Thinking about changing careers but worried about the financial impact? Don’t fret! In this article, we will show you exactly how to financially plan for a career change, ensuring a smooth transition without breaking the bank. Whether you’re considering a shift in industry or pursuing your passion, having a solid financial plan is crucial. We’ll guide you through practical steps, from assessing your current financial situation to creating a budget and exploring potential income sources. So, if you’re ready to take charge of your career and your finances, keep reading!

How to Financially Plan for a Career Change

Embarking on a new career can be an exciting and fulfilling journey. However, it’s essential to plan for the financial aspects of a career change to ensure a smooth transition. In this article, we will guide you through the process of financially planning for a career change, covering important topics such as assessing your current financial situation, creating a budget, managing debt, saving for the future, and exploring potential income sources during the transition period.

Assessing Your Current Financial Situation

Before making any career changes, it’s crucial to evaluate your current financial standing. Understanding your financial situation will help you determine your readiness for a career change and enable you to make informed decisions. Here are some steps to assess your current financial situation:

1. Calculate your income and expenses: Analyze your current income sources, including salary, investments, and other potential sources of revenue. Take note of your monthly expenses, including bills, debt payments, and discretionary spending.

2. Determine your net worth: Calculate your assets (such as savings, investments, and property) and subtract your liabilities (debts and financial obligations). Understanding your net worth will give you a clearer picture of your overall financial health.

3. Review your savings and emergency fund: Evaluate your savings account balance and emergency fund. Ideally, you should have three to six months’ worth of expenses set aside in case of unforeseen circumstances.

4. Consider your debt obligations: Take stock of your current debt, such as credit cards, loans, or mortgages. Make a note of interest rates, monthly payments, and any outstanding balances.

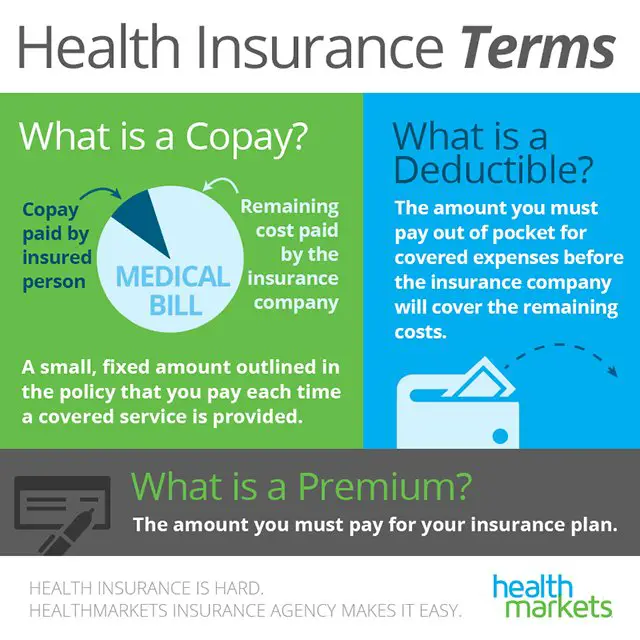

5. Evaluate your insurance coverage: Review your health, life, and disability insurance policies to ensure they meet your needs. Adequate insurance coverage is especially important during a career change when unexpected events can occur.

Creating a Budget

Once you have a clear understanding of your financial situation, it’s time to create a budget that aligns with your career change goals. A budget will help you manage your expenses, allocate funds for necessary investments, and ensure you stay on track financially. Follow these steps to create an effective budget:

1. Track your expenses: Keep track of all your expenses for at least a month. This will help you identify areas where you can cut back and give you a realistic view of your spending habits.

2. Differentiate between needs and wants: Categorize your expenses into essential needs and discretionary wants. Focus on prioritizing needs while cutting back on wants, especially during the career transition period.

3. Set financial goals: Establish short-term and long-term financial goals related to your career change. These goals can include saving a specific amount of money, paying off debt, or investing in further education.

4. Create a budget plan: Based on your income and expenses, create a budget plan that includes all your necessary expenditures, such as housing, utilities, transportation, and groceries. Allocate a portion of your income towards savings and debt repayment.

5. Evaluate and adjust your budget: Regularly review your budget to ensure it remains aligned with your financial goals. Adjust your budget as needed, considering any changes in income, expenses, or financial priorities.

Managing Debt

Debt management is an integral part of financial planning, especially during a career change. Reducing and managing your debt will provide you with more financial flexibility and peace of mind. Consider the following strategies to effectively manage your debt:

1. Prioritize high-interest debt: Identify the debts with the highest interest rates, such as credit cards or personal loans. Allocate more funds towards paying off these debts as they tend to accumulate interest quickly.

2. Consolidate debt if applicable: Explore the possibility of consolidating multiple debts into a single loan with a lower interest rate. Debt consolidation can simplify your repayment process and potentially reduce your monthly payments.

3. Negotiate with lenders: If you’re struggling to meet your debt obligations, reach out to your lenders and discuss possible options. They may be willing to negotiate a lower interest rate, extend the repayment period, or offer other solutions.

4. Avoid accumulating new debt: During a career change, it’s essential to minimize the accumulation of new debt. Practice discipline in your spending habits and avoid unnecessary purchases.

Saving for the Future

Financial planning for a career change should also take into account your long-term financial goals. Saving for the future will help you maintain financial security and achieve your aspirations. Here are some strategies to consider:

1. Emergency fund: Set aside a dedicated emergency fund to cover unexpected expenses, such as medical bills or car repairs. Aim to save at least three to six months’ worth of living expenses.

2. Retirement savings: Continue contributing to your retirement savings, even during a career change. Explore retirement account options, such as employer-sponsored plans (e.g., 401(k)) or individual retirement accounts (IRAs).

3. Automate savings: Set up automatic transfers from your checking account to a dedicated savings account. This approach ensures consistent savings without the need for manual transfers.

4. Explore investment opportunities: Consider investing in stocks, bonds, or other investment vehicles based on your risk tolerance and financial goals. Consult with a financial advisor to understand your options and make informed investment decisions.

Exploring Potential Income Sources during Transition

While transitioning to a new career, it’s crucial to explore potential income sources to support yourself financially. Here are some avenues to consider:

1. Part-time or freelance work: Seek part-time or freelance opportunities that align with your skills and interests. These roles can provide a steady income stream while allowing you to gain experience in your new field.

2. Gig economy platforms: Explore gig economy platforms such as Uber, Airbnb, or TaskRabbit to leverage your skills and generate additional income.

3. Monetize your hobbies or passions: Identify ways to monetize your hobbies or passions through teaching, creating online courses, selling handmade products, or offering consulting services.

4. Networking and mentorship: Build a strong professional network and seek mentorship opportunities within your desired industry. These connections can lead to job opportunities or introductions to potential clients in your new career.

In conclusion, financially planning for a career change requires a thorough assessment of your current financial situation, creating a budget, managing debt, saving for the future, and exploring potential income sources during the transition. By following these steps and implementing effective strategies, you can ensure a smooth and financially secure career change. Remember, seeking guidance from a financial advisor can provide valuable insights tailored to your specific situation. Best of luck on your career change journey!

How Do We Financially Plan For A Career Shift?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I financially plan for a career change?

Assess your current financial situation, create a budget, save an emergency fund, research potential income sources, and consider the costs of additional training or education.

2. What steps can I take to minimize financial risks during a career change?

You can reduce financial risks by saving money before making the change, exploring part-time or freelance work options, researching the demand and earning potential of your new career, and seeking financial advice from professionals.

3. Is it a good idea to take out a loan to finance a career change?

While taking out a loan can be an option, it is essential to carefully consider the interest rates, repayment terms, and potential impact on your financial stability. Explore other financing options and weigh the pros and cons before making a decision.

4. How can I make the most of my current savings while transitioning careers?

Focus on budgeting and cutting unnecessary expenses, explore investment opportunities that align with your risk tolerance and timeframe, and consult with a financial advisor to optimize your savings strategy during the career transition.

5. Are there any government programs or grants available to support career changes financially?

Research potential government programs, grants, or subsidies that may provide financial support specifically for career changers. Check with local authorities, employment agencies, or professional associations for relevant opportunities.

6. Should I consider building a side hustle while planning for a career change?

Building a side hustle can provide additional income and financial stability during a career change. Evaluate your skills and interests to identify potential side business opportunities that align with your long-term goals.

7. How can I manage my expenses effectively during a career change?

Track your expenses meticulously, prioritize necessary expenses, cut back on discretionary spending, negotiate bills and subscriptions, and consider alternative cost-saving measures such as downsizing or sharing resources.

8. How important is it to have a backup plan for financial stability during a career change?

Having a backup plan is crucial to mitigate financial risks. This could involve maintaining a part-time job, building an emergency fund, acquiring in-demand skills, or establishing a network of contacts within your desired industry to increase opportunities for financial stability.

Final Thoughts

Financially planning for a career change requires careful consideration and strategic decision-making. Firstly, it is essential to assess your current financial situation by analyzing your income, expenses, and savings. This will help you determine how much financial support you may need during the transition period. Next, create a realistic budget that accounts for any necessary lifestyle adjustments and accounts for potential income fluctuations. Additionally, explore opportunities to enhance your skillset or pursue additional education to increase your chances of successful career transition. Finally, consider exploring alternative sources of income, such as freelance work or part-time jobs, to supplement your finances during this period. By following these steps, you can effectively and confidently navigate the financial aspects of a career change.