Looking to boost your investment portfolio? Want to maximize your returns while minimizing risks? Well, you’ve come to the right place! In this blog article, we’ll show you exactly how to diversify your investment portfolio, ensuring that you have a well-rounded mix of assets that can weather any storm. Diversification is an essential strategy that every investor should know, and by the end of this article, you’ll be armed with the knowledge and tools to implement it effectively. So, let’s dive right in and explore the art of diversifying your investment portfolio.

How to Diversify Your Investment Portfolio

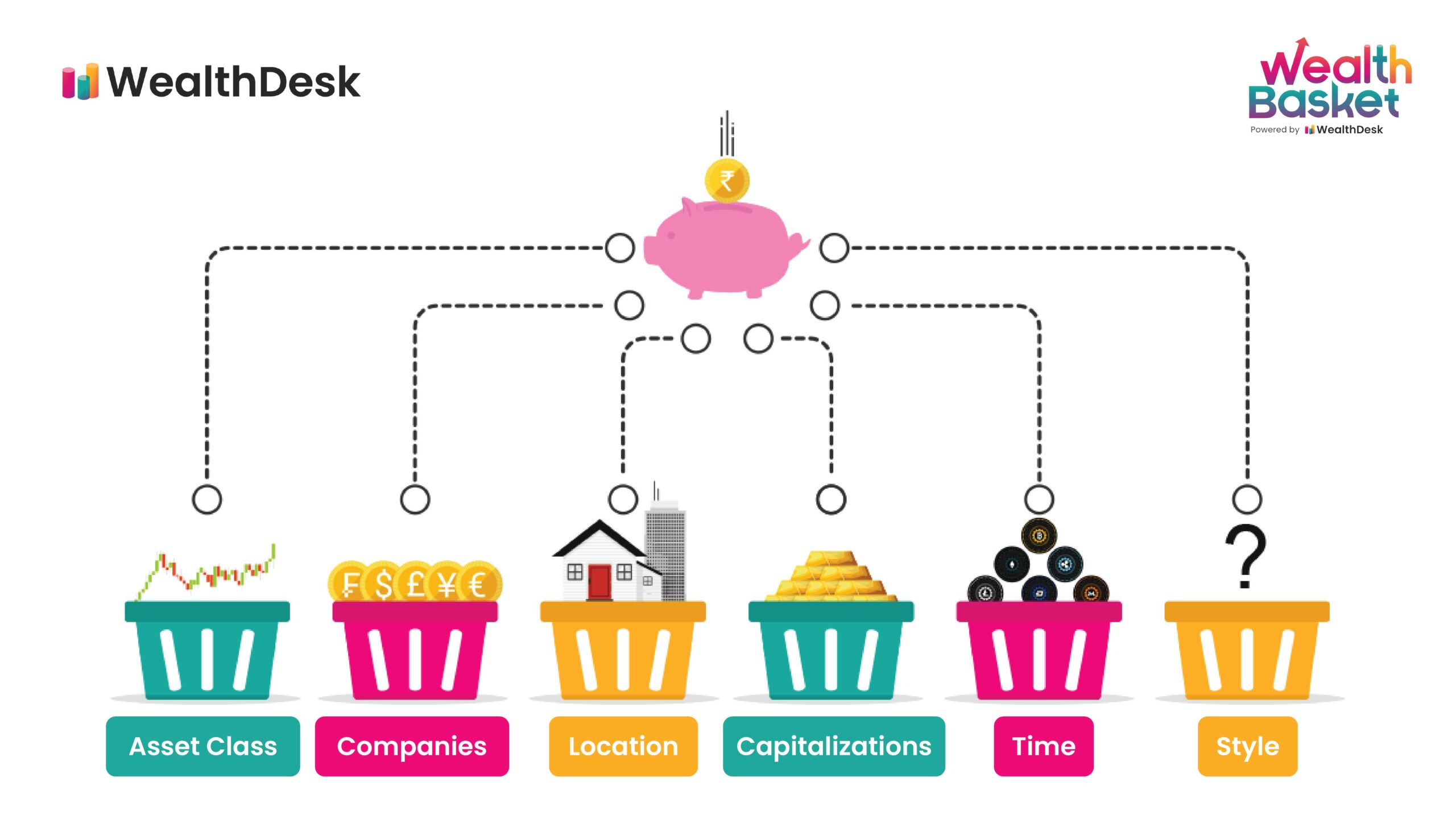

Investing is a great way to grow your wealth and secure your financial future. However, putting all your eggs in one basket can be risky. That’s where diversification comes in. Diversifying your investment portfolio is a strategy that involves spreading your investments across different asset classes, industries, and geographic regions to reduce risk and potentially maximize returns. In this article, we will explore the importance of diversification and provide you with practical steps on how to effectively diversify your investment portfolio.

Why is Diversification Important?

Diversification is like having a safety net for your investments. It helps protect you from significant losses that can occur if one particular investment suffers a downturn. By spreading your investments across different asset classes, you can lower the overall risk in your portfolio. Here are some key reasons why diversification is important:

1. Risk Reduction: Diversifying your investments helps reduce the impact of volatility in any single asset or market. When one investment performs poorly, others may provide stability or even positive returns.

2. Maximizing Returns: Diversification allows you to capture gains from different sectors or asset classes that may outperform others. By having exposure to various investments, you have a higher chance of benefiting from potential growth opportunities.

3. Stability: A well-diversified portfolio tends to be more stable over time. Even if one sector or asset class experiences a downturn, the impact on your overall portfolio is likely to be mitigated.

4. Protection Against Inflation: Diversifying across asset classes that perform well during inflationary periods can help you protect the purchasing power of your investments.

How to Diversify Your Investment Portfolio

Now that we understand the importance of diversification, let’s delve into the practical steps you can take to diversify your investment portfolio effectively.

1. Set Your Investment Goals

Before you begin diversifying, it’s important to clarify your investment goals and risk tolerance. Are you investing for long-term growth, generating income, or a combination of both? Assessing your financial goals and risk appetite will guide your diversification strategy.

2. Asset Allocation

One of the key steps in diversifying your investment portfolio is determining the appropriate mix of asset classes. Asset allocation refers to the distribution of your investments across different categories such as stocks, bonds, cash, real estate, and commodities. Here’s a breakdown of common asset classes:

– Stocks: Investing in individual stocks or exchange-traded funds (ETFs) offers potential capital appreciation but comes with higher risks.

– Bonds: Fixed income investments like government bonds or corporate bonds provide regular income and are generally considered less risky than stocks.

– Cash: Holding cash or cash equivalents like money market funds provides stability and liquidity, but may not generate significant returns.

– Real Estate: Investing in properties or real estate investment trusts (REITs) can offer diversification and potentially generate rental income.

– Commodities: Investing in commodities like gold, oil, or agricultural products can act as a hedge against inflation and provide diversification benefits.

The optimal asset allocation varies based on your risk tolerance, investment horizon, and market conditions. Generally, diversifying across multiple asset classes is recommended to achieve a balanced portfolio.

3. Diversify Within Each Asset Class

Once you determine your asset allocation, it’s important to further diversify within each asset class. This involves spreading your investments across different sectors, industries, and geographic regions. Here’s how you can achieve diversification within different asset classes:

Stocks:

– Invest in stocks from different sectors such as technology, healthcare, finance, and consumer goods.

– Consider investing in stocks of companies of various sizes, including large-cap, mid-cap, and small-cap stocks.

– Explore international stocks to gain exposure to different economies and markets.

Bonds:

– Diversify your bond holdings across various issuers like government, municipal, and corporate bonds.

– Consider bonds with different maturities to manage interest rate risk.

– Look for bonds with different credit ratings to diversify credit risk.

Real Estate:

– Invest in properties located in different regions or cities to avoid concentration risk.

– Consider diversifying across different types of real estate, such as residential, commercial, or industrial properties.

– Explore opportunities in real estate investment trusts (REITs) that offer diversification within the real estate sector.

4. Consider Mutual Funds and ETFs

Mutual funds and exchange-traded funds (ETFs) are popular investment vehicles that can provide instant diversification. These investment options pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They are managed by professional fund managers who make investment decisions on behalf of the investors. By investing in mutual funds or ETFs, you gain exposure to a broad range of securities, saving you the time and effort of selecting individual investments.

5. Rebalance Regularly

Once you have diversified your portfolio, it’s important to review and rebalance periodically. Over time, the performance of different investments will vary, causing your asset allocation to deviate from your original plan. Rebalancing involves selling investments that have performed well and buying more of the underperforming ones to maintain your desired asset allocation. Regular rebalancing ensures that you stay on track with your investment goals and maintain the benefits of diversification.

6. Stay Informed and Seek Professional Advice

To effectively diversify your investment portfolio, it’s crucial to stay informed about market trends, economic indicators, and geopolitical events that can impact your investments. Additionally, seeking professional advice from a financial advisor or investment expert can provide valuable insights and guidance tailored to your specific situation.

In conclusion, diversifying your investment portfolio is a key strategy to mitigate risk and potentially improve returns. By spreading your investments across different asset classes, industries, and geographic regions, you can create a well-rounded and resilient portfolio. Remember to set clear investment goals, determine the optimal asset allocation, diversify within each asset class, consider mutual funds and ETFs, regularly rebalance, and stay informed. With these steps, you can build a diversified investment portfolio that aligns with your financial objectives and risk tolerance. Happy investing!

Ray Dalio’s All Weather Portfolio: How To Properly Diversify Your Investments And Lower Risk

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I diversify my investment portfolio?

Diversifying your investment portfolio involves spreading your investments across different asset classes, industries, and geographic regions. This can be achieved through various strategies such as investing in stocks, bonds, real estate, commodities, and mutual funds. By diversifying, you can reduce the risk of losing all your investments in case one sector or asset class underperforms.

Is diversifying my portfolio important?

Yes, diversifying your portfolio is essential because it helps mitigate risk. If you invest all your money in a single asset or industry, you face the risk of losing it all if that particular investment performs poorly. Diversification allows you to potentially reduce the impact of negative market events on your overall portfolio and increases the chances of achieving better returns.

How many investments should I have in my portfolio?

The number of investments in your portfolio will vary based on your individual goals and risk tolerance. However, it is generally recommended to have a mix of different assets to achieve proper diversification. As a rule of thumb, having at least 10 to 20 investments across various asset classes can provide a good level of diversification.

What are the benefits of diversifying my investment portfolio?

Diversifying your investment portfolio offers several benefits. Firstly, it helps reduce the impact of volatility in any single investment. Secondly, it allows you to take advantage of different market opportunities across sectors and regions. Thirdly, it helps to protect your portfolio against unforeseen events that may negatively impact specific industries or asset classes.

Should I consider investing in different industries?

Yes, investing in different industries is an important aspect of diversification. Industries can perform differently based on various factors, such as economic conditions, technological advancements, or changes in consumer behavior. By spreading your investments across multiple industries, you lessen the risk of being heavily exposed to a single industry’s performance.

What role does asset allocation play in diversification?

Asset allocation refers to the process of dividing your investment portfolio among different asset classes, such as stocks, bonds, and cash. It is a crucial element of diversification as it determines how much of your investments are allocated to each asset class. By choosing the right asset allocation based on your risk tolerance and investment goals, you can achieve optimal diversification.

Should I consider investing in international markets for diversification?

Yes, investing in international markets can provide additional diversification to your portfolio. Different countries and regions may have varying economic cycles and market conditions. By investing in international stocks and bonds, you can potentially benefit from economic growth and market trends in different parts of the world, mitigating the risk associated with concentrating solely on your domestic market.

What is the role of a financial advisor in portfolio diversification?

A financial advisor can play a crucial role in helping you diversify your investment portfolio effectively. They have the expertise and knowledge to analyze your financial situation, risk tolerance, and investment objectives. A financial advisor can recommend suitable investment options, suggest asset allocation strategies, and monitor your portfolio regularly to ensure proper diversification based on your specific needs.

Final Thoughts

Diversifying your investment portfolio is crucial for long-term financial success. By spreading your investments across different asset classes, sectors, and geographical regions, you can reduce risk and maximize potential returns. Start by thoroughly researching various investment options and assessing their risk and return profiles. Allocate your funds strategically, considering your risk tolerance, investment goals, and time horizon. Regularly review and rebalance your portfolio to maintain diversification. Remember, a diversified portfolio is not immune to market fluctuations, but it can provide more stability and resilience over time. So, take the necessary steps to diversify your investment portfolio and set yourself up for a more secure financial future.