Planning a big move can be an exciting yet daunting task. One of the crucial aspects to consider is how to financially plan for a big move. Whether you’re relocating for a job, starting a new chapter in life, or simply seeking a change of scenery, it’s essential to have a strategic plan in place. In this article, we’ll explore practical tips and strategies to help you navigate the financial aspects of a big move seamlessly. So, if you’re wondering how to financially plan for a big move, you’ve come to the right place! Let’s dive in and discover how you can tackle this challenge head-on.

How to Financially Plan for a Big Move

Moving to a new place can be an exciting adventure, but it can also be a financially stressful experience if not properly planned. From hiring movers to purchasing new furniture, the costs of a big move can quickly add up. That’s why it’s crucial to have a solid financial plan in place before embarking on your relocation journey. In this guide, we’ll walk you through the essential steps to help you financially prepare for a big move.

1. Determine Your Budget

Before you start packing your bags, it’s important to establish a budget for your move. Take the time to assess your current financial situation, including your income, savings, and any outstanding debts. Having a clear understanding of your financial standing will help you set realistic expectations and make informed decisions throughout the moving process. Here’s how you can determine your budget:

- Create a spreadsheet or use budgeting tools to track your income, expenses, and savings. This will help you visualize your financial resources and identify areas where you can cut back.

- Consider the costs associated with your move, such as transportation, packing supplies, moving services, and potential temporary housing. Research and gather estimates for each expense to get a better idea of the overall cost.

- Review your financial goals and priorities. Assess how much you can allocate towards your move without compromising your future plans. It’s important to strike a balance between your immediate needs and long-term financial stability.

2. Save and Cut Expenses

Once you have a budget in place, it’s time to start saving and cutting unnecessary expenses to fund your move. Here are some practical tips to help you save money:

- Create a dedicated moving fund. Set up a separate savings account specifically for your moving expenses. This will help you stay organized and prevent dipping into funds meant for other purposes.

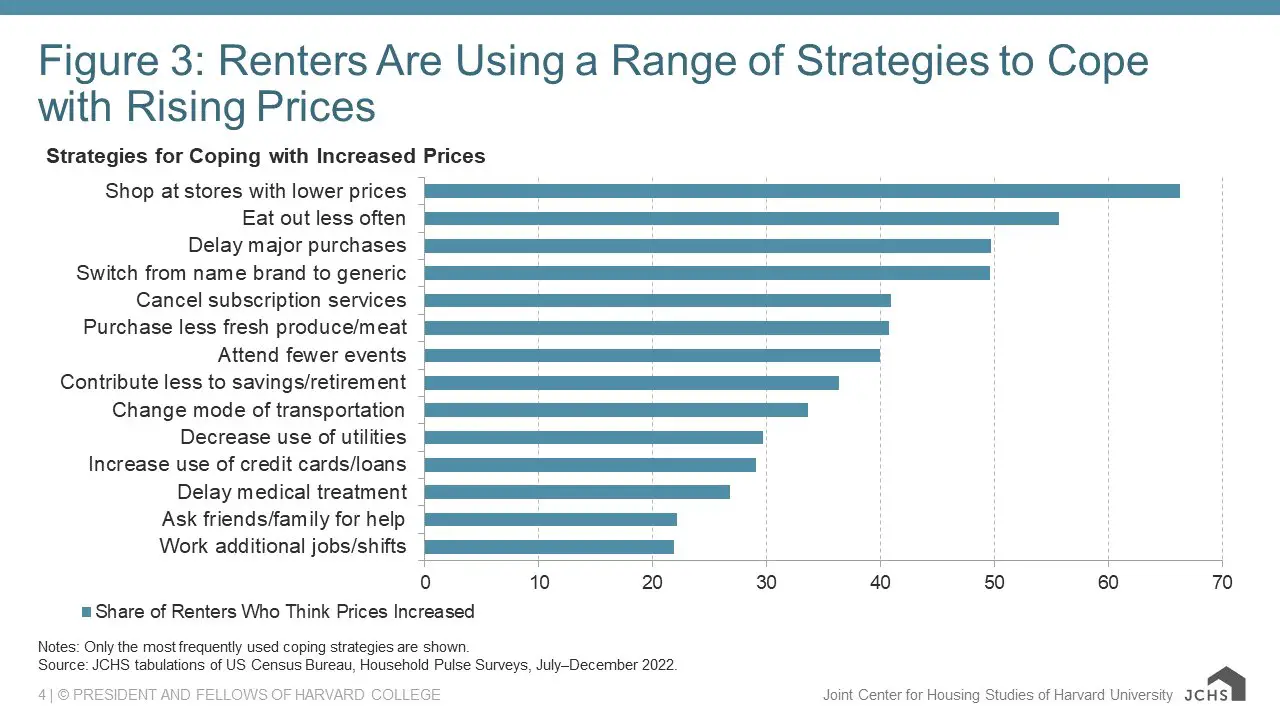

- Minimize discretionary spending. Analyze your monthly expenses and identify areas where you can cut back. Consider reducing dining out, entertainment, or subscription services temporarily to save extra cash for your move.

- Downsize and declutter. Moving is an excellent opportunity to declutter your belongings and save on transportation costs. Sell or donate items that you no longer need or use. Not only will this lighten your load, but it can also generate extra income.

- Explore cost-saving alternatives. Research cost-effective moving options, such as renting a truck and doing the moving yourself, or hiring a portable storage container that allows you to pack and load at your own pace.

3. Research Moving Costs

One of the critical aspects of financial planning for a big move is understanding the potential expenses involved. Conduct thorough research to estimate the costs associated with your specific move, including:

- Moving company fees: If you plan to hire professional movers, request quotes from different companies and compare their rates. Be sure to ask about additional charges for services like packing and unpacking.

- Transportation costs: If you’re moving long-distance, consider the expenses of renting a truck, fuel, tolls, and lodging. Additionally, factor in the cost of shipping your car if necessary.

- Packing supplies: Boxes, packing tape, bubble wrap, and other supplies can quickly add up. Look for economical options like sourcing free boxes from local stores or utilizing eco-friendly alternatives like reusable storage containers.

- Insurance coverage: Review your insurance policies to ensure your belongings are adequately protected during the move. If needed, consider purchasing additional coverage to mitigate any potential losses.

- Temporary storage: If there’s a gap between moving out of your current place and moving into your new one, you may need to store your belongings temporarily. Research local storage facilities and compare prices.

4. Plan Ahead for Additional Expenses

In addition to the typical moving costs, there are often unexpected expenses that can catch you off guard. By planning ahead and accounting for these potential additional costs, you’ll be better equipped to handle any financial surprises that may arise. Consider the following:

- Utility setup fees: Contact utility companies in your new location to inquire about any connection fees or deposits required to set up services like electricity, water, internet, and cable.

- Home repairs and upgrades: If you’re moving into a new home, factor in potential expenses for repairs, renovations, or upgrades. Plan a budget for these improvements to avoid any financial strain after the move.

- Address change and mailing costs: Notify relevant parties about your address change, such as the post office, banks, credit card companies, and subscriptions. Account for any fees associated with changing your address and forwarding mail.

- Licensing and registration fees: If you’re moving to a different state or country, research the costs of obtaining new driver’s licenses, vehicle registration, and other necessary permits.

- Emergency fund: Establish an emergency fund to address any unforeseen circumstances or emergencies during your move. Having some extra money set aside will provide peace of mind and help you navigate unexpected expenses.

5. Explore Financial Assistance Options

If your move is due to a job relocation or for educational purposes, it’s worth exploring potential financial assistance options that may be available to you. Research and take advantage of programs or benefits that can alleviate some of the financial burdens associated with your move. Consider the following possibilities:

- Employer relocation assistance: Speak with your employer to determine if they offer any relocation packages or reimbursement for moving expenses. Some companies may provide financial support, covering costs like transportation, temporary housing, or even packing services.

- Tax deductions and credits: Familiarize yourself with the tax deductions or credits related to moving expenses. If your move meets certain criteria, you may be eligible for deducting some of the costs on your tax return.

- Scholarships or grants: If you’re moving for educational purposes, research scholarship or grant opportunities that can help offset some of the expenses associated with the move. Universities or organizations often provide financial aid to students in need.

- Government assistance programs: Check if there are any government programs designed to support individuals or families going through significant life changes, such as moving. These programs may offer financial assistance, housing support, or employment services, depending on your circumstances.

6. Keep Track of Your Expenses

Throughout the moving process, it’s crucial to keep track of all your expenses. By meticulously documenting your spending, you’ll have a clear understanding of where your money is going and be able to stay within your budget. Consider the following tips:

- Save all receipts and invoices related to your move, including moving company fees, packing supplies, transportation expenses, and any other relevant costs.

- Organize your financial records in a dedicated folder or use digital tools like expense tracking apps or spreadsheets to categorize and track your expenses.

- Regularly review your spending against your budget to ensure you’re on track. If necessary, make adjustments or find ways to cut costs to avoid overspending.

By following these essential steps to financially plan for a big move, you’ll be well-prepared to tackle the financial challenges that come with relocating. Remember to establish a budget, save and cut expenses, research moving costs, plan ahead for additional expenses, explore financial assistance options, and keep track of your expenses. With careful financial planning, you can make your big move a smooth and financially manageable process.

How to Financially Prepare Your Move Abroad in 5 Steps

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I financially plan for a big move?

There are several steps you can take to financially plan for a big move:

- Create a budget to estimate moving costs and set aside money for it.

- Research and compare moving companies to find the most cost-effective option.

- Sell or donate any unnecessary belongings to lighten your load and earn extra cash.

- Notify your utility companies in advance to avoid unnecessary charges.

- Consider purchasing moving insurance to protect your belongings during the move.

2. What are some ways to save money during a big move?

To save money during a big move, you can:

- Opt for a do-it-yourself move instead of hiring professional movers.

- Ask family and friends for help with packing and transporting your belongings.

- Compare prices of packing supplies and purchase them in advance to avoid last-minute expenses.

- Timing your move during off-peak seasons may result in lower costs.

- Consider using alternative methods of transportation, such as shipping some items instead of moving them yourself.

3. Should I set up an emergency fund before a big move?

Yes, setting up an emergency fund before a big move is highly recommended. It provides a financial safety net in case unexpected expenses arise during or after the move. Aim to save at least three to six months’ worth of living expenses in your emergency fund.

4. Are there any hidden costs I should consider when financially planning for a big move?

Yes, there can be hidden costs when financially planning for a big move. Some common ones include:

- Storage fees if you need to temporarily store your belongings.

- Additional transportation costs if you have pets or vehicles to move.

- Cleaning costs for both your old and new residence.

- Extra charges for moving heavy or bulky items.

- Costs associated with changing your address and updating important documents.

5. How early should I start financially planning for a big move?

It is advisable to start financially planning for a big move as early as possible. Ideally, start planning at least three to six months before your intended move date. This will give you ample time to save money, research costs, and make necessary arrangements.

6. Is it worth hiring a professional moving company for a big move?

Whether to hire a professional moving company for a big move depends on your specific needs and circumstances. Hiring professionals can save you time and effort, especially if you have large or fragile items to move. However, it may come at a higher cost compared to a do-it-yourself move.

7. What are the benefits of downsizing before a big move?

Downsizing before a big move can bring several benefits:

- Reduced moving costs, as you will have fewer belongings to transport.

- Less clutter and a fresh start in your new home.

- Potential to earn extra money by selling unnecessary items.

- Easier organization and unpacking at your new location.

- Opportunity to reevaluate your possessions and simplify your life.

8. How can I lower my housing expenses during a big move?

To lower your housing expenses during a big move, consider the following:

- Research and compare rental or housing options in your new location to find the most affordable one.

- Consider downsizing your living space, which can lead to lower rent or mortgage payments.

- Explore the possibility of sharing housing with roommates or family members to split costs.

- Negotiate your rent or mortgage terms to potentially secure a better deal.

- Look for housing incentives or subsidies that may be available in your new area.

Final Thoughts

Financially planning for a big move can seem overwhelming, but with careful consideration and organization, it can be manageable. To begin, create a budget that outlines your income, expenses, and savings goals to determine how much you can allocate towards your move. Next, research moving costs such as transportation, shipping, and any necessary travel expenses. Remember to factor in additional expenses like packing supplies and insurance. Additionally, explore ways to save money during the move, such as decluttering and selling unused items. Lastly, consider potential sources of financial assistance, such as employer relocation packages or government grants. By following these steps and staying diligent, you can successfully financially plan for your big move.