Looking to make a career change? Unsure how to financially navigate this transition successfully? Don’t worry, I’ve got you covered! In this blog article, we’ll delve into the practical steps and strategies you can implement to ensure a smooth financial journey while switching careers. From budgeting effectively to maximizing your income potential, we’ll explore various aspects that will empower you to confidently embrace your new career path. So, if you’re ready to take charge of your financial future and learn how to financially navigate a career change, keep reading!

How to Financially Navigate a Career Change

Introduction

Making a career change can be an exciting but daunting endeavor. Along with the professional and personal adjustments, financial considerations play a crucial role in ensuring a smooth transition. Whether you’re switching industries, starting your own business, or pursuing a different career path, careful financial planning is essential. This comprehensive guide will delve into various strategies and tips to help you navigate the financial aspects of a career change successfully.

1. Assess Your Current Financial Situation

Before diving into a career change, it’s important to evaluate your current financial standing. Take the following steps to gain a clear understanding of your financial situation:

Gather and Evaluate your Financial Information

- Calculate your total income, including salary, bonuses, side gigs, and investments.

- Review your monthly expenses, such as rent/mortgage, utilities, transportation, and personal expenses.

- Take stock of your assets, such as savings, investments, and retirement accounts.

- Identify any outstanding debts, including credit card balances, loans, or student loans.

Identify and Prioritize Financial Goals

- Consider short-term and long-term financial objectives, such as building an emergency fund, paying off debts, saving for a down payment, or investing for retirement.

- Rank these goals in order of importance to allocate your resources effectively.

Assess Risk Tolerance

- Evaluate your comfort level with financial risk, considering factors such as age, responsibilities, and financial obligations.

- Assessing risk tolerance will help guide your investment decisions during and after the career transition.

Create a Budget and Emergency Fund

- Develop a realistic budget that aligns with your financial goals and current income.

- Set aside a portion of your income as an emergency fund to cover unexpected expenses during the career change.

2. Research Your New Career Path

Before pursuing a career change, thorough research is crucial to ensure a successful transition. The financial considerations during this stage include:

Salary Expectations

- Research the salary range for your desired role and industry to set realistic income expectations.

- Consider factors such as location, experience, and demand for the role.

Industry Trends and Stability

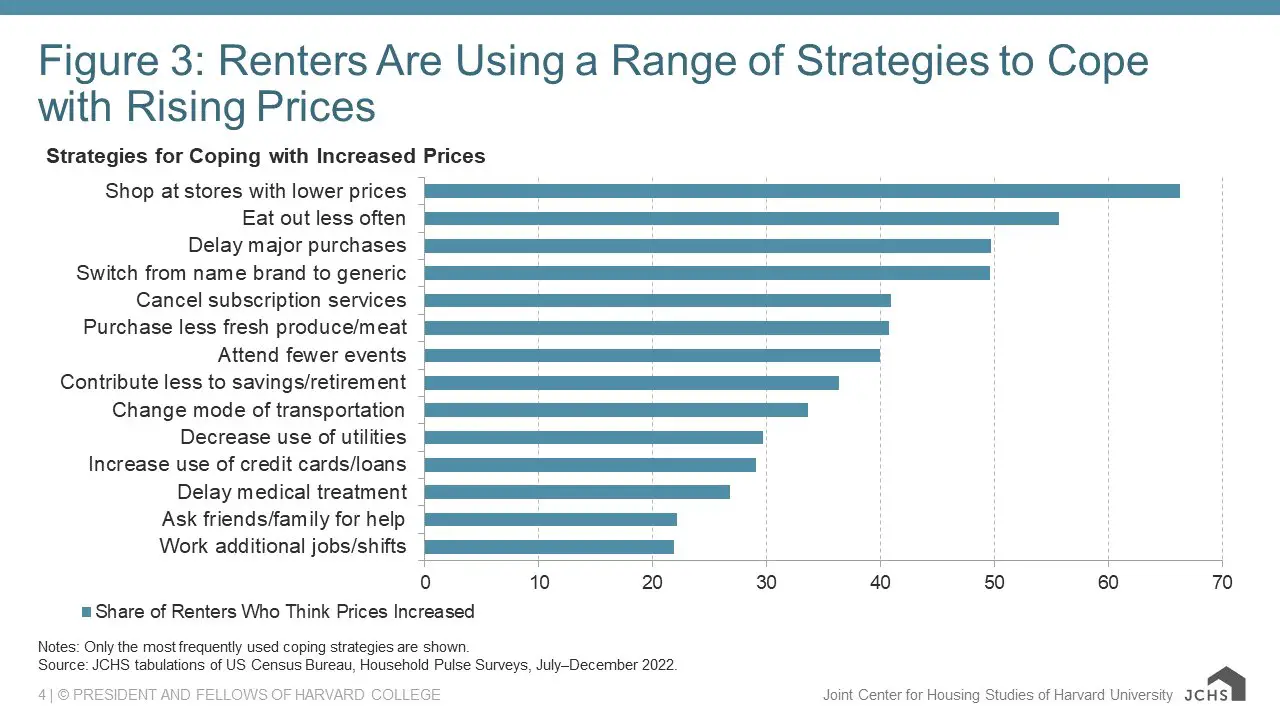

- Explore the current state of the industry you’re entering, including growth projections, market conditions, and potential challenges.

- Understanding industry trends can help you make informed financial decisions and prepare for potential fluctuations.

Training and Education Costs

- Identify any additional training or education required to pursue your new career path.

- Estimate the associated costs, such as tuition fees, certification exams, or professional development programs.

Networking and Mentorship Opportunities

- Build connections within your target industry to gain insights, mentorship, and potential job opportunities.

- Networking can also provide valuable guidance on the financial aspects of the career change.

3. Develop a Financial Transition Plan

Creating a financial transition plan will ensure a smooth change from your current career to the new one. Consider the following key elements:

Income and Expense Projections

- Estimate your expected income and expenses during the transition period.

- Include any changes in salary, benefits, or bonuses and adjust your budget accordingly.

Account for Additional Training or Education Costs

- Budget for any costs associated with acquiring new skills or qualifications.

- Consider the impact on your income and expenses during the planned training period.

Plan for Potential Income Gaps

- Anticipate any periods without income during the transition, such as when starting a business or pursuing freelance opportunities.

- Ensure you have sufficient savings or alternative income sources to cover your expenses during these gaps.

Review Employee Benefits and Retirement Plans

- Assess the impact of your career change on benefits like health insurance, retirement plans, and other employee perks.

- Consider rolling over retirement funds or exploring alternative retirement savings options.

4. Manage Debt and Minimize Financial Risk

Taking control of your debt and minimizing financial risk is essential to maintain stability during a career change. Consider the following strategies:

Pay Off High-Interest Debt

- Prioritize paying off high-interest debts, such as credit card balances, to reduce financial strain during the transition period.

- Consider consolidating or refinancing debts to lower interest rates and simplify repayment.

Build an Emergency Fund

- Continue building your emergency fund to cover unexpected expenses and reduce reliance on credit during the career change.

- Having an adequate safety net can provide peace of mind and financial flexibility.

Consider Insurance Coverage

- Evaluate your insurance coverage, including health, life, disability, and liability insurance.

- Ensure you have appropriate coverage to mitigate potential risks and protect your finances.

Explore Income Streams and Side Gigs

- Consider exploring additional sources of income, such as freelancing, consulting, or part-time work, to supplement your finances during the transition.

- Diversifying your income streams can help stabilize your financial situation and provide a buffer during uncertainties.

5. Update Your Financial Plan and Investments

Reassessing your financial plan and investment strategy is crucial when embarking on a career change. Consider the following steps:

Adjust Your Budget

- Update your budget to reflect changes in income and expenses after the career change.

- Ensure your new budget aligns with your financial goals and supports your lifestyle within the new career.

Review Retirement Savings

- Review and adjust your retirement savings strategy to align with the new career path.

- Consider exploring new retirement account options or increasing contributions to catch up if necessary.

Rebalance and Diversify Investments

- Assess your investment portfolio and adjust asset allocations to reflect your risk tolerance and new financial goals.

- Diversify your investments to minimize risk and maximize potential returns.

Consult with a Financial Advisor

- Consider seeking professional advice from a financial advisor to navigate the complex financial implications of a career change.

- An advisor can help you make informed decisions, optimize your investment strategy, and provide guidance for achieving your financial goals.

Navigating the financial aspects of a career change requires careful planning, assessment, and adjustment. By evaluating your current financial situation, researching your new career path, developing a transition plan, managing debt, and updating your financial plan and investments, you can ensure a smoother financial transition. Remember, seeking guidance from professionals and leveraging resources in your network can provide valuable support during this exciting journey. With thorough preparation and financial diligence, you’ll be better equipped to navigate the challenges and embrace the opportunities that come with a career change.

How to know if it’s time to change careers | The Way We Work, a TED series

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I financially navigate a career change?

When you are considering a career change, it is important to assess your financial situation and make a plan. Begin by analyzing your current income, expenses, and any financial obligations you have. Create a budget that takes into account your new career prospects and any potential changes in income. It’s also wise to build an emergency fund to cover unexpected expenses during the transition period. Additionally, consider exploring resources such as career counseling or financial planning services to help you navigate this transition successfully.

2. Should I save money before making a career change?

Yes, it is advisable to have some savings before making a career change. Having a financial cushion can help you manage any potential income gaps or unexpected expenses that may arise during the transition. Aim to save at least three to six months’ worth of living expenses before embarking on a career change. This will provide you with a safety net and peace of mind as you pursue your new career path.

3. How can I budget for a career change?

When budgeting for a career change, start by examining your current income and expenses. Identify areas where you can cut back or save, such as reducing discretionary spending or renegotiating bills. Prioritize your financial goals and allocate funds accordingly. Consider the potential changes in your income and adjust your budget accordingly. Regularly review and revise your budget as needed to ensure you stay on track during your career transition.

4. What financial considerations should I keep in mind when changing careers?

When changing careers, it’s essential to consider several financial factors. Evaluate the potential salary and benefits of your new career path and compare them to your current situation. Assess the cost of any additional education or training that may be required for your desired career. Also, remember to factor in any changes in work hours, commuting expenses, or potential relocation costs. Take the time to research and understand the financial implications of your career change to make informed decisions.

5. How can I handle potential income gaps during a career change?

Potential income gaps are common during a career change, especially if you’re transitioning into a new industry or starting your own business. To handle these gaps, it’s crucial to have a financial plan in place. Build an emergency fund that can cover your expenses for several months. Consider part-time work or freelancing opportunities in your new field to generate income while you make the transition. Having a budget and financial cushion will help you navigate any income gaps more smoothly.

6. Is it wise to seek financial advice when considering a career change?

Yes, seeking financial advice can be beneficial when contemplating a career change. A financial advisor can help you assess your current financial situation, develop a comprehensive plan, and provide guidance on how to manage your finances during the transition. They can help you evaluate the potential impact on your long-term financial goals and provide strategies to minimize any risks or challenges that may arise. Consulting with a professional can provide valuable insights and peace of mind.

7. How can I minimize the financial risks of a career change?

To minimize the financial risks of a career change, it’s essential to plan and prepare in advance. Start by thoroughly researching your new career field to understand the potential salary range and job prospects. Network with professionals already working in the industry to gain insights and advice. Consider acquiring additional skills or education that will make you more marketable in your chosen field. Building a financial safety net, reducing debts, and having a solid budget will also help mitigate financial risks during this transition.

8. Are there any financial assistance programs available for individuals undergoing a career change?

Yes, there are financial assistance programs available for individuals undergoing a career change. Some government and nonprofit organizations offer grants or scholarships for retraining or educational programs. Additionally, you may be eligible for unemployment benefits or other financial aid while you pursue your new career path. Research and explore these opportunities to determine if you qualify for any financial assistance programs that can support you during your career transition.

Final Thoughts

In conclusion, navigating a career change requires careful financial planning and strategizing. To ensure a smooth transition, it is essential to assess your current financial situation, create a budget, and consider any necessary adjustments. Building an emergency fund and researching potential income opportunities can provide a safety net during the transition period. Additionally, exploring education and training options, as well as leveraging transferable skills, can facilitate a successful career pivot. By focusing on financial stability and making informed decisions, individuals can effectively navigate the challenges of a career change and set themselves up for long-term success. So, when it comes to financially navigating a career change, preparation and proactive decision-making are key.