Planning a wedding is an exciting time, but it can also be a financially daunting one. As a parent, you want to make sure your child’s special day is magical without breaking the bank. So, how can you financially prepare for your child’s wedding? In this article, we’ll walk you through practical steps and smart strategies to ensure you can support your child’s dreams while keeping your budget intact. From setting a realistic budget to exploring creative ways to save, we’ve got you covered. Let’s dive in and make your child’s wedding dreams come true!

How to Financially Prepare for Your Child’s Wedding

Weddings are joyous occasions, but they can also be expensive. Planning and financially preparing for your child’s wedding can help alleviate some of the stress and ensure that you can provide a memorable celebration without breaking the bank. In this article, we will explore various strategies and tips for financially preparing for your child’s wedding.

Create a Budget

Setting a budget is essential when it comes to financially preparing for your child’s wedding. It helps you determine how much you can afford to spend and acts as a roadmap for all the wedding expenses. Here’s how you can create a wedding budget:

- Assess your finances: Take a close look at your savings, income, and other financial obligations to determine how much you can allocate towards the wedding.

- Consult with your child: Sit down with your child and discuss their wedding expectations and priorities. This will help you set realistic budget limits.

- Break down the expenses: Categorize the wedding expenses into different segments, such as venue, catering, attire, decorations, photography, and transportation. Allocate a budget for each category based on your priorities.

- Research costs: Gather information about average wedding costs in your area. This will give you a better understanding of how much you need to budget for each category.

- Track your spending: As you start making payments and booking vendors, track your expenses to ensure you stay within your budget.

Start Saving Early

Preparing for your child’s wedding financially involves saving money well in advance. The earlier you start saving, the more you can accumulate in your wedding fund. Here are some tips to help you save for your child’s wedding:

- Create a separate wedding savings account: Open a dedicated savings account specifically for wedding expenses. This will help you keep track of your progress and prevent you from dipping into the funds for other purposes.

- Automate your savings: Set up automatic transfers from your main account to your wedding savings account. This way, you’ll consistently save without having to remember to do it manually.

- Cut back on unnecessary expenses: Look for areas in your budget where you can reduce spending. Consider cutting back on dining out, entertainment, or other non-essential items to save more for the wedding.

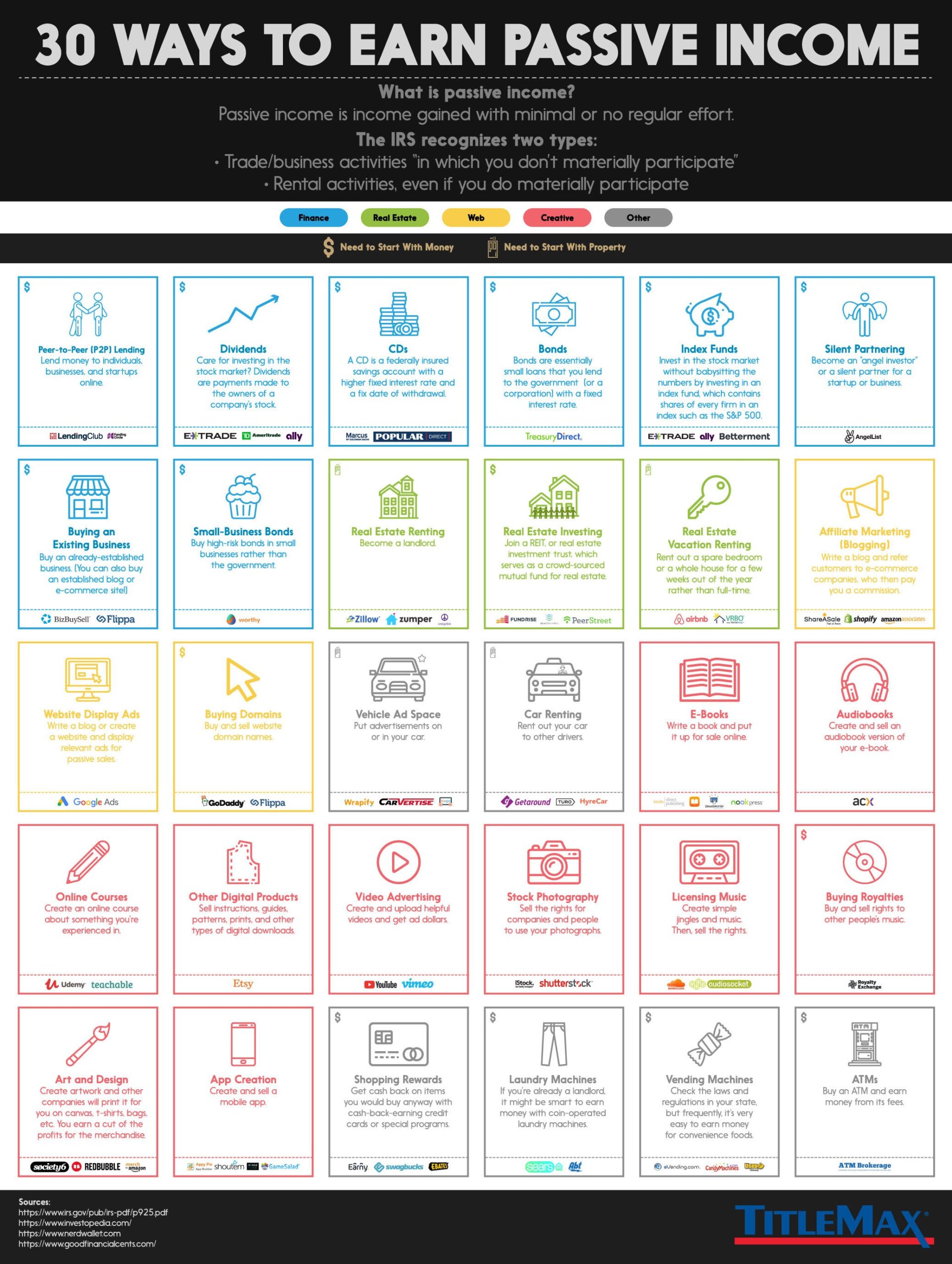

- Explore additional income sources: If possible, consider taking on a part-time job or freelance work to increase your income. This extra money can be directly allocated towards the wedding fund.

Research and Compare Vendors

Choosing the right vendors for your child’s wedding can make a significant difference in your overall expenses. Conduct thorough research and compare multiple vendors to find the best deals. Here’s what you can do:

- Get recommendations: Ask friends, family, or other recently married couples for vendor recommendations. Word-of-mouth referrals can help you find reliable vendors.

- Research online: Utilize wedding websites and forums to gather information about vendors in your area. Read reviews and ratings to assess their quality of service.

- Request quotes: Reach out to multiple vendors in each category and request price quotes. Make sure to provide them with the exact details of your requirements, so you receive accurate quotes.

- Compare prices and packages: Once you have received quotes from different vendors, compare their prices, packages, and inclusions. Look for any hidden costs and assess the value you will receive for the price.

- Negotiate: Don’t be afraid to negotiate with vendors. Sometimes they are willing to provide discounts or customize packages based on your budget.

Consider DIY and Creative Alternatives

Engaging in do-it-yourself (DIY) projects and exploring creative alternatives can be a cost-effective way to contribute to your child’s wedding. Here are some ideas:

- DIY decorations: Create handmade decorations or centerpieces for the wedding, which can save money while adding a personal touch.

- Borrow or rent items: Instead of purchasing expensive items that will only be used once, consider borrowing or renting them. This includes things like wedding attire, accessories, or even tableware.

- Engage friends and family: If you have friends or family members with specific skills or talents, consider asking for their help. They might be willing to offer their services as a wedding gift.

- Opt for non-traditional venues: Traditional wedding venues can be costly. Explore alternative options such as parks, community centers, or even your own backyard to reduce venue expenses.

Communicate Openly and Manage Expectations

Clear communication and managing expectations are crucial when it comes to financially preparing for your child’s wedding. Openly discuss budget constraints and set realistic expectations with your child and other family members involved. Here’s what you can do:

- Sit down with your child: Have an open and honest conversation with your child about the wedding budget. Discuss any limitations or compromises that need to be made and ensure everyone is on the same page.

- Involve all parties: If other family members or contributors are involved in the wedding expenses, ensure everyone is aware of the budget and their responsibilities.

- Prioritize what matters most: Work together with your child to identify their top priorities for the wedding. This will help you allocate the budget accordingly and focus on what truly matters.

- Be realistic and flexible: Understand that not everything may be possible within the budget. Stay flexible and open to alternatives that can still create a memorable experience without overspending.

By following these tips and strategies, you can effectively financially prepare for your child’s wedding. Remember that it’s important to prioritize what matters most to your child and celebrate their special day in a way that aligns with your financial capabilities. With proper planning and budgeting, you can create a beautiful and meaningful wedding experience without unnecessary financial stress.

Saving for your kid's WEDDING // Investing for your kids

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I financially prepare for my child’s wedding?

In order to financially prepare for your child’s wedding, it is important to plan ahead and establish a budget. Here are some steps you can take:

When should I start saving for my child’s wedding?

It is never too early to start saving for your child’s wedding. Ideally, you should start saving as soon as you can to give yourself enough time to accumulate the necessary funds.

What are some ways I can save money for my child’s wedding?

There are several ways you can save money for your child’s wedding, including:

Should I consider taking out a loan to cover my child’s wedding expenses?

While taking out a loan is an option, it is generally advisable to avoid going into debt for a wedding. It is better to save and plan ahead rather than relying on borrowed money.

How can I involve my child in the financial planning process for their wedding?

It is important to involve your child in the financial planning process for their wedding to ensure their expectations align with the budget. Some ways to involve them include:

Are there any potential hidden costs to consider when financially preparing for a wedding?

Yes, there can be hidden costs when financially preparing for a wedding. Some potential hidden costs to consider include:

What are some creative ways to cut costs for my child’s wedding?

There are various creative ways to cut costs for your child’s wedding. Here are a few ideas:

Is it appropriate to ask family members to contribute financially to my child’s wedding?

It is a personal decision whether or not to ask family members to contribute financially to your child’s wedding. However, if you do choose to ask for contributions, it is important to approach the topic with sensitivity and respect.

Final Thoughts

Preparing for your child’s wedding can be a financial challenge, but with careful planning, it is possible to navigate this milestone without breaking the bank. Start by setting a budget and saving ahead of time, prioritizing expenses that matter the most. Consider alternative options for venues, catering, and decorations that can help reduce costs. Additionally, explore creative ways to involve friends and family in the planning process, such as DIY projects or asking for their assistance instead of hiring professional services. By taking these steps and being proactive, you can financially prepare for your child’s wedding and create a memorable day without unnecessary stress.