So, you’ve decided to bring a new furry friend into your life? Congratulations! Welcoming a pet into your home can bring immeasurable joy and love. However, it’s important to remember that being a pet parent also comes with financial responsibilities. But fret not, because in this article, we’ll tell you exactly how to financially prepare for a new pet. From budgeting for initial expenses to planning for ongoing costs, we’ve got you covered. So, let’s dive right in and ensure you’re fully prepared for this exciting new chapter in your life.

How to Financially Prepare for a New Pet

Welcoming a new pet into your home is an exciting and fulfilling experience. However, it’s important to recognize that owning a pet comes with financial responsibilities. From initial expenses to ongoing costs, being prepared financially will ensure that you can provide the best care for your new furry friend. In this article, we will guide you through the process of financially preparing for a new pet, covering everything from budgeting to insurance options.

1. Research the Cost of Different Pets

Before bringing a new pet home, it’s crucial to research the costs associated with various types of pets. Different animals have different needs, and these can significantly impact your budget. Consider factors such as:

- Size: Larger pets generally require more food, grooming, and healthcare, which can lead to higher expenses.

- Breed: Certain breeds may be more susceptible to health issues, requiring additional veterinary care and potential insurance coverage.

- Lifespan: The longer the lifespan, the more years of care you will need to budget for.

- Specific needs: Some pets have unique requirements, such as specialized diets or environmental conditions, which may increase costs.

By understanding the cost differences between pets, you can make an informed decision based on your budget and lifestyle.

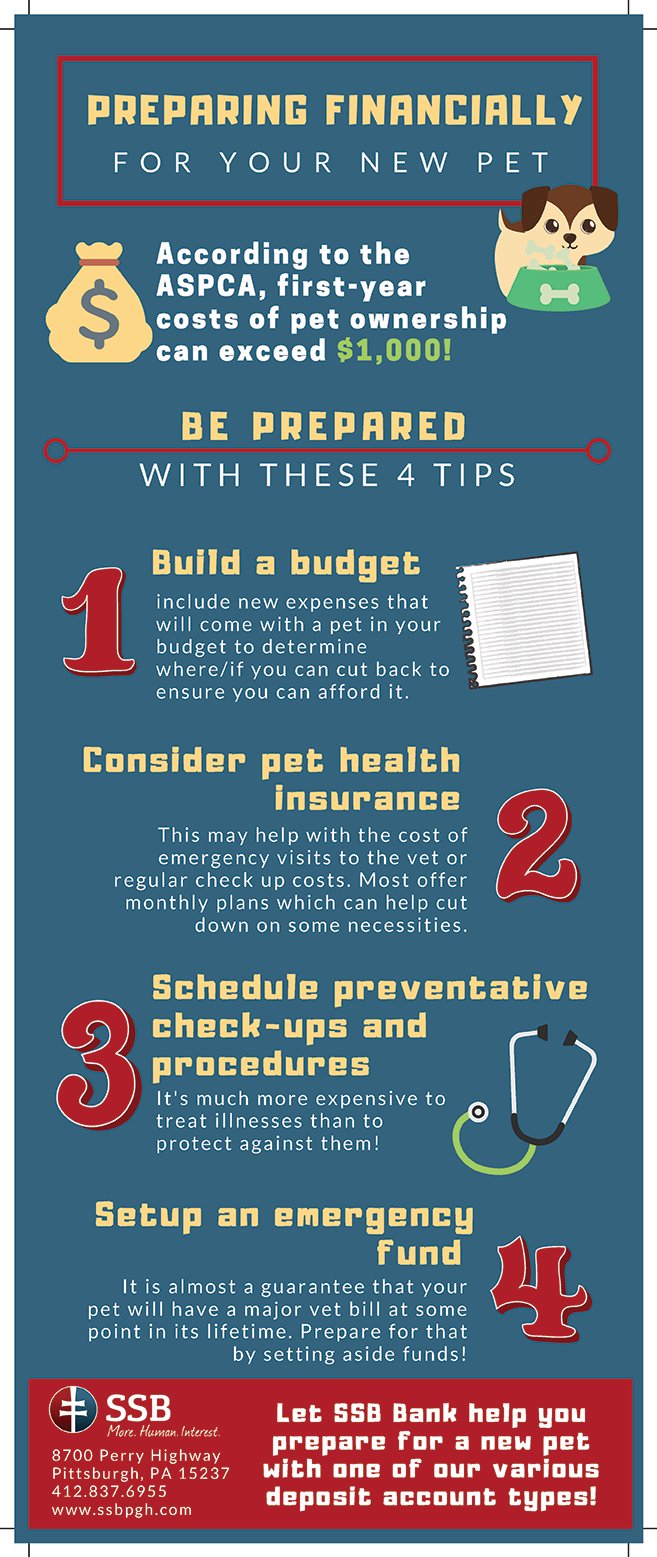

2. Budget for Initial Expenses

When welcoming a new pet, there are several initial expenses to consider. These may include:

- Adoption or purchase fees: If you’re getting a pet from a shelter or breeder, there may be adoption or purchase fees involved.

- Spaying or neutering: Unless your pet is already sterilized, you will likely need to cover the cost of spaying or neutering.

- Vaccinations and microchipping: Your new pet will need vaccinations to stay healthy, and microchipping is essential for identification purposes.

- Essential supplies: Prepare for expenses such as a collar, leash, food and water bowls, bedding, toys, grooming tools, and a litter box or crate depending on the type of pet.

Creating a budget for these initial expenses will help you avoid any surprises.

3. Plan for Ongoing Expenses

Beyond the initial expenses, there are ongoing costs associated with pet ownership. It’s important to factor these into your budget to ensure you can provide consistent care. Some common ongoing expenses include:

- Food and treats: The nutritional needs of pets vary, so research the appropriate diet for your furry friend.

- Healthcare: Regular veterinary check-ups, vaccinations, flea and tick prevention, and unexpected medical costs should be considered.

- Grooming: Depending on the breed, your pet may require regular grooming, such as brushing, bathing, and professional grooming services.

- Training: If you have a dog, training classes or private sessions can help with obedience, socialization, and behavior management.

- Supplies: Ongoing purchases of items like litter, bedding, toys, and replacements for worn-out or damaged items should be anticipated.

- Insurance: Consider pet insurance to help manage unforeseen veterinary expenses. Research different policies and providers to find the best fit for your pet’s needs and your budget.

Estimating these ongoing expenses and incorporating them into your monthly or annual budget will help ensure the financial well-being of your new pet.

4. Create a Pet Emergency Fund

Life can be unpredictable, and unexpected veterinary expenses can arise. To protect your finances and your pet’s health, it’s wise to create a pet emergency fund. Set aside a designated amount each month to build up this fund, in case your pet requires urgent medical attention or unexpected surgical procedures.

Having a pet emergency fund can alleviate the stress of costly veterinary bills and allow you to make decisions based on what is best for your pet’s well-being, rather than solely on financial constraints.

5. Consider Pet Insurance

As mentioned earlier, pet insurance can be a valuable tool in managing the costs of veterinary care. When comparing insurance options, consider the following:

- Coverage: Review the coverage options available, including routine care, accidents, illnesses, and hereditary conditions.

- Deductibles and premiums: Assess the deductible amounts and premiums associated with different policies. Find a balance between affordability and coverage.

- Waiting periods and exclusions: Understand any waiting periods before coverage becomes effective and any exclusions for pre-existing conditions.

- Reputation and reviews: Research the reputation and reviews of insurance providers to ensure they have a good track record of customer satisfaction and claims processing.

While pet insurance is an additional expense, it can provide peace of mind and financial security in case of unexpected veterinary expenses.

6. Explore Ways to Save Money

Pet ownership doesn’t have to break the bank. There are several ways to save money without compromising your pet’s well-being. Consider the following tips:

- Bulk buying: Purchase pet supplies in bulk to take advantage of cost savings.

- Couponing and discounts: Keep an eye out for coupons, sales, and discounts on pet food, supplies, and services.

- Comparison shopping: Compare prices for veterinary services, including routine check-ups, vaccinations, and medications, to ensure you’re getting the best value for your money.

- Grooming at home: Learn to groom your pet at home rather than relying solely on professional grooming services.

- DIY toys and treats: Get creative and make your pet’s toys and treats at home using safe and cost-effective ingredients.

- Preventive care: Investing in preventive care, such as regular dental cleanings and flea prevention, can save you money in the long run by avoiding more serious health issues.

By implementing these money-saving strategies, pet ownership can be affordable and enjoyable.

Welcoming a new pet into your home is a wonderful experience, and being financially prepared ensures that you can provide the care and love they deserve. By researching different pets, budgeting for initial and ongoing expenses, creating a pet emergency fund, considering pet insurance, and exploring ways to save money, you can confidently embark on the journey of pet ownership. Remember, financial preparation is key to providing a happy and healthy life for your new furry friend.

TALKING DOGS: How to Financially Prepare for a Dog (ft. a Financial Coach & Dog Lover)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How do I financially prepare for a new pet?

Financially preparing for a new pet involves several important considerations:

What are the initial costs of getting a new pet?

The initial costs of getting a new pet may include:

What are the ongoing expenses of owning a pet?

As a pet owner, you should be prepared for ongoing expenses such as:

How can I budget for pet food and supplies?

To budget for pet food and supplies, you can follow these steps:

Are there any medical expenses I should anticipate?

Yes, there are medical expenses to anticipate when you have a new pet:

Should I consider pet insurance?

Considering pet insurance can be beneficial in the following ways:

How can I save money on veterinary care?

To save money on veterinary care, you can try the following strategies:

What other unexpected expenses should I be prepared for?

In addition to the regular expenses, you should be prepared for:

Final Thoughts

Financially preparing for a new pet is crucial for ensuring a smooth transition and happy life together. Start by researching the costs associated with pet ownership, including food, vet bills, grooming, and supplies. Create a budget specifically for your pet’s needs, taking into account both recurring expenses and potential emergencies. Consider purchasing pet insurance to help alleviate some of the financial burden. Additionally, save up an emergency fund for unexpected vet bills or other pet-related expenses. By taking these proactive steps, you can confidently welcome your new pet into your home knowing that you are prepared for the financial responsibilities that come with it.