Preparing for unpaid maternity leave can be a daunting task, but fear not! I have some practical advice on how to navigate this challenge and ensure your financial stability during this important time. In this article, we will explore various strategies and tips on how to financially prepare for unpaid maternity leave. From budgeting and saving techniques to exploring alternative income sources, we will cover it all. So, if you’re wondering how to financially prepare for unpaid maternity leave, keep reading for expert insights and actionable steps. Let’s dive in!

How to Financially Prepare for Unpaid Maternity Leave

Becoming a mother is a precious and life-changing experience, but it also comes with its fair share of challenges. One of the most significant concerns for expectant mothers is how to manage their finances during the period of unpaid maternity leave. Without a steady income, it’s essential to plan ahead and take proactive steps to ensure financial stability during this time. In this article, we’ll explore practical strategies and tips for financially preparing for unpaid maternity leave.

Create a Budget and Evaluate Your Expenses

Before your maternity leave begins, it’s crucial to assess your current financial situation and create a comprehensive budget. Understanding your income and expenses will help you make informed decisions and identify areas where you can potentially cut back or save money. Here’s how you can get started:

- Track your monthly income: Calculate your total monthly income, including your salary, spouse’s income, and any additional sources of revenue.

- Itemize your expenses: List all your monthly expenses, such as rent or mortgage payments, utilities, groceries, transportation, insurance, and any other financial obligations. Be sure to include discretionary expenses as well, like entertainment and dining out.

- Analyze your spending: Review your expenses and identify areas where you can reduce costs. Look for non-essential items that you can temporarily eliminate or find cheaper alternatives for.

- Prioritize essential expenses: Focus on essential expenses like housing, utilities, and groceries, ensuring they are covered even during unpaid maternity leave.

Build an Emergency Fund

Having a solid emergency fund is crucial for financial stability, especially during periods of uncertainty like maternity leave. An emergency fund acts as a safety net, providing you with the necessary funds to cover unforeseen expenses or bridge the gap in income. Here are some tips for building an emergency fund:

- Set savings goals: Determine how much you aim to save and establish a timeline for achieving your goals. Consider the length of your maternity leave and the potential expenses you may encounter.

- Automate your savings: Make saving easier by setting up automatic transfers from your paycheck to a separate savings account dedicated to your emergency fund.

- Reduce unnecessary expenses: Assess your budget and identify areas where you can cut back on non-essential spending. Redirect the money saved towards your emergency fund.

- Supplement your income: Explore opportunities to supplement your income before your maternity leave begins. Consider taking on freelance work, selling unused items, or starting a small side business.

Understand Your Employee Benefits

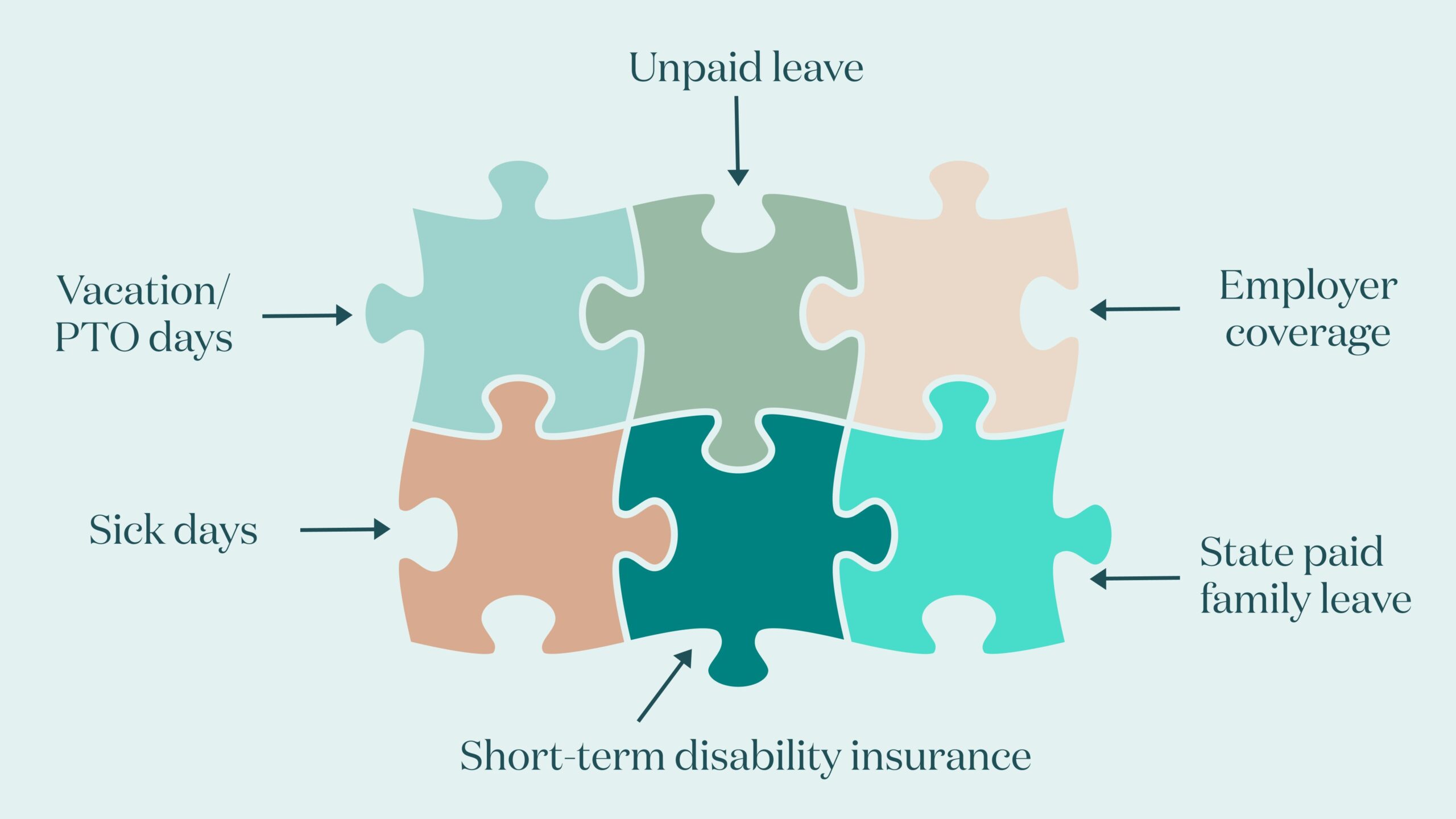

Familiarize yourself with your employee benefits and policies regarding maternity leave. Understanding your entitlements and options will help you make informed decisions and maximize the financial support available to you. Here are some key aspects to consider:

- Maternity leave policy: Review your company’s policy on maternity leave to determine the duration of leave and if any portion will be paid or unpaid.

- Short-term disability insurance: If your employer offers short-term disability insurance, find out if it covers maternity leave. Familiarize yourself with the coverage limits and any waiting periods.

- Family and Medical Leave Act (FMLA): Determine if you qualify for FMLA, which allows eligible employees to take up to 12 weeks of unpaid leave for certain medical reasons, including the birth or adoption of a child.

- Use vacation and sick days wisely: Consider using accumulated vacation and sick days before your maternity leave begins, which can help you extend your paid leave period.

Explore Income Replacement Options

While maternity leave is typically unpaid, there are alternative income replacement options that can help alleviate the financial strain. These options may vary depending on your location and employment status. Here are a few possibilities to consider:

- Short-term disability insurance: If available, short-term disability insurance can provide a percentage of your regular salary during maternity leave. Research different insurance providers and compare coverage options.

- Maternity leave benefits: Research government programs or employer initiatives that provide income support during maternity leave. Some employers offer partial pay for a portion of the leave, so inquire about any available benefits.

- State or provincial programs: Investigate whether your state or province offers any programs or benefits specifically designed to support individuals on maternity leave.

- Supplemental maternity insurance: Look into supplemental insurance plans that provide maternity benefits. These plans can help cover expenses not covered by other programs or insurance.

Communicate and Negotiate with Your Employer

Open and honest communication with your employer is crucial when preparing for unpaid maternity leave. While it may feel daunting, discussing your needs and negotiating certain arrangements can lead to a more supportive work environment. Consider the following steps:

- Discuss maternity leave options: Initiate a conversation with your employer or HR department to understand your options and clarify any uncertainties regarding your maternity leave.

- Explore flexible work arrangements: Inquire about the possibility of remote work, reduced hours, or a phased return to work after your maternity leave ends. Flexible arrangements can help ease the financial burden.

- Request additional benefits: If your employer doesn’t offer maternity leave benefits, inquire about other available benefits or support programs that might assist you during your unpaid leave.

- Seek clarity on job security: Understand your rights and job security during your maternity leave. Ask about the policies in place to secure your position and ensure a smooth transition back to work.

Explore Government Assistance Programs

Government assistance programs can provide valuable support during unpaid maternity leave. Familiarize yourself with the programs available in your country or region to determine if you meet the eligibility criteria. Here are a few examples:

- Family and Medical Leave Act (FMLA): As mentioned earlier, FMLA provides eligible employees in the United States with up to 12 weeks of unpaid leave per year. Review the requirements and understand how it may apply to your situation.

- Temporary Assistance for Needy Families (TANF): TANF provides financial assistance to low-income families with children. Research the program’s eligibility criteria and benefits in your area.

- Supplemental Nutrition Assistance Program (SNAP): SNAP offers nutrition assistance to eligible individuals and families. Check if you qualify for this program and explore how it can help during your maternity leave.

- Childcare assistance programs: Research available programs that offer financial assistance or subsidies for childcare. Understanding your options can help alleviate the financial burden of childcare expenses while on unpaid leave.

Explore Additional Sources of Income

In addition to any benefits, savings, or insurance coverage, exploring additional sources of income can help supplement your finances during maternity leave. Here are some ideas to consider:

- Paid maternity studies: Some universities or research organizations conduct paid studies or trials during pregnancy or postpartum. Participating in these studies can provide an additional income source.

- Freelancing or consulting: If you possess specific skills or expertise, consider offering freelance services or consulting work on a part-time basis. This flexibility allows you to work from home while caring for your newborn.

- Selling handmade or crafted items: If you have creative talents, consider selling homemade crafts or other handmade items online. Platforms like Etsy provide opportunities to showcase and sell your creations.

- Online tutoring or teaching: Utilize your knowledge and skills by offering online tutoring or teaching services. This can be done remotely, allowing you to work from home and earn additional income.

Preparing for unpaid maternity leave requires careful financial planning and proactive measures. By creating a budget, building an emergency fund, understanding your employee benefits, exploring income replacement options, communicating with your employer, exploring government assistance programs, and seeking additional income sources, you can navigate this period with greater financial ease and peace of mind. Remember, it’s never too early to start preparing, so take action today to ensure a financially secure maternity leave.

HOW TO AFFORD TO TAKE MATERNITY LEAVE

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I financially prepare for unpaid maternity leave?

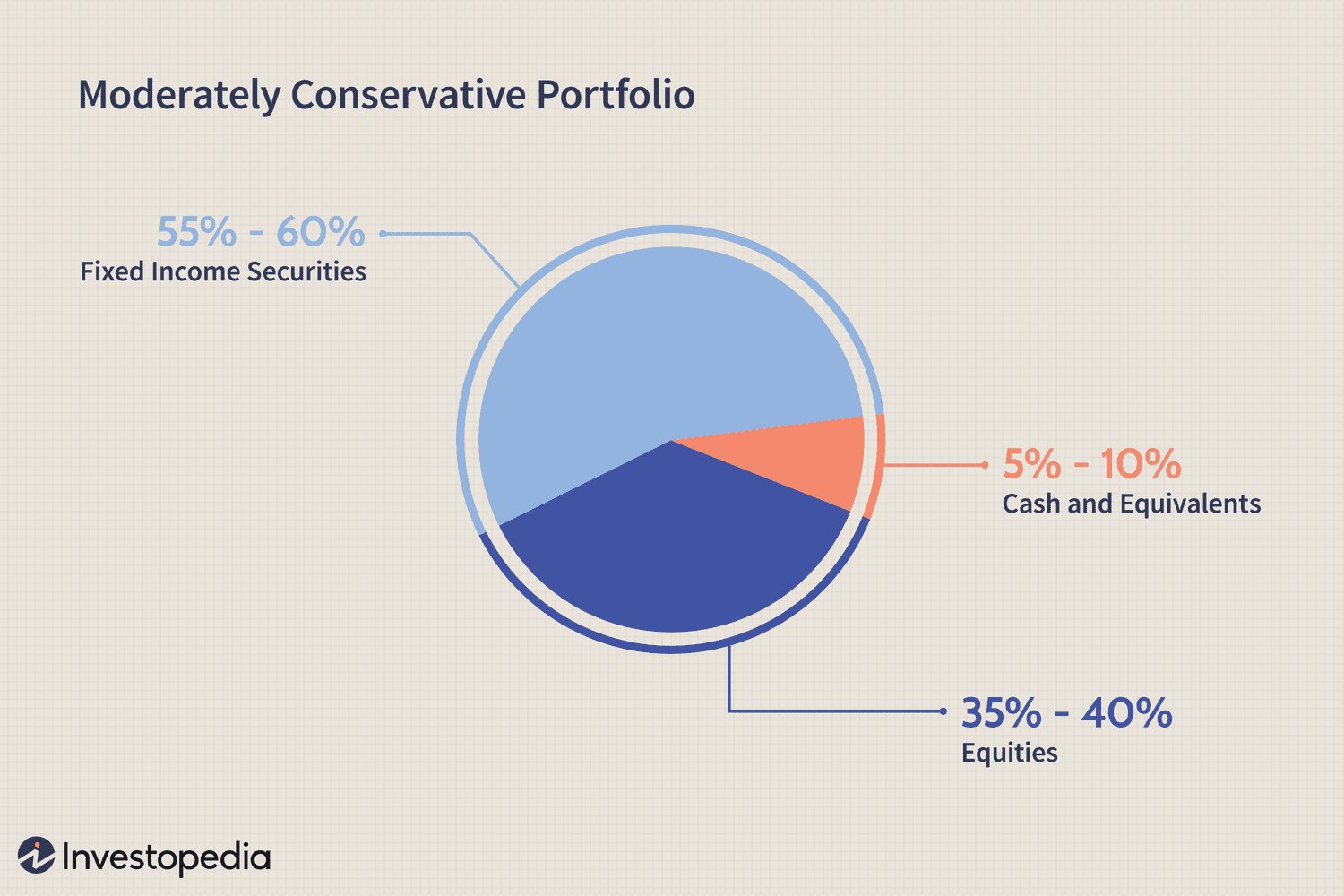

Preparing for unpaid maternity leave requires careful planning and budgeting. Here are some steps you can take:

1. What should I consider when creating a budget for unpaid maternity leave?

When creating a budget for unpaid maternity leave, consider your monthly expenses, such as rent/mortgage, utilities, groceries, insurance, and transportation. Prioritize necessities and identify areas where you can cut back temporarily.

2. Is it possible to save money in advance for maternity leave?

Yes, it is highly recommended to save money in advance for maternity leave. Start saving as soon as possible by setting aside a portion of your income each month. Consider opening a separate savings account specifically for this purpose.

3. Are there any government programs or benefits available for maternity leave?

In some countries, there may be government programs or benefits available to support individuals during maternity leave. Research the specific policies and regulations in your country to determine if you are eligible for any financial assistance.

4. Can I negotiate with my employer for paid maternity leave?

It is worth discussing the possibility of paid maternity leave with your employer. Some companies offer paid leave as part of their benefits package or may be open to negotiating a temporary arrangement to support you during your maternity leave.

5. Should I consider getting short-term disability insurance for maternity leave?

Short-term disability insurance can provide financial coverage during maternity leave if complications arise. Research the terms and conditions of various insurance policies and consult with a professional to determine if it is a suitable option for you.

6. How can I supplement my income during unpaid maternity leave?

Consider exploring alternative sources of income during unpaid maternity leave, such as freelance work, part-time remote jobs, or starting a small home-based business. These options can help supplement your finances during this period.

7. What financial resources or community support can I seek during unpaid maternity leave?

Look for local community resources or support groups that provide assistance for individuals on unpaid maternity leave. They may offer guidance, tips, and even financial aid to help you navigate this challenging time.

8. How can I manage my existing debts during unpaid maternity leave?

Prioritize your debts based on interest rates and minimum payment requirements. Contact your creditors to discuss the possibility of modifying payment plans or temporarily reducing payments during your maternity leave. Keeping open communication and seeking professional advice can help you manage your debts effectively.

Final Thoughts

Financially preparing for unpaid maternity leave is essential for expecting parents to ensure financial stability during this period. There are several strategies to consider, such as creating a budget, saving in advance, exploring additional sources of income, and understanding available benefits and entitlements. By carefully planning and prioritizing expenses, individuals can minimize financial stress and make the most of their time off. It is crucial to start the preparation early, researching and implementing these strategies to ensure a smooth transition into maternity leave without compromising financial well-being. So, when it comes to how to financially prepare for unpaid maternity leave, diligent planning and proactive steps are key.