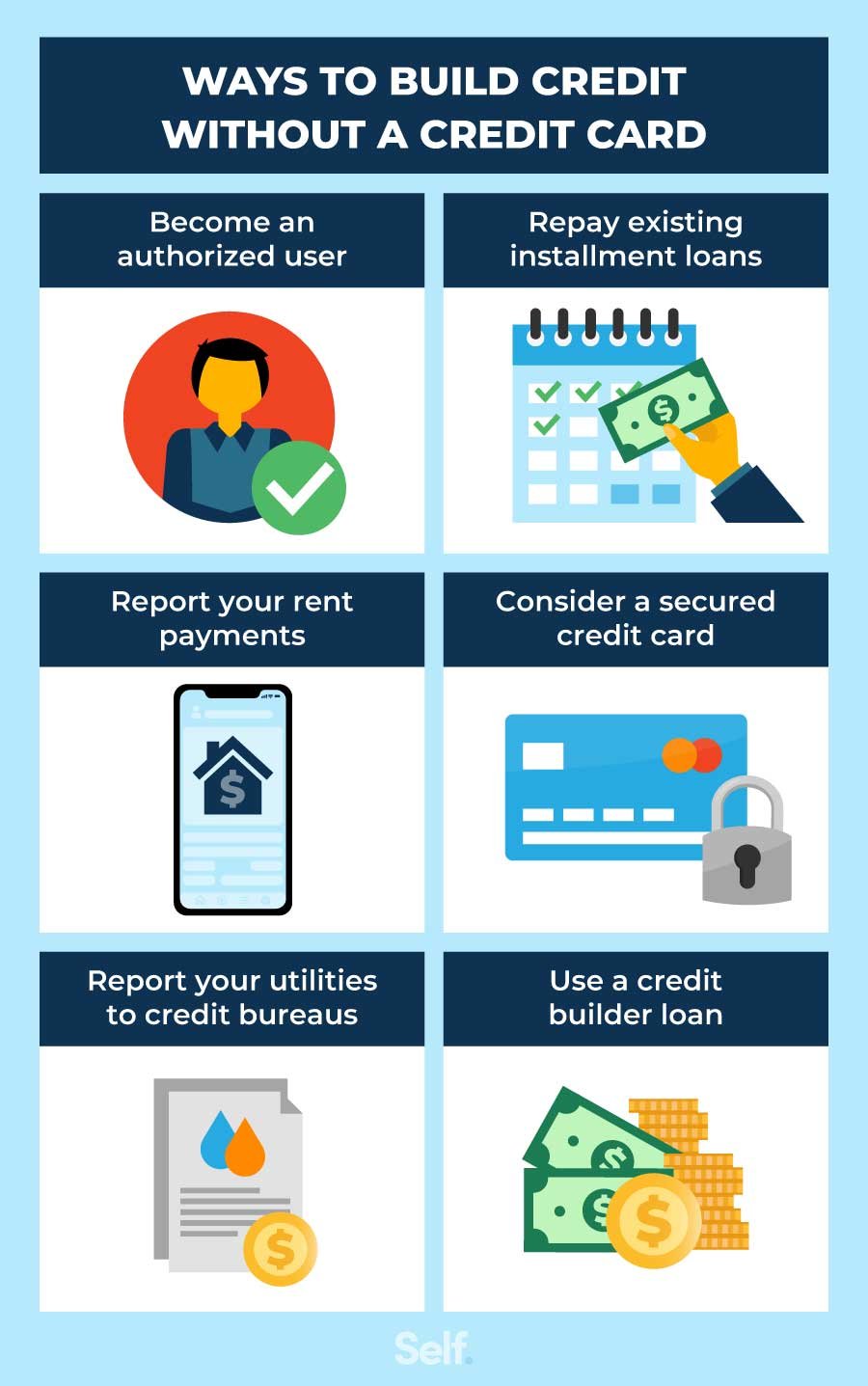

Looking to build credit but don’t have a credit card? You’re not alone! Many people mistakenly believe that a credit card is the only way to establish a credit history. However, there are alternative methods available that can help you build credit without relying on plastic. In this article, we’ll explore actionable strategies for building credit without a credit card. So whether you’re averse to credit cards or simply looking for additional ways to improve your creditworthiness, keep reading to discover how to build credit without a credit card.

How to Build Credit Without a Credit Card

Building credit is an essential step towards financial stability and independence. While credit cards are a common tool for establishing credit history, they’re not the only option available. In this article, we will explore various effective strategies to build credit without relying on a credit card. Whether you’re just starting out or looking to diversify your credit portfolio, these methods will help you establish and improve your creditworthiness.

1. Become an Authorized User

One of the easiest ways to build credit without a credit card is by becoming an authorized user on someone else’s credit card account. By being added as an authorized user, you can piggyback off the primary cardholder’s credit history and benefit from their responsible credit behavior. Here’s how it works:

- Find a trusted friend or family member who has a credit card with good payment history and low credit utilization.

- Ask them to add you as an authorized user on their account.

- Ensure that the credit card company reports authorized user information to credit bureaus. This step is crucial as not all companies report authorized user activity.

- Once added, the primary cardholder’s positive credit behavior will reflect on your credit report, helping you build a positive credit history.

2. Apply for a Credit Builder Loan

A credit builder loan is specifically designed to help individuals establish or rebuild their credit. Unlike traditional loans, the borrowed money is held in a secured account, and you make monthly payments towards it. These loans have several advantages:

- As you make timely payments, the lender reports them to credit bureaus, allowing you to demonstrate responsible repayment behavior.

- Once you’ve completed all payments, you’ll receive the full amount of the loan. This is an excellent way to build savings while building credit.

- Look for credit builder loans offered by community banks, credit unions, or online lenders. Compare terms and interest rates to find the best option for your needs.

3. Explore Credit Alternatives

While credit cards are the most common credit-building tool, other financial products can help you establish credit without relying on them. Consider the following alternatives:

Secured Loans

- Similar to credit builder loans, secured loans require collateral, such as a savings account or a certificate of deposit (CD), to secure the loan.

- By borrowing against your own funds, you minimize the lender’s risk, making it easier to qualify for the loan.

- Make timely payments to build a positive credit history.

Microloans

- Microloans are small loans typically offered by non-profit organizations or community development financial institutions (CDFIs).

- These loans are often aimed at entrepreneurs and individuals with limited credit history.

- By making regular payments on a microloan, you can establish a positive payment history.

Peer-to-Peer Lending

- Peer-to-peer lending platforms connect borrowers directly with individual lenders.

- If approved, you’ll receive a loan from an individual investor who is willing to lend you money.

- Make consistent payments to demonstrate your creditworthiness.

4. Pay Your Rent and Utilities on Time

Your rental payment history and utility bills can help you build credit. While these payments typically do not appear on your credit report, certain services can report them to credit bureaus. Here are some options to consider:

- Sign up for rent reporting services like RentTrack or PayYourRent, which report your rental payment history to credit bureaus.

- Some utilities, such as gas, electricity, and telecommunications, report your payment history to credit bureaus. Ensure that your accounts are in good standing to benefit from this reporting.

- Keep in mind that late or missed payments may have a negative impact on your credit. Pay your bills on time to establish a positive credit history.

5. Get a Credit-Builder Credit Card

Although this article is about building credit without a credit card, it’s worth mentioning credit-builder credit cards. These cards are specifically designed for individuals with limited or poor credit history. Here’s how they work:

- With a credit-builder card, you provide a security deposit, which acts as collateral for the credit limit.

- Make small purchases and pay them off in full each month to demonstrate responsible credit usage.

- Ensure that the card issuer reports your activity to credit bureaus.

- Over time, responsible credit usage with a credit-builder card can help you improve your credit score.

6. Monitor Your Credit Report

Regardless of the credit-building method you choose, regularly monitoring your credit report is crucial. By keeping an eye on your credit history, you can quickly identify any errors or fraudulent activity that could negatively impact your credit score. Here’s what you should do:

- Request a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, TransUnion) once a year.

- Review the report for accuracy, including your personal information, credit accounts, and payment history.

- If you notice any errors, dispute them with the credit bureau to have them corrected.

- Consider subscribing to a credit monitoring service that provides regular updates on your credit activity.

In conclusion, building credit without a credit card is possible. By becoming an authorized user, exploring credit alternatives, making timely rent and utility payments, and monitoring your credit report, you can establish a solid credit history. Remember, building credit takes time and discipline, so stay consistent, and your efforts will pay off in the long run.

What's The Best Way To Build Credit Without A Credit Card?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

Question 1: Can I build credit without a credit card?

Yes, it is possible to build credit without a credit card. There are alternative methods available that can help you establish and improve your credit history.

Question 2: What are some alternatives to using a credit card to build credit?

Some alternatives to using a credit card to build credit include taking out a credit builder loan, becoming an authorized user on someone else’s credit card, or applying for a secured credit card.

Question 3: How does a credit builder loan work?

A credit builder loan is a type of loan designed to help individuals with limited or no credit history build credit. The loan amount is typically held in a savings account or certificate of deposit (CD) as collateral. As you make regular payments on the loan, the lender reports your payment history to the credit bureaus, helping you establish a positive credit history.

Question 4: What is an authorized user, and how does it help build credit?

An authorized user is someone who is allowed to make purchases using another person’s credit card. By becoming an authorized user on someone else’s credit card, you can benefit from their positive credit history. The primary cardholder’s payment history and credit limit will be reflected on your credit report, helping you build credit.

Question 5: What is a secured credit card, and how does it work?

A secured credit card requires a cash deposit as collateral, which then becomes your credit limit. It functions similarly to a regular credit card, allowing you to make purchases and build credit. By consistently making on-time payments and keeping your credit utilization low, you can gradually improve your credit score.

Question 6: How long does it take to build credit without a credit card?

The time it takes to build credit without a credit card can vary depending on various factors, including your financial habits and the credit-building methods you choose. Generally, it may take several months or even a few years to establish a solid credit history.

Question 7: What are some other ways to demonstrate creditworthiness without a credit card?

Aside from credit builder loans, authorized user arrangements, and secured credit cards, you can demonstrate creditworthiness by paying your rent and utility bills on time. Some credit bureaus consider rent and utility payments when calculating credit scores.

Question 8: Will building credit without a credit card guarantee a good credit score?

Building credit without a credit card is a positive step towards establishing a credit history. However, a good credit score also depends on other factors such as payment history, credit utilization, and the length of your credit history. It’s important to practice responsible borrowing habits and consistently make on-time payments to improve your credit score over time.

Final Thoughts

To build credit without a credit card, there are several alternative strategies available. One option is to become an authorized user on someone else’s credit card, which allows you to establish credit history using their account. Another approach is to apply for a credit-builder loan, where you borrow a small amount and make regular payments to build credit. Additionally, paying your rent and utility bills on time can contribute to building credit, as some credit reporting agencies now include these payments in their reports. By exploring these alternatives, individuals can effectively build credit without relying on a credit card.