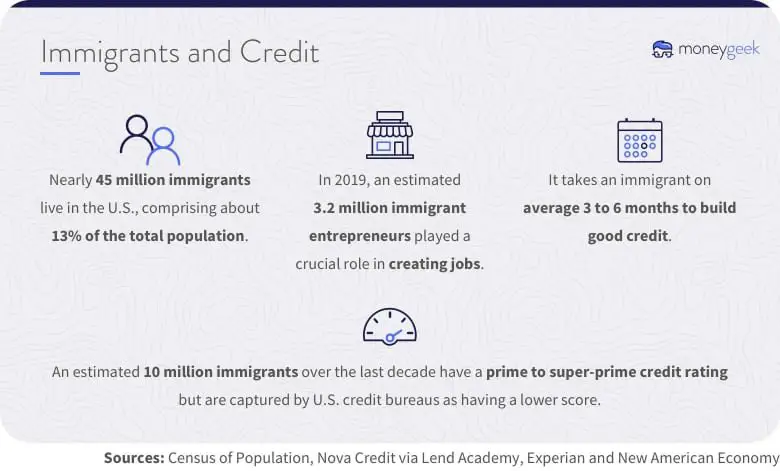

Are you a new immigrant wondering how to build credit in your new home? We’ve got you covered! Building credit as a new immigrant may seem daunting, but with the right knowledge and strategies, you can establish a solid credit history. In this article, we’ll guide you through the steps to build credit from scratch, providing you with practical advice and actionable tips. So, if you’re ready to take control of your financial future and unlock the opportunities that come with a robust credit profile, keep reading!

How to Build Credit as a New Immigrant

Welcome to your new home! As a new immigrant, one of the essential steps in establishing your financial foundation is building credit. Having good credit is crucial for securing loans, renting an apartment, and even landing certain jobs. In this guide, we will explore effective strategies for building credit from scratch as a new immigrant. Whether you’re a student, a working professional, or a refugee starting anew, these tips will help you navigate the U.S. credit system and achieve your financial goals.

Understanding Credit and Its Importance

Before diving into credit-building strategies, let’s take a moment to understand what credit is and why it matters. Credit is a measure of your ability to borrow money and repay it. It demonstrates your financial responsibility and provides lenders with an idea of how likely you are to pay back borrowed funds. A good credit score allows you to access various financial opportunities, such as:

- Obtaining favorable loan terms

- Securing apartment rentals

- Qualifying for credit cards with higher limits and rewards

- Getting better insurance rates

- Increasing employment prospects

Building credit as a new immigrant can be challenging since you may not have a credit history in the United States. However, by following the strategies outlined below, you can start building a positive credit history and set yourself on a path to financial success.

1. Obtain a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

One of the first steps towards building credit as a new immigrant is obtaining a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN). Without an SSN or ITIN, it will be difficult to apply for credit cards, loans, or rental agreements.

The SSN is a nine-digit number issued by the Social Security Administration (SSA) to U.S. citizens, permanent residents, and non-immigrants authorized to work in the United States. If you are eligible, apply for an SSN as soon as possible after arriving in the country.

If you are not eligible for an SSN, you can apply for an ITIN from the Internal Revenue Service (IRS). The ITIN is a nine-digit number issued to individuals who need to file taxes but are not eligible for an SSN. While an ITIN alone may not be sufficient for all credit applications, it is often accepted by some lenders and credit card issuers.

2. Open a Bank Account

Opening a bank account is an essential step in establishing your financial presence and building credit. Having a checking or savings account allows you to showcase stability and responsible money management. When choosing a bank, consider the following factors:

- Fee structure: Look for accounts with low or no monthly fees.

- Branch accessibility: Choose a bank with branches conveniently located near your home or workplace.

- Online banking options: Ensure the bank offers robust online banking services for easy access to your accounts.

- Additional perks: Some banks offer features like cashback rewards or higher interest rates on savings accounts.

Once you have a bank account, make regular deposits and manage your finances responsibly. This will demonstrate your ability to handle money and establish a positive relationship with the bank, which may be beneficial when applying for credit in the future.

3. Apply for a Secured Credit Card

A secured credit card is an excellent tool for establishing credit history as a new immigrant. Unlike a traditional credit card, a secured card requires a security deposit, which serves as collateral. The deposit acts as a safety net for the credit card company, reducing the risk associated with lending to someone without a credit history.

When choosing a secured credit card, consider the following factors:

- Security deposit amount: Look for a card that allows you to deposit an amount you can comfortably afford.

- Annual fees: Compare cards to find one with low or no annual fees.

- Reporting to credit bureaus: Ensure the card issuer reports your credit activity to major credit bureaus.

- Upgrade options: Some secured cards offer the possibility of upgrading to an unsecured card after a period of responsible usage.

Once you have a secured credit card, use it responsibly by making small purchases and paying the balance in full each month. This demonstrates your ability to manage credit responsibly and positively impacts your credit score.

4. Build Credit History with Credit-Builder Loans

Credit-builder loans are specifically designed to help individuals build credit. These loans function differently from traditional loans because the lender holds the loan amount in a separate account, and you make regular payments towards it. Once you complete the loan term and repay the full amount, you receive the funds.

These loans allow you to build credit history by making on-time monthly payments. This demonstrates your ability to repay borrowed funds and can have a positive impact on your credit score.

Check with local credit unions or community banks to see if they offer credit-builder loan programs. Ensure the loan activity is reported to credit bureaus, as this is crucial for building credit history.

5. Become an Authorized User

If you have family or close friends with good credit, you may ask them to add you as an authorized user on their credit card. This allows their positive credit history to be reflected on your credit report. However, it’s important to ensure that the primary cardholder has a good credit history and makes timely payments.

Keep in mind that not all credit card issuers report authorized user activity to credit bureaus. Verify with the credit card company that they report authorized user activities to ensure it positively impacts your credit history.

6. Pay Bills on Time

A key factor in building credit is consistently paying your bills on time. This includes credit card payments, utility bills, rent, and any other financial obligations you may have. Late payments can significantly damage your credit score.

Consider setting up automatic payments or reminders to ensure you never miss a payment. Consistently making timely payments demonstrates your responsibility and reliability to lenders, contributing to a positive credit history.

7. Monitor Your Credit Report

Regularly monitoring your credit report is crucial for building credit and protecting yourself from potential fraud or errors. By checking your credit report, you can identify any negative or incorrect information, allowing you to take corrective action.

Under federal law, you are entitled to a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year. Take advantage of this and review your credit report for any discrepancies.

If you notice any inaccuracies, such as accounts you didn’t open or incorrect personal information, contact the relevant credit bureau and the creditor to dispute the information and have it corrected.

8. Apply for a Starter Credit Card

Once you have built some credit history with a secured credit card or credit-builder loan, you can explore applying for a starter credit card. These cards are designed for individuals with limited or fair credit and often have lower credit limits and higher interest rates.

When choosing a starter credit card, consider the following factors:

- Credit limit: Look for a card with a credit limit that suits your needs.

- Annual fees: Consider cards with low or no annual fees.

- Interest rates: Compare interest rates to find a card with the lowest possible rate.

- Rewards and benefits: Some starter credit cards offer rewards or benefits that cater to specific needs, such as cashback on certain purchases.

Having a starter credit card and using it responsibly by making timely payments and keeping your credit utilization low will continue to build your credit history and may open doors to better credit opportunities in the future.

9. Establish a Positive Payment History

Consistently making on-time payments is one of the most important factors in building and maintaining good credit. Your payment history accounts for a significant portion of your credit score, so it’s crucial to establish a positive track record of responsible payment behavior.

Avoid missing payments or making late payments, as these can have a significant negative impact on your credit score. Set up reminders or automatic payments to ensure you stay on track.

10. Be Patient and Stay Committed

Building credit takes time, especially as a new immigrant without an established credit history. It’s important to be patient and stay committed to your goals. By consistently following the strategies outlined in this guide and practicing responsible financial habits, you can build a strong credit foundation over time.

Remember, building credit is a marathon, not a sprint. With determination and discipline, you can achieve your financial dreams and access the opportunities you deserve.

How to Quickly Build CREDIT For Immigrants & Ex-Pats in the United States (2021)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I build credit as a new immigrant?

Building credit as a new immigrant can be challenging, but with the right strategies, it is achievable. Here are some steps you can take:

1. What is the first step to build credit as a new immigrant?

The first step is to obtain a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). These identification numbers are required to apply for credit in the United States.

2. Can I apply for a credit card as a new immigrant?

Yes, you can apply for a credit card as a new immigrant. However, it might be easier to get a secured credit card initially, where you make a deposit that becomes your credit limit. This can help you establish a credit history.

3. How can I start building credit without a credit history?

If you don’t have a credit history, you can start building credit by applying for a secured credit card, becoming an authorized user on someone else’s credit card, or applying for a credit-builder loan.

4. How important is it to pay my bills on time?

Paying your bills on time is crucial for building credit. Late payments can have a negative impact on your credit score and make it harder to establish a good credit history. Set up reminders or automatic payments to ensure you never miss a due date.

5. Should I open multiple credit accounts to build credit quickly?

While having multiple credit accounts can help diversify your credit profile, it’s important to be cautious. Opening too many accounts within a short period can negatively impact your credit score. Start with one or two accounts and use them responsibly before considering additional accounts.

6. How long does it take to build good credit?

Building good credit takes time and consistent positive credit behaviors. It typically takes around six months of responsible credit usage to start establishing a credit history and up to several years to build a solid credit score.

7. Are there any alternatives to credit cards for building credit?

Yes, alternatives to credit cards for building credit include taking out a small personal loan from a bank or credit union, getting a credit-builder loan, or applying for a secured loan. These options can help you establish credit history while diversifying your credit mix.

8. How can I monitor my credit progress?

You can monitor your credit progress by checking your credit reports regularly. You are entitled to a free annual credit report from each of the major credit bureaus (Equifax, Experian, and TransUnion). Additionally, there are various credit monitoring services available that provide regular updates on your credit score and report changes.

Final Thoughts

Building credit as a new immigrant can be a challenge, but with the right approach, it is entirely achievable. First and foremost, obtain a social security number or Individual Taxpayer Identification Number (ITIN) to establish your identity in the United States. Next, open a bank account to demonstrate financial stability and responsibility. Consider applying for a secured credit card, as it requires a cash deposit as collateral and can help establish credit history. Make consistent, on-time payments and keep your credit utilization low. Finally, regularly check your credit reports and address any errors promptly. By following these steps, new immigrants can successfully build credit in their new country.