Planning to take a sabbatical? Wondering how to financially prepare for a sabbatical? Look no further! This blog article has got you covered. We understand that embarking on a sabbatical can be an exciting yet nerve-wracking time, especially when it comes to your finances. But fear not, with a little bit of careful planning and some smart strategies, you can set yourself up for a worry-free sabbatical experience. So, let’s dive in and explore some practical tips to help you financially prepare for a sabbatical.

How to Financially Prepare for a Sabbatical

Embarking on a sabbatical can be a life-changing experience, allowing you to take a break from your everyday routine and explore new opportunities or interests. However, to fully embrace this time away, it’s important to plan your finances accordingly. In this article, we’ll guide you through the process of financially preparing for a sabbatical, ensuring that you can enjoy your time off without unnecessary stress.

Create a Budget

Before diving into the specifics of your sabbatical, it’s crucial to establish a budget. Start by assessing your current financial situation, including your income, expenses, and savings. Consider both fixed costs (such as rent or mortgage payments, utilities, and loan repayments) and variable expenses (such as groceries, entertainment, and transportation).

Then, determine how much money you’ll need to cover your essential expenses during your sabbatical. This includes any ongoing financial obligations that must be met while you’re away. By calculating these costs, you’ll have a clear understanding of the minimum amount you need to save before your sabbatical begins.

In addition to your essential expenses, take some time to estimate the amount of money you’ll need for discretionary spending, such as travel, accommodation, and exploration during your time off. While it’s important to be realistic about your budget, don’t forget to consider potential unexpected expenses that may arise.

Start Saving Early

Now that you have a budget in place, it’s time to start saving for your sabbatical. The earlier you begin, the more time you’ll have to accumulate the necessary funds. Here are some strategies to help you save:

- Automate your savings: Set up automatic transfers from your checking account to a dedicated savings account specifically for your sabbatical funds. This ensures that you consistently save a portion of your income without temptation.

- Trim unnecessary expenses: Review your budget and identify areas where you can cut back. Consider reducing discretionary spending, such as dining out or entertainment, and redirect those funds to your sabbatical savings.

- Seek additional income: Explore opportunities to generate extra income, such as taking on freelance work or selling unused belongings. Use the proceeds from these ventures to boost your sabbatical savings.

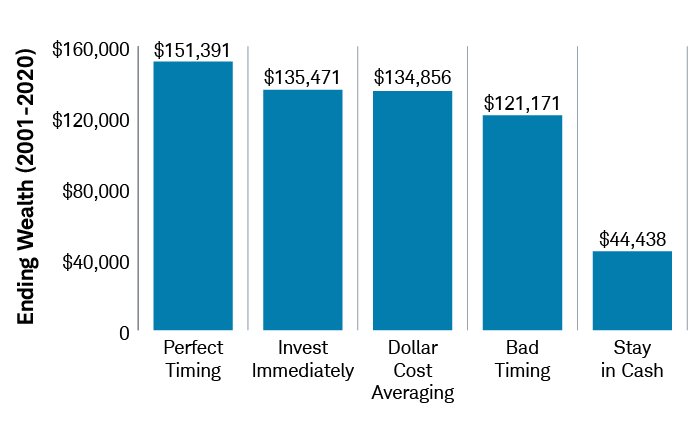

- Optimize your investments: Consult with a financial advisor to ensure that your investments align with your sabbatical goals. They can help you make informed decisions about reallocating assets for short-term liquidity or adjusting your risk tolerance.

Consider Passive Income Sources

While you’re on your sabbatical, having passive income sources can be an excellent way to supplement your savings and maintain a steady stream of cash flow. Passive income refers to money earned with little to no effort on your part, typically through investments or income-generating assets. Here are some passive income ideas to explore:

- Rental properties: If you own property, consider renting it out while you’re away. This can help cover mortgage payments and generate extra income.

- Dividend-paying stocks: Invest in stocks that offer regular dividend payments. This can provide a consistent income source during your sabbatical.

- Peer-to-peer lending: Explore investing in peer-to-peer lending platforms, where you can earn interest on loans given to individuals or businesses.

- Royalties: If you have creative works, such as books, music, or art, consider licensing them to generate royalties while you’re on your sabbatical.

Research Health Insurance Options

When you take a sabbatical, it’s essential to consider your health insurance coverage. Depending on your situation, you might need to research alternative options to ensure you have comprehensive coverage while you’re away. Here are a few options:

- Cobra coverage: If you’re currently employed and your employer offers health insurance, you may be eligible for continued coverage through COBRA. However, keep in mind that this can be quite costly, as you’ll be responsible for the entire premium.

- Private insurance plans: Explore private health insurance plans that provide coverage during your sabbatical. Compare different policies and providers to find the best fit for your needs.

- International coverage: If you plan to travel abroad during your sabbatical, consider obtaining international health insurance. This type of coverage offers protection in foreign countries and may be tailored to your specific travel needs.

Emergency Fund and Contingency Plan

Life is unpredictable, and having an emergency fund and contingency plan is essential during your sabbatical. Here’s how to prepare:

- Emergency fund: Prioritize building an emergency fund before your sabbatical. Set aside three to six months’ worth of living expenses in a separate account to ensure financial security in case of unforeseen circumstances.

- Contingency plan: Consider potential scenarios that could disrupt your sabbatical plans, such as unexpected job loss or health issues. Develop a contingency plan that outlines possible solutions and alternatives should these situations arise.

By establishing an emergency fund and contingency plan, you’ll have peace of mind during your sabbatical, knowing that you’re financially prepared for any unforeseen events.

Preparing for a sabbatical involves careful financial planning and consideration. By creating a budget, saving diligently, exploring passive income sources, researching health insurance options, and establishing an emergency fund and contingency plan, you’ll be well-equipped to enjoy your time off without financial stress. Remember, early preparation is key, so start planning now to make your sabbatical dreams a reality!

Planning a Personal Sabbatical? Avoid these 3 Pitfalls

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I financially prepare for a sabbatical?

Preparing financially for a sabbatical requires careful planning and budgeting. Here are some steps you can take:

1. How much money should I save?

It depends on the duration of your sabbatical and your anticipated expenses. A general rule of thumb is to save enough to cover at least six months of living expenses.

2. Should I create a separate savings account?

Yes, it’s a good idea to have a separate savings account dedicated to your sabbatical funds. This will help you track your progress and avoid dipping into the money for other purposes.

3. How can I cut down on my expenses?

Consider reducing discretionary spending, such as dining out or entertainment costs. You can also find ways to save on bills by negotiating better rates for utilities and services.

4. Should I consider a part-time job?

If you anticipate needing additional income during your sabbatical, taking on a part-time job can be a way to supplement your savings. Explore freelance or remote work opportunities that fit your skills and schedule.

5. What about health insurance during my sabbatical?

Ensure that you have adequate health insurance coverage while on sabbatical. Check with your employer if your existing plan can be extended or consider purchasing a short-term health insurance plan.

6. Are there any financial assistance programs available?

Research and explore grant programs, scholarships, or fellowships that specifically support individuals on sabbatical. These opportunities can provide financial aid and resources to help make your sabbatical more affordable.

7. How can I protect my financial assets while on sabbatical?

Consider setting up automatic bill payments, notifying your bank about your travel plans, and keeping important financial documents in a safe place. It’s also advisable to monitor your accounts regularly to detect any unauthorized activity.

8. What if unexpected financial needs arise during my sabbatical?

Having an emergency fund is crucial to handle unforeseen expenses. Prioritize building an emergency fund before your sabbatical and consider it as part of your overall financial preparation.

Final Thoughts

When preparing for a sabbatical, a key aspect to focus on is financial preparation. Start by setting a clear goal and timeline for your sabbatical, and then create a budget that includes not only your daily expenses but also any additional costs related to your time off. It’s important to save diligently in advance and consider alternative income streams or ways to reduce expenses. Researching and understanding your employee benefits, such as paid leave or unpaid sabbatical options, can also help alleviate financial strain. By taking these steps and being proactive in your financial planning, you can ensure a smoother transition into your sabbatical experience.