Looking to make the most of your savings? Wondering how to choose a high-interest savings account that will help your money grow? You’ve come to the right place! In this article, we’ll guide you through the process of selecting the perfect account for your financial goals. Whether you’re saving for a big purchase, an emergency fund, or simply looking to grow your wealth, finding the right high-interest savings account can make a significant difference. So, let’s dive in and explore the key factors to consider when selecting an account that will maximize your savings potential.

How to Choose a High-Interest Savings Account

When it comes to saving money, finding the right savings account is crucial. But with so many options available, how do you choose the best one for your needs? In this article, we will explore the essential factors to consider when selecting a high-interest savings account. By the end, you will be equipped with the knowledge to make an informed decision and maximize your savings.

1. Assess Your Savings Goals and Financial Needs

The first step in choosing a high-interest savings account is to evaluate your savings goals and financial needs. Consider the following:

- Short-term or long-term savings: Determine whether you are saving for a specific short-term goal, such as a vacation, or for a long-term goal, like buying a house or retirement.

- Liquidity requirements: Assess how quickly you may need access to your funds. Some savings accounts may have restrictions or penalties for withdrawals.

- Amount of savings: Consider the initial deposit and the minimum balance requirements for the account. Make sure the account aligns with your available funds.

Understanding your financial objectives will help you narrow down the options and find a savings account that suits your specific requirements.

2. Compare Interest Rates

One of the primary factors to consider when choosing a high-interest savings account is the interest rate. A higher interest rate means your money will grow faster over time. Here’s how to compare interest rates effectively:

- Annual Percentage Yield (APY): Look for the APY, which represents the total interest you will earn on your savings over a year, including compounding.

- Variable vs. fixed rates: Determine whether the interest rate is variable or fixed. Variable rates may change over time, while fixed rates remain constant.

- Promotional rates: Be cautious of promotional rates that are only valid for a limited time. Ensure the account offers a competitive rate beyond the promotional period.

Remember, finding the highest interest rate alone may not be sufficient. Consider other factors such as fees and account features before making a decision.

3. Understand Account Fees and Charges

Savings accounts may come with various fees and charges that can impact your overall savings. When comparing accounts, consider the following:

- Maintenance fees: Some savings accounts charge a monthly maintenance fee. Look for accounts that offer fee waivers or low-cost options.

- Minimum balance requirements: Determine if the account has a minimum balance requirement. If so, ensure it aligns with your financial situation. Falling below the minimum balance may trigger fees or loss of interest.

- Transaction fees: Check if there are any fees associated with transactions, such as ATM withdrawals or transfers. Choose an account that offers convenient and low-cost transaction options.

Understanding the fees and charges associated with a savings account will help you avoid unnecessary costs and maximize your savings.

4. Evaluate Account Accessibility

Easy access to your funds is an important consideration when selecting a high-interest savings account. Here are some aspects to evaluate:

- Branch access: If you prefer in-person banking, choose an account offered by a bank with physical branches near your location.

- ATM access: Consider the availability and convenience of ATMs for withdrawals and deposits. Some banks offer fee-free access to a network of ATMs.

- Online and mobile banking: Evaluate the bank’s online and mobile banking capabilities. Ensure they provide a user-friendly interface, convenient features, and reliable customer support.

Finding an account with the right balance of accessibility and convenience will make managing your savings easier and more efficient.

5. Research the Reputation and Stability of the Bank

When choosing a high-interest savings account, it’s essential to consider the reputation and stability of the bank or financial institution. Here’s what to look for:

- Bank’s history: Research the bank’s background, including its establishment date and track record. Consider factors such as customer satisfaction, financial stability, and any recent news or controversies.

- FDIC insurance: Ensure that the bank is a member of the Federal Deposit Insurance Corporation (FDIC), which protects your deposits up to $250,000 per depositor, per account ownership category.

- Customer reviews and ratings: Read customer reviews and ratings to gain insights into the bank’s customer service, reliability, and overall satisfaction level.

Choosing a well-established and reliable bank will provide peace of mind and security for your hard-earned savings.

6. Consider Additional Account Features

Beyond interest rates and fees, certain additional features can enhance your savings experience. Look out for the following:

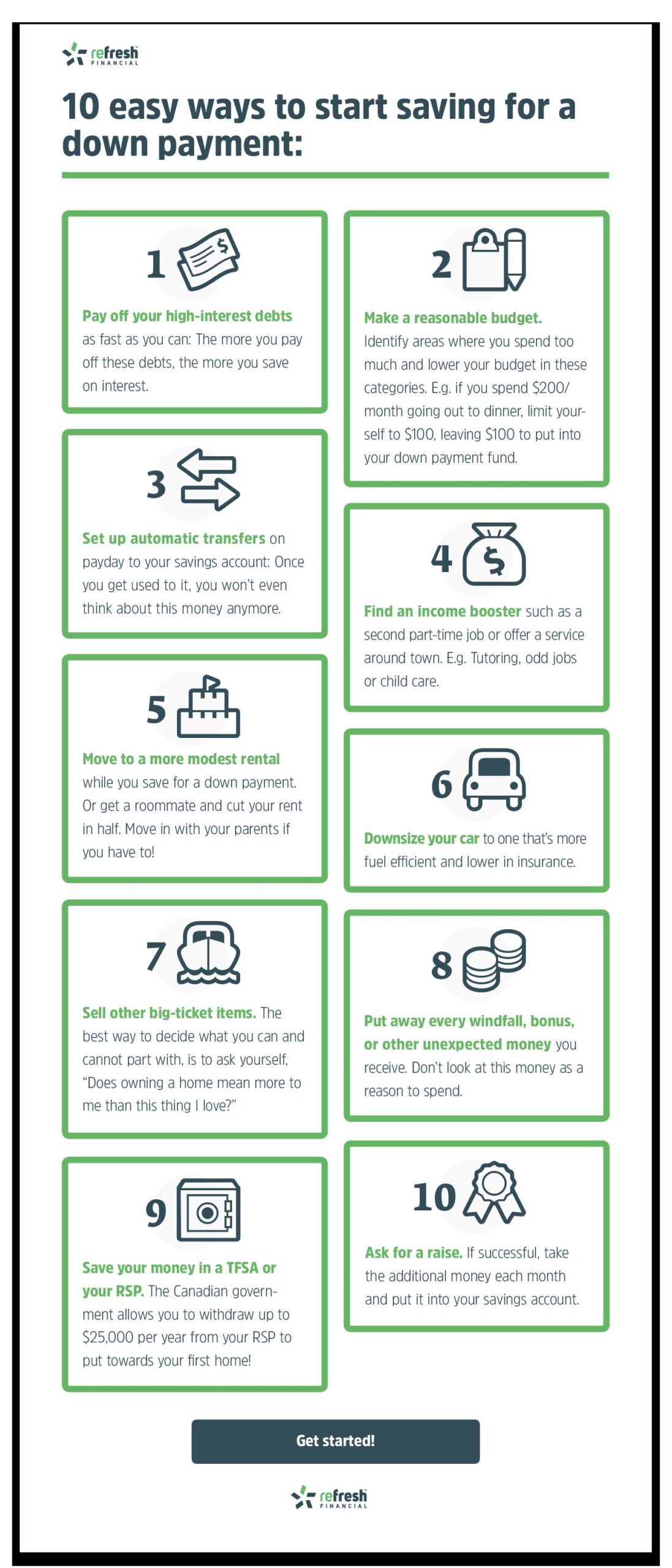

- Automatic transfers: Some banks offer the option to set up automatic transfers from your checking account to your savings account. This feature can help you save consistently.

- Mobile check deposit: Check if the bank provides a mobile check deposit feature, allowing you to deposit checks conveniently through your smartphone.

- Customer support: Evaluate the quality of customer support provided by the bank. Look for multiple channels of communication, such as phone, email, or live chat.

Considering these extra features will help streamline your savings process and make it more convenient for you.

In conclusion, choosing a high-interest savings account requires careful consideration of your financial goals, interest rates, fees, accessibility, and the reputation of the bank. By evaluating these factors, you can find the perfect account that aligns with your needs and helps you achieve your savings objectives. Remember to regularly reassess your savings account to ensure it continues to meet your evolving financial circumstances.

I FOUND THE 5 BEST BANK ACCOUNTS OF 2023

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How do I choose a high-interest savings account?

To choose a high-interest savings account, you should consider the following factors:

- The interest rate offered: Look for accounts that offer competitive interest rates compared to other available options.

- Fees and charges: Check for any monthly maintenance fees, transaction fees, or minimum balance requirements, as these can affect your overall savings.

- Accessibility: Determine if the account allows easy access to your funds through ATMs, online banking, mobile apps, or branches.

- Account features: Consider additional features such as overdraft protection, linked checking accounts, or rewards programs that may be beneficial to you.

- Financial institution reputation: Research the financial institution’s reputation, stability, and customer reviews to ensure you choose a reliable provider.

2. What is the difference between a regular savings account and a high-interest savings account?

A regular savings account typically offers a lower interest rate compared to a high-interest savings account. High-interest savings accounts generally provide higher interest rates, allowing your savings to grow at a faster pace.

3. Can I open a high-interest savings account online?

Yes, many financial institutions offer the convenience of opening a high-interest savings account online. You can visit the bank’s website or use their mobile app to complete the account opening process.

4. Are there any eligibility criteria for opening a high-interest savings account?

Each financial institution may have specific eligibility criteria, but generally, you will need to provide identification documents, such as a valid ID or passport, proof of address, and sometimes a minimum initial deposit.

5. Can I have multiple high-interest savings accounts?

Yes, you can have multiple high-interest savings accounts with different financial institutions if you wish to diversify your savings or take advantage of various offerings. However, make sure you consider the management and maintenance aspects of having multiple accounts.

6. How often does the interest on a high-interest savings account compound?

The frequency of interest compounding can vary based on the financial institution and the specific account. Some accounts compound interest on a monthly basis, while others may compound it quarterly or annually. It’s important to verify the compounding frequency before opening an account.

7. What is the minimum balance I need to maintain in a high-interest savings account?

The minimum balance requirement can vary among different financial institutions and specific account types. Before opening an account, check the terms and conditions to determine the minimum balance required, as it may affect any fees or interest rates associated with the account.

8. Can I withdraw money from a high-interest savings account anytime?

Generally, high-interest savings accounts provide easy access to your funds. However, there may be restrictions, such as a limited number of free withdrawals per month or penalties for exceeding certain limits. Review the account details to understand any limitations on withdrawals.

Final Thoughts

When choosing a high-interest savings account, there are several key factors to consider. Firstly, compare the interest rates offered by different banks or financial institutions. Look for accounts that provide competitive rates to maximize your earnings. Additionally, consider the account requirements, such as minimum deposit and balance, as well as any fees associated with the account. Research the bank’s reputation and customer service to ensure a reliable and trustworthy institution. Finally, assess the account’s accessibility and convenience, including online banking features and mobile app capabilities. By considering these factors, you can make an informed decision and select a high-interest savings account that meets your financial goals.