Are you tired of relying on a single source of income to make ends meet? If so, you’ve come to the right place! In this blog article, we will explore the secrets of how to create multiple streams of passive income. Yes, you heard it right – multiple streams of income that flow effortlessly into your bank account. We all dream of financial freedom, and by diversifying your income streams and making them work for you even while you sleep, you can turn that dream into a reality. So, let’s delve into the world of passive income and discover how you can achieve financial independence by implementing this powerful strategy.

How to Create Multiple Streams of Passive Income

Passive income refers to the money you earn regularly with little to no effort on your part. It’s an excellent way to secure additional income streams that can provide financial stability and, possibly, even wealth. Creating multiple streams of passive income can diversify your earnings and provide greater financial security. In this article, we will explore various strategies and methods to help you generate multiple streams of passive income.

Diversify Your Investments

Investing is a popular way to generate passive income. By diversifying your investments, you can increase your chances of earning passive income from various sources. Here are some investment options to consider:

- Stocks and Dividends: Investing in dividend-paying stocks allows you to earn passive income through regular dividend payments. Look for companies with a history of consistent dividend payouts and solid financial performance.

- Real Estate: Rental properties can provide a steady stream of passive income. You can choose between residential or commercial properties, depending on your preferences and investment goals. Alternatively, you can invest in real estate investment trusts (REITs), which allow you to invest in real estate without direct ownership.

- Bonds: Bonds are fixed-income securities that pay interest over a specified period. Investing in government or corporate bonds can generate regular passive income.

- Peer-to-Peer Lending: Peer-to-peer lending platforms enable you to lend money directly to individuals or small businesses in exchange for interest payments. These platforms connect borrowers and lenders, eliminating the need for traditional financial institutions.

- Index Funds: Index funds offer a diversified investment portfolio that tracks a specific market index, such as the S&P 500. By investing in index funds, you can passively earn income based on the performance of the overall market.

- Cryptocurrency: Cryptocurrency has gained popularity as an investment option. Buying and holding cryptocurrencies like Bitcoin or Ethereum can potentially generate passive income through price appreciation and staking rewards.

Create and Monetize a Blog or Website

Blogging and website creation provide opportunities to earn passive income through various monetization methods. Here’s how you can get started:

- Select a Niche: Choose a topic or niche that you are passionate and knowledgeable about. This will make it easier to create content that attracts and engages your target audience.

- Create Quality Content: Develop high-quality and valuable content that caters to your audience’s needs and interests. Consistently produce informative articles, videos, or podcasts to establish your authority and attract a loyal following.

- Monetize Your Blog: There are several ways to monetize your blog or website, including:

- Display Advertising: Sign up for an advertising network like Google AdSense or Media.net to display ads on your site. Earn passive income based on the number of ad impressions or clicks.

- Affiliate Marketing: Promote products or services through affiliate links on your blog. Earn a commission for every sale or lead generated through your referral.

- Sponsored Content: Collaborate with brands to create sponsored posts or reviews. Charge a fee for featuring their products or services on your platform.

- Online Courses: Share your expertise by creating and selling online courses. Platforms like Udemy or Teachable can help you reach a wide audience and earn passive income from course enrollments.

- Membership or Subscription: Offer exclusive content or resources to subscribers in exchange for a recurring fee. This can be in the form of premium articles, access to a community, or downloadable content.

Generate Passive Income through E-commerce

E-commerce provides opportunities to earn passive income by selling products online. Consider the following methods:

- Dropshipping: Start an online store without the need to hold inventory. With dropshipping, you partner with suppliers who handle product storage and shipping. You only need to focus on marketing and customer service.

- Print-on-Demand: Design and sell custom products such as t-shirts, mugs, or phone cases. Partner with print-on-demand platforms that handle production and shipping on your behalf.

- Amazon FBA: Leverage the power of Amazon by using their Fulfillment by Amazon (FBA) program. You send your products to Amazon’s fulfillment centers, and they handle storage, packaging, and shipping.

- Affiliate E-commerce: Create a niche affiliate e-commerce website focused on promoting products from various brands. Earn commissions for every sale referred through your affiliate links.

Invest in Rental Properties

Investing in rental properties is a classic method of generating passive income. Here’s how you can get started:

- Research and Choose the Right Location: Look for areas with high demand for rentals and potential for growth. Consider factors such as job opportunities, amenities, and population growth.

- Do the Math: Calculate the potential rental income and expenses involved, including mortgage payments, property taxes, insurance, maintenance costs, and property management fees.

- Acquire Financing: Determine how you will finance your rental property investment. Options include obtaining a mortgage, partnering with other investors, or using your own savings.

- Find and Screen Tenants: Advertise your rental property and thoroughly screen potential tenants. Perform background checks, check references, and verify their ability to pay rent.

- Manage Your Property: Decide whether you will manage the property yourself or hire a property management company. Property managers handle tasks such as rent collection, maintenance, and tenant communication.

Create and Sell Digital Products

Creating and selling digital products can be an effective way to generate passive income. Consider the following options:

- E-books: Write and publish e-books on platforms like Amazon Kindle Direct Publishing. Earn passive income through book sales.

- Online Courses: Share your expertise and create online courses on topics in high demand. Platforms like Udemy, Coursera, or Teachable can help you reach a wide audience.

- Software and Apps: Develop and sell software programs or mobile applications. This requires technical skills or collaboration with developers.

- Photography and Graphics: Sell your photos, illustrations, or graphic designs on stock photography websites or platforms like Shutterstock or Creative Market.

- Music and Audio: Create and sell music tracks, sound effects, or audio recordings on platforms like iTunes or Spotify.

Consider Peer-to-Peer Lending

Peer-to-peer lending provides an opportunity to earn passive income by lending money to individuals or businesses. Here’s how it works:

- Select a P2P Lending Platform: Research and choose a reputable peer-to-peer lending platform that aligns with your investment goals and risk tolerance.

- Diversify Your Investments: Spread your investments across multiple borrowers to reduce the risk of default. Allocate your investment amounts based on risk assessments provided by the platform.

- Review Borrower Profiles: Evaluate borrower profiles, loan purposes, and creditworthiness to make informed investment decisions. Some platforms provide detailed borrower information, including credit scores and loan repayment history.

- Monitor and Reinvest: Regularly monitor your investments and reinvest the returns to compound your passive income over time.

Automate Your Business Processes

Automation can significantly increase your passive income potential by streamlining business processes. Consider the following automation methods:

- Email Marketing Automation: Use email marketing platforms like Mailchimp or ConvertKit to set up automated email campaigns. Nurture leads, send product recommendations, and promote your passive income streams.

- Outsource Tasks: Delegate time-consuming tasks to virtual assistants or freelancers. This allows you to focus on the strategic aspects of your business and frees up your time.

- Invest in Systems and Software: Explore software solutions that can automate various aspects of your business, such as customer relationship management (CRM) software or project management tools.

- Create Sales Funnels: Develop sales funnels that guide potential customers through a series of automated steps, leading to conversion and passive income generation.

- Optimize SEO: Improve your website’s search engine optimization (SEO) to attract organic traffic and increase your passive income opportunities through higher visibility.

In conclusion, creating multiple streams of passive income is an attainable goal with determination, strategic thinking, and a willingness to explore various opportunities. Diversify your investments, explore e-commerce options, invest in rental properties, create and sell digital products, consider peer-to-peer lending, and automate your business processes. By implementing these strategies, you can increase your financial stability and enjoy the benefits of passive income for years to come.

How To Create Multiple Sources Of Income ???? ???? | Clever Girl Finance

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. What are passive income streams and why are they important?

Passive income streams are sources of income that generate revenue with minimal effort or active participation. They are crucial because they provide financial stability and the potential for long-term wealth accumulation without relying solely on a traditional job.

2. How can I create multiple streams of passive income?

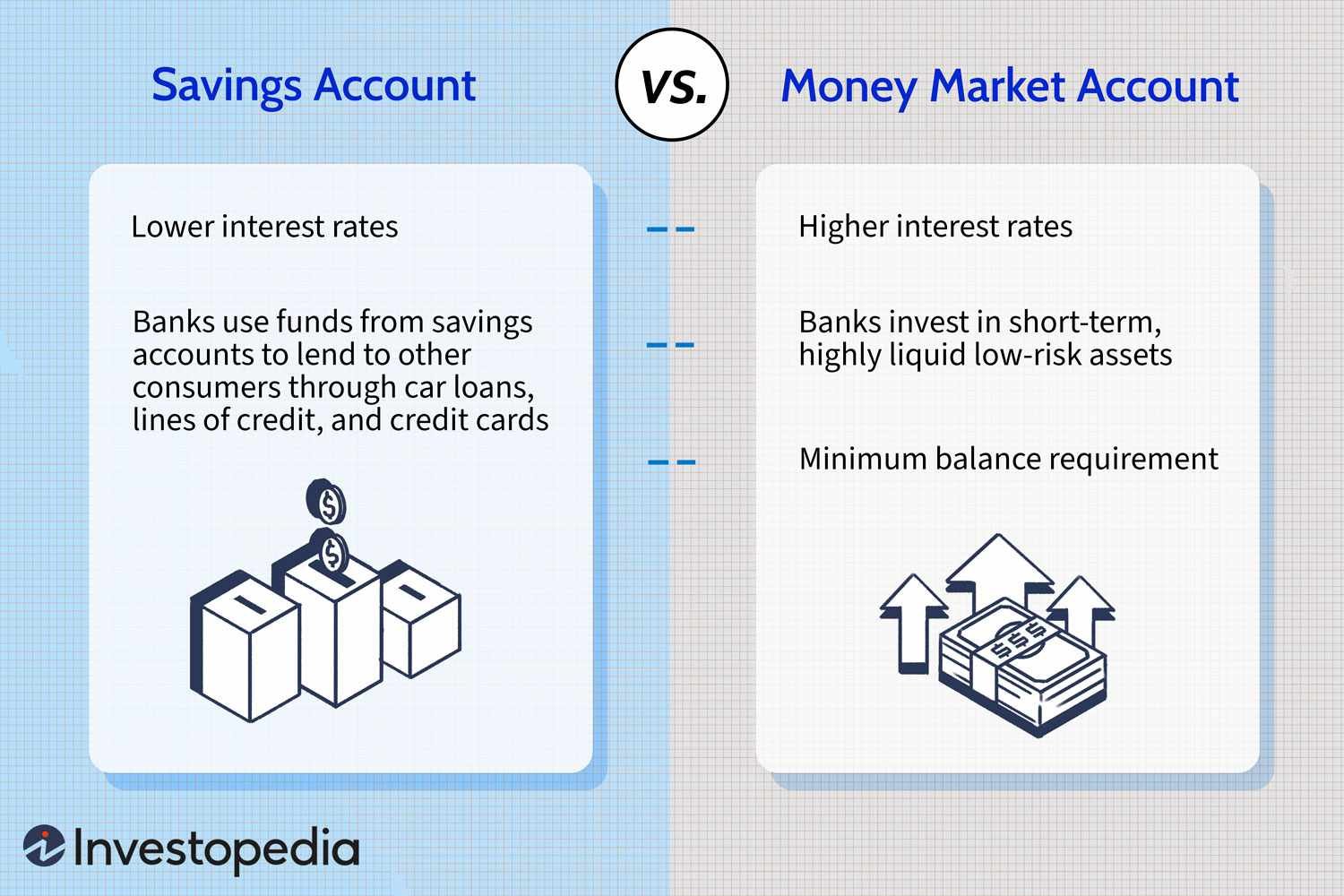

Creating multiple streams of passive income involves diversifying your income sources. Some effective ways to do this include investing in real estate, stocks, or bonds, starting an online business, earning royalties from intellectual property, or participating in affiliate marketing programs.

3. Is it necessary to have a large initial investment to create passive income streams?

No, it is not always necessary to have a large initial investment. While some passive income streams may require significant capital upfront, there are also low-cost or even free options available. For example, starting a blog or a YouTube channel can be done with minimal investment.

4. How long does it take to establish multiple streams of passive income?

The timeframe to establish multiple streams of passive income varies depending on various factors, such as the chosen income stream and the effort you put into it. It can take months or even years to build a sustainable passive income portfolio. Consistency, patience, and a long-term mindset are key.

5. What are some potential risks or challenges associated with creating passive income streams?

While passive income can offer immense benefits, it’s important to be aware of potential risks and challenges. These may include initial time and effort required to set up the income stream, the risk of market volatility affecting investments, regulatory changes, or the need to continuously adapt to market trends.

6. Can I create passive income streams while having a full-time job?

Yes, it is possible to create passive income streams while working a full-time job. Many passive income strategies allow for flexibility and can be managed during your free time. It may require proper time management, dedication, and finding income streams that align with your lifestyle and interests.

7. How can I determine which passive income streams are suitable for me?

To determine which passive income streams are suitable for you, consider factors such as your skills, interests, available time, risk tolerance, and financial goals. Research different options, evaluate their potential returns, and choose those that align with your resources and long-term objectives.

8. Are passive income streams completely effortless once established?

While passive income streams require less ongoing effort compared to active income, they still require monitoring, maintenance, and occasional optimization. Regular evaluation, staying updated with market trends, and adapting to changes are necessary to ensure the sustainability and growth of your passive income streams.

Final Thoughts

Creating multiple streams of passive income is a smart financial strategy. Diversifying your income sources not only provides stability but also allows you to generate money without actively trading your time for it. By investing in stocks, bonds, or real estate, you can earn dividends, interest, or rental income. Starting an online business or creating digital products can also generate passive income through affiliate marketing or royalty payments. Remember to focus on building a strong foundation and consistently nurturing your income streams. With dedication and smart choices, you can achieve financial freedom and enjoy the benefits of multiple streams of passive income.