Natural disasters can strike without warning, leaving devastation in their wake. When faced with such a catastrophic event, it is essential to have a solid financial plan in place. So, how can you financially plan for natural disasters? In this article, we will explore practical strategies and tips to help you prepare for the unexpected, ensuring that you and your loved ones are equipped to weather any storm. From emergency funds to insurance coverage, we will delve into the steps you can take to safeguard your financial well-being in times of crisis. Let’s dive in and discover how to financially plan for natural disasters.

How to Financially Plan for Natural Disasters

Natural disasters can strike at any time, causing significant damage and financial strain. From hurricanes and earthquakes to floods and wildfires, these events can have a devastating impact on individuals, families, and communities. While we cannot control when or where a natural disaster will occur, we can take steps to financially prepare ourselves and minimize the impact on our lives. In this comprehensive guide, we will explore various strategies and tips to help you plan for natural disasters financially.

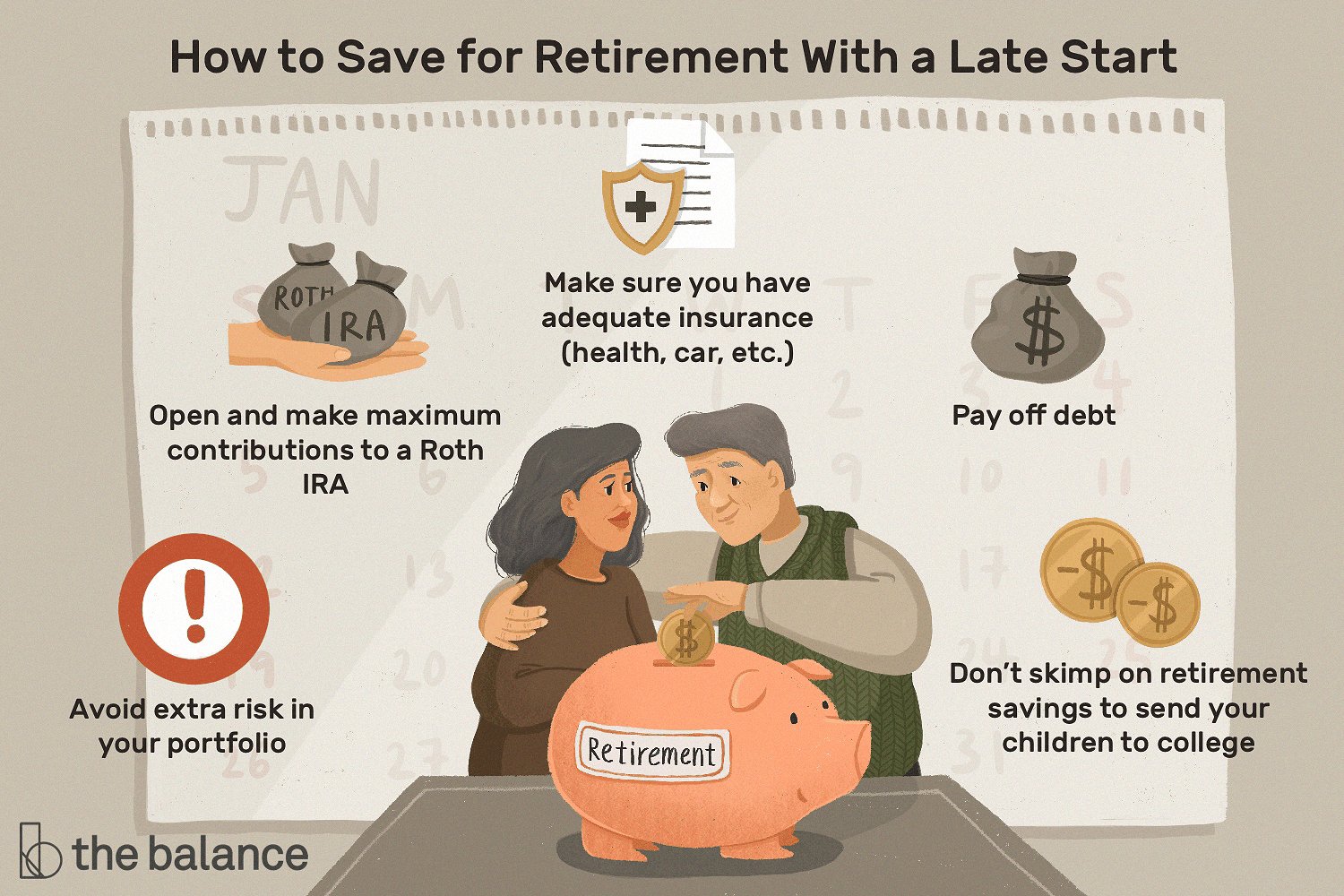

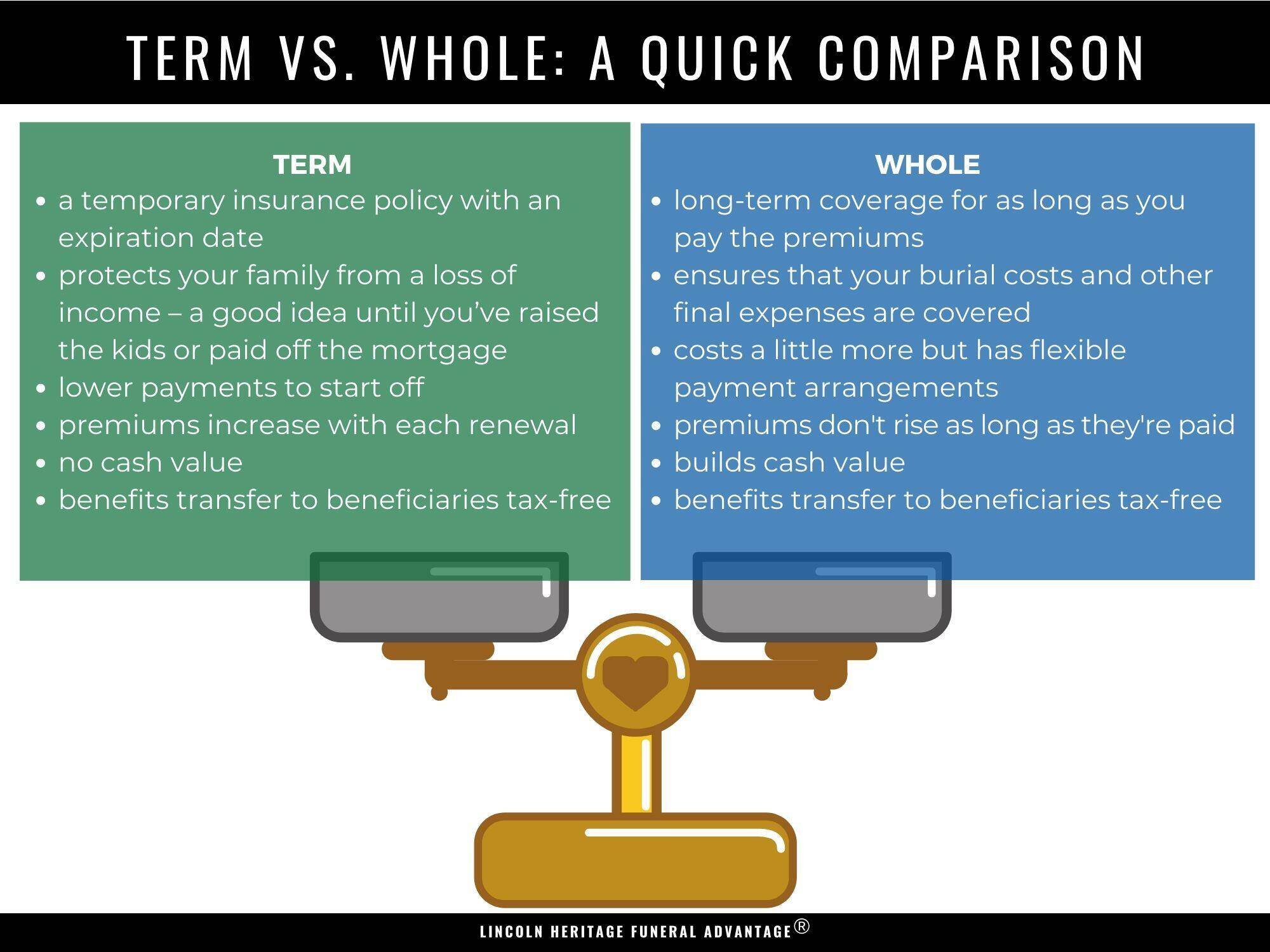

Evaluate Your Insurance Coverage

One of the most crucial steps in financially planning for natural disasters is to review and evaluate your insurance coverage. Having adequate insurance can make a significant difference in your ability to recover from a disaster. Here are a few types of insurance you should consider:

Homeowners or Renters Insurance

Ensure that your homeowners or renters insurance policy provides coverage for natural disasters such as hurricanes, earthquakes, floods, and wildfires. Review the policy to understand the extent of coverage and any exclusions that may apply. Consider adding additional coverage if needed.

Flood Insurance

Standard homeowners or renters insurance usually does not cover flood damage. If you live in an area prone to flooding, it is essential to obtain separate flood insurance through the National Flood Insurance Program (NFIP) or a private insurer.

Earthquake Insurance

If you reside in an earthquake-prone region, consider purchasing earthquake insurance to protect your property. Standard homeowners or renters insurance typically does not include earthquake coverage.

Auto Insurance

Review your auto insurance policy to ensure that it covers damage caused by natural disasters. Comprehensive coverage generally includes protection against events like hurricanes, floods, and wildfires.

Create an Emergency Fund

Building an emergency fund is a critical aspect of financial planning for natural disasters. An emergency fund provides a financial safety net during times of crisis and can help cover unexpected expenses. Here are some tips for creating and maintaining an emergency fund:

Set Financial Goals

Determine how much money you would like to save in your emergency fund and set specific financial goals. Aim to save at least three to six months’ worth of living expenses. However, if you live in an area prone to frequent or severe natural disasters, consider saving even more.

Automate Savings

Set up automatic transfers from your paycheck or checking account to your emergency fund. This ensures consistent contributions and makes saving easier. Treat your emergency fund as a non-negotiable expense.

Minimize Expenses

Look for ways to cut back on unnecessary expenses and redirect that money towards your emergency fund. Evaluate your budget and identify areas where you can reduce spending.

Save Windfalls

Whenever you receive unexpected money, such as a tax refund or bonus, consider putting a portion or all of it into your emergency fund. This can help you reach your savings goals faster.

Develop a Disaster Recovery Plan

In addition to insurance coverage and an emergency fund, having a well-thought-out disaster recovery plan is essential. Here’s what you should consider:

Know Your Risks

Research and understand the natural disaster risks specific to your geographical location. This knowledge will help you prepare and take appropriate measures to protect your finances.

Create an Inventory

Make a detailed inventory of your possessions, including their value and condition. Include photographs or videos of each item and store this information in a safe place or online. This will facilitate the insurance claims process in case of damage or loss.

Secure Important Documents

Store important documents such as insurance policies, identification papers, property deeds, and financial records in a secure, waterproof container or a safe deposit box. Consider making digital copies and storing them securely online as well.

Develop a Communication Plan

Establish a communication plan with your family members or close friends to ensure that everyone stays informed and connected during a natural disaster. Share emergency contact information and establish a meeting place or a point of contact outside the affected area.

Explore Government Assistance Programs

In the aftermath of a natural disaster, various government assistance programs may be available to help individuals and communities recover financially. Familiarize yourself with these programs to understand the eligibility criteria and application processes. Some common assistance programs include:

Federal Emergency Management Agency (FEMA)

FEMA provides financial assistance, temporary housing, and other support to individuals and communities affected by natural disasters. Visit their website and keep their contact information handy.

Small Business Administration (SBA)

If you own a small business affected by a natural disaster, the SBA offers low-interest disaster loans to help with recovery and rebuilding efforts.

State and Local Assistance Programs

Check with your state and local government for additional assistance programs that may be available. These programs can help with housing, food, and other essential needs.

Consider Risk Mitigation Measures

While we cannot completely eliminate the risk of natural disasters, taking proactive steps to mitigate risks can reduce potential financial losses. Consider the following measures:

Home and Property Maintenance

Regularly maintain your home and property. Keep gutters clean, trim trees and branches away from structures, and secure loose items that could become hazards during high winds. Taking preventive measures can help minimize damage.

Invest in Disaster-Resistant Upgrades

Explore options for retrofitting your home to make it more resistant to natural disasters. For example, strengthening your roof against hurricanes or installing seismic anchors for earthquakes. These upgrades can potentially reduce damage and insurance premiums.

Create a Go-Bag or Emergency Kit

Prepare a go-bag or emergency kit with essential supplies such as food, water, medications, flashlights, batteries, and important documents. This ensures that you are prepared for immediate evacuation if necessary.

Stay Informed

Stay updated on weather and disaster-related information by subscribing to emergency alerts and following local news channels. Being aware of potential threats allows you to take timely action and make informed decisions.

Review and Update Your Plan Regularly

Financial planning for natural disasters is an ongoing process. It is essential to review and update your plan regularly to adapt to changing circumstances. Reassess your insurance coverage, emergency fund goals, and disaster recovery plan at least once a year or whenever a significant life event occurs.

By taking proactive steps and implementing these strategies, you can better financially prepare for natural disasters. Remember, it is never too early to start planning, and being prepared can make a world of difference when disaster strikes. Stay safe, and may your financial well-being be safeguarded in the face of adversity.

3 Steps to Prepare Your Finances for Natural Disasters — consumerfinance.gov

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I financially plan for natural disasters?

Financial planning for natural disasters is crucial to ensure your stability in times of emergency. Here are some steps you can take:

What should I include in my emergency fund?

Your emergency fund should ideally cover three to six months’ worth of essential expenses, such as housing, food, utilities, and insurance premiums.

How can I budget effectively for natural disasters?

Creating a comprehensive budget is essential. Identify potential disaster-related expenses, such as evacuation costs, repairs, and temporary accommodation, and allocate funds accordingly.

What types of insurance should I consider for natural disasters?

Homeowners or renters insurance typically cover some natural disasters, but comprehensive coverage may require additional policies, such as flood or earthquake insurance. Consult with an insurance agent to determine your specific needs.

Should I invest in a generator for emergency power?

Having a generator can be beneficial during power outages caused by natural disasters. Consider the cost, maintenance, and fuel requirements before making a decision.

How can I protect important documents and valuables?

Store copies of essential documents, such as identification, insurance policies, and financial records, in a secure, waterproof container. You can also consider digital backups or safe deposit boxes.

What steps should I take to handle financial matters during a disaster?

Prioritize your safety and well-being during a disaster. If you need to evacuate, bring important financial documents and contact information. Inform your bank and credit card companies about your situation and explore available assistance programs.

What financial assistance options are available after a natural disaster?

After a natural disaster, government agencies, non-profit organizations, and insurance companies may offer financial assistance programs. Research and contact these resources to explore your eligibility for grants, loans, or other forms of aid.

How can I rebuild my finances after a natural disaster?

Rebuilding your finances after a natural disaster takes time and patience. Reassess your budget, prioritize expenses, and consider working with financial advisors or counselors if needed. Seek out resources and support available in your community.

Final Thoughts

Financial planning for natural disasters is crucial to ensure stability and resilience in the face of unpredictable events. Start by creating an emergency fund specifically designated for such situations. This fund should ideally cover three to six months’ worth of living expenses. Additionally, review and update your insurance policies, ensuring they provide adequate coverage for various types of natural disasters. Conducting a thorough assessment of your assets and liabilities will also help in identifying potential financial vulnerabilities. By incorporating these steps into your financial plan, you can be better prepared to handle unforeseen circumstances and protect your financial well-being. Remember: financial planning for natural disasters is not a luxury but a necessity for every individual and family.