Are you faced with the daunting decision of choosing between term and whole life insurance? We understand the importance of protecting your loved ones and securing their financial future, but with so many options available, it can be overwhelming. That’s why we’re here to help you navigate this complex decision-making process. In this article, we will guide you through the factors to consider when deciding between term and whole life insurance, empowering you to make an informed choice that suits your unique needs, goals, and budget. So, let’s dive in and explore how to decide between term and whole life insurance.

How to Decide Between Term and Whole Life Insurance

Introduction

When it comes to choosing the right life insurance policy, the decision between term and whole life insurance can be a difficult one. Both options have their advantages and disadvantages, and understanding the differences between them is crucial to making an informed decision. In this article, we will explore the key factors to consider when deciding between term and whole life insurance, helping you choose the best option for your unique needs and financial situation.

Understanding Term and Whole Life Insurance

Before we dive into the decision-making process, let’s take a moment to understand what term and whole life insurance actually are.

Term Life Insurance

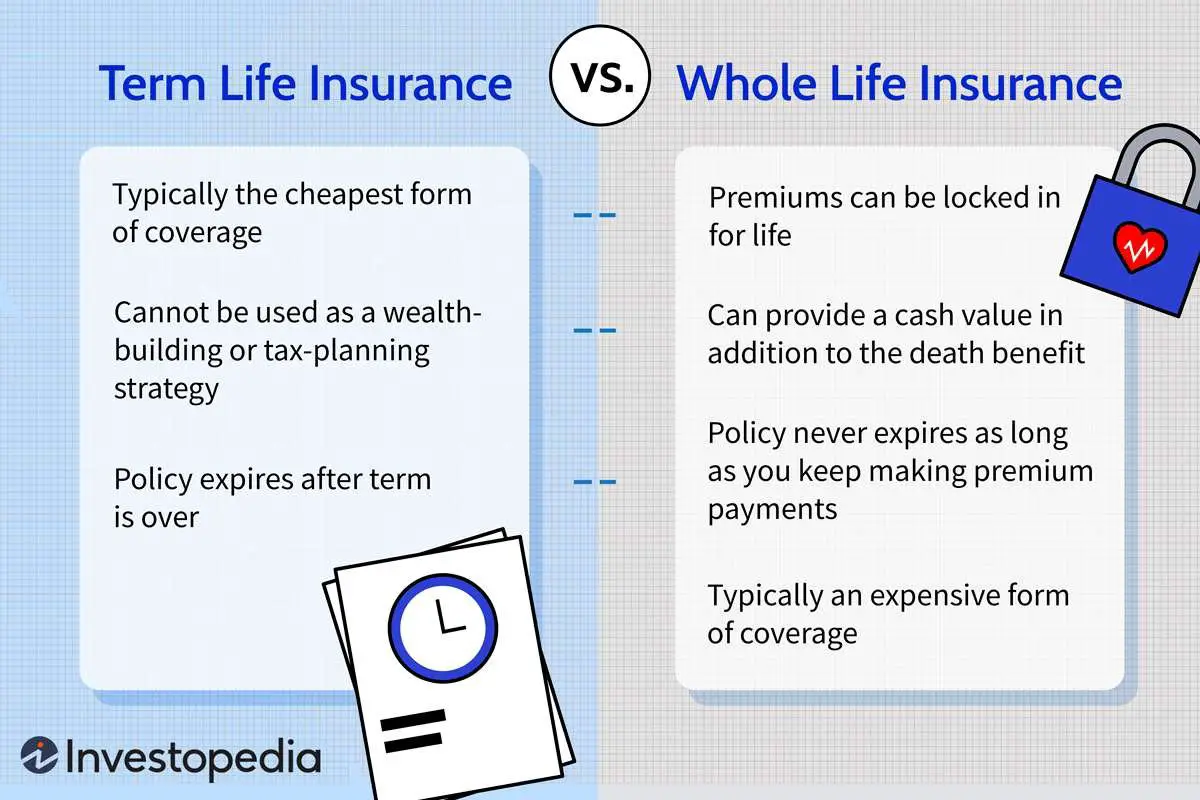

Term life insurance provides coverage for a specific period of time, typically 10, 20, or 30 years. If the insured individual passes away during the term of the policy, the death benefit is paid out to the designated beneficiaries. Term life insurance is generally more affordable than whole life insurance, making it a popular choice for individuals seeking temporary coverage.

Whole Life Insurance

Whole life insurance, on the other hand, provides coverage for the entire lifetime of the insured individual. It not only offers a death benefit but also includes a cash value component that grows over time. Whole life insurance policies tend to be more expensive than term life insurance due to the added cash value feature.

Now that we have a basic understanding of term and whole life insurance, let’s explore the factors to consider when deciding between the two.

Factors to Consider When Choosing Between Term and Whole Life Insurance

1.

Duration of Coverage Needed

One of the most critical factors to consider when choosing between term and whole life insurance is the duration of coverage needed. Ask yourself the following questions:

– How long do you expect to need life insurance coverage?

– Are you looking for coverage to protect your family until your children are financially independent?

– Do you need coverage to pay off a mortgage or other loans?

If you only require coverage for a specific period, such as until your mortgage is paid off or your children are no longer dependent, term life insurance may be the most suitable option. Whole life insurance, on the other hand, is ideal if you want coverage that lasts for your entire lifetime.

2.

Financial Considerations

Financial considerations play a significant role in the decision-making process. Here are some factors to consider:

– Affordability: Term life insurance generally has lower premiums compared to whole life insurance, making it a more affordable option, especially for younger individuals or those on a tight budget.

– Cash value growth: Whole life insurance policies accumulate cash value over time, which can be borrowed against or used for investment purposes. If you are interested in building cash value within your policy, whole life insurance may be the better choice.

– Estate planning: Whole life insurance policies can be used as part of an estate planning strategy, providing tax advantages and a source of liquidity to cover estate taxes. If estate planning is a priority for you, whole life insurance may be worth considering.

3.

Flexibility

Consider your need for flexibility when deciding between term and whole life insurance:

– Convertibility: Some term life insurance policies offer the option to convert to whole life insurance without additional underwriting. If you anticipate the need for permanent coverage in the future, choosing a convertible term policy can provide flexibility.

– Adjusting coverage: Term life insurance allows you to choose coverage based on your current needs. As your circumstances change, you can increase or decrease the coverage amount accordingly. Whole life insurance, on the other hand, is typically more rigid and may not allow for as much flexibility in adjusting coverage.

4.

Investment Considerations

If you are looking to use your life insurance policy as an investment vehicle, whole life insurance may be more suitable:

– Cash value growth: Whole life insurance policies provide a cash value component that grows over time. This cash value can be accessed through policy loans or withdrawals and can potentially provide a source of funds for various financial needs.

– Risk tolerance: Whole life insurance offers a guaranteed death benefit and a guaranteed cash value component. If you prefer a more conservative and predictable investment approach, whole life insurance may align with your risk tolerance.

5.

Health and Age

Your current health and age can also influence the type of life insurance that is most appropriate for you:

– Underwriting requirements: Whole life insurance policies typically have more stringent underwriting requirements, including medical exams and detailed health questionnaires. If you have pre-existing health conditions or are older, obtaining whole life insurance may be more challenging or expensive.

– Premiums: Your age and health status will impact the premiums you are quoted for both term and whole life insurance. Generally, premiums for older individuals or those with health issues tend to be higher.

Choosing between term and whole life insurance requires careful consideration of various factors, including the duration of coverage needed, financial considerations, flexibility, investment preferences, and personal health and age. By understanding the key differences between the two types of insurance and evaluating your unique circumstances, you can make an informed decision that provides the necessary protection for you and your loved ones. Remember, it’s always a good idea to consult with a licensed insurance professional who can provide personalized guidance based on your specific needs and goals.

Term Vs. Whole Life Insurance (Life Insurance Explained)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I decide between term and whole life insurance?

Choosing between term and whole life insurance depends on your specific needs and financial goals. Consider the following factors to help you make an informed decision:

What are the key differences between term and whole life insurance?

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years, while whole life insurance provides coverage for the insured’s entire lifetime. Additionally, term life insurance usually has lower premiums compared to whole life insurance.

When is term life insurance a better option?

Term life insurance is often a suitable choice if you only need coverage for a specific period, such as during your working years when your dependents rely on your income or to pay off a mortgage. It provides affordable coverage without accumulating cash value.

When should I consider whole life insurance?

Whole life insurance is beneficial if you desire lifelong coverage and want to accumulate cash value over time. It can provide a death benefit to your beneficiaries while building a cash reserve that you can borrow against or withdraw from during your lifetime.

What factors should I consider when comparing premiums?

When evaluating premiums, consider the length of coverage, your budget, and your future financial commitments. Assess how much coverage you need and how much you can comfortably afford in premiums to ensure you make the right decision.

Can I convert my term life insurance policy to whole life insurance later?

Most term life insurance policies offer the option to convert to a whole life insurance policy. However, conversion terms may vary, so it is important to understand the conversion options available to you before purchasing a policy.

Is it possible to have both term and whole life insurance policies?

Yes, it is possible to have a combination of term and whole life insurance policies. This strategy, known as laddering, allows you to have different policies to meet various coverage needs at different stages of life.

How can a financial advisor help me decide between term and whole life insurance?

A financial advisor can provide personalized guidance based on your unique financial situation and goals. They can help you assess your insurance needs, compare policy options, and make an informed decision that aligns with your long-term financial plan.

Final Thoughts

Deciding between term and whole life insurance can be a crucial financial decision. To make an informed choice, consider your specific needs, budget, and future goals. Term insurance provides coverage for a specific period, offering affordable premiums but no cash value. Whole life insurance, on the other hand, offers lifelong coverage with a cash value component but comes at a higher cost. Evaluate your financial situation, risk tolerance, and long-term objectives to determine which option aligns best with your needs. Seek advice from a licensed insurance professional who can guide you in the decision-making process. Make an informed choice that balances your current financial circumstances and future security.