Having a baby is an exciting and life-changing journey. Amidst the joy and anticipation, it’s crucial to make sure you are financially prepared for this new phase. Wondering how to financially prepare for a baby? Look no further! In this article, we will guide you through practical steps to ensure a stable financial foundation for your growing family. From budgeting wisely to exploring insurance options, we’ll help you navigate through the financial aspects of welcoming your bundle of joy. So let’s dive in and get your finances ready for this new chapter!

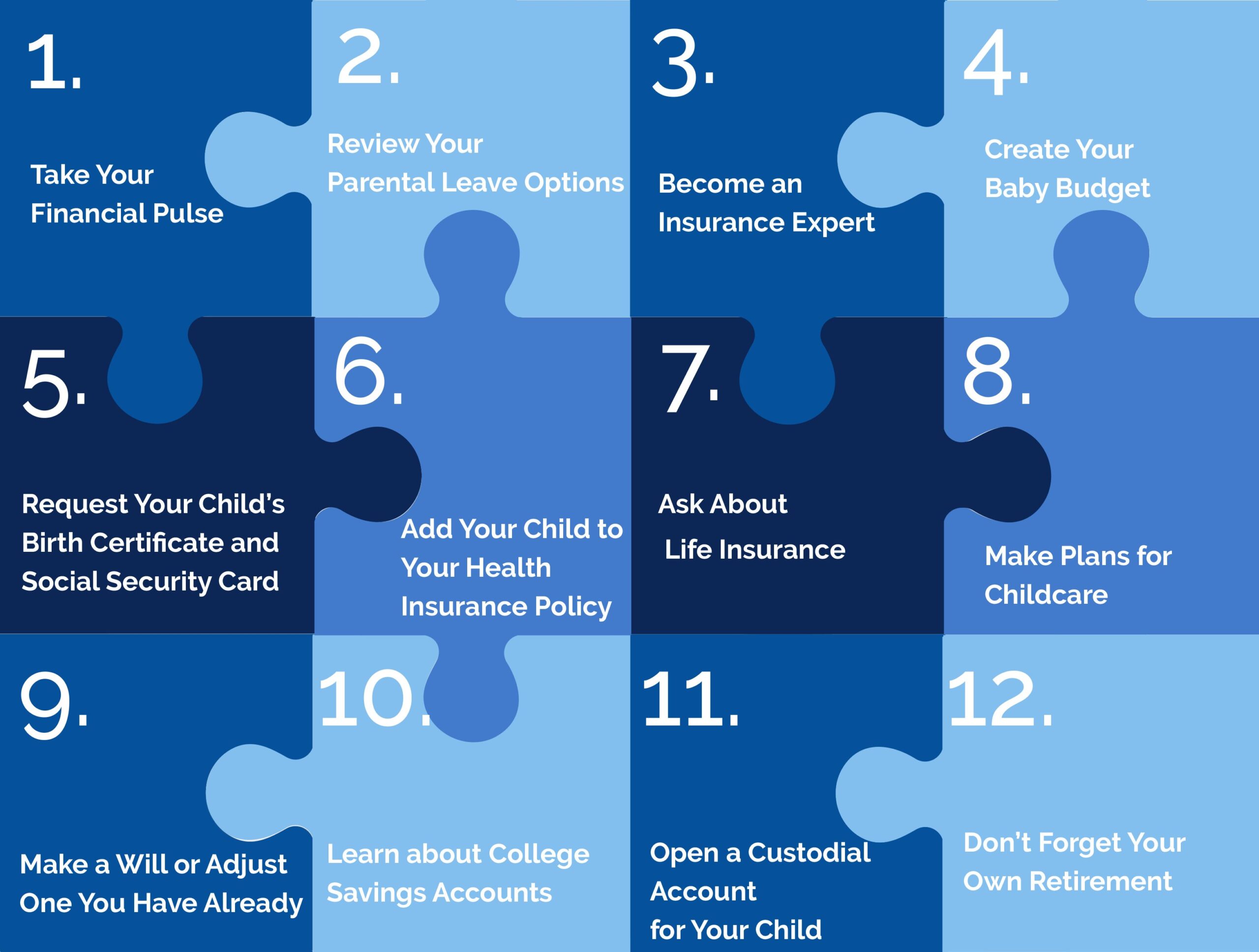

How to Financially Prepare for a Baby

Congratulations on the exciting news of expecting a baby! Welcoming a little one into your life is a joyous occasion, but it also comes with a host of new responsibilities, including the need for financial preparation. Planning ahead and taking steps to secure your financial future can help alleviate stress and allow you to focus on the joys of parenthood. In this comprehensive guide, we’ll explore various strategies and considerations to help you financially prepare for the arrival of your bundle of joy.

1. Create a Budget

One of the first steps in financially preparing for a baby is to create a comprehensive budget. This will help you gain a clear understanding of your current financial situation and identify areas where you can make adjustments to accommodate the needs of your growing family. Consider the following when creating your budget:

- Track your income and expenses: Start by listing all sources of income and identify your monthly expenses. Be sure to include both fixed expenses (rent/mortgage, utilities, insurance) and variable expenses (groceries, entertainment, dining out).

- Identify areas to cut back: Look for areas where you can trim expenses to make room for new baby-related costs. This might include reducing discretionary spending or renegotiating bills.

- Plan for additional baby expenses: Factor in the costs of diapers, formula/breastfeeding supplies, baby clothes, and other essentials that will become part of your monthly budget.

- Consider childcare costs: If both parents plan to return to work, research the costs of childcare in your area and factor that into your budget.

- Save for emergencies: Set aside a portion of your income each month for unexpected expenses, such as medical emergencies or home repairs.

2. Evaluate Your Insurance Needs

Reviewing your insurance coverage is vital when preparing for a baby. Ensure you have adequate coverage in the following areas:

Health Insurance:

- Check if your current health insurance policy covers pregnancy and childbirth expenses. Review deductible, copayments, and out-of-pocket maximums to understand your potential expenses.

- Consider adding your child to your health insurance policy or exploring separate coverage options.

Life Insurance:

- Assess your life insurance coverage to ensure it is sufficient to protect your growing family. Consider both parents’ coverage and the financial impact on the surviving spouse and child in the event of an unforeseen tragedy.

- Calculate the necessary coverage amount by considering factors such as outstanding debts (mortgage, student loans, etc.), future childcare costs, and income replacement.

Disability Insurance:

- Review your disability insurance policy to understand the extent of your coverage and any limitations that may arise during pregnancy or childbirth.

- Consider the financial implications if one or both parents are unable to work for an extended period due to disability.

3. Save for Pregnancy and Delivery Costs

Pregnancy and childbirth expenses can vary significantly depending on factors like insurance coverage, location, and any complications that may arise. Taking proactive measures to save for these costs can help alleviate financial strain. Consider the following:

- Review your health insurance coverage to understand the out-of-pocket expenses associated with prenatal care, delivery, and postnatal care. Determine the deductible, copayments, and coinsurance amounts.

- Start saving early by allocating a portion of your monthly budget towards a dedicated “Baby Fund”.

- Explore options such as Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) that may provide tax advantages when saving for medical expenses.

- Research available government assistance programs or grants that can help offset the costs of medical care.

4. Plan for Childcare Expenses

Childcare expenses can be a significant portion of your budget, especially if both parents plan to continue working after the baby arrives. It is crucial to start planning and saving for these costs well in advance. Consider the following:

- Research different childcare options and their associated costs, such as daycare centers, in-home daycare, or hiring a nanny.

- Consider the location and proximity of childcare facilities to your home or workplace.

- Factor in the potential need for after-school care or extracurricular activities as your child grows older.

- Explore childcare assistance programs or tax benefits offered by your employer or government agencies.

5. Adapt Your Financial Goals and Investments

Preparing for a baby may require adjustments to your long-term financial goals and investment strategies. Consider the following:

- Review your existing financial goals and reassess priorities in light of your new family dynamics.

- Consult with a financial advisor to evaluate your investment portfolio and make necessary adjustments to align with your new objectives and risk tolerance.

- Start a college savings account (e.g., 529 Plan) to ensure you can help fund your child’s education in the future.

- Consider creating an emergency fund to cover unexpected expenses associated with raising a child.

6. Plan for Maternity and Paternity Leave

Understanding your rights and available options for maternity and paternity leave is essential when financially preparing for a baby. Consider the following:

- Research your country’s laws and your employer’s policies regarding leave for new parents.

- Review your employee benefits to understand if you are eligible for paid maternity or paternity leave.

- Estimate your potential loss of income during the leave period and adjust your budget and savings accordingly.

- Explore options for temporary disability benefits if applicable.

7. Update Your Estate Plan

As you embark on this new journey of parenthood, updating your estate plan becomes crucial to ensure the well-being and financial security of your child. Consider the following:

- Consult with an estate planning attorney to create or update a will that designates guardianship for your child if something were to happen to both parents.

- Consider establishing a trust to manage and protect assets for your child’s future.

- Review and update beneficiary designations on life insurance policies, retirement accounts, and other financial assets.

By taking proactive steps to financially prepare for a baby, you can set a solid foundation for your growing family’s future. Planning ahead, creating a budget, evaluating insurance coverage, saving for pregnancy and delivery costs, and adapting your financial goals will help you navigate the financial responsibilities of parenthood with confidence and peace of mind. Enjoy this exciting phase of your life knowing that you have taken the necessary steps to secure your family’s financial well-being.

Remember, every family’s financial situation is unique, and it’s important to personalize these suggestions to align with your specific needs and goals.

Preparing For A Baby Financially (For New Moms And Soon-To-Be Moms)! | Clever Girl Finance

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I financially prepare for a baby?

To financially prepare for a baby, start by creating a budget to track your expenses and identify areas where you can save money. Consider setting up a separate savings account specifically for baby-related expenses. Additionally, review your insurance coverage, consider investing in a life insurance policy, and explore available government benefits or tax credits for parents.

2. Should I start saving for my baby before they are born?

Yes, it is recommended to start saving for your baby before they are born. From prenatal care to purchasing essential items, there will be various expenses associated with having a baby. By starting to save early, you can better manage these costs and alleviate financial stress once the baby arrives.

3. What are some practical steps to save money for a baby?

To save money for a baby, consider cutting back on unnecessary expenses, such as dining out or entertainment costs. Look for deals and discounts when purchasing baby items, consider buying second-hand items in good condition, and compare prices before making any major purchases. Additionally, explore options for childcare that fit within your budget.

4. How can I plan for medical expenses related to having a baby?

Planning for medical expenses related to having a baby is crucial. Review your health insurance policy to understand what is covered and what is not. Consider adding maternity coverage if it is not already included. Look into the costs of prenatal visits, delivery, and postnatal care. It may be beneficial to set aside funds or explore health savings accounts or flexible spending accounts to cover these expenses.

5. What are some unexpected costs to consider when financially preparing for a baby?

While you may have planned for the essential baby items and medical expenses, there could be unexpected costs. These may include emergency medical care, unexpected complications during pregnancy or delivery, or necessary home modifications for baby proofing. It is essential to have a contingency fund or emergency savings to handle these unexpected expenses.

6. How can I manage the cost of childcare?

Childcare costs can be significant, so it’s important to explore various options. Research the cost of different childcare providers in your area, such as daycare centers, in-home caregivers, or family members. Consider alternatives like nanny sharing or flexible work arrangements to reduce childcare expenses. Additionally, you may be eligible for government assistance or employer-provided childcare benefits.

7. Should I consider investing for my child’s future?

Investing for your child’s future can be a wise financial decision. Start by researching and considering options such as a 529 college savings plan or a custodial account. These accounts allow you to set aside funds for your child’s education or other long-term financial goals. Consult with a financial advisor to determine the best investment strategy based on your financial situation and goals.

8. What are some ways to cut costs without sacrificing quality when preparing for a baby?

Cutting costs without sacrificing quality is possible when preparing for a baby. Look for sales and discounts on baby essentials, compare prices across different stores or online platforms, and consider buying gently used items. Take advantage of hand-me-downs from friends or family members, and focus on purchasing only what is necessary. Additionally, consider breastfeeding instead of formula feeding, as it can save a significant amount of money on infant formula costs.

Final Thoughts

To financially prepare for a baby, there are a few key steps you can take. Firstly, create a budget and assess your current financial situation. This will help you identify areas where you can cut back on expenses and save more for your baby’s arrival. Additionally, start saving for healthcare costs and consider getting adequate insurance coverage. It’s important to plan for childcare expenses and create an emergency fund. Finally, review your current financial plans and make any necessary adjustments to ensure you are on track to meet your goals. By following these steps, you can feel confident in your ability to financially prepare for your baby’s future.