Are you wondering how to choose between a credit union and a bank? Well, look no further! In today’s financial landscape, deciding between these two options can seem daunting, but fear not. This article aims to guide you through the process, providing you with the insights you need to make an informed decision. Whether you’re looking for better rates, personalized service, or a community-focused approach, we’ll explore the key factors to consider when evaluating credit unions and banks. So, let’s dive in and unravel the differences to help you determine the best fit for your financial needs.

How to Choose Between a Credit Union and a Bank

When it comes to managing your finances, one of the most important decisions you’ll make is choosing where to keep your money. While banks have long been a popular choice, credit unions are becoming increasingly popular for their unique benefits and customer-focused approach. But how do you decide which option is right for you? In this comprehensive guide, we will explore the factors you should consider when choosing between a credit union and a bank.

Understanding the Difference

Before delving into the factors that can influence your decision, it’s essential to understand the fundamental differences between credit unions and banks.

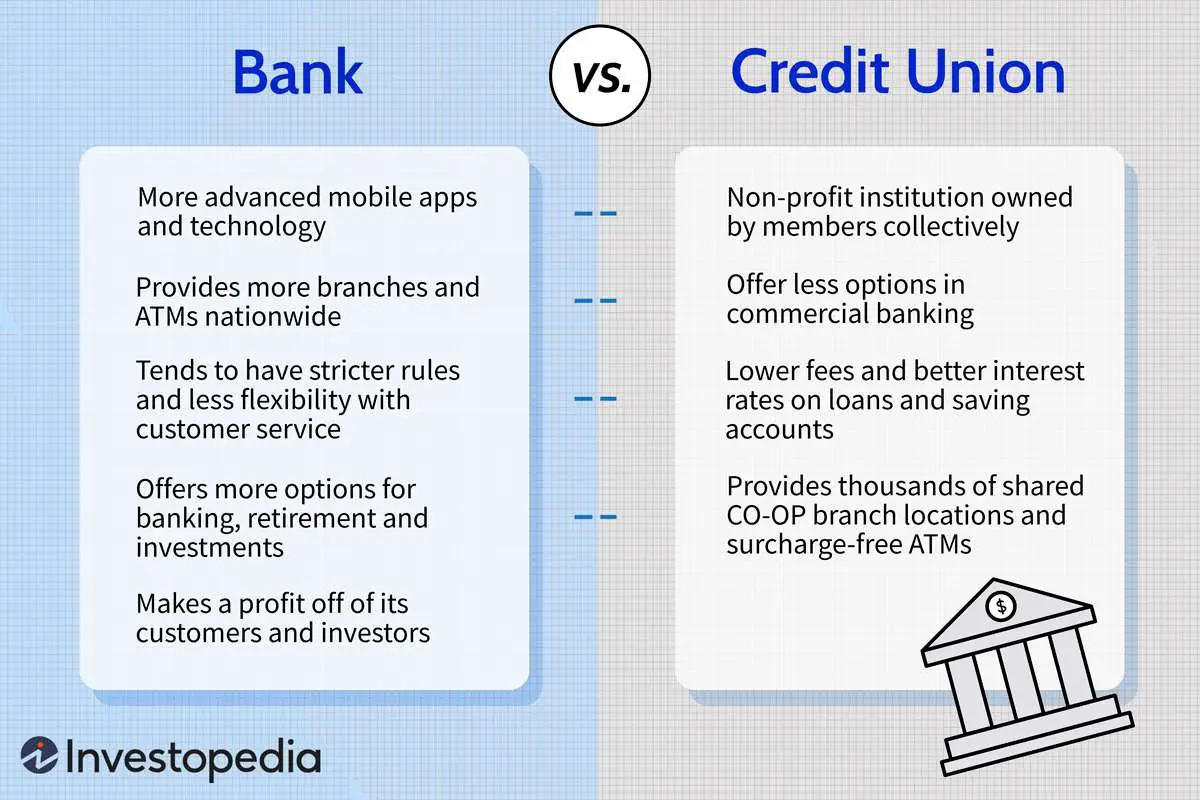

- Ownership: Credit unions are member-owned, not-for-profit financial institutions, while banks are typically for-profit entities owned by shareholders.

- Membership: Credit unions have membership requirements, such as residing in a specific area, belonging to a certain profession, or being affiliated with a particular organization. Banks, on the other hand, are open to anyone who meets their eligibility criteria.

- Services: Both credit unions and banks offer similar financial services, such as checking and savings accounts, loans, and credit cards. However, there may be differences in the fees, interest rates, and account options available.

- Structure: Credit unions are typically smaller and more localized, serving a specific community or group of individuals. Banks, on the other hand, can range from small local branches to large national or international institutions.

Evaluating Your Needs and Priorities

To make an informed decision, it’s crucial to evaluate your needs and priorities. Consider the following factors when deciding between a credit union and a bank:

Membership Eligibility

One of the primary considerations is whether you meet the membership requirements of a credit union. If you belong to a specific organization or live in a particular area, you may be eligible to join a credit union catering to that community. Banks, on the other hand, are generally open to anyone who meets their eligibility criteria.

Convenience and Accessibility

When it comes to convenience and accessibility, banks often have an edge. They typically have a broader network of branches and ATMs, making it easier to access your funds and conduct transactions. Credit unions, on the other hand, may have a limited presence, especially if they are smaller or community-based. However, many credit unions are part of shared branch networks and ATM networks, allowing members to access services at other credit unions’ locations.

Customer Service and Relationship Building

Credit unions are known for their customer-centric approach and focus on building relationships with their members. As member-owned institutions, credit unions prioritize meeting their customers’ financial needs and providing personalized service. Banks, while also striving to meet customer needs, may have a more transactional approach due to their for-profit nature. Consider the level of customer service and relationship-building that aligns with your preferences.

Interest Rates and Fees

Comparing interest rates and fees is essential to make a financially responsible decision. Credit unions often offer competitive interest rates on savings accounts and loans, as they are not driven by profit maximization. Additionally, credit unions may have lower fees for various services, such as overdrafts or ATM usage. However, it’s crucial to compare the rates and fees of both credit unions and banks to determine the most favorable terms for your financial situation.

Product and Service Offerings

While credit unions and banks offer similar products and services, there may be differences in the specific options available. Consider your financial needs and the range of products offered by each institution. For example, if you’re looking for specialized mortgage products or investment services, it’s important to evaluate whether a credit union or bank can meet those requirements.

Researching and Comparing Options

Once you’ve evaluated your needs and priorities, it’s time to conduct research and compare the available options. Consider the following steps to make an informed decision:

Gather Information

Start by gathering information about local credit unions and banks. Visit their websites, read customer reviews, and explore their product offerings. Take note of their membership requirements, branch locations, and services provided.

Check for Insurance Coverage

Ensure that the institution you choose is insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA). This insurance protects your deposits up to a certain limit, providing peace of mind in case of financial instability.

Compare Rates and Fees

Compare the interest rates and fees associated with various accounts and services. Pay attention to the terms and conditions, including minimum balance requirements, transaction fees, and penalties. Calculate how these rates and fees align with your anticipated banking activities to make an informed decision.

Visit the Branches

Consider visiting the branches of the credit unions or banks you are interested in. Interact with the staff and get a sense of the customer service they provide. Ask questions about specific products or services you require to gauge their knowledge and willingness to assist.

Seek Recommendations

Don’t hesitate to seek recommendations from friends, family, or colleagues who have experience with credit unions or banks. Their insights and personal experiences can offer valuable perspectives and help you make a more informed decision.

Choosing between a credit union and a bank is a personal decision that depends on your needs, priorities, and financial goals. Consider factors such as membership eligibility, convenience, customer service, interest rates, and product offerings when making your decision. By conducting thorough research and comparing your options, you can find the financial institution that best aligns with your needs and helps you achieve your financial aspirations. Whether you choose a credit union or a bank, remember that the ultimate goal is to find a trusted partner to manage your finances effectively.

Do you use a credit union or a bank? #finance #bank #creditunion #money #investing #credit #debit

Frequently Asked Questions

Frequently Asked Questions (FAQs)

Q: What factors should I consider when choosing between a credit union and a bank?

A: When deciding between a credit union and a bank, consider factors such as fees, interest rates, services offered, location, and the membership requirements of credit unions.

Q: What are the main differences between credit unions and banks?

A: Credit unions are member-owned cooperatives, while banks are for-profit institutions. Credit unions typically offer lower fees and competitive interest rates, while banks may provide a wider range of services and have more locations.

Q: How can I determine which institution offers better interest rates?

A: To compare interest rates between credit unions and banks, you can research and compare the rates offered by different institutions. Additionally, you may want to consider factors such as the type of account and your personal financial goals.

Q: Are credit unions more limited in terms of services compared to banks?

A: Credit unions generally offer a similar range of services as banks, including checking accounts, savings accounts, loans, and credit cards. However, it’s important to check with specific credit unions to ensure they provide the services you require.

Q: What are the membership requirements for credit unions?

A: Credit unions typically have membership requirements, which may include factors such as employment in a certain industry, living in a particular area, or being affiliated with a specific organization. It’s important to check if you meet the eligibility criteria before considering a credit union.

Q: Will I have access to ATMs and online banking with a credit union?

A: Many credit unions offer access to ATMs and online banking services. However, availability may vary depending on the credit union. It’s advisable to inquire about these services when considering a credit union.

Q: What are the advantages of choosing a credit union over a bank?

A: Some advantages of credit unions include potentially lower fees, competitive interest rates, a focus on personalized customer service, and a sense of community since they are member-owned institutions.

Q: Can I have accounts at both a credit union and a bank?

A: Yes, you can have accounts at both a credit union and a bank. This allows you to take advantage of the benefits offered by each institution based on your specific financial needs and preferences.

Final Thoughts

Choosing between a credit union and a bank ultimately depends on your personal financial needs and preferences. Credit unions offer a more community-oriented approach, with member ownership and typically lower fees and interest rates. On the other hand, banks provide a wider range of services, including extensive branch and ATM networks, advanced technology, and potentially more convenience. To make the best choice, consider factors such as customer service, accessibility, fees, interest rates, and the specific services you require. Take the time to compare and contrast the offerings of credit unions and banks in your area to find the financial institution that aligns with your goals and priorities.