- Regularly reviewing and rebalancing your investment portfolio

- Maximizing contributions to tax-advantaged retirement accounts

- Starting early and consistently contributing throughout your career

7. Is it too late to start building a retirement fund if I’m close to retirement age?

It’s never too late to start building a retirement fund, even if you’re close to retirement age. While you may have less time to accumulate savings, every dollar counts. Assess your current financial situation, set realistic goals, and make a plan that focuses on maximizing your savings in the remaining time. Consult a financial advisor to explore strategies that align with your circumstances and timeline.

8. How often should I review my retirement fund progress?

Reviewing your retirement fund’s progress is a crucial part of financial planning. It’s advisable to review your fund at least annually or when significant life events occur, such as job changes, salary increases, or unexpected windfalls. Regular assessments allow you to ensure that you’re on track to meet your retirement goals and make any necessary adjustments to your saving and investment strategies.

Final Thoughts

To build a retirement fund from zero, it’s essential to start early and be consistent with your savings. Begin by creating a budget and identifying areas where you can cut expenses. Allocate a portion of your income towards retirement savings and automate the process to ensure regular contributions. Consider investing in retirement accounts such as a 401(k) or an IRA, taking advantage of any employer matching programs. Diversify your investments and periodically review and adjust your portfolio. Educate yourself about personal finance and seek professional advice if needed. By following these steps, you can gradually build a retirement fund from zero and secure a financially stable future.