Running into unexpected emergencies can be overwhelming, both emotionally and financially. That’s why it’s crucial to have emergency savings in place. In this article, we will explore the practical steps to build emergency savings from scratch. By following these simple strategies, you will be better prepared to handle any unforeseen circumstances that may arise. So, let’s dive in and discover how to build emergency savings from scratch, step by step.

How to Build Emergency Savings from Scratch

Introduction

In times of unexpected financial setbacks or emergencies, having a robust emergency savings fund can provide peace of mind and a safety net. Whether it’s a medical emergency, unexpected car repairs, or a sudden job loss, having the financial resources to cover these unexpected expenses can help you navigate through difficult times without resorting to high-interest loans or credit card debt. In this article, we will guide you through the process of building an emergency savings fund from scratch, step by step.

Why is Building an Emergency Savings Important?

Building an emergency savings fund is not just a good financial practice; it is a crucial step towards securing your financial future. Here are a few reasons why having emergency savings is important:

- Protection against emergencies: Life is unpredictable, and emergencies can happen at any time. Having a dedicated emergency fund can provide you with a financial cushion to handle unexpected situations without disrupting your long-term financial goals.

- Peace of mind: Knowing that you have a safety net to fall back on can alleviate stress and anxiety. It allows you to focus on other aspects of your life without constantly worrying about unforeseen financial challenges.

- Reduced reliance on debt: Without emergency savings, individuals often resort to using credit cards or taking out loans to cover unexpected expenses. This can lead to accumulating high-interest debt, which adds to financial stress and may take years to pay off.

- Financial independence: By building emergency savings, you are taking control of your finances and ensuring you have the means to handle financial emergencies without relying on others for support.

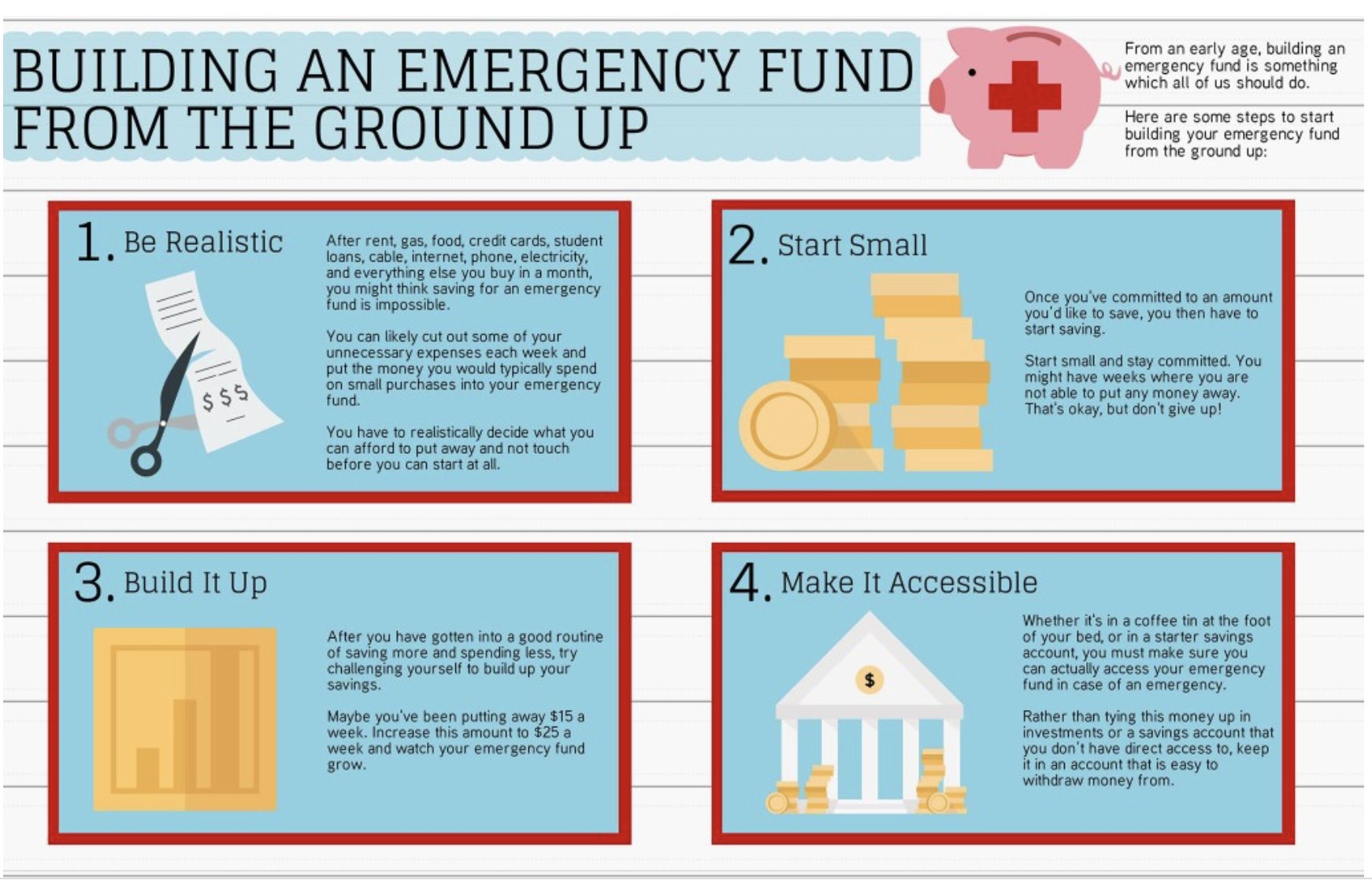

Step-by-Step Guide to Building Emergency Savings

Building an emergency savings fund may seem like a daunting task, especially if you’re starting from scratch. However, with a well-defined plan and consistent effort, you can gradually build up your emergency savings over time. Follow these steps to get started:

Step 1: Set a Realistic Savings Goal

To begin building your emergency savings, you first need to determine how much you want to save. Calculate an amount that will provide you with a sense of security and cover at least three to six months’ worth of living expenses. Consider factors such as monthly bills, rent/mortgage payments, groceries, utilities, insurance, and any other necessary expenses.

Step 2: Track Your Income and Expenses

To effectively save for emergencies, it’s essential to have a clear understanding of your cash flow. Start by tracking your income and expenses using a spreadsheet or budgeting app. Categorize your expenses into fixed (e.g., rent, utilities) and variable (e.g., entertainment, dining out) to identify areas where you can cut back and allocate more towards savings.

Step 3: Create a Budget

Once you have an overview of your income and expenses, create a budget that aligns with your savings goal. Allocate a specific amount each month towards your emergency fund and prioritize saving just as you would with any other financial obligation. Look for areas in your budget where you can make adjustments to free up more money for savings.

Step 4: Automate Your Savings

Make saving for emergencies a streamlined process by setting up an automatic transfer from your checking account to a separate savings account. This way, a predetermined portion of your income will be automatically deposited into your emergency fund without you having to remember or manually transfer the money each month. Automating your savings helps build consistency and removes the temptation to spend the money elsewhere.

Step 5: Cut Back on Non-Essential Expenses

To accelerate your emergency savings growth, consider cutting back on non-essential expenses. Evaluate your monthly subscriptions, dining out habits, entertainment expenses, and other discretionary spending. Identify areas where you can make adjustments without significantly compromising your quality of life. Redirect the money saved from these cutbacks towards your emergency fund.

Step 6: Increase Your Income

If your current income doesn’t allow for significant savings, consider looking for ways to increase your income. This could include taking on a side gig, freelancing, or asking for a raise at your current job. By boosting your income, you’ll have more financial resources to dedicate towards your emergency savings.

Step 7: Set Up a Separate Savings Account

It’s crucial to separate your emergency savings from your regular checking or savings account. Open a separate, dedicated savings account specifically for emergency funds. This separation will help you resist the temptation to dip into the savings for non-emergency expenses.

Step 8: Minimize Financial Waste

Identify areas where you are wasting money unnecessarily and redirect those funds towards your emergency savings. This could include avoiding ATM fees, negotiating lower interest rates on credit cards, refinancing high-interest loans, or shopping around for better deals on insurance policies. Every dollar saved counts towards building your emergency fund faster.

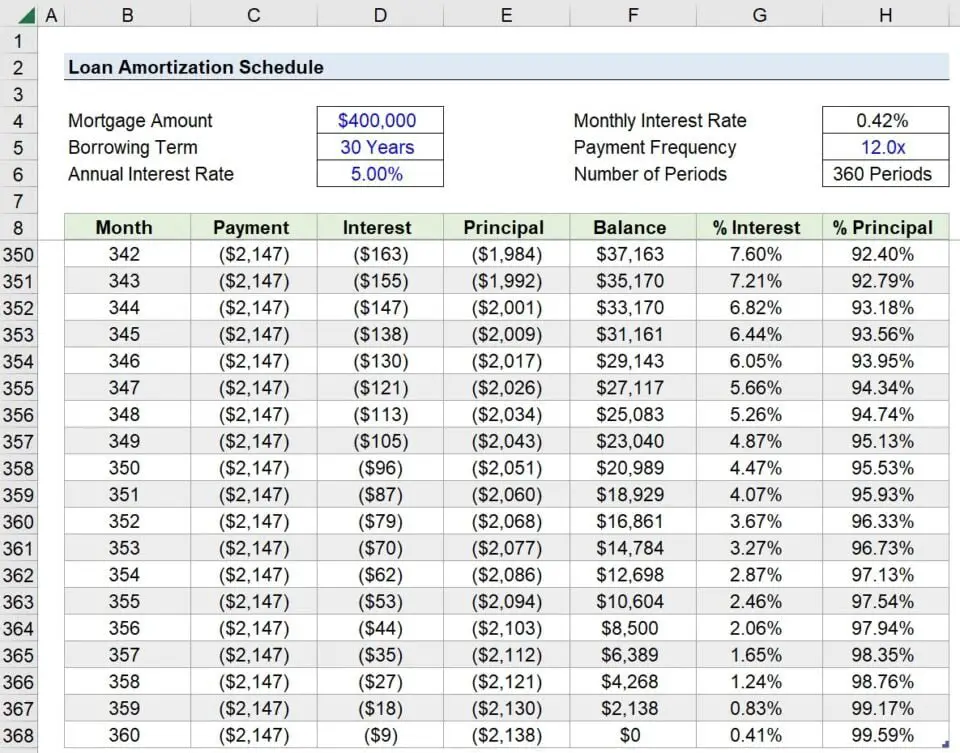

Step 9: Prioritize Debt Repayment

If you have outstanding debt, prioritize repaying it while simultaneously building your emergency savings. Focus on high-interest debt first, as it can accumulate quickly and hinder your ability to save. By paying off debt, you free up more money every month that can be redirected towards your emergency fund.

Step 10: Be Consistent and Patient

Building an emergency savings fund takes time and consistency. Be patient with the process and celebrate small milestones along the way. Even if you can only save a small amount initially, remember that every contribution brings you one step closer to achieving your savings goal.

Building emergency savings from scratch is an essential step towards financial security. By setting a realistic savings goal, tracking your income and expenses, creating a budget, automating savings, and making adjustments to your lifestyle, you can gradually build up a solid emergency fund. Remember, the key is consistency and patience. Keep your emergency savings separate from your regular accounts and resist the temptation to dip into it for non-emergency expenses. With time, you’ll have a robust emergency fund that provides peace of mind and protects you from unexpected financial setbacks. Start building your emergency savings today and take control of your financial future.

How to Build an Emergency Fund | Quick & Easy Guide to Starting An Emergency Fund

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I start building emergency savings from scratch?

To begin building emergency savings from scratch, start by setting a specific monthly savings goal. Analyze your income and expenses to determine how much you can save each month. Consider automating your savings by setting up automatic transfers to a separate savings account.

2. What strategies can I use to save money for emergencies?

There are several strategies you can use to save money for emergencies. Some effective methods include cutting back on discretionary expenses, such as dining out or entertainment, and instead allocating that money towards your emergency fund. You can also save by negotiating bills, seeking out discounts, or increasing your income through side gigs or freelancing.

3. Should I prioritize paying off debt or building emergency savings?

It is generally recommended to prioritize building emergency savings, even if you have existing debt. While it’s important to manage debt, having an emergency fund in place can prevent you from falling deeper into debt when unexpected expenses arise. Aim to strike a balance by allocating a portion of your income towards both debt repayment and emergency savings.

4. How much should I aim to save in my emergency fund?

Aim to save three to six months’ worth of living expenses in your emergency fund. This amount can provide a safety net to cover unexpected costs or temporary loss of income. However, your savings goal may vary depending on your financial situation, such as the stability of your job, the number of dependents you have, and your monthly expenses.

5. Where should I keep my emergency savings?

It’s recommended to keep your emergency savings in a separate savings account that is easily accessible but not too easily tempting to withdraw from for non-emergency purposes. Look for high-yield savings accounts that offer competitive interest rates, ensuring your money grows over time.

6. What should I do if I have an unexpected expense but no emergency savings yet?

If you encounter an unexpected expense and have no emergency savings, consider alternative options such as borrowing from a trusted family member or friend, exploring low-interest personal loans, or utilizing a credit card with a plan to pay it off as soon as possible. However, it’s essential to still prioritize building your emergency savings to avoid future financial stress.

7. How often should I review and adjust my emergency savings goals?

It’s wise to review and adjust your emergency savings goals periodically, especially when significant life changes occur. Evaluate your monthly income, expenses, and any new financial obligations to ensure your savings goals align with your current situation. Aim to revisit your emergency savings goals at least once a year or when there are notable changes in your life.

8. What steps can I take to stay motivated while building emergency savings?

To stay motivated while building emergency savings, set small milestones and celebrate each achievement. Track your progress regularly, visualize the benefits of having an emergency fund, and remind yourself of the peace of mind that comes with financial stability. Engage in personal finance communities for support and share success stories to inspire and motivate yourself.

Final Thoughts

Building emergency savings from scratch is vital for financial stability. Start by setting a realistic goal and creating a budget to determine how much you can save. Cut unnecessary expenses, negotiate bills, and find ways to increase your income. Automating savings and directing a portion of each paycheck to a separate emergency fund can help you stay consistent. Avoid temptation by keeping your emergency savings in a separate account, and resist the urge to dip into it for non-emergency purposes. Building emergency savings may take time, but with discipline and patience, you can achieve financial peace of mind. So, start taking small steps today to build your emergency savings from scratch.