Are you expecting a second child and wondering how to financially plan for their arrival? Don’t worry, we’ve got you covered. Welcoming a new addition to your family is an exciting time, but it’s also important to ensure you are prepared financially. In this article, we’ll guide you through practical steps and smart strategies on how to financially plan for a second child. From setting a budget to maximizing resources, we’ll help you navigate this important stage of your growing family’s life. So, let’s dive in and explore the best ways to prepare financially for the wonderful journey of expanding your family.

How to Financially Plan for a Second Child

Introduction

Congratulations! You’re expanding your family and preparing to bring a second child into your life. Along with the joy and excitement that comes with this news, it’s essential to start considering the financial aspects of raising another child. The financial responsibilities that come with having a second child can be significant, but with careful planning and preparation, you can navigate this new chapter with confidence. In this article, we will discuss various strategies and tips to help you financially plan for a second child, ensuring a secure and stable future for your growing family.

Evaluating Your Current Financial Situation

Before diving into the specifics of financial planning for a second child, it’s crucial to assess your current financial situation. Understanding your income, expenses, and existing financial obligations will provide you with a realistic starting point for planning ahead. Here are some steps to take when evaluating your finances:

1. Analyze Your Income and Savings: Calculate your total household income, including both regular salaries and additional sources, if any. Consider your current savings and investments as well.

2. Assess Your Expenses: Review your monthly expenses, including rent or mortgage payments, utilities, groceries, transportation, insurance, and any outstanding debts. This evaluation will help you identify areas where you can potentially cut back or save.

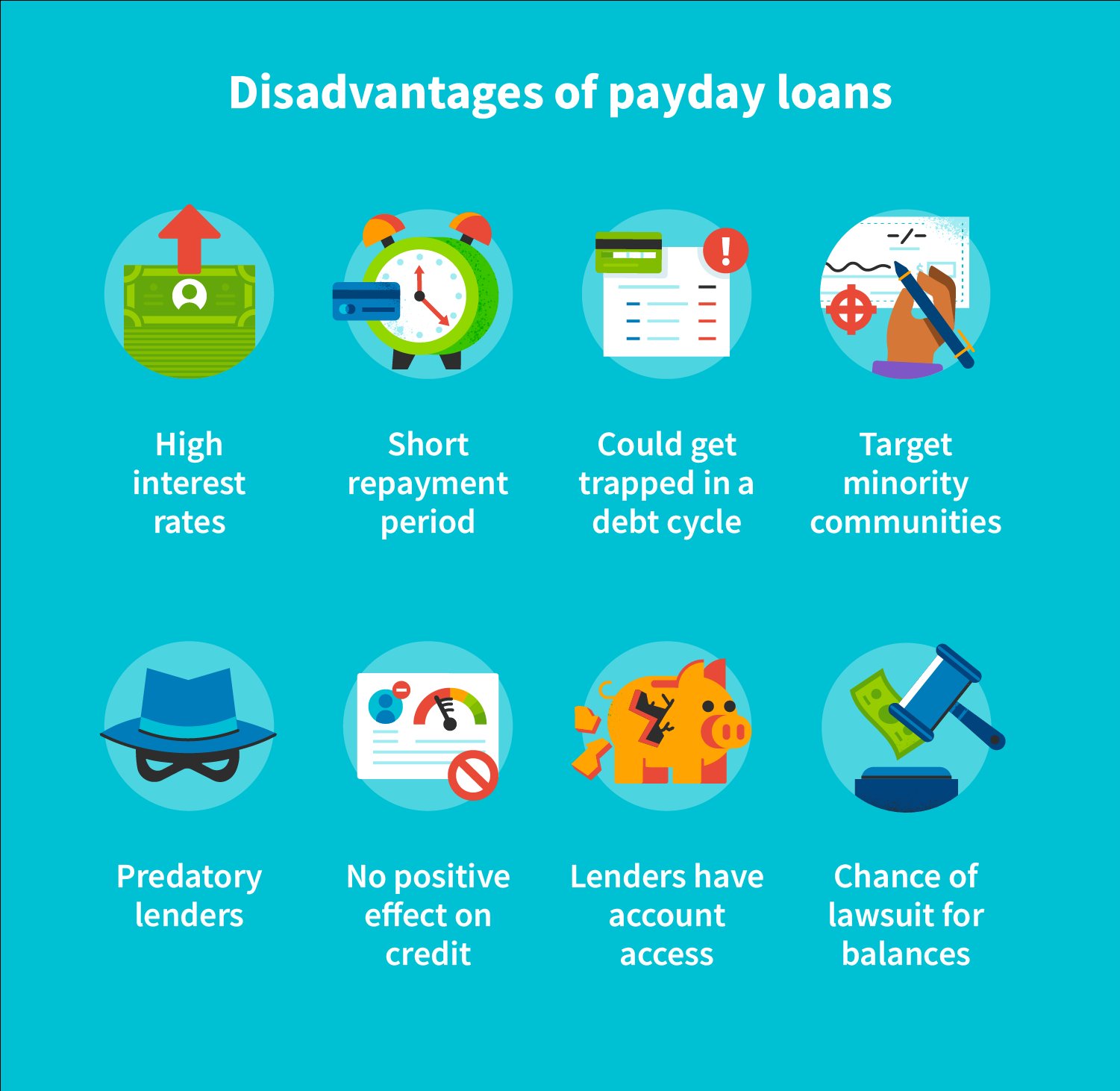

3. Review Your Debts: Take stock of any outstanding debts such as credit card balances, student loans, or car payments. Understanding the amount you owe, the interest rates, and the monthly installments will help you plan for the additional financial responsibilities that come with a second child.

4. Consider Healthcare Costs: If you already have a child, you might be familiar with the healthcare expenses associated with pregnancy, delivery, and raising a child. Keep in mind that these costs will increase with the arrival of your second child. Review your health insurance coverage and analyze any out-of-pocket expenses you may incur.

5. Anticipate Additional Childcare Expenses: If both parents are currently working, it’s essential to consider childcare expenses for your second child. Research the cost of daycare centers, nannies, or babysitters in your area to estimate the impact on your finances.

Creating a Budget

Once you have a clear understanding of your current financial situation, it’s time to create a budget that accommodates the additional expenses associated with a second child. A budget will help you allocate your income effectively and ensure you’re adequately prepared for the financial responsibilities that lie ahead. Follow these steps to create a practical budget:

1. List Your Income: Start by listing all sources of income, including salaries, dividends, rental income, or any other regular payments you receive.

2. Track Your Expenses: Take note of your monthly expenses, categorizing them into essential and discretionary expenses. Essential expenses include bills, groceries, transportation, and debt payments, while discretionary expenses encompass entertainment, dining out, and vacations.

3. Factor in Additional Child-Related Expenses: Consider the additional costs associated with a second child, such as diapers, formula, clothing, educational expenses, and healthcare. Research the average expenses for these items to get a better idea of what to expect.

4. Identify Areas to Cut Back: Look for areas where you can reduce expenses to make room for the new financial commitments. This might involve cutting back on non-essential spending or renegotiating certain bills to get better deals.

5. Allocate Savings: Plan to allocate a portion of your income towards savings. Establish an emergency fund to provide a safety net for unexpected expenses that may arise.

6. Regularly Monitor and Adjust: Your budget should be a flexible tool that adapts to changing circumstances. Regularly review your budget, track your expenses, and make adjustments when necessary.

Adjusting your Insurance Coverage

When planning for a second child, it’s crucial to review and adjust your insurance coverage to suit your growing family’s needs. Here are some key areas to focus on:

1. Health Insurance: Review your existing health insurance plan and ensure it provides adequate coverage for maternity care, pediatric services, vaccinations, and any potential complications that may arise during pregnancy or childbirth. Consider any adjustments you may need to make regarding premiums and deductibles.

2. Life Insurance: Evaluate your life insurance coverage and consider increasing it to account for the additional financial responsibilities associated with a second child. Life insurance ensures your family’s financial security in the event of an unexpected tragedy.

3. Disability Insurance: Look into disability insurance, which provides income replacement if you’re unable to work due to an illness or accident. This type of insurance becomes even more crucial when you have a growing family depending on your income.

Planning for Education Expenses

Education expenses are a significant consideration when financially planning for a second child. With rising tuition costs, it’s wise to start saving early to ensure your children have the opportunity to pursue higher education. Here are some strategies to help you plan for education expenses:

1. Start a 529 College Savings Plan: Investigate and consider opening a 529 college savings account for your children. These plans offer tax advantages and allow you to invest money specifically for education expenses.

2. Research Scholarship Opportunities: Stay informed about potential scholarship opportunities, grants, or financial aid programs available for your children when they reach college age. Understanding the options early on will help you plan financially.

3. Encourage Saving: Teach your children about the importance of saving money from an early age. Help them open their own savings accounts, and encourage them to contribute a portion of any gifts or income they receive towards their future education.

Preparing for Maternity/Paternity Leave

Planning for parental leave is an essential aspect of preparing for the arrival of a second child. Maternity and paternity leave provide valuable time for parents to bond with their newborn and adjust to the new family dynamics. However, it’s important to account for the potential loss of income during this period. Consider the following steps to financially prepare for maternity or paternity leave:

1. Understand Your Employer’s Policies: Review your employer’s policies regarding maternity and paternity leave. Understand the duration and whether it is paid or unpaid. This will help you estimate the income you may be missing and plan accordingly.

2. Save in Advance: By budgeting and saving in advance, you can help offset any loss of income during parental leave. Consider reducing expenses and allocating a portion of your income towards a dedicated savings account for this purpose.

3. Explore Government Programs: Research government programs or initiatives that provide financial support during parental leave. Familiarize yourself with the eligibility criteria and application process to take advantage of any available assistance.

Investing for the Future

Investing is a crucial element of financial planning for a second child, as it allows you to grow your wealth and create a secure future for your family. Here are some investment strategies to consider:

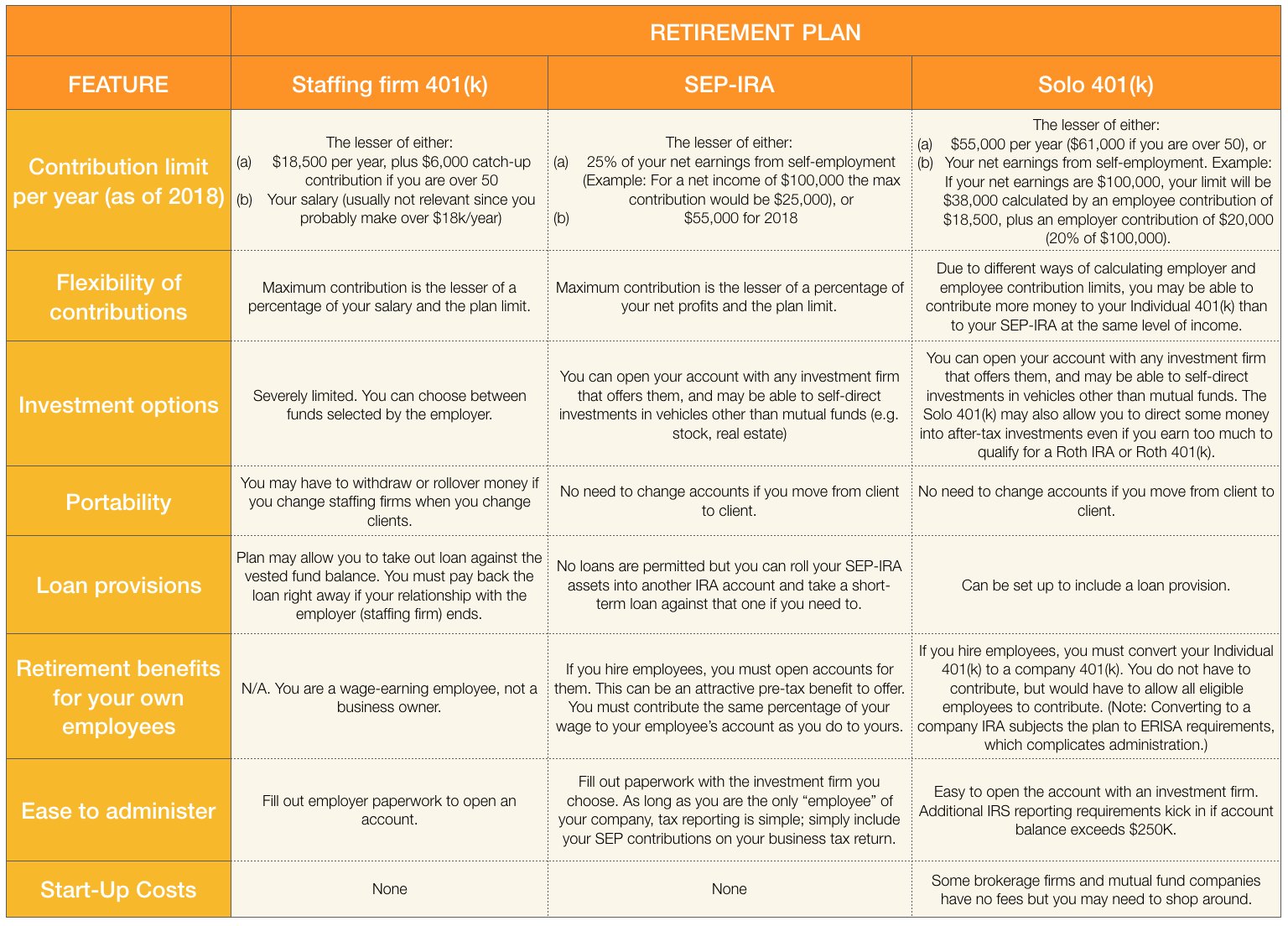

1. Start or Increase Retirement Contributions: Ensure you’re contributing to your retirement savings regularly. If possible, increase your contributions to account for the additional financial responsibilities that come with a second child.

2. Explore Education-Specific Investments: Look into investment options that are primarily designed to fund education expenses, such as Coverdell Education Savings Accounts or custodial accounts like UTMA or UGMA. These accounts offer tax advantages and can aid in funding your children’s education.

3. Diversify Your Investment Portfolio: Diversification is key to managing risk and maximizing returns. Consult with a financial advisor to create a well-rounded investment portfolio that aligns with your family’s long-term financial goals.

Planning for a second child involves careful consideration of your existing financial situation and future goals. By evaluating your finances, creating a budget, adjusting insurance coverage, planning for education expenses, preparing for parental leave, and investing wisely, you can ensure a stable and secure financial future for your growing family. Remember, every family’s financial journey is unique, so tailor these strategies to fit your specific circumstances. By making informed decisions and regularly reviewing your financial plan, you’ll be well-prepared to provide for your second child and nurture their growth and development.

Are We Financially Ready to Have a Baby?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I financially plan for a second child?

When preparing to welcome a second child into your family, it is important to review and adjust your financial plan accordingly. Start by assessing your current financial situation, including your income, expenses, and savings. Consider factors such as daycare costs, medical expenses, and education savings. Develop a budget that accounts for these additional expenses and identifies areas where you can save or cut back. It may also be beneficial to explore insurance policies like life and health insurance to ensure your family is adequately protected.

2. What are some ways to save money when planning for a second child?

There are several strategies you can employ to save money while financially planning for a second child. Consider buying second-hand baby items such as clothes, furniture, and toys, as they can be significantly cheaper than new items. Look for deals and discounts on baby essentials and consider using cloth diapers instead of disposable ones. Additionally, you can explore cost-saving measures such as breastfeeding, making your own baby food, and opting for a shared or part-time childcare arrangement.

3. Should I start an education fund for my second child?

Starting an education fund for your second child can be a wise financial decision. With the rising costs of education, having a dedicated fund can help reduce the burden when it comes time for college or university. Research different education savings options, such as a Registered Education Savings Plan (RESP) or a 529 plan, and choose the one that best aligns with your financial goals and risk tolerance.

4. How can I manage the increased medical expenses associated with a second child?

Preparing for increased medical expenses is an important aspect of financial planning for a second child. Review your health insurance coverage and determine if any adjustments need to be made to accommodate the needs of your growing family. It may be beneficial to explore family health insurance plans or supplemental coverage options. Additionally, consider setting aside some funds in an emergency medical fund to help cover unexpected medical costs.

5. Is it necessary to update my will or estate plan when planning for a second child?

Updating your will or estate plan is highly recommended when preparing for a second child. It is important to ensure that your assets are distributed as per your wishes and that appropriate guardianship arrangements are in place for your children. Consult with a legal professional who specializes in estate planning to ensure your documents reflect your current family situation.

6. What are some financial considerations for maternity/paternity leave with a second child?

Maternity or paternity leave with a second child can impact your finances. Familiarize yourself with your country’s leave policies and understand what benefits and entitlements you are eligible for during this time. Assess your financial situation and make a budget that accounts for any reduced income during the leave period. It may also be beneficial to explore any support programs or subsidies available for families during maternity or paternity leave.

7. Should I consider life insurance when planning for a second child?

Life insurance can provide financial security for your family, especially when planning for a second child. It can help cover expenses and provide for your family’s needs in the event of your untimely death. Assess your current life insurance coverage and consider increasing it to account for the additional financial responsibilities that come with expanding your family.

8. How can I involve my first child in the financial planning for a second child?

Involving your first child in the financial planning for a second child can help them understand the importance of budgeting and saving. Encourage open discussions about the upcoming changes and explain the financial considerations involved. You can also involve them in activities such as shopping for baby items or researching cost-saving strategies. Teaching your children about financial responsibility from an early age can set them up for a successful financial future.

Final Thoughts

Having a second child is an exciting and joyful experience, but it also comes with added financial responsibilities. To ensure a smooth transition, it is essential to plan and prepare your finances accordingly. Start by assessing your current financial situation and identify potential areas where you can make adjustments to accommodate the increased expenses of having another child. Consider creating a budget specifically for your second child, focusing on essentials such as childcare, education, healthcare, and daily living costs. Explore cost-saving measures like purchasing secondhand items or utilizing community resources, and don’t forget to review your insurance coverage to ensure it is adequate for your growing family. By proactively planning and budgeting, you can confidently navigate the financial implications of expanding your family.