Are you currently facing a career gap and wondering how to financially survive it? Well, fret not! In this article, we will delve into effective strategies to navigate through this period while keeping your finances in check. Whether you’re taking a break to pursue further education, raise a family, or simply recalibrate your career path, we’ve got you covered. Discover practical tips and actionable steps on how to financially survive a career gap, ensuring a smoother transition and a more secure financial future. So, let’s dive right in!

How to Financially Survive a Career Gap

Taking a career break can be a necessary and fulfilling choice, whether due to personal reasons, further education, or exploring new opportunities. However, the financial implications of a career gap can be a cause for concern. In this article, we will explore practical strategies and tips to help you financially survive a career gap and navigate this period of transition.

1. Assessing Your Financial Situation

Before diving into planning for a career gap, it’s crucial to assess your current financial situation. This assessment will help you determine how much money you have, your financial obligations, and how long you can sustain yourself without a regular income. Here are a few steps to get started:

- Calculate your existing savings and liquid assets.

- Review your monthly expenses and identify areas where you can cut back.

- Consider any outstanding debts or financial commitments.

By understanding your financial standing, you can create a realistic budget and make informed decisions about your career gap duration and possible adjustments to your lifestyle.

2. Create a Realistic Budget

Developing a budget is essential to ensure that your money is allocated wisely during your career gap. Consider the following steps:

- List all your essential expenses, such as rent/mortgage, utilities, groceries, transportation, and healthcare.

- Identify discretionary expenses that may be reduced or eliminated, such as dining out, entertainment, or subscription services.

- Allocate a portion of your budget for unexpected expenses, emergencies, and savings.

Creating a realistic budget will help you prioritize your spending and make necessary adjustments to align with your financial goals.

3. Explore Alternative Income Sources

While you may be taking a break from your traditional career, there are still opportunities to generate income and maintain financial stability during a career gap. Here are some potential alternative income sources to consider:

- Freelancing or consulting: Leverage your skills and expertise to offer services on a project basis.

- Part-time or temporary work: Look for flexible job opportunities that align with your interests and availability.

- Online platforms: Explore virtual marketplaces and platforms where you can sell products, teach classes, or offer professional services.

- Rent out assets: If you have unused space or possessions, consider renting them out to generate additional income.

By diversifying your income streams, you can reduce the financial strain of a career gap and maintain financial stability.

4. Maximize Your Existing Resources

During a career gap, it’s crucial to make the most of your existing resources to optimize your financial situation. Consider the following strategies:

- Unemployment benefits: Research if you are eligible for unemployment benefits or other government assistance programs.

- Health insurance coverage: Evaluate your health insurance options, such as staying on a partner’s plan, exploring COBRA benefits, or researching affordable alternatives.

- Retirement savings: Review the possibility of utilizing retirement savings options, such as loans or early withdrawals, but carefully consider the long-term impact.

- Scholarships and grants: If you are pursuing further education, research scholarships and grants to help offset the costs.

By leveraging these resources, you can alleviate some financial burden and make the most of the support available to you.

5. Network and Explore New Opportunities

While you may be taking a break from your primary career, it’s essential to network and explore new opportunities during your career gap. Building connections and staying engaged in your field can lead to potential income-generating opportunities. Consider the following:

- Attend industry events and conferences: Build relationships with professionals and stay updated on industry trends.

- Volunteering or internships: Gain new skills and experiences while expanding your network.

- Online communities: Engage with online communities and forums related to your field of interest.

- Professional development: Invest in courses or certifications to enhance your skills and make yourself more marketable.

By staying connected and actively seeking new opportunities, you can enhance your chances of generating income and making a smooth transition back into the workforce.

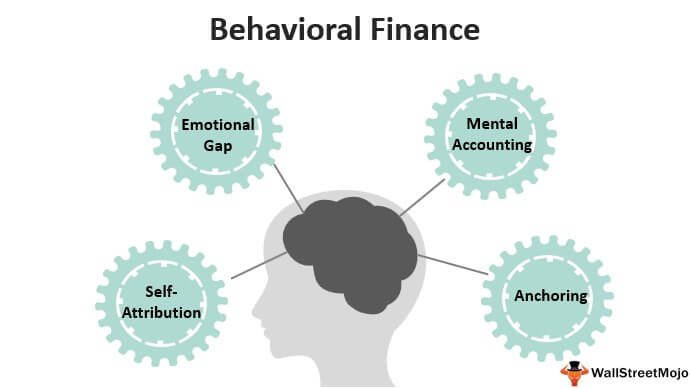

6. Prioritize Financial Health

A career gap provides an opportunity to focus on your overall financial health. While navigating this period, consider implementing the following financial practices:

- Emergency fund: Prioritize building an emergency fund to provide a safety net for unexpected expenses.

- Debt management: Create a plan to manage and reduce any outstanding debts during your career gap.

- Investment and savings: Explore investment options and continue saving for long-term financial goals.

- Financial education: Take advantage of free resources, books, and online courses to enhance your financial literacy.

By focusing on your overall financial well-being, you can ensure long-term stability and set yourself up for future success.

Surviving a career gap financially requires careful planning, resourcefulness, and adaptability. By assessing your financial situation, creating a realistic budget, exploring alternative income sources, maximizing existing resources, networking, and prioritizing financial health, you can successfully navigate this period of transition and come out stronger on the other side. Remember, financial survival is not just about making ends meet; it’s about building a solid foundation for a prosperous future.

How To Financially Survive A Break-Up!

Frequently Asked Questions

Frequently Asked Questions (FAQs)

Q: How can I financially survive a career gap?

A: During a career gap, there are several steps you can take to financially survive:

Q: What should I do before taking a career break to ensure financial stability?

A: Prior to taking a career break, it is important to:

Q: How can I create a budget to manage my finances during a career gap?

A: To create a budget during a career gap, follow these steps:

Q: Are there any government programs or assistance available for individuals experiencing a career gap?

A: Yes, there may be government programs or assistance available to help individuals during a career gap. Some options to explore include:

Q: What are some alternative sources of income I can consider during a career gap?

A: If you are experiencing a career gap, you could explore these alternative sources of income:

Q: Can I consider freelance or part-time work to support myself financially during a career gap?

A: Yes, freelance or part-time work can be a great option to support yourself financially during a career gap. Consider the following:

Q: Is it advisable to dip into my savings or retirement funds during a career gap?

A: It is generally not advisable to rely solely on savings or retirement funds during a career gap. However, if absolutely necessary, you can take the following precautions:

Q: How can I ensure a smooth transition back into my career after a gap?

A: To ensure a smooth transition back into your career after a gap, consider the following steps:

Final Thoughts

Financially surviving a career gap can be challenging, but with proper planning and strategy, it is possible to navigate through this period successfully. Start by creating a budget and cutting unnecessary expenses to manage your finances effectively. Explore alternative income sources such as freelancing or part-time jobs to supplement your finances during the gap. Utilize your savings wisely, and consider seeking financial assistance if needed. Additionally, stay active in your field by networking, upskilling, and volunteering to enhance your chances of securing a job once the gap is over. Remember, with careful financial planning and proactive measures, you can financially survive a career gap.