Are you wondering how to create a financial plan for retirement? Look no further! In this article, we will guide you through the steps to craft a solid financial plan that will set you up for a comfortable retirement. Whether retirement is just around the corner or a few decades away, it’s never too early to start planning. By taking control of your financial future now, you can ensure a stable and secure retirement. So, let’s dive in and explore how to create a financial plan for retirement that aligns with your goals and aspirations.

How to Create a Financial Plan for Retirement

Introduction

Retirement is a phase of life that many of us look forward to. It’s a time when we can finally relax and enjoy the fruits of our labor. However, in order to have a comfortable retirement, it’s crucial to have a solid financial plan in place. Creating a financial plan for retirement is not as daunting as it may seem. With careful consideration and strategic decision-making, you can ensure a financially secure future. In this article, we’ll guide you through the process of creating a comprehensive financial plan for your retirement years.

Assess Your Current Financial Situation

Before you start creating a financial plan for retirement, it’s essential to assess your current financial situation. This will provide you with a clear picture of where you stand financially and help you determine the steps you need to take to achieve your retirement goals. Here are some key aspects to consider during this evaluation:

- Income: Calculate your current income from all sources, including salaries, investments, and rental properties.

- Expenses: Make a detailed list of your monthly expenses, including bills, mortgages, loans, and discretionary spending.

- Assets: Take stock of your assets such as real estate, investments, savings, and retirement accounts.

- Liabilities: Evaluate any outstanding debts, loans, or financial obligations you may have.

By assessing these factors, you’ll be able to determine your net worth and get a better understanding of your financial standing.

Set Clear Retirement Goals

Once you have a clear understanding of your current financial situation, the next step is to set clear retirement goals. Ask yourself what you envision for your retirement years. Do you want to travel the world, start a new hobby, or simply live a comfortable life without financial worries? Setting specific, measurable, achievable, relevant, and time-bound (SMART) goals will help you stay focused and motivated throughout the process. Consider the following when setting your retirement goals:

- Lifestyle: Determine the type of lifestyle you want to lead during retirement, keeping in mind your personal preferences and aspirations.

- Travel: If travel is important to you, calculate the potential costs of your desired trips and include them in your financial plan.

- Healthcare: Account for potential healthcare costs, including insurance premiums, medical emergencies, and long-term care.

- Legacy: Consider any inheritance or financial support you would like to leave behind for your loved ones.

Having clear retirement goals will help you make informed decisions and allocate your resources effectively.

Calculate Your Retirement Needs

Now that you have your goals in mind, it’s time to calculate your retirement needs. This involves determining the amount of money you will need to cover your expenses and maintain your desired lifestyle during retirement. Here are a few factors to consider:

- Life Expectancy: Estimate your life expectancy based on your current health, family history, and lifestyle habits. This will help you gauge the length of your retirement and plan accordingly.

- Inflation: Account for inflation when calculating your retirement needs. Prices of goods and services are expected to increase over time, so it’s important to factor in inflation rates to ensure your savings will be sufficient in the future.

- Retirement Duration: Consider the number of years you expect to spend in retirement. This will vary for each individual and depends on factors such as your desired retirement age and life expectancy.

- Healthcare Costs: Research the potential costs of healthcare during retirement, including insurance premiums, prescription medications, and medical procedures.

By considering these factors, you can estimate the amount of money you will need to save for a comfortable retirement.

Develop a Savings Strategy

Once you have determined your retirement needs, it’s time to develop a savings strategy to achieve your goals. Here are a few key steps to consider:

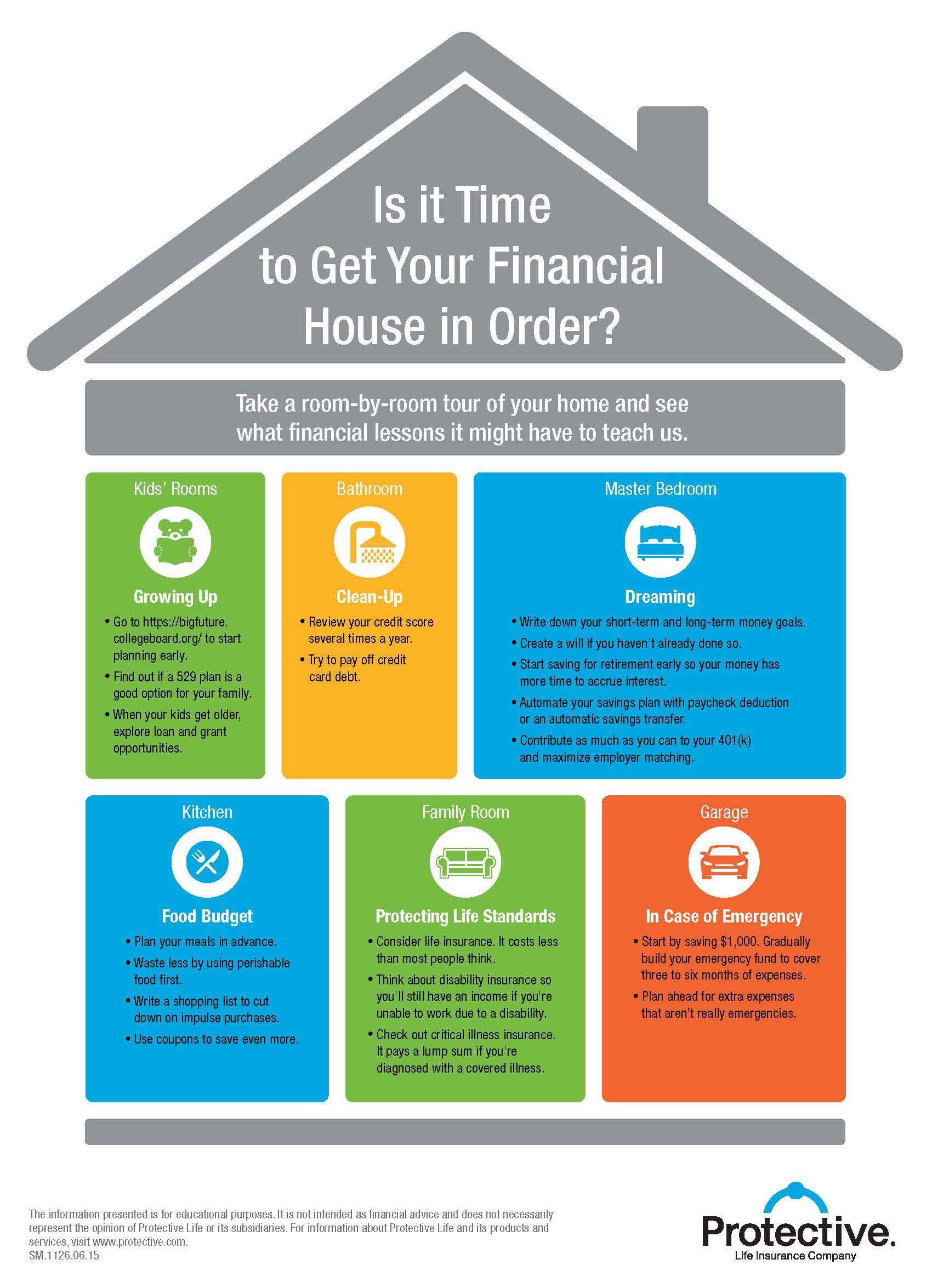

1. Establish an Emergency Fund

Before focusing on retirement savings, it’s crucial to have an emergency fund in place. Aim to save three to six months’ worth of living expenses in a separate account. This fund will act as a safety net during unexpected events such as medical emergencies or job loss.

2. Contribute to Retirement Accounts

Take advantage of retirement accounts such as 401(k)s, IRAs, or Roth IRAs. These accounts offer tax advantages and can help your savings grow significantly over time. Contribute as much as possible, especially if your employer offers matching contributions to your retirement plan.

3. Diversify Your Investments

Diversification is key to minimizing risk and maximizing returns. Allocate your investments across various asset classes such as stocks, bonds, and real estate. This strategy helps mitigate potential losses and ensures your portfolio is balanced.

4. Consider Hiring a Financial Advisor

If you are unsure about managing your investments or need professional guidance, consider hiring a certified financial planner. A financial advisor can help you navigate the complexities of retirement planning, provide personalized advice, and optimize your savings strategy.

Review and Adjust Your Plan Regularly

Creating a financial plan for retirement is not a one-time task. It requires regular reviews and adjustments to ensure you stay on track. As you progress through different life stages, your financial situation and goals may change. Here are a few important considerations:

- Annual Review: Review your financial plan at least once a year. Assess your progress, reassess your goals, and make any necessary adjustments.

- Life Events: Major life events such as marriage, the birth of a child, or a career change can impact your financial plan. Revisit and revise your plan accordingly to accommodate these changes.

- Market Changes: Economic conditions and market fluctuations can affect your investments. Stay informed about market trends and adjust your investment strategy if necessary.

- Healthcare Needs: As you age, your healthcare needs may change. Review your healthcare coverage and make adjustments to ensure you are adequately protected.

Regularly reviewing and adjusting your financial plan will help you stay on top of your retirement goals and ensure long-term financial security.

Creating a financial plan for retirement may seem overwhelming at first, but with careful planning and consistent effort, you can achieve your retirement goals. Assessing your current financial situation, setting clear retirement goals, calculating your retirement needs, and developing a savings strategy are crucial steps in the planning process. Regularly reviewing and adjusting your plan ensures you stay on track and adapt to any changes in your financial circumstances. Remember, a financially secure retirement is within your reach if you start planning early and stay committed to your goals.

My 4 steps to creating a solid financial plan for retirement

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a financial plan for retirement?

A financial plan for retirement is a comprehensive strategy that helps individuals or couples prepare financially for their retirement years. It involves setting goals, estimating expenses, analyzing income sources, and creating a plan to accumulate savings and investments to support a comfortable retirement lifestyle.

Why is it important to create a financial plan for retirement?

Creating a financial plan for retirement is crucial because it allows you to have a clear understanding of your financial situation and helps you make informed decisions about saving, investing, and spending. A well-crafted plan provides a roadmap to ensure you have enough money to sustain your desired lifestyle during retirement.

When should I start creating a financial plan for retirement?

It’s never too early to start creating a financial plan for retirement. Ideally, you should begin as soon as you start earning income. Starting early allows you to take advantage of compounding interest and gives you a longer time horizon to save and invest, increasing your chances of achieving your retirement goals.

What factors should I consider when creating a financial plan for retirement?

Several factors to consider when creating a financial plan for retirement include your current age, expected retirement age, desired retirement lifestyle, anticipated expenses, existing savings and investments, expected income sources, and any potential financial obligations or responsibilities.

How do I estimate my expenses for retirement?

To estimate your expenses for retirement, start by examining your current spending habits. Consider your routine expenses like housing, utilities, healthcare, transportation, and groceries. Account for any expected changes in expenses, such as paid-off mortgages or increased healthcare costs. It’s also wise to plan for occasional expenses like travel or hobbies.

What are some common income sources for retirement?

Common income sources for retirement include Social Security benefits, pensions, employer-sponsored retirement plans like 401(k), individual retirement accounts (IRAs), annuities, rental income, dividend income from investments, and part-time employment or freelance work.

How do I determine my retirement savings goal?

Determining your retirement savings goal involves considering factors such as your desired retirement lifestyle, anticipated expenses, and expected income sources. Generally, financial experts recommend saving enough to replace around 70-80% of your pre-retirement income. However, your specific savings goal will depend on your individual circumstances and retirement aspirations.

Should I seek professional help in creating my financial plan for retirement?

While creating a financial plan for retirement is possible to do on your own, seeking professional help can provide valuable expertise and guidance. Financial advisors can help you assess your financial situation, develop a customized plan, provide investment recommendations, and offer ongoing monitoring and adjustments to ensure you stay on track towards your retirement goals.

Final Thoughts

Creating a financial plan for retirement is crucial to ensure a secure and comfortable future. Start by assessing your current financial situation, including your income, expenses, and any existing savings or investments. Set clear retirement goals and determine the amount of money you will need to meet those goals. Consider various financial vehicles such as 401(k)s, IRAs, and other investment options to maximize your savings. Regularly review and adjust your plan as your circumstances change. Seek advice from a financial advisor if needed. By following these steps and staying disciplined, you can create a comprehensive financial plan for retirement that will provide you with peace of mind and financial stability during your golden years.