Looking to invest in rental property? Curious about how to calculate return on investment? Well, you’ve come to the right place! In this article, we will guide you through the process of determining your return on investment for rental properties. By understanding the formula and factors involved, you’ll gain valuable insights into the profitability of your investment. So, whether you’re a seasoned investor or just starting out, let’s delve into the world of calculating return on investment for rental property and empower you with the knowledge you need to make informed decisions.

How to Calculate Return on Investment for Rental Property

Investing in rental property can be a lucrative venture, but before you make any decisions, it’s crucial to determine the potential return on investment (ROI) for the property. Calculating ROI will help you evaluate the profitability of your investment and make informed financial decisions. In this article, we will guide you through the process of calculating ROI for rental property, taking into account the key factors and considerations that can impact your returns.

Gross Rental Income

The first step in calculating ROI is determining the gross rental income. This refers to the total income generated by the property from rental payments. To calculate this figure, multiply the monthly rent by 12 to get the annual rental income.

Example:

If your property generates $1,500 in monthly rent, the gross rental income would be $1,500 x 12 = $18,000 per year.

Operating Expenses

Next, you need to determine the operating expenses associated with the rental property. Operating expenses are the costs incurred to operate and maintain the property. Here are some common expenses to consider:

- Property management fees

- Property taxes

- Insurance premiums

- Maintenance and repairs

- Utilities

- HOA fees (if applicable)

- Vacancy and credit loss

Example:

Let’s assume the total operating expenses for your rental property amount to $5,000 per year.

Net Operating Income (NOI)

The net operating income (NOI) is calculated by subtracting the operating expenses from the gross rental income. NOI represents the income generated after deducting the direct expenses associated with the property.

Example:

Using the previous examples, if your gross rental income is $18,000 and your operating expenses are $5,000, the NOI would be $18,000 – $5,000 = $13,000 per year.

Capital Expenditures

In addition to operating expenses, it’s essential to account for capital expenditures (CapEx) when calculating ROI. Capital expenditures are major repairs or improvements that enhance the property’s value and have a long-term impact. Examples include replacing the roof, renovating the kitchen, or upgrading the HVAC system.

These costs are not included in the operating expenses because they are typically incurred less frequently. To calculate the ROI accurately, estimate the annual capital expenditure and subtract it from the NOI.

Example:

Assuming the annual capital expenditure for your rental property is $2,000, the adjusted NOI would be $13,000 – $2,000 = $11,000 per year.

Total Investment

To calculate ROI, you need to determine the total investment in the property. This includes the initial purchase price, closing costs, and any other expenses incurred when acquiring the property. Be sure to include any financing costs or fees associated with the purchase.

Example:

Let’s say you purchased the rental property for $200,000, and the closing costs amounted to $10,000. Your total investment would be $200,000 + $10,000 = $210,000.

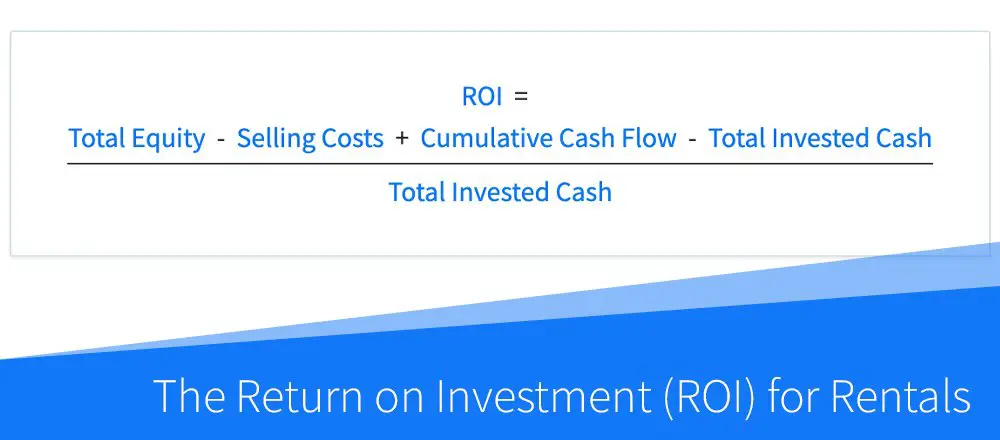

Return on Investment (ROI)

Once you have the NOI and the total investment, calculating the ROI is relatively straightforward. Divide the NOI by the total investment and multiply the result by 100 to express it as a percentage.

Example:

Using the numbers from our previous examples, the ROI for your rental property would be ($11,000 / $210,000) x 100 = 5.24%.

Appreciation and Cash Flow

ROI is a key metric for evaluating the profitability of a rental property, but it’s important to consider other factors that contribute to the overall return. Two of these factors are appreciation and cash flow.

Appreciation:

Appreciation refers to the increase in the property’s value over time. It can significantly impact your ROI. While appreciation is challenging to predict accurately, you can research historical trends in the local real estate market to estimate potential future value increases.

Cash Flow:

Cash flow is the income generated by the property after deducting all expenses, including mortgage payments and taxes. Positive cash flow indicates that the property generates more income than it costs to own and operate. Negative cash flow, on the other hand, means you’re spending more than you’re earning.

When calculating ROI, it’s important to consider the impact of both appreciation and cash flow to get a comprehensive understanding of your investment’s potential profitability.

Comparing ROI Across Properties

Calculating ROI is an effective way to compare different rental properties and assess their relative investment potential. By calculating the ROI for each property, you can make data-driven decisions on which investment is likely to yield the highest returns.

When comparing ROI across properties, it’s also essential to consider other factors such as location, market conditions, growth potential, and any unique features or amenities that may impact rental demand.

Leveraging Technology for ROI Calculations

Calculating ROI manually can be time-consuming and prone to errors. Fortunately, there are several online calculators and real estate investment software available that can streamline the process and provide more accurate results.

These tools allow you to input your property’s financial information and automatically calculate the ROI, taking into account various factors such as financing costs, depreciation, and tax implications. By leveraging technology, you can save time and make more informed investment decisions.

Calculating ROI for rental property is a fundamental step in evaluating the profitability of an investment. By considering the gross rental income, operating expenses, capital expenditures, and total investment, you can determine the ROI percentage, enabling you to compare different properties and make informed decisions.

Remember, ROI is just one aspect to consider when evaluating a rental property. Take into account factors like appreciation, cash flow, and market conditions to gain a holistic view of the investment’s potential. With careful analysis and the right tools, you can make sound financial choices and maximize your returns in the rental property market.

Calculating Returns On a Rental Property (ROI with Excel Template)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How do I calculate the return on investment for a rental property?

To calculate the return on investment (ROI) for a rental property, you can follow these steps:

- Step 1: Determine the total cost of acquiring the rental property, including purchase price, closing costs, and any necessary repairs or renovations.

- Step 2: Calculate the annual rental income by multiplying the monthly rental income by 12.

- Step 3: Subtract the annual expenses, such as property taxes, insurance, maintenance costs, and property management fees, from the annual rental income.

- Step 4: Divide the net annual income by the total cost of acquiring the property and multiply by 100 to get the ROI as a percentage.

What factors should I consider when calculating ROI for a rental property?

When calculating ROI for a rental property, you should consider the following factors:

- Initial purchase price

- Costs of financing, including interest rates

- Expenses such as property taxes, insurance, repairs, and maintenance

- Vacancy rates

- Property management fees, if applicable

- Projected rental income

- Appreciation potential

- Market conditions

Can you give an example of calculating ROI for a rental property?

Sure! Let’s say you purchased a rental property for $200,000. The monthly rental income is $1,500, and the annual expenses (including property taxes, insurance, and maintenance) amount to $8,000. With these figures, you can calculate the ROI as follows:

- Total cost of acquiring the property: $200,000

- Annual rental income: $1,500 x 12 = $18,000

- Net annual income: $18,000 – $8,000 = $10,000

- ROI: ($10,000 / $200,000) x 100 ≈ 5%

Is there a specific ROI percentage I should aim for when investing in rental properties?

There is no definitive answer to this question as the ideal ROI percentage can vary depending on factors such as location, market conditions, and individual investment goals. It’s important to research the local market, analyze potential risks and returns, and set realistic expectations based on your investment strategy.

Can ROI be negative for a rental property?

Yes, the ROI can be negative for a rental property if the expenses exceed the rental income. This typically occurs when there are high maintenance costs, vacancies, or other unforeseen expenses. It is important to carefully evaluate the potential risks and costs associated with a rental property investment.

Are there any online tools or calculators available to help with ROI calculations for rental properties?

Yes, there are various online tools and calculators specifically designed to assist in calculating ROI for rental properties. These tools often take into account factors such as purchase price, rental income, expenses, and financing costs to provide an estimate of the potential ROI. Some popular options include Zillow’s Rental Property Calculator, Mashvisor, and BiggerPockets’ Rental Property Calculator.

What other metrics should I consider alongside ROI when evaluating a rental property?

In addition to ROI, it can be helpful to consider other metrics when evaluating a rental property investment. Some common metrics include cash flow (the net income generated after deducting expenses), capitalization rate (the ratio of net operating income to property value), and cash-on-cash return (the ratio of annual pre-tax cash flow to the total investment). These metrics provide a more comprehensive picture of the property’s profitability and potential returns.

Can ROI calculations for rental properties be used to compare different investment opportunities?

Yes, ROI calculations can be useful for comparing different investment opportunities. By calculating and comparing the ROI percentages of different rental properties, investors can gain insights into which properties may offer better returns. It is important to consider other factors such as location, market conditions, and individual investment goals in conjunction with the ROI calculations to make informed decisions.

Final Thoughts

To calculate the return on investment for a rental property, follow these steps. First, determine the property’s annual rental income by adding up the monthly rent for all units. Subtract the property’s annual expenses, such as taxes, insurance, and maintenance costs. Divide the resulting amount by the property’s purchase price and multiply by 100 to get the return on investment percentage. Keep in mind that additional factors, like vacancy rates and potential appreciation, should also be considered. By understanding how to calculate return on investment for rental property, investors can make informed decisions and maximize their profits.