Looking to build credit as a college student? You’re in the right place! Building credit may seem daunting, especially when balancing classes, exams, and social life. But fear not, because in this article, we’ll guide you on how to navigate the credit-building process effortlessly. From understanding the importance of credit to practical steps you can take, we’ve got you covered. So, if you’re ready to take control of your financial future and establish a solid credit history, keep reading!

How to Build Credit as a College Student

Building credit as a college student is an important step towards establishing a strong financial foundation for the future. By responsibly managing credit, you can open doors to better loan terms, lower interest rates, and increased financial opportunities. In this comprehensive guide, we will explore various strategies and tips to help you build credit while you are still in college.

Understanding Credit and Why It Matters

Before we delve into the specific steps you can take to build credit, it’s important to understand what credit is and why it holds significance in your financial life. Credit is a system that allows individuals to borrow money or access goods and services with the understanding that they will repay the borrowed amount at a later date, typically with interest.

Having a good credit score is crucial because it impacts your ability to secure loans, rent an apartment, buy a car, and even get a job. A higher credit score demonstrates to lenders that you are a responsible borrower, making you a more attractive candidate for financial opportunities.

Start with a Solid Foundation

Building credit from scratch can be challenging, but starting early can give you a head start. Here are some essential steps to lay a solid foundation:

1. Open a Bank Account

Opening a bank account is an important first step towards building credit. It shows financial institutions that you have a stable relationship with a trusted institution. Look for a bank that offers student-friendly accounts or accounts specifically designed to help young adults build credit.

2. Understand Credit Reports and Scores

Familiarize yourself with the concept of credit reports and credit scores. Your credit report is a detailed record of your credit history, while your credit score is a numerical representation of your creditworthiness. Regularly checking your credit report allows you to ensure its accuracy and identify areas for improvement.

3. Become an Authorized User

If your parents or a close family member have good credit, ask them to add you as an authorized user on one of their credit cards. This allows you to benefit from their positive credit history and can help establish your own credit.

Building Credit Responsibly

Once you have a solid foundation, it’s time to start actively building credit on your own. Here are some strategies to help you build credit responsibly:

1. Get a Secured Credit Card

Secured credit cards are designed for individuals with limited or no credit history. They require a security deposit, which serves as collateral for the credit limit you are given. By using a secured credit card responsibly and making timely payments, you can start building a positive credit history.

2. Make On-Time Payments

One of the most crucial factors in building credit is making all payments on time. Late payments can significantly impact your credit score and make it harder to build credit in the future. Set up automatic payments or reminders to ensure you never miss a due date.

3. Keep Credit Utilization Low

Credit utilization refers to the percentage of your available credit that you are using. Aim to keep your credit utilization below 30% to demonstrate responsible credit usage. For example, if you have a $1,000 credit limit, try to keep your balance below $300.

4. Apply for Student Credit Cards

Many credit card issuers offer credit cards specifically designed for college students. These cards often have lower credit limits but may come with benefits like cashback rewards or introductory 0% APR offers. Compare different options and choose a card that aligns with your needs and spending habits.

5. Limit the Number of Credit Applications

Each time you apply for credit, it generates a hard inquiry on your credit report, which can temporarily lower your credit score. Be selective about the credit applications you submit and only apply for credit when necessary.

Additional Tips for Building Credit

In addition to the strategies mentioned above, here are some additional tips to help you build credit as a college student:

1. Pay Bills on Time

Aside from credit card payments, make sure you pay all your bills, including rent, utilities, and student loans, on time. Timely bill payments contribute to your overall financial responsibility and can positively impact your credit history.

2. Monitor Your Credit

Regularly monitoring your credit allows you to stay aware of any changes or potential errors on your credit report. There are several free online tools and services available that can help you keep track of your credit score.

3. Avoid Maxing Out Credit Cards

While having a credit card can be a valuable tool for building credit, it’s important not to max out your cards. Maxing out credit cards can negatively affect your credit score and make it challenging to meet your financial obligations.

4. Build a Positive Credit Mix

Having a mix of different types of credit can strengthen your creditworthiness. Consider diversifying your credit by applying for a small personal loan or a student loan and managing them responsibly.

5. Seek Professional Help if Needed

If you encounter challenges or have questions about building credit, don’t hesitate to seek professional assistance. Financial advisors or credit counseling services can provide personalized guidance to help you navigate the credit-building process.

By following these strategies and tips, you can steadily build your credit as a college student. Remember, building credit is a gradual process that requires patience and responsible financial management. Start early, take consistent steps, and watch your credit history grow, setting you up for a successful financial future.

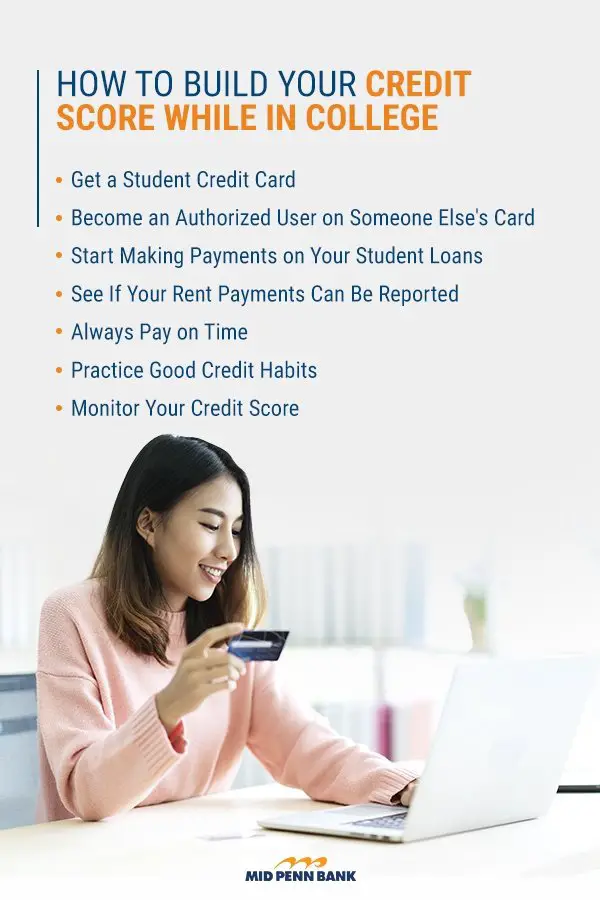

How to BUILD your credit score as a College Student

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I build credit as a college student?

To build credit as a college student, you can follow these steps:

What is the importance of building credit as a college student?

Building credit as a college student is important because it establishes a positive credit history, which can benefit you in the future when you need to borrow money for a car, a house, or other major expenses.

Can I get a credit card as a college student?

Yes, college students can apply for credit cards. Many banks and credit card companies offer credit cards specifically designed for students. These cards often have lower credit limits and more favorable terms for those with limited credit history.

How can I get approved for a credit card as a college student with no credit?

To increase your chances of getting approved for a credit card with no credit history, you can consider the following options:

– Apply for a secured credit card, which requires a security deposit that serves as your credit limit.

– Become an authorized user on a family member’s credit card account.

– Apply for a student credit card with a cosigner, such as a parent or guardian.

What other ways can I build credit besides getting a credit card?

In addition to getting a credit card, you can build credit as a college student by:

– Paying your rent and other bills on time

– Applying for a small personal loan or a student loan and making regular, timely payments

– Getting a secured loan from a credit union or bank

– Keeping your student loan debt under control by making regular payments

How important is it to make payments on time to build credit?

Making payments on time is crucial for building credit. Late or missed payments can negatively impact your credit score and make it harder to build a positive credit history. Set reminders or use automatic payments to ensure you never miss a due date.

What is a credit utilization ratio, and how does it affect my credit score?

Your credit utilization ratio is the percentage of your available credit that you’re using. It’s calculated by dividing your total credit card balances by your total credit card limits. A high credit utilization ratio can negatively impact your credit score. Aim to keep your ratio below 30% to maintain a good credit score.

How long does it take to build good credit as a college student?

Building good credit takes time and consistent responsible credit behavior. It typically takes several months to a year or more to establish a positive credit history and see significant improvements in your credit score. Patience and consistent financial habits are key to building good credit as a college student.

Final Thoughts

Building credit as a college student is crucial for future financial success. To start, open a student credit card and use it responsibly. Make payments on time and keep your credit utilization low. Consider becoming an authorized user on a parent or guardian’s credit card to gain positive credit history. Additionally, pay all bills promptly, including student loans. Monitor your credit score regularly to track progress. By following these steps, you can lay a strong foundation for building credit as a college student. Remember, responsible credit usage is key to financial stability.