Looking to effectively use financial planning software? Look no further! In this article, we will dive into the ins and outs of utilizing financial planning software to its fullest potential. Whether you’re a beginner or an experienced user, mastering this powerful tool can greatly enhance your financial management skills. So, let’s explore the key strategies and techniques for harnessing the true power of financial planning software. Get ready to take control of your finances and make informed decisions with ease.

How to Effectively Use Financial Planning Software

Introduction

Financial planning plays a crucial role in managing personal and business finances. In today’s digitally-driven world, financial planning software has become an essential tool for individuals and businesses seeking efficient ways to manage their finances. With the right financial planning software, you can easily track your spending, create budgets, set financial goals, analyze investment opportunities, and make informed decisions. In this article, we will explore how to effectively use financial planning software and optimize its features to streamline your financial management process.

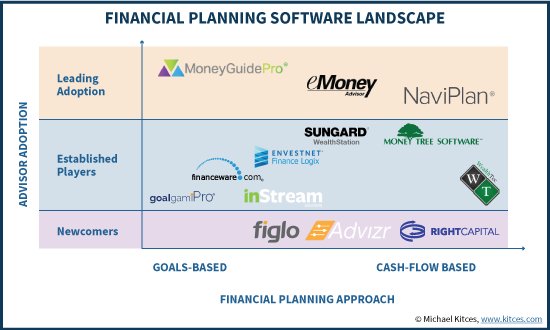

Choosing the Right Financial Planning Software

Before diving into the effective use of financial planning software, it is important to choose the right software that caters to your specific needs. Here are some key factors to consider when selecting financial planning software:

1. User-Friendly Interface

A user-friendly interface is essential for smooth navigation and efficient use of the software. Look for software with intuitive layouts and easily accessible features.

2. Comprehensive Budgeting Tools

Effective financial planning software should provide robust budgeting tools that allow you to create, customize, and track your budgets. Look for features like expense categorization, budget alerts, and spending analysis.

3. Goal Tracking and Visualization

The software should enable you to set financial goals and track your progress towards achieving them. Visual representations, such as charts and graphs, can be immensely helpful in visualizing your goals and monitoring your progress.

4. Investment Analysis

If you are interested in investment planning, opt for software that offers investment analysis tools. These tools can provide insights into investment opportunities, track market trends, and help you make informed investment decisions.

5. Integration with Financial Institutions

To effectively manage your finances, choose software that can seamlessly integrate with your bank accounts, credit cards, and other financial institutions. This integration allows for automatic transaction imports and real-time data synchronization.

Setting Up and Getting Started

Once you have chosen the right financial planning software, it’s time to set it up and get started. Here are the steps to effectively set up and make the most of your financial planning software:

1. Gather and Import Financial Data

To get an accurate picture of your financial situation, gather all relevant financial documents such as bank statements, credit card statements, investment statements, and loan documents. Import this data into the software to have a comprehensive view of your finances.

2. Customize Your Dashboard

Most financial planning software allows you to customize your dashboard according to your preferences. Arrange the widgets and modules to display the information that is most important to you, such as account balances, budgets, and upcoming bills.

3. Create and Manage Your Budget

Utilize the budgeting tools provided by the software to create a realistic budget based on your income, expenses, and financial goals. Categorize your expenses and set limits for each category to avoid overspending. Regularly review and adjust your budget as needed.

4. Set Financial Goals

Define your short-term and long-term financial goals within the software. Whether it’s saving for a down payment on a house or paying off debt, clearly outline your goals and set target dates for achieving them. Regularly monitor your progress and make adjustments accordingly.

5. Track and Categorize Expenses

Efficiently track and categorize your expenses to gain insights into your spending habits. Use the software’s expense tracking features to automatically import transactions and assign them to specific categories. Reviewing your spending patterns can help identify areas for potential cost savings.

Advanced Features and Techniques

Financial planning software often offers advanced features and techniques that can further enhance your financial management experience. Let’s explore some of these features:

1. Scenario Planning

Take advantage of scenario planning tools to model different financial scenarios. This helps you assess the impact of potential financial decisions or changes in circumstances. For example, you can simulate the effects of a salary increase, a major expense, or an investment opportunity.

2. Investment Analysis and Portfolio Management

If you are interested in investments, leverage the investment analysis and portfolio management features of the software. These tools can help you analyze investment options, track the performance of your portfolio, and rebalance your investments based on your risk tolerance and goals.

3. Debt Management

Use the debt management features to track and manage your debts effectively. The software can help you create a payoff plan, monitor interest rates, and visualize your progress towards becoming debt-free.

4. Tax Planning and Optimization

Utilize the tax planning and optimization tools available within the software. These features can help you track deductible expenses, estimate your tax liability, and identify potential tax-saving strategies.

Security and Data Privacy

When using financial planning software, it is crucial to prioritize security and data privacy. Here are some measures to ensure the safety of your financial information:

1. Choose Secure Software

Select reputable financial planning software that employs robust security measures, such as encryption and secure servers. Research the software’s security features and check for any certifications or audits.

2. Use Strong and Unique Passwords

Create strong and unique passwords for your financial planning software and regularly update them. Avoid reusing passwords from other accounts to prevent potential security breaches.

3. Enable Two-Factor Authentication

Enable two-factor authentication whenever possible. This adds an extra layer of security by requiring a second form of verification, such as a code sent to your mobile device, in addition to your password.

4. Regularly Update and Backup Your Software

Keep your financial planning software up to date by installing the latest updates and patches. Additionally, regularly back up your financial data to prevent data loss in case of system failures or cyber-attacks.

Financial planning software is a powerful tool that can significantly streamline your financial management process. By choosing the right software, setting it up effectively, and utilizing advanced features, you can gain better control over your finances, achieve your financial goals, and make informed decisions. Remember to prioritize security and data privacy while using financial planning software. So, unleash the full potential of financial planning software and take charge of your financial future.

How I Automate My Finances

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I effectively use financial planning software?

Using financial planning software effectively involves following these steps:

1.

What are the key features to look for in financial planning software?

When selecting financial planning software, consider features such as budgeting tools, goal setting capabilities, investment tracking, and the ability to generate comprehensive reports.

2.

How do I get started with financial planning software?

Start by inputting your financial information, including income, expenses, assets, and debts. Set specific financial goals and track your progress regularly.

3.

Can financial planning software help me create a budget?

Yes, financial planning software often includes budgeting tools that allow you to track your income and expenses, categorize spending, and identify areas where you can save money.

4.

Can financial planning software help with investment management?

Absolutely! Many financial planning software options offer features like investment tracking, portfolio analysis, and the ability to model different investment scenarios to help you make informed decisions.

5.

How can financial planning software assist with retirement planning?

Financial planning software can project your future income, expenses, and savings, helping you estimate whether you’re on track for a comfortable retirement. It can also help you optimize your retirement savings strategies.

6.

Can financial planning software help me stay organized with my taxes?

Yes, some financial planning software enables you to track tax-related information throughout the year, allowing for easier tax preparation and maximizing potential deductions.

7.

What security measures should I consider when using financial planning software?

Ensure that the software you choose has robust security features, such as encryption and multi-factor authentication. It’s also important to keep your software and devices updated with the latest security patches.

8.

How often should I review and update my financial plan using the software?

Regularly review your financial plan and update it when significant life events occur, such as changes in income, expenses, or financial goals. It’s recommended to review your plan at least once a year.

Final Thoughts

To effectively use financial planning software, follow these key strategies. Firstly, familiarize yourself with the software’s features and capabilities through user guides or tutorials. Secondly, input accurate and up-to-date financial data, such as income, expenses, and savings goals. This ensures the software can provide reliable forecasts and suggestions. Next, regularly review and update your financial information to reflect any changes in your circumstances. Additionally, take advantage of the software’s analysis and reporting tools to gain insight into your financial situation. Lastly, collaborate with a financial advisor who can offer guidance and support as you navigate the software. By embracing these practices, you can harness the power of financial planning software and make informed decisions regarding your financial future.