Planning for the holidays can be exhilarating, but the thought of overspending can quickly dampen the excitement. That’s why it’s crucial to know how to create a holiday spending budget. By setting clear financial boundaries, you’re not only ensuring a stress-free holiday season but also taking control of your expenses. In this article, we’ll walk you through simple yet effective steps to help you create a holiday spending budget that will keep your finances in check. So, let’s dive right in and discover how to create a holiday spending budget that works specifically for you.

How to Create a Holiday Spending Budget

The holiday season is a time of joy and celebration, but it can also be a time of increased expenses. From gifts to parties to travel expenses, the costs can quickly add up, leaving you with financial stress in the new year. However, with careful planning and budgeting, you can enjoy the holiday season without breaking the bank. In this article, we will guide you through the steps of creating a holiday spending budget that will help you stay on track and make the most of your holiday festivities.

1. Assess Your Finances

Before diving into creating a holiday spending budget, it’s essential to assess your current financial situation. Take a look at your income, savings, and any outstanding debts or financial obligations you have. Understanding your financial standing will give you a realistic idea of how much you can allocate towards holiday expenses.

2. Set Clear Budget Goals

Now that you have a clear picture of your finances, it’s time to establish your holiday budget goals. Determine the total amount you are comfortable spending on the holiday season. This figure should take into account both your financial capabilities and your overall financial goals. For example, if you are working towards paying off debts or saving for a specific goal, your budget may be more conservative.

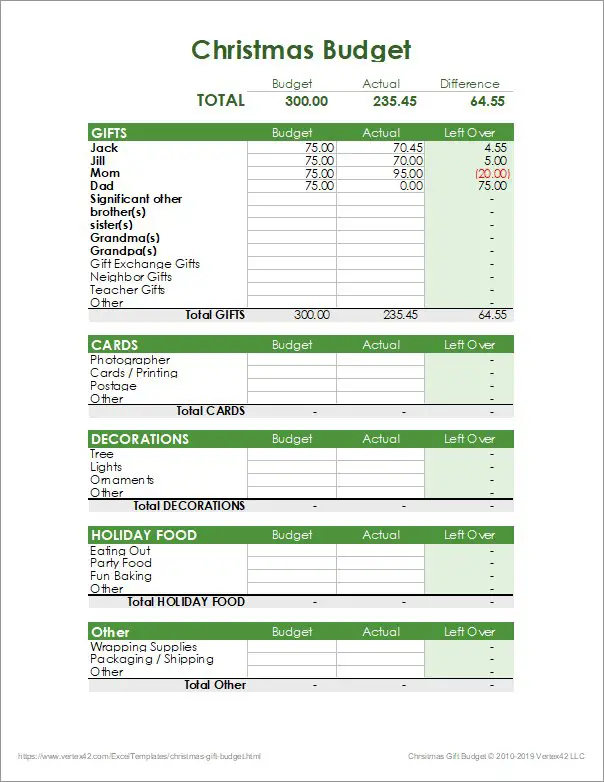

2.1 Allocate Funds for Key Categories

Within your overall holiday budget, it’s helpful to allocate specific amounts to different categories. This will help you prioritize your spending and ensure you have enough money for the most important aspects of the season. Some common categories to consider include:

- Gifts: Determine the amount you can afford to spend on gifts for your loved ones, and divide it among the recipients.

- Travel: If you plan to travel during the holidays, set aside a specific amount for transportation, accommodation, and other related expenses.

- Decorations: Consider how much you are willing to spend on decorations for your home or office.

- Food and Entertainment: Allocate a budget for festive meals, parties, and other seasonal activities.

2.2 Plan for Unexpected Expenses

It’s crucial to factor in unexpected expenses that may arise during the holiday season. Whether it’s a last-minute gift or an unforeseen hosting cost, having a buffer in your budget will help you navigate any surprises without derailing your financial plans. Aim to set aside a small percentage of your overall budget for these unexpected expenses.

3. Track Your Spending

Creating a budget is only the first step; you also need to track your spending to ensure you’re staying within your allocated amounts. There are several ways to track your spending, including:

- Maintain a spreadsheet: Create a simple spreadsheet where you can record your expenses throughout the holiday season. This will give you a visual representation of where your money is going.

- Use budgeting apps: There are numerous budgeting apps available that can help you track your spending and provide insights into your financial habits.

- Keep receipts: Save all your receipts to review later and compare them against your budgeted amounts.

4. Look for Ways to Save

Part of creating a holiday spending budget is finding ways to save money without compromising the joy of the season. Consider the following strategies to help you save:

- Set price limits for gifts: Instead of buying extravagant gifts, establish price limits for each person on your gift list. This will ensure fairness and help you stay within your budget.

- Shop smart: Take advantage of sales, discounts, and promotional offers. Compare prices and shop around to get the best deals on gifts, decorations, and travel expenses.

- DIY gifts and decorations: Get creative and make personalized gifts or decorations. Handmade presents can be more meaningful and often cost less than store-bought items.

- Consider alternatives to expensive traditions: Evaluate your holiday traditions and see if there are less expensive alternatives that still bring joy and create lasting memories.

5. Communicate and Collaborate

If you’re not the only one contributing to the holiday expenses, it’s crucial to communicate and collaborate with others involved. Whether it’s your partner, family, or friends, discussing and agreeing on a shared budget will help avoid misunderstandings and financial strain.

5.1 Secret Santa or Gift Exchanges

Consider implementing a Secret Santa or gift exchange system within your family or friend group. This reduces the number of gifts each person has to purchase, allowing everyone to save money while still enjoying the spirit of giving.

5.2 Potluck Celebrations

Instead of shouldering the entire cost of hosting a holiday meal or party, suggest a potluck celebration where everyone brings a dish. Not only does this distribute the financial burden, but it also adds variety and excitement to the event.

6. Stay Mindful of Non-Monetary Gifts

Remember that the holiday season is not solely about material gifts and spending money. There are plenty of non-monetary gifts and gestures that can bring joy to your loved ones and create lasting memories. Consider these alternatives:

- Offer your time: Spend quality time with family and friends, organizing activities or outings that don’t require spending money.

- Write heartfelt letters: Express your love and appreciation through handwritten letters or heartfelt messages. This personal touch can often mean more than an expensive gift.

- Give the gift of service: Offer your skills or talents as gifts. Whether it’s babysitting, a home-cooked meal, or helping with household chores, these acts of service can be incredibly meaningful.

7. Reflect and Adjust for Future Holidays

Once the holiday season is over, take some time to reflect on your budgeting efforts. Evaluate what worked well and what could be improved upon for future holidays. Consider adjusting your budget based on your experiences and any changes in your financial situation. Each year provides an opportunity to refine and optimize your holiday spending budget.

In conclusion, creating a holiday spending budget is a proactive approach to managing your finances during the festive season. By assessing your finances, setting clear budget goals, tracking your spending, looking for ways to save, communicating with others, and staying mindful of non-monetary gifts, you can enjoy the holidays while maintaining financial peace of mind. Remember, the true spirit of the holidays lies in the moments shared with loved ones, not the price tags on gifts.

Tips for keeping a budget when holiday spending

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I create a holiday spending budget?

To create a holiday spending budget, follow these steps:

What factors should I consider when creating a holiday spending budget?

When creating a holiday spending budget, consider the following factors:

How do I determine my holiday spending limit?

To determine your holiday spending limit, take the following steps:

Should I include gifts for immediate family only or extended family and friends as well?

Including gifts for extended family and friends in your holiday spending budget is a personal decision. However, to maintain a budget, you may choose to set limits or find creative alternatives.

What are some tips for saving money during the holiday season?

Here are some money-saving tips for the holiday season:

How can I track my holiday spending to stay within budget?

To track your holiday spending effectively, consider the following tips:

What if I exceed my holiday spending budget?

If you exceed your holiday spending budget, there are a few things you can do:

Is it advisable to use credit cards for holiday expenses?

Using credit cards for holiday expenses can have pros and cons:

Final Thoughts

Creating a holiday spending budget is crucial for managing your finances during the festive season. Start by assessing your financial situation and setting a realistic budget that aligns with your income and expenses. Track your expenses and categorize them to identify areas where you can cut back or allocate more funds. Prioritize your spending based on what matters most to you and consider alternative ways to celebrate without overspending. Finally, regularly review and adjust your budget as needed to stay on track. By following these steps, you can create a holiday spending budget that helps you enjoy the season without breaking the bank.