Looking to create a college savings plan? You’re in the right place! Planning for your child’s education can be a daunting task, but fear not, because this article will guide you through the steps of creating a college savings plan that suits your needs. From setting goals to exploring different savings options, we’ve got you covered. So, whether your child is starting kindergarten or heading off to high school, read on to learn how to create a college savings plan that will set them up for success. Let’s dive in!

How to Create a College Savings Plan

Introduction

Preparing for your child’s future education is a crucial financial step that requires careful planning. College expenses continue to rise rapidly, and without a solid savings plan, it can be challenging to afford the cost of tuition, books, and other necessary expenses. However, by creating a college savings plan, you can alleviate some of the financial burdens associated with higher education.

In this comprehensive guide, we will walk you through the process of creating a college savings plan. We will cover various aspects, including setting goals, choosing the right savings vehicle, maximizing your savings potential, and exploring additional strategies to boost your savings. By following these steps, you’ll be well-prepared to provide your child with a quality education and set them up for success in their academic journey.

Setting Goals and Determining Your Savings Needs

Before diving into the specifics of your college savings plan, it’s essential to establish clear goals and determine your savings needs. Ask yourself the following questions:

1. How many years until your child starts college?

2. What type of institution do you envision your child attending (public, private, in-state, out-of-state)?

3. What is the estimated cost of tuition and other expenses?

4. How much do you want to contribute to your child’s education?

5. Are there any scholarships or financial aid options that might be available?

Once you have answered these questions, you can calculate your savings needs. Consider using a college savings calculator or consulting with a financial advisor to estimate the amount you need to save each month to reach your goals.

Choosing the Right Savings Vehicle

With the numerous options available for college savings, it’s crucial to select the most suitable savings vehicle for your specific needs. Here are some popular choices:

529 Plans

529 plans are tax-advantaged savings plans specifically designed for education expenses. They come in two types: prepaid tuition plans and college savings plans.

– Prepaid Tuition Plans: These plans allow you to prepay a portion or the entire cost of tuition at today’s rates, protecting against future tuition hikes.

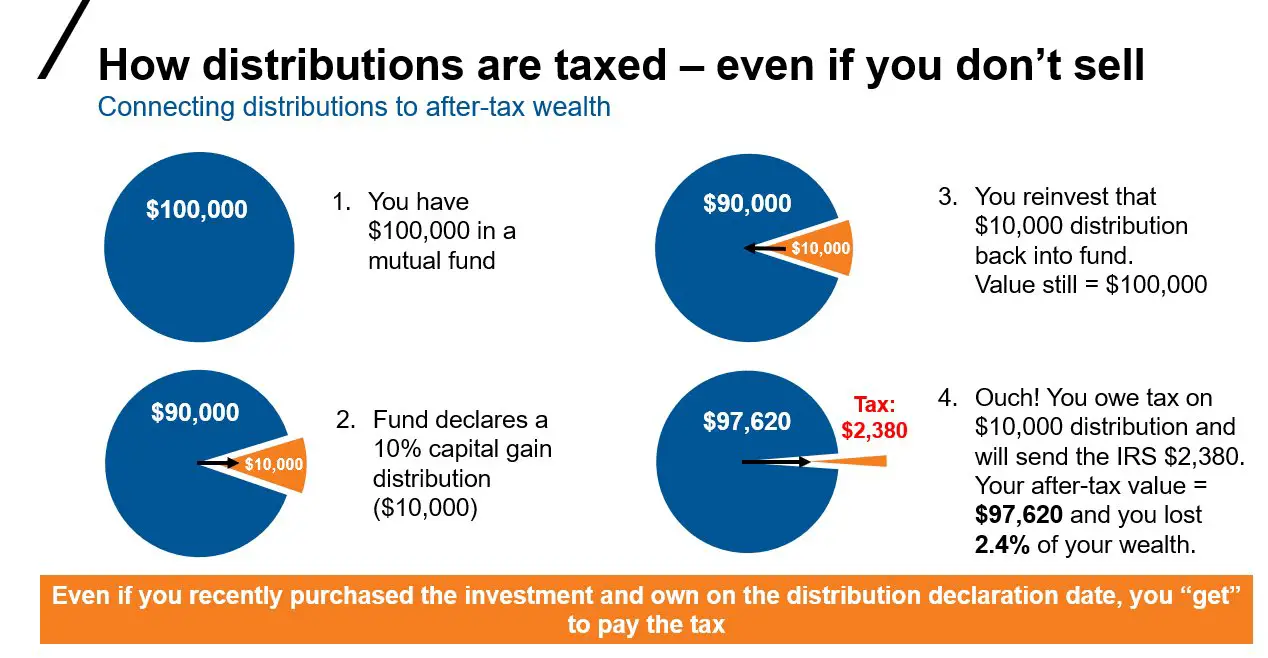

– College Savings Plans: These plans function like investment accounts, allowing you to invest your contributions in various investment options, such as mutual funds. Earnings grow tax-free, and withdrawals for qualified educational expenses are also tax-free.

Coverdell Education Savings Accounts (ESAs)

Coverdell ESAs are another tax-advantaged savings option. They allow you to contribute up to $2,000 per year per child, and earnings grow tax-free. However, there are income limitations to consider when opening a Coverdell ESA.

UGMA/UTMA Accounts

Uniform Gift to Minors Act (UGMA) and Uniform Transfer to Minors Act (UTMA) accounts are custodial accounts that allow you to hold investments on behalf of a minor. While these accounts offer flexibility in terms of how funds can be used, they lack the specific tax advantages of 529 plans or Coverdell ESAs.

Other Savings Options

Apart from dedicated college savings plans, you may also consider the following options:

– High-yield savings accounts: These accounts can provide a safe and accessible way to save for college, but they may not offer the same tax advantages as specialized college savings plans.

– Roth IRAs: While primarily used for retirement savings, Roth IRAs can also be used as a backup option for education funding. Withdrawals of contributions can be made penalty-free for qualified education expenses.

Maximizing Your Savings Potential

Now that you have selected the appropriate savings vehicle, it’s time to explore strategies to maximize your savings potential. Consider the following tips:

Start Early

The power of compounding interest can significantly impact your savings. By starting early, you allow your investments more time to grow, potentially resulting in more funds available for college expenses.

Automate Your Contributions

Set up automatic contributions to your college savings account to ensure consistency. This removes the temptation to spend the money elsewhere and helps you stay on track with your savings goals.

Contribute Regularly

Consistent contributions, even if they are small, can add up over time. Make it a priority to contribute a set amount each month, and consider increasing your contributions as your financial situation allows.

Take Advantage of Employer Matching Programs

If your employer offers a matching program, make sure to contribute enough to receive the full match. This is essentially free money that can significantly boost your college savings.

Reallocate Funds Wisely

Regularly assess your investments and make adjustments as necessary. As your child gets closer to college age, it may be prudent to shift your investments to lower-risk options to protect your savings from market fluctuations.

Additional Strategies to Boost Your Savings

In addition to the core savings strategies, there are additional methods that can help you further boost your college savings:

Encourage Other Family Members to Contribute

Share your college savings goals with grandparents, extended family, and close friends. They may be interested in contributing to your child’s education fund for special occasions like birthdays and holidays.

Apply for Scholarships and Grants

Encourage your child to apply for scholarships and grants. There are numerous opportunities available based on academic achievements, talents, and other criteria. Scholarships and grants can significantly reduce the financial burden of college.

Consider Part-Time Work or Internships

During their high school and college years, students may consider part-time work or internships to earn money for their education. This can instill a sense of responsibility and ownership in their academic journey while providing valuable financial support.

Explore Tax Credits and Deductions

Educate yourself about tax credits and deductions available for higher education expenses. The American Opportunity Tax Credit and the Lifetime Learning Credit are two examples that can reduce your tax liability while funding your child’s education.

Creating a college savings plan is a vital step in securing your child’s future education. By setting clear goals, selecting the right savings vehicle, maximizing your savings potential, and exploring additional strategies, you can ensure that you have the financial means to support your child’s educational aspirations. Remember, every dollar saved now can make a significant difference in the long run. Start planning early, stay disciplined, and watch your college savings grow over time.

Now that you have a comprehensive understanding of how to create a college savings plan, you can confidently take the necessary steps towards providing your child with a solid foundation for their academic journey.

529 College Savings Plan Fully Explained! (Beginner's Guide To 529s in 2020)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I start creating a college savings plan?

To create a college savings plan, start by setting a savings goal and determining how much you need to save each month to reach that goal. Research different savings options, such as 529 plans or a high-interest savings account, and choose the one that aligns with your financial situation and goals. Open the account and contribute regularly to build your college savings fund.

2. What is a 529 plan and how does it work?

A 529 plan is a tax-advantaged savings plan designed to help individuals save for education expenses. It allows you to contribute funds that can grow tax-free over time. When the time comes to pay for qualified education expenses, such as college tuition or fees, the funds can be withdrawn tax-free.

3. How much should I save each month for my child’s college education?

The amount you should save each month depends on various factors, including the expected cost of college and the number of years you have until your child will start college. Consider using a college savings calculator to estimate how much you need to save monthly to meet your goals.

4. Are there any penalties for using college savings funds for non-education expenses?

Yes, if you use the funds from a 529 plan or other college savings account for non-qualified expenses, you may have to pay income tax on the earnings portion of the withdrawal, along with a 10% penalty. It’s important to use the funds only for qualified education expenses to avoid penalties.

5. Can grandparents or other family members contribute to a college savings plan?

Yes, many college savings plans allow contributions from family members, including grandparents. It’s a great way for family members to help save for a child’s education. Each plan may have its own rules and limits regarding contributions, so it’s essential to check with the specific plan provider.

6. Is it better to start a college savings plan early or wait until later?

Starting a college savings plan early is generally recommended. The longer you have to save, the more time your money has to grow through compounding interest. However, it’s never too late to start saving, and even small contributions can make a difference over time.

7. Can I change the beneficiary of a college savings plan?

Yes, in most cases, you can change the beneficiary of a college savings plan. If the original beneficiary decides not to pursue higher education or has leftover funds, you can typically transfer the savings to another eligible family member, such as a sibling or cousin.

8. What happens to the funds in a college savings plan if my child doesn’t attend college?

If the designated beneficiary decides not to attend college, you have several options. You can change the beneficiary to another eligible family member, keep the funds in the account in case the beneficiary decides to pursue higher education later, or withdraw the funds for non-qualified expenses (subject to taxes and penalties).

Final Thoughts

Creating a college savings plan is a crucial step towards securing your child’s future education. Start by setting clear financial goals and determining how much you need to save each month. Explore different savings options, such as 529 plans or custodial accounts, and consider the potential tax benefits they offer. Automating your savings and cutting unnecessary expenses can help you stay on track. Regularly review and adjust your plan as your child’s needs and college costs may change. By proactively creating a college savings plan, you can ensure your child’s educational dreams become a reality.