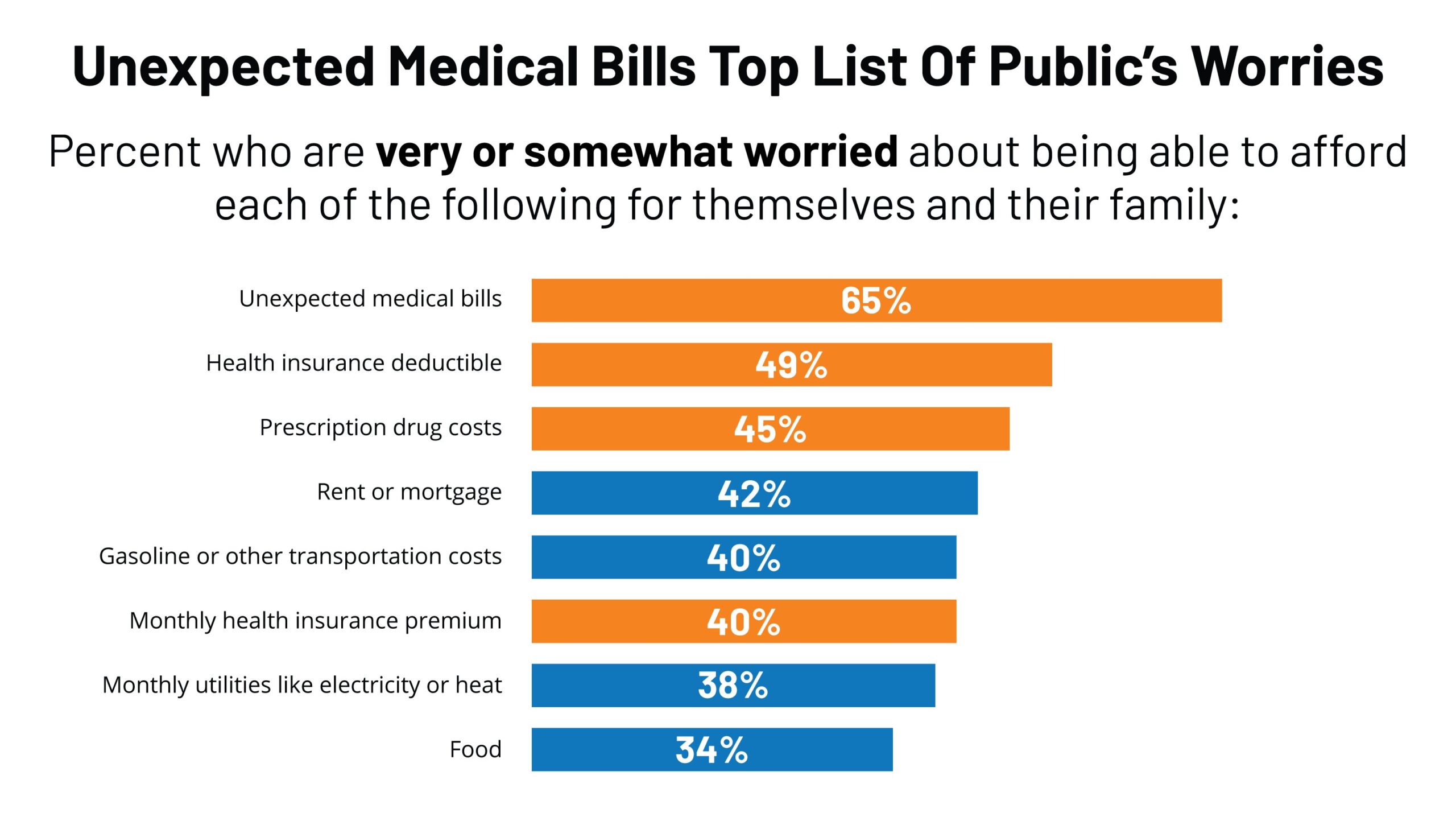

Dealing with unexpected medical expenses can be overwhelming, leaving many individuals feeling uncertain and anxious. But fret not, for there are practical solutions to navigate this challenging situation. In this article, we will explore effective strategies on how to deal with unexpected medical expenses. Whether you’ve been hit with a surprise medical bill or are just looking to prepare for the future, we’ve got you covered. So, let’s dive in and find out how to effectively manage these unforeseen costs, ensuring peace of mind and financial stability.

How to Deal with Unexpected Medical Expenses

Dealing with unexpected medical expenses can be overwhelming, both emotionally and financially. Whether it’s a sudden illness, an accident, or a chronic condition that requires ongoing treatment, medical bills can quickly add up and put a strain on your finances. However, there are steps you can take to manage and mitigate the impact of unexpected medical expenses. In this article, we will explore various strategies and resources that can help you navigate through these challenging situations.

1. Review Your Health Insurance Coverage

One of the first steps you should take when facing unexpected medical expenses is to carefully review your health insurance coverage. Understanding the different aspects of your policy can help you assess your financial responsibility and potential out-of-pocket costs. Consider the following:

- Check your deductible: Determine the amount you need to pay before your insurance starts covering the costs.

- Review co-pays and co-insurance: Understand the percentage you’re responsible for and how it applies to different services.

- Know the network: Ensure your healthcare providers and facilities are in-network to maximize your coverage.

- Explore coverage limits: Be aware of any annual or lifetime limits on specific services or treatments.

By gaining a clear understanding of your health insurance coverage, you can better plan and budget for unexpected medical expenses.

2. Create an Emergency Fund

Having an emergency fund is essential to prepare for unexpected financial obligations, including medical expenses. Consider establishing a separate savings account specifically designated for emergencies. Here are some tips to build your emergency fund:

- Set a monthly savings goal: Determine a realistic amount to save each month and make it a priority.

- Automate your savings: Schedule automatic transfers from your checking account to your emergency fund.

- Reduce unnecessary expenses: Cut back on non-essential spending to free up money for your emergency fund.

- Consider additional income sources: Explore ways to increase your income, such as taking on a side job or freelancing.

Having a well-funded emergency fund can provide peace of mind and help you manage unexpected medical expenses without resorting to debt or financial hardship.

3. Negotiate Medical Bills

When faced with high medical bills, don’t hesitate to negotiate with healthcare providers, hospitals, and insurance companies. Here are some strategies to consider:

- Ask for an itemized bill: Review the charges carefully and ensure there are no errors or double billing.

- Research fair pricing: Research the average costs for specific treatments or procedures in your area to negotiate for a lower rate.

- Reach out to healthcare providers: Discuss your financial situation with your healthcare provider and inquire about discounts or payment plans.

- Appeal denied claims: If your insurance denies coverage for a necessary treatment, appeal the decision with supporting documentation from your healthcare provider.

- Utilize medical billing advocates: Consider enlisting the help of professionals who specialize in negotiating medical bills on your behalf.

Remember, healthcare providers and insurance companies are often willing to work with patients to find a mutually agreeable solution.

4. Explore Financial Assistance Programs

Many organizations and government programs offer financial assistance for individuals who are struggling to pay their medical bills. Here are a few resources to consider:

- Nonprofit organizations: There are various nonprofit organizations that provide financial assistance, grants, or low-cost treatment options for specific medical conditions.

- Government programs: Depending on your income and circumstances, you may qualify for government programs such as Medicaid or the Children’s Health Insurance Program (CHIP).

- Hospital financial assistance: Some hospitals have their own financial assistance programs for patients who meet certain criteria.

- Prescription assistance programs: If you’re struggling to afford medications, check if there are any prescription assistance programs available through pharmaceutical companies or charitable organizations.

Research and explore these options to determine if you qualify for any financial assistance programs that can help alleviate the burden of unexpected medical expenses.

5. Consider Medical Credit Cards or Loans

In certain situations, medical credit cards or loans can provide a feasible solution for managing unexpected medical expenses. However, it’s crucial to approach these options with caution and understand the terms and interest rates involved. Consider the following factors before opting for medical credit cards or loans:

- Interest rates and repayment terms: Carefully review the terms, including interest rates, repayment schedules, and any penalties or fees.

- Compare multiple options: Shop around and compare different medical credit cards or loan providers to ensure you’re getting the best terms possible.

- Create a repayment plan: Before taking on additional debt, create a realistic repayment plan to ensure you can manage the monthly payments without causing further financial strain.

While medical credit cards or loans may offer a temporary solution, it’s essential to consider your long-term financial well-being and only pursue these options if you can comfortably afford the repayments.

6. Seek Legal Assistance if Needed

In some cases, unexpected medical expenses may be a result of a negligent party or an accident caused by someone else. If you believe you have a legal claim, it may be worthwhile to consult with an attorney who specializes in medical malpractice or personal injury cases. They can assess your situation, guide you through the legal process, and help you seek compensation for your medical expenses and related damages.

7. Prioritize Preventive Care and Healthy Lifestyle

While unexpected medical expenses can arise at any time, prioritizing preventive care and maintaining a healthy lifestyle can reduce the likelihood of expensive medical treatments. Here are some tips:

- Regular check-ups and screenings: Schedule routine check-ups and preventive screenings to detect and address any potential health issues early.

- Healthy habits: Follow a balanced diet, exercise regularly, get enough sleep, manage stress, and avoid harmful habits like smoking and excessive alcohol consumption.

- Practice safety precautions: Take necessary precautions to prevent accidents and injuries, such as wearing seat belts, using protective gear, and practicing proper workplace safety.

By investing in your health and well-being, you can potentially minimize the need for costly medical interventions in the future.

Unexpected medical expenses can be challenging to navigate, but with careful planning and proactive steps, you can manage the financial impact more effectively. Reviewing your health insurance coverage, building an emergency fund, negotiating medical bills, exploring financial assistance programs, considering medical credit options responsibly, and seeking legal assistance if needed are all strategies that can help you deal with unexpected medical expenses. Additionally, prioritizing preventive care and a healthy lifestyle can contribute to reducing the likelihood of future medical emergencies. Remember, it’s crucial to stay proactive, informed, and seek help when necessary to mitigate the financial strain and focus on your overall well-being.

Right on the Money: How to handle surprise medical bills

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I deal with unexpected medical expenses?

One way to deal with unexpected medical expenses is to review your insurance coverage. Understand what is covered by your insurance policy and be aware of any deductibles, co-pays, or limits on coverage. It is also a good idea to set up an emergency fund specifically for medical expenses.

2. What are some ways to reduce medical costs?

There are several strategies to help reduce medical costs. Consider negotiating with healthcare providers for lower fees or payment plans. You can also shop around for more affordable prescriptions or seek generic alternatives. Additionally, exploring government or non-profit assistance programs can provide financial relief.

3. Should I consider a medical credit card to cover unexpected expenses?

While medical credit cards may seem like a convenient option, it’s crucial to carefully evaluate the terms and interest rates before committing. These cards often come with high interest rates and fees, so it’s important to consider alternative options like payment plans or negotiating directly with healthcare providers.

4. Are there any tax deductions or credits available for medical expenses?

Yes, certain medical expenses can be deducted from your income taxes, but there are specific criteria and limitations. Expenses that exceed a certain percentage of your adjusted gross income may be eligible for deduction. Consult with a tax professional or refer to IRS guidelines for more information.

5. Can I set up a payment plan with my healthcare provider for unexpected medical expenses?

Many healthcare providers offer payment plans to help patients manage unexpected medical expenses. It’s best to contact your provider’s billing department directly to discuss the available options and negotiate a payment plan that works for you.

6. Should I consider crowdfunding or seeking financial assistance from charitable organizations?

Crowdfunding and seeking financial assistance from charitable organizations can be viable options, especially for individuals facing significant medical expenses. Platforms like GoFundMe can help raise funds, and there are various organizations that provide grants or financial aid specifically for medical purposes.

7. How can budgeting help in dealing with unexpected medical expenses?

Budgeting is essential for managing unexpected medical expenses. By creating a budget and allocating funds for potential healthcare costs, you can better prepare for emergencies. Additionally, building an emergency fund and regularly reviewing and adjusting your budget can provide greater financial security.

8. Should I consider health insurance options if I don’t have coverage?

Yes, it’s crucial to explore health insurance options if you don’t currently have coverage. Research available plans, including government-funded programs or insurance marketplaces, to find an affordable option that suits your needs. Having insurance can help protect you from high medical costs in the future.

Final Thoughts

In conclusion, unexpected medical expenses can cause financial stress and uncertainty. However, there are steps you can take to effectively deal with these situations. Firstly, it is crucial to have an emergency fund to cover unforeseen medical costs. Additionally, researching and selecting the right health insurance plan can provide financial protection. Seeking financial assistance through payment plans or negotiating medical bills can also help alleviate the burden. Lastly, prioritizing preventive care and maintaining a healthy lifestyle can help minimize the risk of unexpected medical expenses. By taking these proactive measures, you can better handle and manage unexpected medical expenses.