If you’re facing the daunting challenge of recovering financially after a health crisis, you’re not alone. The road to recovery may seem overwhelming, but with the right strategies and a determined mindset, you can regain control of your finances and rebuild your life. In this article, I’ll guide you through practical and actionable steps on how to financially recover after a health crisis. Whether you’re dealing with medical bills, loss of income, or other financial setbacks, this comprehensive guide will provide you with the tools and insights you need to overcome these obstacles and pave the way towards a secure and stable future. Let’s dive in!

How to Financially Recover After a Health Crisis

The Financial Impact of a Health Crisis

A health crisis can have a significant impact on your finances, with medical bills, loss of income, and other unexpected expenses putting a strain on your budget. During this challenging time, it’s important to take proactive steps to recover financially. By following the strategies outlined below, you can regain control of your finances and work towards a secure financial future.

1. Assess Your Current Financial Situation

The first step in recovering financially after a health crisis is to assess your current financial situation. Take the time to evaluate your income, expenses, and debts. This will give you a clear picture of where you stand and help you identify areas where you can make adjustments to improve your financial health.

- Create a detailed budget that includes all your income sources and expenses. This will help you understand where your money is going and where you can potentially cut back.

- Review your medical bills and insurance coverage to ensure that you’re not overpaying for healthcare services. Look for any errors or discrepancies that can be disputed.

- Contact your creditors and explain the situation. They may be willing to work with you to create a more manageable payment plan while you recover financially.

2. Prioritize Your Expenses

During a financial recovery period, it’s crucial to prioritize your expenses and focus on the most essential ones. By doing so, you can ensure that you have enough money to cover your basic needs and start rebuilding your financial stability.

- Start by covering your basic necessities such as housing, utilities, and groceries. These should be the first items on your budget.

- Identify discretionary expenses that can be temporarily reduced or eliminated. This might include dining out, entertainment subscriptions, or non-essential shopping.

- Consider downgrading or negotiating lower rates for services such as cable or internet to reduce your monthly expenses.

3. Explore Additional Sources of Income

To recover financially after a health crisis, it may be necessary to explore additional sources of income. This can help offset the financial burden and provide some breathing room as you work towards rebuilding your finances.

- Look for part-time or freelance work that you can take on while you recover. This can be in-person or remote, depending on your health condition.

- Consider renting out a spare room in your home or using platforms like Airbnb to generate extra income.

- If your health allows, explore the possibility of returning to work or transitioning to a job that accommodates your current condition.

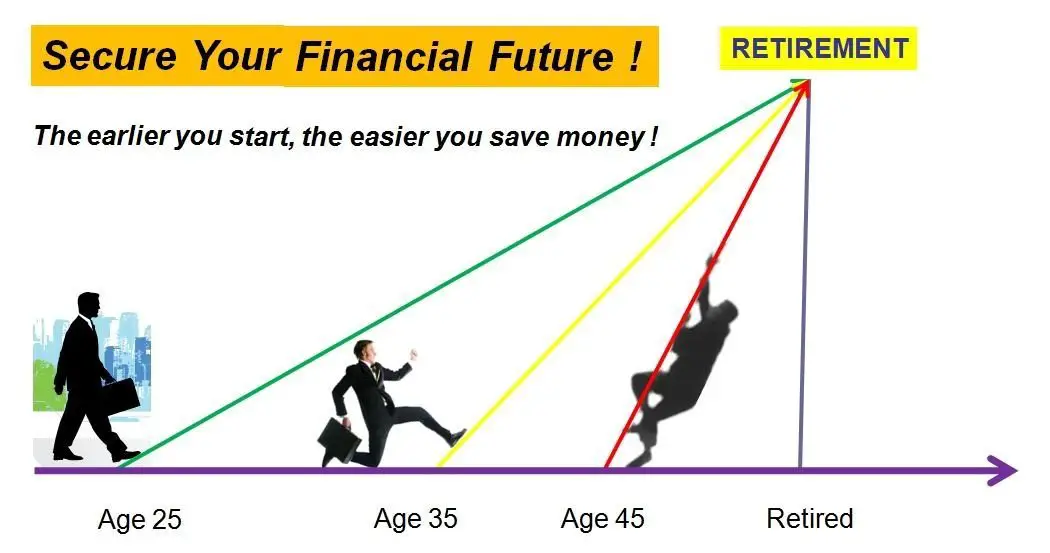

4. Build or Rebuild an Emergency Fund

Having an emergency fund is crucial to financial stability, especially after a health crisis. It provides a safety net for unexpected expenses and helps prevent future financial setbacks. If you don’t already have an emergency fund, now is the time to start building one. If your emergency fund was depleted during the health crisis, focus on rebuilding it as soon as possible.

- Start by setting aside a small portion of your income each month towards your emergency fund. Even a small amount can add up over time.

- Consider automating your savings by setting up automatic transfers from your checking account to your emergency fund.

- Look for ways to increase your savings by cutting back on unnecessary expenses or finding creative ways to save money.

5. Review and Adjust Your Insurance Coverage

After a health crisis, it’s important to review and adjust your insurance coverage to ensure that you’re adequately protected. This will help prevent future financial hardships in case of another unexpected health event.

- Review your health insurance policy to understand your coverage and any limitations.

- Consider adding supplemental insurance coverage such as disability insurance or critical illness insurance to protect against future financial risks.

- Shop around for insurance policies to ensure you’re getting the best coverage at the most affordable price.

6. Seek Financial Counseling or Assistance

If you’re struggling to recover financially after a health crisis, don’t hesitate to seek financial counseling or assistance. There are organizations and professionals who specialize in helping individuals navigate through challenging financial situations.

- Reach out to nonprofit credit counseling agencies that can provide guidance on managing debt and creating a sustainable financial plan.

- Consider meeting with a financial advisor who can help you develop a personalized recovery strategy based on your specific circumstances.

- Research government programs or grants that may offer financial assistance to individuals recovering from a health crisis.

Recovering financially after a health crisis can be a challenging journey, but with the right strategies and mindset, it’s possible to regain control of your finances. By assessing your current situation, prioritizing expenses, exploring additional income sources, building an emergency fund, reviewing insurance coverage, and seeking professional assistance if needed, you can overcome the financial obstacles caused by a health crisis and pave the way for a secure financial future. Remember, it’s important to be patient and persistent during this process, as financial recovery takes time.

Recovery from a mental illness IS possible. You CAN get better. You can turn your life around

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I financially recover after a health crisis?

After a health crisis, it is important to take certain steps to regain your financial stability. Here are some actions you can take:

1. What should I do if I have medical bills I can’t afford to pay?

If you can’t afford to pay your medical bills, you should reach out to the healthcare provider and explain your situation. They may be able to offer financial assistance or set up a payment plan based on your income and ability to pay.

2. Are there any government programs that can help with medical expenses?

Yes, there are government programs such as Medicaid and Medicare that provide healthcare coverage for individuals with low income or disabilities. You may be eligible for these programs depending on your specific circumstances.

3. How can I manage my daily living expenses if I am unable to work?

If you are unable to work due to a health crisis, you can explore options such as disability benefits, unemployment benefits, or social assistance programs. Additionally, creating a budget and cutting down on unnecessary expenses can also help manage your daily living expenses.

4. What should I do if I have accumulated debt during my health crisis?

If you have accumulated debt during a health crisis, it is important to prioritize your debts. Start by making a list of all outstanding debts and develop a plan to pay them off gradually. Consider contacting your creditors to negotiate payment plans or explore debt consolidation options.

5. How can I rebuild my savings after a health crisis?

To rebuild your savings after a health crisis, you can start by setting realistic financial goals. Allocate a portion of your income towards savings each month and consider automating the process by setting up automatic transfers to a savings account. Cut down on unnecessary expenses and explore ways to increase your income, such as freelancing or part-time work.

6. Should I consider reevaluating my insurance coverage?

Yes, it is advisable to reevaluate your insurance coverage after a health crisis. Assess your current health insurance plan and consider if it provides adequate coverage for potential future medical expenses. You may need to make adjustments or explore alternative insurance options to ensure you are adequately protected.

7. Is it a good idea to seek professional financial advice?

Yes, seeking professional financial advice can be beneficial after a health crisis. A financial advisor can help you assess your current financial situation, create a long-term recovery plan, and provide guidance on managing debts, investments, and insurance.

8. How can I protect myself from future financial crises related to health?

To protect yourself from future financial crises related to health, consider having an emergency fund in place. Save a portion of your income regularly to build a fund that can cover unexpected medical expenses. Additionally, maintaining a healthy lifestyle and investing in preventive care can help minimize the risk of future health issues.

Final Thoughts

After experiencing a health crisis, it is crucial to take proactive steps towards financial recovery. Firstly, reassess your budget and prioritize essential expenses. Consider negotiating medical bills and exploring financial assistance programs to alleviate the burden. Secondly, focus on rebuilding your emergency fund by trimming unnecessary expenses and increasing your income through part-time work or freelancing opportunities. Additionally, explore insurance options to protect against future health-related financial challenges. It is important to remember that financial recovery is a gradual process, so be patient and seek support from professionals and loved ones. By taking these proactive measures, you can begin to regain stability and overcome the financial setbacks caused by a health crisis.