Looking to calculate your monthly loan payments? You’ve come to the right place! Understanding how to calculate monthly loan payments is an essential skill that can help you budget and plan your finances effectively. Whether you’re considering a new car loan, a mortgage, or even a personal loan, having a clear understanding of how much you’ll need to repay each month is crucial. In this article, we’ll walk you through the steps to calculate your monthly loan payments accurately. No need to worry, we’ll keep it simple and easy to understand. So, let’s dive in and demystify the process of calculating monthly loan payments!

How to Calculate Monthly Loan Payments: A Comprehensive Guide

Whether you’re considering a mortgage, a car loan, or any other type of loan, it’s important to understand how monthly loan payments are calculated. By having a clear understanding of this process, you can make informed financial decisions and plan your budget effectively. In this guide, we’ll break down the steps involved in calculating monthly loan payments in a simple and straightforward manner. Let’s dive in!

Gather the Necessary Information

Before you can begin calculating your monthly loan payments, you’ll need to gather some essential information. The following details are typically required:

- Loan amount: The total amount of money you’re borrowing.

- Interest rate: The annual interest rate percentage charged by the lender.

- Loan term: The duration of the loan, typically stated in months.

Having these details at hand will streamline the calculation process and give you accurate results.

Understand the Loan Payment Formula

To calculate monthly loan payments, you’ll use a standard formula. The formula takes into account the loan amount, interest rate, and loan term. Here’s the formula:

Monthly Payment = P × (r(1+r)^n) / ((1+r)^n – 1)

- P represents the loan amount.

- r is the monthly interest rate (annual interest rate divided by 12).

- n denotes the number of monthly payments, i.e., the loan term in months.

Now that we have the formula, let’s break it down further.

Calculate the Monthly Interest Rate

Before diving into the actual calculation, it’s essential to adjust the annual interest rate to a monthly rate. To do this, divide the annual interest rate by 12. Let’s say the annual interest rate is 6%. The monthly interest rate would then be 6% / 12 = 0.005 (or 0.5%).

Example Calculation: Mortgage Loan

Suppose you’re planning to take out a mortgage loan for $200,000 with an annual interest rate of 4.5% and a loan term of 30 years (360 months). Let’s calculate the monthly loan payment using the formula:

- P (loan amount) = $200,000

- r (monthly interest rate) = 4.5% / 12 = 0.375%

- n (number of payments) = 30 years × 12 months/year = 360 months

Plugging these values into the formula, we get:

Monthly Payment = $200,000 × (0.375%(1+0.375%)^360) / ((1+0.375%)^360 – 1)

Using a calculator or spreadsheet software, evaluate the expression to find the monthly payment. In this scenario, the monthly payment would be $1,013.37.

Consider Additional Factors

While the formula we’ve discussed provides a general calculation, keep in mind that there might be additional factors that influence your monthly loan payments. Here are a few worth considering:

- Down payment: If you make a substantial down payment, your loan amount will decrease, leading to lower monthly payments.

- Private Mortgage Insurance (PMI): If you’re obtaining a mortgage with less than a 20% down payment, you may be required to pay for PMI, which can increase your monthly payments.

- Property taxes and insurance: If your loan includes escrow for property taxes and insurance, these costs will be added to your monthly payment.

- Variable interest rates: Some loans, such as adjustable-rate mortgages, may have variable interest rates that can cause fluctuations in your monthly payments over time.

Understanding these additional factors is crucial to accurately estimate your monthly loan payments.

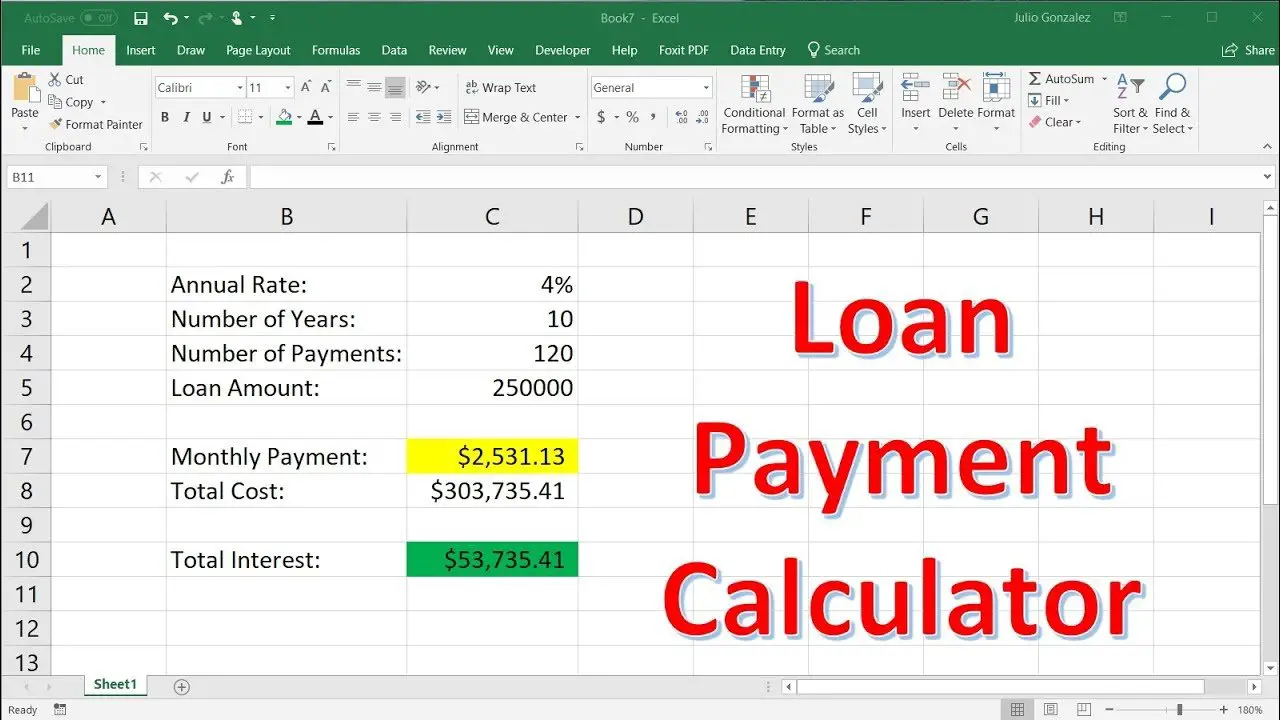

Utilize Online Loan Calculators

While the manual calculation method we’ve discussed is valuable for understanding the underlying principles, there are numerous online loan calculators available that can provide quick and accurate results. These calculators allow you to input your loan details and instantly generate the monthly payment amount. They often provide a breakdown of principal and interest payments as well.

Using online loan calculators can save you time and effort, especially when exploring different loan options or making adjustments to loan terms or interest rates.

Calculating monthly loan payments is an essential skill for anyone seeking to borrow money. By understanding the calculation process and considering additional factors, you can make informed financial decisions and plan your budget effectively. Remember to gather all the necessary information, use the loan payment formula, and consider any extra costs associated with your loan. Utilizing online loan calculators can also simplify the process. Armed with this knowledge, you’re ready to navigate the loan landscape with confidence!

How To Calculate Your Mortgage Payment

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How do I calculate monthly loan payments?

To calculate monthly loan payments, you can use the following formula:

Monthly Payment = (Loan Amount x Interest Rate) / (1 – (1 + Interest Rate) ^ -Loan Term)

Where the loan amount is the total amount borrowed, the interest rate is the annual interest rate, and the loan term is the number of months over which you’ll be repaying the loan.

Can you explain the terms used in the loan payment calculation formula?

Certainly! In the loan payment calculation formula, the following terms are used:

– Loan Amount: This refers to the total amount of money you have borrowed.

– Interest Rate: It represents the annual interest rate charged on the loan amount.

– Loan Term: This refers to the length of time, usually in months, over which you’ll be repaying the loan.

Does the loan payment calculation formula work for all types of loans?

Yes, the loan payment calculation formula is generally applicable to most types of loans, including personal loans, auto loans, and mortgages. However, it’s important to note that some loan agreements may have additional fees or factors that need to be considered for a more accurate calculation.

Is the calculated monthly payment the final amount I’ll have to pay each month?

The calculated monthly payment represents the principal and interest portion of your loan repayment. However, it’s important to note that in some cases, your monthly payment may also include additional costs, such as insurance or taxes, depending on the specific loan agreement. Always review your loan terms to ensure you have a complete understanding of the total amount due each month.

What happens if I miss a monthly loan payment?

Missing a monthly loan payment can have several consequences. Firstly, it may result in late payment fees and increased interest charges. Additionally, it can negatively impact your credit score, making it more difficult to obtain credit in the future. It’s crucial to contact your lender as soon as possible if you’re unable to make a payment to discuss potential options or arrangements.

Can I pay off my loan early?

In most cases, you can pay off your loan early. However, some lenders may charge prepayment penalties or fees for doing so. It’s essential to review your loan agreement or contact your lender directly to understand any potential costs or restrictions associated with paying off your loan before the agreed-upon term.

Does the loan payment calculation formula account for interest rate changes?

No, the loan payment calculation formula assumes a fixed interest rate throughout the loan term. If your loan has a variable interest rate, the monthly payments may change as the interest rate fluctuates. In such cases, it’s advisable to consult with your lender or financial institution for a more accurate calculation based on the specific terms of your loan.

Can I use the loan payment calculation formula for interest-only loans?

No, the loan payment calculation formula provided is not suitable for interest-only loans. Interest-only loans require a different calculation that considers the interest rate, loan amount, and the specific terms of the interest-only period. It’s recommended to consult with your lender or financial advisor for an accurate calculation for interest-only loan payments.

Final Thoughts

In conclusion, calculating monthly loan payments is a straightforward process that can greatly help individuals manage their finances. By using the loan amount, interest rate, and loan term, one can easily determine the monthly repayment amount. This calculation empowers borrowers to plan their budget effectively and make informed decisions. Knowing how to calculate monthly loan payments provides individuals with a clear understanding of their financial obligations, enabling them to stay on track and avoid any unexpected financial difficulties.