Are you looking to gain control over your finances and make smarter financial decisions? One crucial aspect of managing your money effectively is understanding your cash flow. By knowing how to calculate and track your cash flow, you can monitor your income and expenses, identify areas where you can save or invest, and ultimately achieve your financial goals. In this article, we will cover the step-by-step process of calculating and tracking your cash flow, empowering you to take charge of your financial future. So let’s dive in and explore how to calculate and track your cash flow effectively.

How to Calculate and Track Your Cash Flow

Cash flow is a crucial aspect of managing your finances, whether you’re an individual or a business. It represents the movement of money in and out of your accounts, indicating how well you manage your income and expenses. Understanding how to calculate and track your cash flow can provide valuable insights into your financial health and help you make informed decisions. In this article, we’ll delve into the details of calculating and tracking your cash flow, step by step.

What is Cash Flow?

Cash flow refers to the inflow and outflow of cash in a given time period. It shows the net change in your liquid assets, such as cash and cash equivalents, enabling you to assess the overall financial performance of an individual, business, or project. Positive cash flow indicates that more money is coming in than going out, while negative cash flow suggests the opposite.

Cash flow is categorized into three main types:

1. Operating Cash Flow: This refers to the cash generated or utilized by a company’s core operations, such as sales and services. It reflects the day-to-day revenue and expenses related to conducting business.

2. Investing Cash Flow: This category covers the cash flow resulting from buying or selling long-term assets, such as property, equipment, or investments. Investments and divestments fall under this category.

3. Financing Cash Flow: Financing cash flow includes the inflow and outflow of cash related to obtaining or repaying capital, such as loans, issuing or buying back shares, or paying dividends. It represents the financial structure and funding activities of a company.

Why is Cash Flow Important?

Maintaining a positive cash flow is vital for the stability and growth of any entity. Here’s why cash flow is important:

1. Liquidity: Positive cash flow ensures you have enough liquid assets to cover your expenses and financial obligations on time. It prevents liquidity issues that could impact your operations or personal finances.

2. Financial Health: Monitoring your cash flow helps assess your financial health and solvency. It provides a clearer picture of your ability to meet short-term and long-term financial commitments.

3. Planning and Decision Making: Understanding your cash flow enables you to make informed decisions regarding investments, expansion, debt repayment, and more. It helps you align your resources and identify potential risks or opportunities.

Calculating Cash Flow

To calculate your cash flow, you need to gather relevant financial data and follow a structured approach. Here’s a step-by-step guide to calculating your cash flow:

Step 1: Determine the Timeframe

Decide on the period for which you want to calculate your cash flow. It could be a month, quarter, or year, depending on your needs and the level of detail you seek.

Step 2: Gather Cash Inflow Data

Identify the sources of cash inflow during the specified timeframe. This includes:

- Revenue from sales of products or services

- Interest earned on investments or savings accounts

- Rental income

- Loan proceeds

- Capital contributions

- Other sources of income

Step 3: Compile Cash Outflow Data

List all the cash outflows during the chosen period. Some common categories of cash outflows include:

- Expenses (both fixed and variable)

- Loan repayments

- Inventory or raw material purchases

- Payroll

- Utilities and rent

- Taxes and fees

- Dividends or distributions

Step 4: Calculate Operating Cash Flow

To calculate your operating cash flow, subtract your cash outflows from your cash inflows. The formula is:

Operating Cash Flow = Cash Inflows – Cash Outflows

A positive operating cash flow indicates that your core business activities generate enough cash to cover expenses and leave a surplus.

Step 5: Analyze Investing and Financing Activities

Apart from operating cash flow, analyze the cash flow related to investing and financing activities. This step involves:

- Identifying cash inflows from investments or asset sales

- Determining cash outflows from investments or asset acquisitions

- Evaluating cash inflows from financing activities, such as loans or equity funding

- Considering cash outflows from debt repayment or dividend payments

Step 6: Calculate Net Cash Flow

To determine your net cash flow, sum up the operating, investing, and financing cash flows. The formula is:

Net Cash Flow = Operating Cash Flow + Investing Cash Flow + Financing Cash Flow

A positive net cash flow implies your total cash inflows exceed the outflows, indicating financial health and potential for growth.

Tracking Cash Flow

Once you have calculated your cash flow, it’s crucial to track it regularly to monitor trends, identify areas of improvement, and make informed financial decisions. Here are some effective ways to track your cash flow:

Use Accounting Software or Tools

Accounting software or tools can simplify cash flow tracking by automating calculations and providing real-time insights. These tools enable you to categorize income and expenses, generate cash flow statements, and create visual reports for better analysis.

Maintain Accurate Financial Records

Ensure you have accurate and up-to-date financial records, including invoices, receipts, bank statements, and expense reports. This documentation helps you track your cash flow and simplifies the process during tax filing or financial audits.

Monitor Key Performance Indicators (KPIs)

Identify relevant KPIs that align with your goals and industry benchmarks. Common cash flow-related KPIs include operating cash flow ratio, cash conversion cycle, and days payable outstanding. Regularly tracking these metrics provides insights into your cash flow efficiency and alerts you to potential issues.

Create Cash Flow Forecasts

Develop a cash flow forecast by projecting your expected inflows and outflows for a future period. This forward-looking analysis helps you anticipate potential cash shortages or surpluses and take proactive measures to manage your finances effectively.

Review and Analyze Cash Flow Statements

Regularly review your cash flow statements to analyze trends, patterns, and potential areas for improvement. Look for any significant changes in cash flow from one period to another and investigate the causes. This analysis will enable you to make strategic decisions and take corrective actions when necessary.

In Conclusion

Calculating and tracking your cash flow is essential for maintaining financial stability and making well-informed decisions. By following the step-by-step approach outlined in this article, you can accurately calculate your cash flow and establish effective methods for tracking it. Remember, cash flow management is an ongoing process, so regular monitoring and analysis are key to optimizing your financial well-being.

The CASH FLOW STATEMENT for BEGINNERS

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I calculate my cash flow?

To calculate your cash flow, you need to subtract your total expenses from your total income for a specific period. This will give you a clear picture of how much money you have coming in and going out.

What is the importance of tracking cash flow?

Tracking your cash flow is crucial as it helps you understand the financial health of your business and make informed decisions. It allows you to identify potential cash shortages, manage your expenses, and ensure you have enough funds for future growth.

What are some common methods to track cash flow?

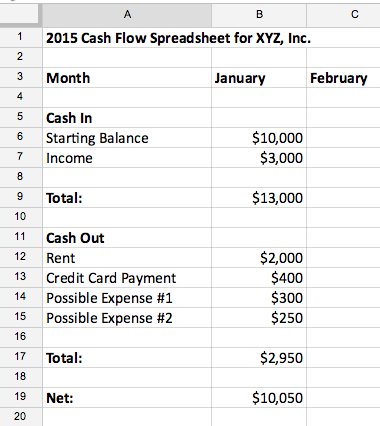

There are various methods to track cash flow. You can use spreadsheets to manually record and categorize your income and expenses. Alternatively, you can use accounting software or online tools that automate the process and provide you with real-time insights into your cash flow.

How often should I track my cash flow?

It is recommended to track your cash flow regularly, at least on a monthly basis. This ensures that you have an up-to-date understanding of your financial situation and allows you to make timely adjustments if needed.

What are the components of cash flow?

Cash flow consists of three main components: operating cash flow, investing cash flow, and financing cash flow. Operating cash flow represents the cash generated or used in daily business activities, investing cash flow relates to buying or selling assets, and financing cash flow involves activities such as taking loans or issuing stock.

Why is it important to categorize income and expenses?

Categorizing income and expenses helps you analyze your cash flow in a more detailed manner. It allows you to identify areas where you are spending the most, assess the profitability of different revenue sources, and make informed decisions on cost-cutting or revenue-growing strategies.

Can I use cash flow to predict future financial trends?

While cash flow provides insights into your current financial situation, it may not always accurately predict future trends. However, by analyzing historical cash flow patterns and considering external factors, you can make more informed projections about your financial future.

What steps can I take to improve my cash flow?

To improve your cash flow, you can take several steps, such as reducing expenses, negotiating better payment terms with suppliers, increasing prices, improving inventory management, and exploring additional revenue streams. It is important to regularly review your cash flow and implement appropriate strategies for improvement.

Final Thoughts

In conclusion, calculating and tracking your cash flow is crucial for maintaining a healthy financial state. By following a few simple steps, you can gain valuable insights into your business’s financial performance. Start by documenting all your income and expenses, ensuring accuracy and completeness. Next, subtract your total expenses from your total income to calculate your net cash flow. Regularly track your cash flow using tools like spreadsheets or financial software to monitor any fluctuations or patterns. By mastering the art of calculating and tracking your cash flow, you can make informed decisions and effectively manage your finances.