Dreaming of studying abroad? Wondering how to financially plan for study abroad? Look no further! We’ve got you covered with practical tips and strategies that will help you turn your study abroad dreams into a reality. Planning for study abroad can be both exciting and overwhelming, but with the right financial plan in place, you can embark on this incredible journey without any worries. In this article, we will break down the steps, offer expert advice, and guide you towards a successful and financially sound study abroad experience. So, let’s dive in and explore how to financially plan for study abroad!

How to Financially Plan for Study Abroad

Studying abroad can be an exciting and life-changing experience, but it often comes with a hefty price tag. From tuition fees to accommodation, travel expenses, and daily living costs, the financial aspect of studying abroad can seem overwhelming. However, with proper planning and budgeting, you can make your study abroad dreams a reality without breaking the bank. In this article, we will guide you through the process of financially planning for your study abroad journey, ensuring that you can enjoy your time abroad without constantly worrying about money.

Research and Compare Costs

Before diving into the financial planning process, it’s crucial to conduct thorough research and compare the costs of studying abroad in different countries and institutions. Tuition fees, accommodation, and living expenses can vary significantly depending on the location. Take the time to explore different educational institutions, cities, and countries that align with your academic goals and budget. Consider factors such as exchange rates, cost of living, and any available scholarships or financial aid opportunities. This research will give you a clearer picture of the financial commitment required for your study abroad adventure.

Create a Realistic Budget

Once you have gathered information about the costs involved, it’s time to create a realistic budget. Start by listing all the expenses you anticipate during your study abroad period. Categorize them into fixed costs (tuition fees, housing, etc.) and variable costs (food, transportation, entertainment, etc.). Research the average prices of these expenses in your chosen destination to ensure accuracy.

Here are some key elements to consider when creating your budget:

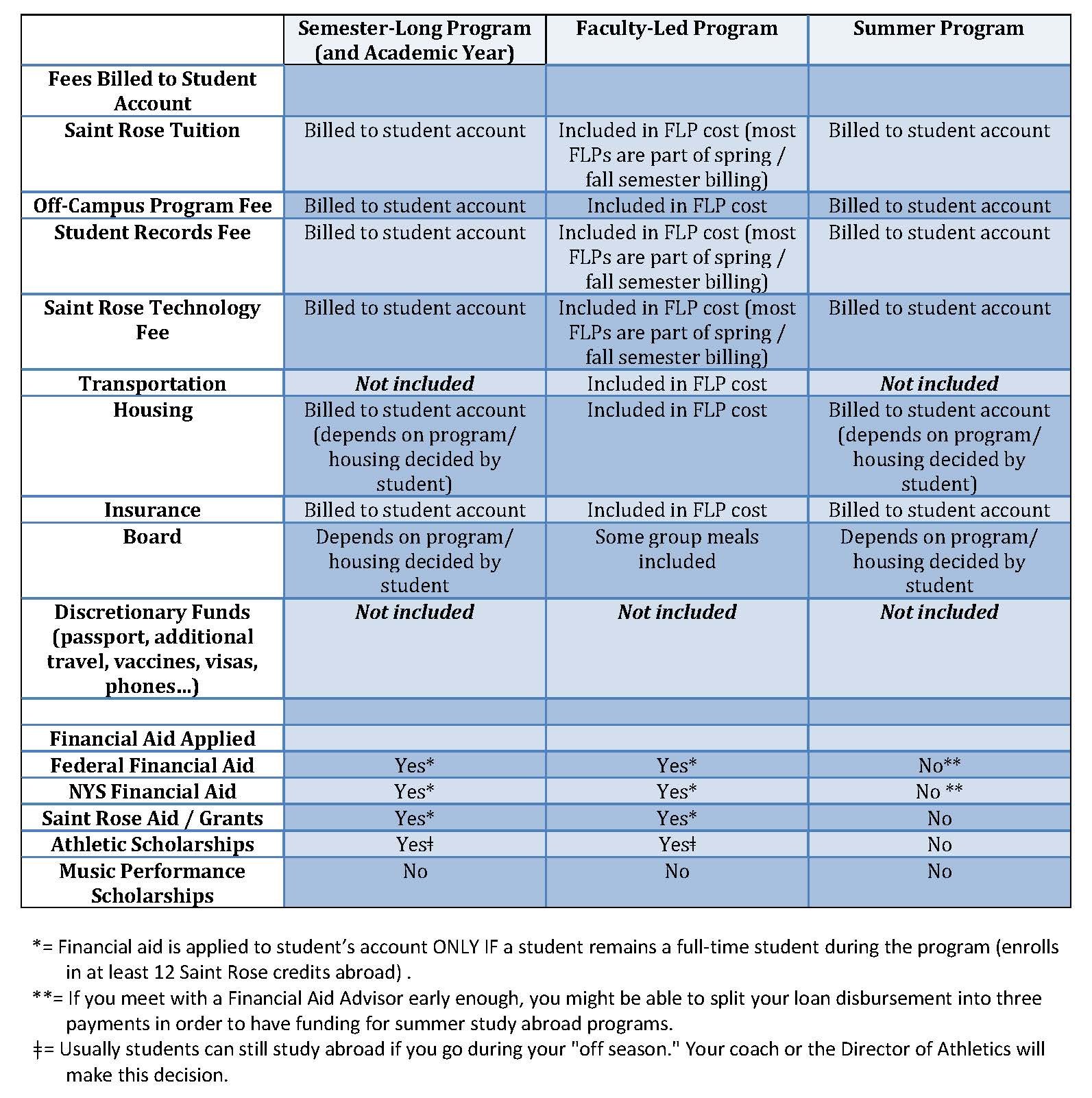

- Tuition fees: Research and note down the cost of tuition at your chosen institution. Be sure to include any additional fees, such as registration or technology fees.

- Accommodation: Explore different housing options, such as university dormitories, private rentals, or homestays. Compare the costs and choose the option that fits your budget best.

- Living expenses: Estimate your monthly expenses for groceries, transportation, utilities, and leisure activities. Take into account the cost of basic necessities in your chosen destination.

- Health insurance: Check if you need to purchase health insurance coverage specific to your study abroad country. Research different insurance providers and their costs.

- Travel expenses: Include the cost of round-trip airfare, visa fees, and transportation within your study abroad country.

- Emergency fund: Set aside a portion of your budget for unexpected expenses or emergencies.

Explore Scholarships and Grants

Studying abroad doesn’t have to drain your bank account. There are numerous scholarships and grants available to help students finance their international education. Many educational institutions, governments, and private organizations offer financial assistance to qualified students. Research and apply for scholarships and grants as early as possible, as many have specific deadlines.

Here are some avenues to explore:

- Institutional scholarships: Check if your chosen educational institution offers any scholarships or financial aid packages for international students.

- Government scholarships: Some countries, such as Germany and Australia, offer scholarships specifically for international students.

- Private organizations and foundations: Research private organizations and foundations that provide financial support for studying abroad. These may be based on academic achievement, specific fields of study, or personal circumstances.

- Exchange programs: Look into exchange programs sponsored by your university, as they often come with financial benefits.

Consider Part-Time Work Opportunities

If you have a valid student visa that permits you to work part-time, consider taking up a job to support your finances while studying abroad. Part-time work can help cover your day-to-day expenses and reduce your financial burden.

Here are a few options to explore:

- Campus jobs: Check if your university offers on-campus job opportunities for international students. These jobs are often flexible and tailored to students’ schedules.

- Tutoring: If you excel in a particular subject, consider offering tutoring services to fellow students or local residents.

- Freelancing: If you have specific skills, explore freelancing options that allow you to work remotely and on your own schedule.

- Internships: Look for internships related to your field of study. These can provide valuable work experience while helping to support your finances.

Save and Cut Expenses

While studying abroad, it’s essential to be mindful of your spending habits and find ways to save money. Here are some tips to cut expenses and build up your savings:

- Create a savings plan: Start saving for your study abroad journey well in advance. Set a monthly savings target and stick to it.

- Track your spending: Use budgeting apps or spreadsheets to track your expenses and identify areas where you can cut back.

- Cook your own meals: Eating out can quickly add up. Try cooking your meals at home and packing lunch to save money.

- Use public transportation: Opt for public transportation instead of taxis or ride-sharing services. It’s usually more affordable and a great way to explore the city.

- Buy used textbooks: Textbooks can be expensive, so consider buying used or renting them instead.

- Take advantage of student discounts: Many places offer discounts for students. Always carry your student ID and inquire about available discounts.

- Limit entertainment expenses: Look for free or low-cost activities and events in your study abroad city. Take advantage of parks, museums, and student clubs.

Consult with Financial Advisors

If you’re unsure about your financial plan or need expert advice, consider consulting with a financial advisor specializing in study abroad finances. They can provide personalized guidance tailored to your specific situation, ensuring you make informed financial decisions.

Planning for the financial aspect of studying abroad is crucial to ensure a smooth and enjoyable experience. By conducting thorough research, creating a realistic budget, exploring scholarship opportunities, considering part-time work, saving, and cutting expenses, you can embark on your study abroad journey without unnecessary financial stress. Remember, a well-planned financial strategy will allow you to fully immerse yourself in the cultural and educational experience of studying abroad while still managing your finances responsibly.

HOW TO ACTUALLY AFFORD STUDY ABROAD & THE REAL COST

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I financially plan for studying abroad?

Studying abroad requires careful financial planning, and here are some steps to help you:

1. What expenses should I consider when planning to study abroad?

When planning to study abroad, consider expenses like tuition fees, accommodation, travel costs, visa fees, health insurance, textbooks, living expenses, and any additional program or university fees.

2. How can I estimate the total cost of studying abroad?

To estimate the total cost, research the tuition fees and living costs in your desired study destination. Factor in exchange rates, inflation, and any additional expenses to get a comprehensive estimate.

3. What are some ways to save money for studying abroad?

To save money for studying abroad, you can consider working part-time, applying for scholarships or grants, reducing unnecessary expenses, creating a budget, and saving a portion of your income regularly.

4. Can I apply for financial aid or scholarships to study abroad?

Yes, many universities and organizations offer scholarships, grants, or financial aid to international students. Research and apply for such opportunities to alleviate your financial burden.

5. Are there any student loans available for studying abroad?

Some financial institutions offer student loans specifically designed for studying abroad. Research different loan options, compare interest rates and terms, and choose the one that suits your needs.

6. Should I consider working part-time while studying abroad?

Working part-time while studying abroad can help cover some of your living expenses. However, make sure to check the regulations and limitations regarding work permits for international students in your study destination.

7. How can I manage my budget effectively while studying abroad?

To manage your budget effectively, create a detailed budget plan, track your expenses, prioritize necessary expenses, look for student discounts, and make informed choices when it comes to accommodation, transportation, and leisure activities.

8. Is it possible to reduce study abroad costs by choosing a more affordable destination?

Yes, choosing a more affordable study destination can significantly reduce your study abroad costs. Research countries or universities with lower tuition fees, lower living costs, or scholarships specifically for international students.

Final Thoughts

Planning for study abroad can be a daunting task, especially when it comes to finances. However, with careful financial planning, you can make your study abroad dreams a reality. Start by calculating your budget and determining your sources of funding. Research scholarships, grants, and part-time job opportunities to help cover the costs. Create a savings plan and cut down on unnecessary expenses. Consider cost-effective study abroad destinations and housing options. Finally, monitor your expenses while abroad and make adjustments if necessary. By following these steps and having a well-thought-out financial plan, you can successfully manage the expenses and make the most of your study abroad experience. So, if you are wondering how to financially plan for study abroad, remember to calculate your budget, research funding options, create a savings plan, and monitor your expenses while abroad.