Moving to a new city for a job can be an exciting prospect, but it also comes with its fair share of challenges. One crucial aspect that often gets overlooked amidst the chaos of packing boxes and bidding farewell to familiar surroundings is the financial planning required for a successful job relocation. But worry not, because in this article, we will show you how to financially plan for a job relocation. From budgeting for moving expenses to managing housing costs and ensuring a smooth transition, we’ve got you covered. So, let’s dive in and explore the practical steps you can take to make your job relocation a financially sound endeavor.

How to Financially Plan for a Job Relocation

Moving to a new city for a job opportunity can be an exciting and transformative experience. However, it also comes with its fair share of challenges, one of which is figuring out how to financially plan for the relocation. By carefully considering your expenses, budgeting effectively, and exploring potential cost-saving strategies, you can confidently navigate the financial aspects of a job relocation. In this article, we will explore various steps and strategies to help you financially plan for a job relocation and ensure a smooth transition.

Evaluate Your Current Financial Situation

Before diving into the financial planning process, it is essential to assess your current financial situation. This evaluation will provide you with a clear understanding of your income, expenses, savings, and any outstanding debts or obligations you may have. Consider the following steps to get a comprehensive view:

- Create a budget: Start by tracking your monthly income and expenses. Categorize your expenses into essential (such as rent, utilities, groceries) and discretionary (entertainment, dining out, etc.). This will help identify areas where you can potentially reduce spending.

- Review your savings: Take a look at your emergency fund and other savings you have accumulated. This will help determine how much you can allocate towards your relocation expenses.

- Assess your debts: If you have any outstanding debts, such as credit card balances or loans, factor them into your financial planning. Consider creating a repayment strategy to manage your debts effectively.

Research the Cost of Living in the New City

Understanding the cost of living in your new city is crucial for creating an accurate budget and avoiding financial surprises. Keep in mind that living expenses can vary significantly from one location to another. Research the following aspects:

- Housing costs: Explore the rental and housing market in your new city. Compare prices and consider factors like the average cost of rent, property taxes, and homeowner’s insurance.

- Transportation expenses: Look into public transportation costs, fuel prices, and parking fees. If you plan on commuting, determine if you need to purchase a new vehicle or if your current mode of transportation is feasible.

- Utilities and amenities: Find out the average monthly costs of utilities like electricity, water, and internet services. Additionally, consider expenses like gym memberships, cable TV, and other amenities you regularly use.

- Grocery and daily expenses: Look into the typical prices of groceries and other daily essentials. Understanding the average cost of living will help you plan your monthly expenses more accurately.

Calculate and Allocate Your Relocation Budget

Once you have a clear idea of your financial situation and the cost of living in your new city, you can start creating a relocation budget. Consider the following expenses and allocate your funds accordingly:

- Moving company or transportation costs: Estimate the cost of hiring professional movers or renting a moving truck. If you plan on driving to your new city, calculate fuel expenses, lodging costs, and any tolls or parking fees along the way.

- Temporary accommodation: If you need temporary accommodation before finding a permanent residence, budget for hotel stays or short-term rentals.

- Security deposits and fees: Be prepared to pay security deposits and other associated fees when renting a new place. These expenses can include first and last month’s rent, pet deposits, or application fees.

- Packing supplies: Budget for packing materials such as boxes, tape, bubble wrap, and other supplies you may need for the move.

- Storage fees: If you need to store your belongings temporarily, research the cost of renting a storage unit.

- Travel expenses: Consider the cost of traveling to your new city for interviews or to explore potential neighborhoods.

Explore Cost-Saving Measures

Relocating for a job doesn’t have to break the bank. There are several cost-saving measures you can implement to minimize your expenses. Consider the following strategies:

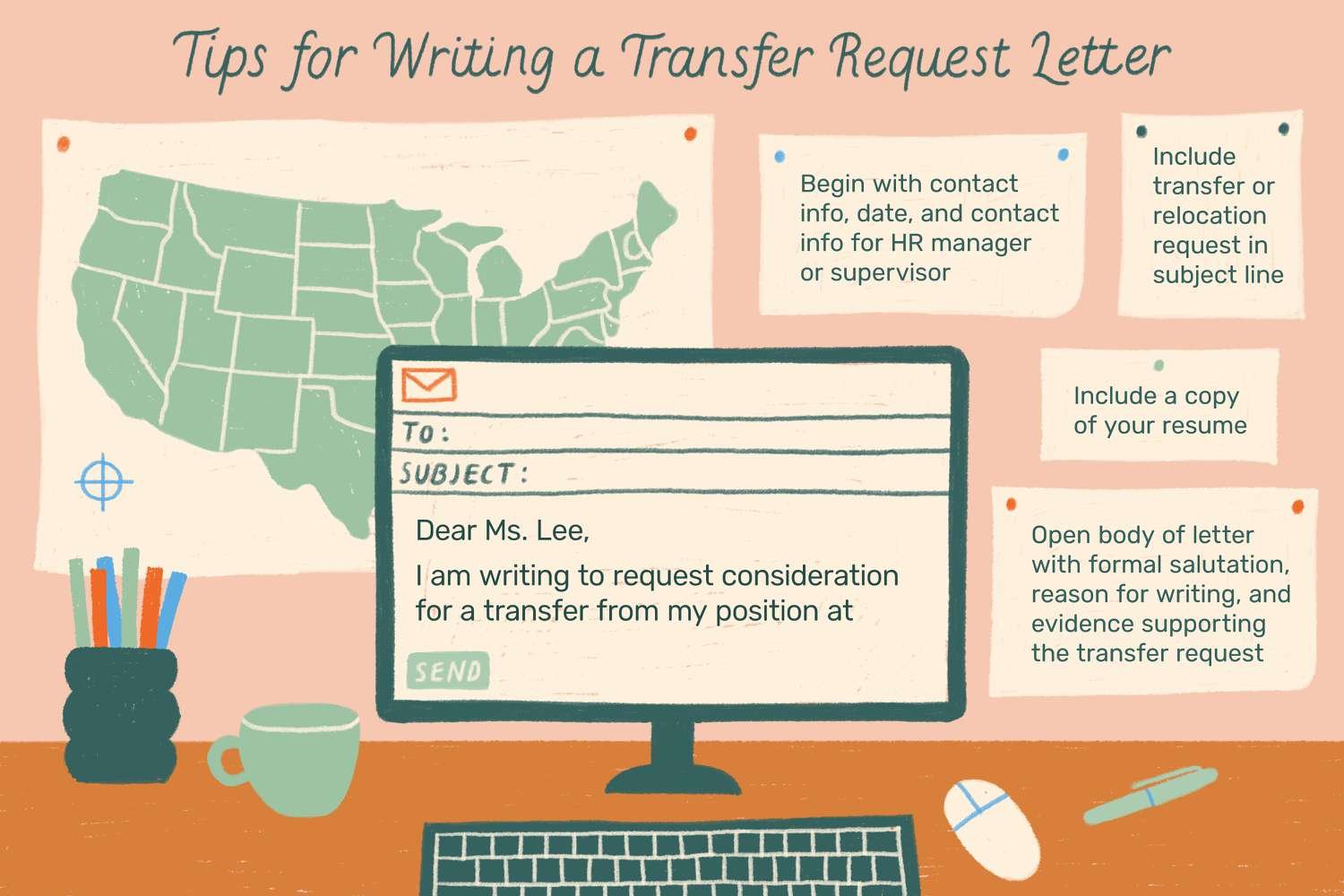

- Negotiate relocation assistance: If your new employer offers relocation benefits, try negotiating with them to cover some of your expenses.

- Reduce moving costs: Opt for a DIY move if feasible. You can save money by packing and moving your belongings yourself.

- Sell unwanted items: Declutter your belongings before the move and sell any items you no longer need. This can help generate some extra cash and minimize the number of things you need to move.

- Plan your move during off-peak times: Moving during peak seasons or weekends can be more expensive. Consider scheduling your move during weekdays or off-peak seasons to potentially secure better deals.

- Use cost comparison websites: When looking for housing, utilities, or other services, utilize online platforms that allow you to compare prices and find the most affordable options.

- Seek out discounts and deals: Research discounts or special offers that may be available for certain services, such as moving companies, transportation, or storage facilities.

Update Your Financial Accounts and Utilities

As part of your financial planning for a job relocation, it is essential to update your financial accounts and utilities. Take the following actions:

- Notify your bank and update your address: Inform your bank about your upcoming move and update your mailing address to ensure you receive important documents and minimize any disruptions in banking services.

- Transfer or close utility accounts: Contact your current utility providers and arrange for the transfer or closure of your accounts. Set up new accounts in your new city, ensuring a seamless transition of services.

- Update subscription services and memberships: If you have any subscriptions or memberships tied to your current location, update the address or consider canceling them if they are no longer needed. This can help avoid unnecessary charges.

Plan for the Unexpected

While thorough financial planning can minimize surprises, it’s crucial to plan for unexpected expenses. Set aside an emergency fund to handle any unforeseen costs that may arise during or after your relocation. Aim to have three to six months’ worth of living expenses saved up to provide a safety net during the transition.

Continuously Review and Adjust Your Budget

After you have successfully relocated and settled into your new job, continue to review and adjust your budget as needed. Living in a new city may come with different expenses and financial priorities. Regularly reassess your budget to ensure your financial plans align with your new circumstances.

In conclusion, financially planning for a job relocation requires careful evaluation, budgeting, and research. By understanding your current financial situation, researching the cost of living in your new city, allocating a relocation budget, and exploring cost-saving measures, you can navigate the financial aspects of your move with confidence. Remember to update your financial accounts and utilities, plan for the unexpected, and continuously review and adjust your budget to ensure a successful and financially sound relocation. With proper financial planning, you can focus on embracing your new job opportunity and enjoying the adventures that await you in your new city.

How to Prepare Financially for Job Relocation

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How do I financially plan for a job relocation?

Having a financial plan in place is crucial when preparing for a job relocation. Start by assessing your current financial situation and estimating the cost of the relocation, including moving expenses, temporary accommodation, and any potential loss of income during the transition.

2. What expenses should I consider when financially planning for a job relocation?

When planning for a job relocation, consider expenses such as transportation costs (moving company, travel expenses), housing costs (rental deposit, down payment on a new home), living expenses (utilities, groceries), and potential registration or licensing fees.

3. How can I estimate the cost of moving my belongings?

To estimate the cost of moving your belongings, you can obtain quotes from several moving companies. Consider factors like the distance of the move, the weight of your belongings, and any additional services you may require, such as packing and unpacking.

4. Should I save money specifically for job relocation?

Yes, it is advisable to save money specifically for job relocation. Having a separate fund can help you cover unexpected expenses and ensure a smooth transition. Aim to save at least three to six months’ worth of living expenses to provide a financial cushion during the relocation process.

5. Are there any financial assistance programs available for job relocations?

Some companies offer relocation assistance as part of their employment package. Check with your new employer to determine if they provide any financial support or reimbursement for relocation-related expenses. Additionally, certain government programs or grants might be available to assist with job relocations in specific industries or regions.

6. Should I consider selling or renting out my current property?

Deciding whether to sell or rent out your current property depends on various factors, such as the local real estate market, your long-term plans, and financial considerations. Evaluate the potential rental income, the cost of property management (if applicable), and the potential appreciation value before making a decision.

7. How can I minimize financial risks during a job relocation?

To minimize financial risks during a job relocation, you can consider negotiating a relocation package with your new employer that covers some of the expenses. Additionally, create a detailed budget, explore cost-saving strategies, and have an emergency fund in place to handle any unexpected financial challenges.

8. What steps can I take to manage my finances effectively after job relocation?

After a job relocation, it’s important to update your financial information and make necessary adjustments. This includes updating your address with banks and credit card companies, reviewing your insurance coverage, and revising your budget to account for any changes in living expenses. Consider working with a financial advisor to ensure a smooth transition and long-term financial stability.

Final Thoughts

Financial planning is essential when it comes to job relocation. Firstly, assess your current financial situation, including savings, debts, and monthly expenses. Set a realistic budget for the relocation process, factoring in costs such as moving expenses, housing deposits, and potential travel expenses. Research the cost of living in your new location to determine if there will be any significant changes in expenses. Consider the impact on your income, such as potential salary adjustments, taxes, and benefits. It is crucial to save for unexpected expenses and have an emergency fund in place. Lastly, consider consulting a financial advisor to ensure you make informed decisions and take advantage of any available financial assistance programs. Financially planning for a job relocation is necessary to ensure a smooth transition and minimize any financial stress that may arise.