Natural disasters can strike unexpectedly, leaving a trail of destruction and financial burdens in their wake. So, how can you financially prepare for a natural disaster? The key lies in having a solid plan in place, ensuring that you and your loved ones are protected from the financial fallout. From creating an emergency fund to reviewing insurance policies, understanding the steps to secure your financial future is crucial. In this article, we will delve into practical strategies on how to financially prepare for a natural disaster, providing you with the peace of mind and protection you need. Let’s get started.

How to Financially Prepare for a Natural Disaster

Natural disasters can strike at any moment, leaving behind a trail of destruction and chaos. From hurricanes and earthquakes to floods and wildfires, these events can have a devastating impact on homes, businesses, and communities. While it’s impossible to predict or prevent natural disasters, being financially prepared can help you navigate the aftermath and recover more quickly. In this article, we will explore various strategies and tips to help you financially prepare for a natural disaster.

1. Build an Emergency Fund

One of the first steps to financially prepare for a natural disaster is to build an emergency fund. This fund should consist of three to six months’ worth of living expenses and be easily accessible in case of an emergency. Here’s how you can start building your emergency fund:

- Set a savings goal: Determine how much you want to save based on your monthly expenses and set a realistic savings goal.

- Create a budget: Identify areas where you can cut back on expenses and allocate those savings to your emergency fund.

- Automate savings: Set up automatic transfers from your checking account to your emergency fund every month to ensure consistent savings.

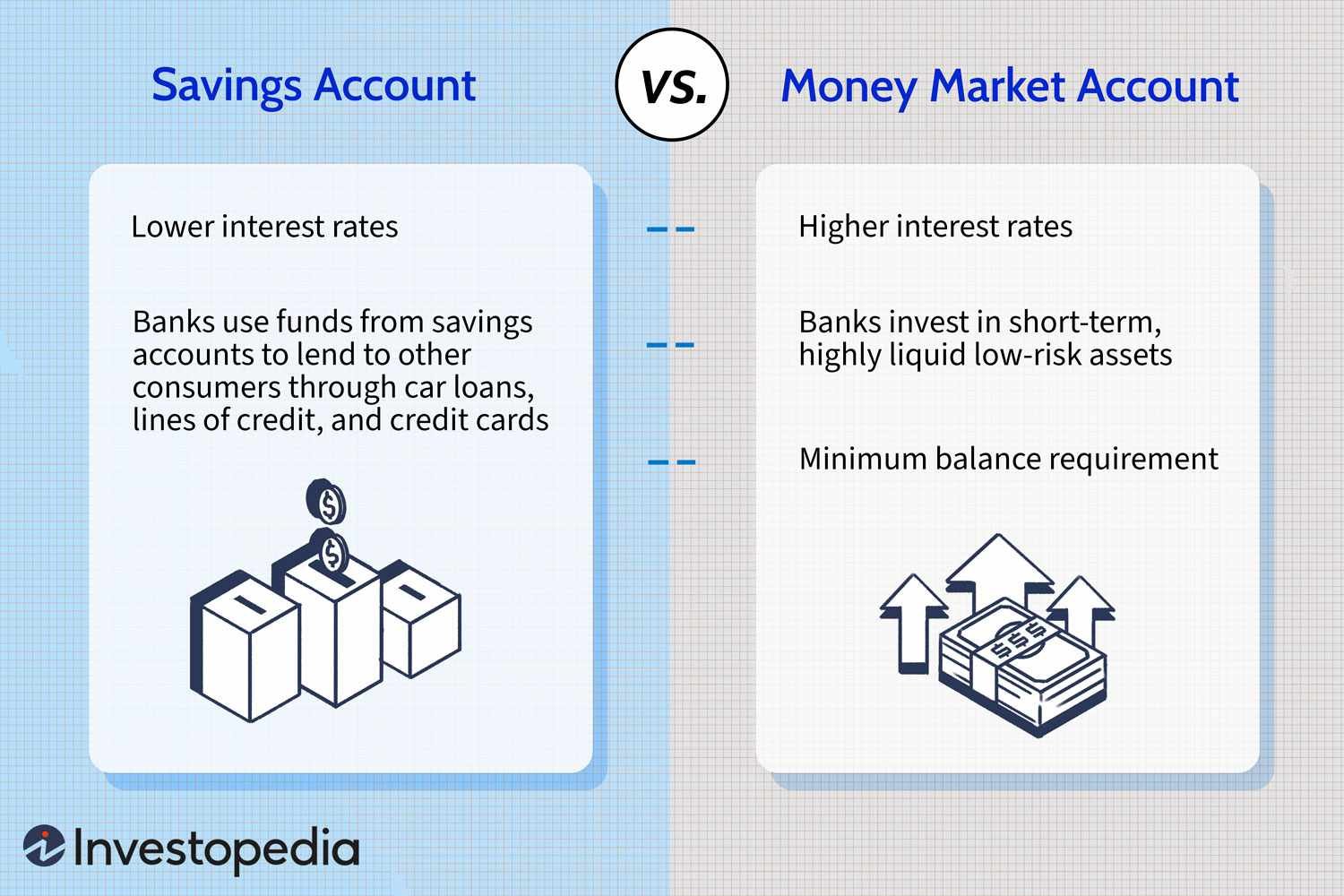

- Explore high-yield savings accounts: Look for accounts that offer higher interest rates to help your emergency fund grow faster.

2. Review and Update Your Insurance Policies

Insurance plays a crucial role in protecting your finances in the event of a natural disaster. Take the time to review and update your insurance policies to ensure you have adequate coverage. Here are some key considerations:

- Homeowners or renters insurance: Make sure your policy covers natural disasters relevant to your area, such as hurricanes or earthquakes.

- Flood insurance: Standard homeowners insurance often does not cover flood damage, so consider purchasing a separate flood insurance policy if you live in a flood-prone area.

- Review coverage limits: Evaluate whether your coverage limits are sufficient to cover the cost of rebuilding or replacing your belongings in the event of a disaster.

- Document your possessions: Create a detailed inventory of your belongings, including photos or videos, to facilitate the claims process.

3. Create a Disaster Preparedness Kit

A disaster preparedness kit is essential for weathering the immediate aftermath of a natural disaster. While it may not directly impact your finances, it can save you money by providing the necessary supplies and reducing the need for additional expenses. Here is a list of items to include in your disaster preparedness kit:

- Non-perishable food items

- Bottled water

- Prescription medications

- First aid kit

- Batteries and flashlights

- Blankets and warm clothing

- Important documents (identification, insurance policies, etc.)

- Cash

- Portable phone charger

- Emergency contact information

4. Develop an Evacuation Plan

In some situations, evacuating your home may be necessary for your safety. Having a well-thought-out evacuation plan in place can help minimize potential damage and ensure the well-being of your family. Consider the following when creating your evacuation plan:

- Identify evacuation routes: Research and map out the safest evacuation routes from your area.

- Establish meeting points: Choose meeting points where you and your family can reunite if separated during the evacuation.

- Arrange transportation: Determine how you will evacuate and make necessary arrangements, whether it’s by car, public transportation, or seeking assistance.

- Pack essential items: Prepare a “go-bag” with essential items like clothing, medication, important documents, and cash.

- Stay informed: Stay tuned to local news and official sources for updates and instructions during a natural disaster.

5. Safeguard Important Documents and Data

Natural disasters can destroy physical documents and digital files, causing significant financial and personal loss. To protect your valuable information, consider the following steps:

- Create digital backups: Scan important documents (identification, insurance policies, etc.) and store them securely in the cloud or on external hard drives.

- Use fireproof and waterproof containers: Keep physical copies of essential documents in containers that can withstand disasters.

- Share access with a trusted person: Provide a trusted family member or friend with access to your secure digital backups or physical copies.

- Secure your data: Use strong passwords, two-factor authentication, and encryption to protect your digital data.

6. Consider Additional Coverage Options

In addition to standard insurance policies, there are additional coverage options that can offer financial protection during and after a natural disaster. Explore these options to determine if they align with your needs:

- Disaster recovery insurance: This coverage provides additional financial assistance to help you recover from a natural disaster, covering expenses not typically covered by standard insurance policies.

- Business interruption insurance: If you’re a business owner, consider adding business interruption insurance to protect against income loss during a disaster.

- Life and disability insurance: Having life and disability insurance ensures your loved ones are financially secure in the event of your death or disability resulting from a natural disaster.

7. Establish a Communication Plan

Communication is vital during a natural disaster, especially when you may be separated from your loved ones. Establish a communication plan to maintain contact and ensure everyone’s well-being. Here are some tips to consider:

- Exchange emergency contacts: Share emergency contact information with family members, neighbors, and friends.

- Use multiple communication channels: Have a backup communication method in case traditional phone lines are unavailable. Consider using text messages, social media, or walkie-talkies.

- Designate an out-of-area contact: Choose a trusted person outside the affected area who can serve as a central point of communication.

- Keep communication devices charged: Have spare batteries or portable chargers available to keep your communication devices powered.

8. Seek Professional Financial Advice

If you find the process of financially preparing for a natural disaster overwhelming or confusing, don’t hesitate to seek professional financial advice. A financial advisor can help you assess your specific situation and provide tailored guidance to protect your finances. They can offer insights on insurance coverage, emergency funds, and other financial strategies to weather the storm.

While we cannot control the occurrence of natural disasters, we can take proactive steps to financially prepare for them. Building an emergency fund, reviewing insurance policies, creating a disaster preparedness kit, developing an evacuation plan, safeguarding important documents, considering additional coverage options, establishing a communication plan, and seeking professional financial advice are all crucial steps to ensure financial resilience in the face of a natural disaster. By taking the time to prepare now, you can minimize the financial impact and increase your ability to recover quickly when disaster strikes. Stay safe and be prepared!

How to prepare financially for a natural disaster

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I financially prepare for a natural disaster?

Being financially prepared for a natural disaster is crucial. Here are some steps you can take:

– Create an emergency fund: Save enough money to cover living expenses for at least three months.

– Review your insurance coverage: Ensure your home, property, and belongings are adequately insured against natural disasters.

– Create a disaster budget: Prepare a budget that includes potential expenses during and after a natural disaster.

– Keep important documents safe: Store important documents (insurance policies, identification, etc.) in a waterproof and fireproof container or digitally.

2. Should I consider getting additional insurance coverage?

While basic insurance coverage is essential, it may not include specific natural disaster-related damages. Consider additional coverage such as flood insurance or earthquake insurance, depending on your location and the risks involved.

3. How should I prioritize my expenses when preparing for a natural disaster?

When preparing for a natural disaster financially, prioritize the following:

– Basic necessities: Allocate funds for food, water, and essential supplies.

– Shelter and safety: Ensure your home is secure and invest in safety measures.

– Emergency savings: Build an emergency fund to cover unexpected expenses.

– Insurance premiums: Pay insurance premiums on time to maintain coverage.

4. Are there any government assistance programs available to help with financial preparation for natural disasters?

Yes, governments often offer assistance programs to aid individuals and communities in preparing for natural disasters. Research and inquire about programs available in your area, such as grants, loans, or tax relief options.

5. Are there any tax benefits or deductions for natural disaster preparedness expenses?

Tax benefits or deductions related to natural disaster preparedness expenses can vary depending on your location and tax laws. Consult with a tax professional or refer to relevant government resources to determine if you qualify for any tax benefits.

6. How can I protect my financial records and important documents during a natural disaster?

To protect your financial records and important documents during a natural disaster:

– Store digital copies: Scan and save important documents in a secure online storage service or a password-protected external hard drive.

– Use waterproof containers: Keep physical copies of documents in waterproof and fireproof containers.

– Consider a safe deposit box: Utilize a safe deposit box at a bank to store essential documents.

7. What steps can I take to ensure I have access to my finances during a natural disaster?

To ensure access to your finances during a natural disaster:

– Maintain multiple forms of payment: Have cash on hand, as well as alternative payment methods like credit cards or mobile payment apps.

– Keep important financial information accessible: Know your bank account details, online banking login credentials, and contact information for financial institutions.

8. How often should I review and update my financial preparedness plan for natural disasters?

It is recommended to review and update your financial preparedness plan for natural disasters at least once a year or whenever you experience significant life changes. Regularly assess your insurance coverage, emergency fund, and overall financial situation to ensure you remain adequately prepared.

Final Thoughts

In conclusion, preparing financially for a natural disaster is crucial in ensuring you can cope with the aftermath and rebuild your life. Start by creating an emergency fund that can cover at least three to six months of living expenses. Review your insurance policies to ensure they adequately cover potential damages and losses. Keep important documents safe and accessible. Invest in preventive measures such as reinforcing your home and landscaping to minimize potential damages. Finally, educate yourself about government assistance programs and local resources available to support you during and after a disaster. By taking these steps, you can better protect yourself and your finances when faced with a natural disaster.