Are you looking for a way to navigate the stormy waters of a market downturn and protect your finances? Look no further! In this article, we will explore practical tips and strategies on how to financially survive a market downturn. Whether you’re an experienced investor or just starting out, these insights will provide you with the knowledge and tools needed to weather the storm. So, let’s dive in and discover how to safeguard your financial well-being amidst market uncertainties.

How to Financially Survive a Market Downturn

Introduction

Market downturns are an inevitable part of the economic cycle, and they can wreak havoc on personal finances. Just like the calming before a storm, it’s crucial to prepare yourself beforehand to minimize the impact and navigate through the challenging times. In this comprehensive guide, we’ll explore effective strategies and practical tips to help you financially survive a market downturn. From building a robust emergency fund to diversifying your investments, we’ll discuss all the essential steps you need to take to safeguard your financial well-being.

Understanding Market Downturns

Before we delve into the strategies to survive a market downturn, let’s first understand what it means. A market downturn, also known as a bear market, is a period of time when stock prices decline significantly. These downturns can be triggered by various factors, such as economic recessions, geopolitical uncertainties, or even changes in investor sentiments. Market downturns are often characterized by a general pessimistic outlook and a decrease in overall economic activity.

1. Building an Emergency Fund

Having a solid emergency fund is crucial to weathering the storm during a market downturn. An emergency fund is a pool of money set aside specifically to cover unexpected expenses or income disruptions. Here’s how you can build and manage your emergency fund effectively:

- Set a realistic savings goal: Aim to save at least 3-6 months’ worth of living expenses.

- Automate your savings: Set up automatic transfers from your primary account to a separate high-yield savings account.

- Cut back on non-essential expenses: Identify areas where you can reduce spending and allocate those savings towards your emergency fund.

- Monitor and replenish your fund: Always keep an eye on your emergency fund and replenish it whenever you dip into it.

2. Diversifying Your Investments

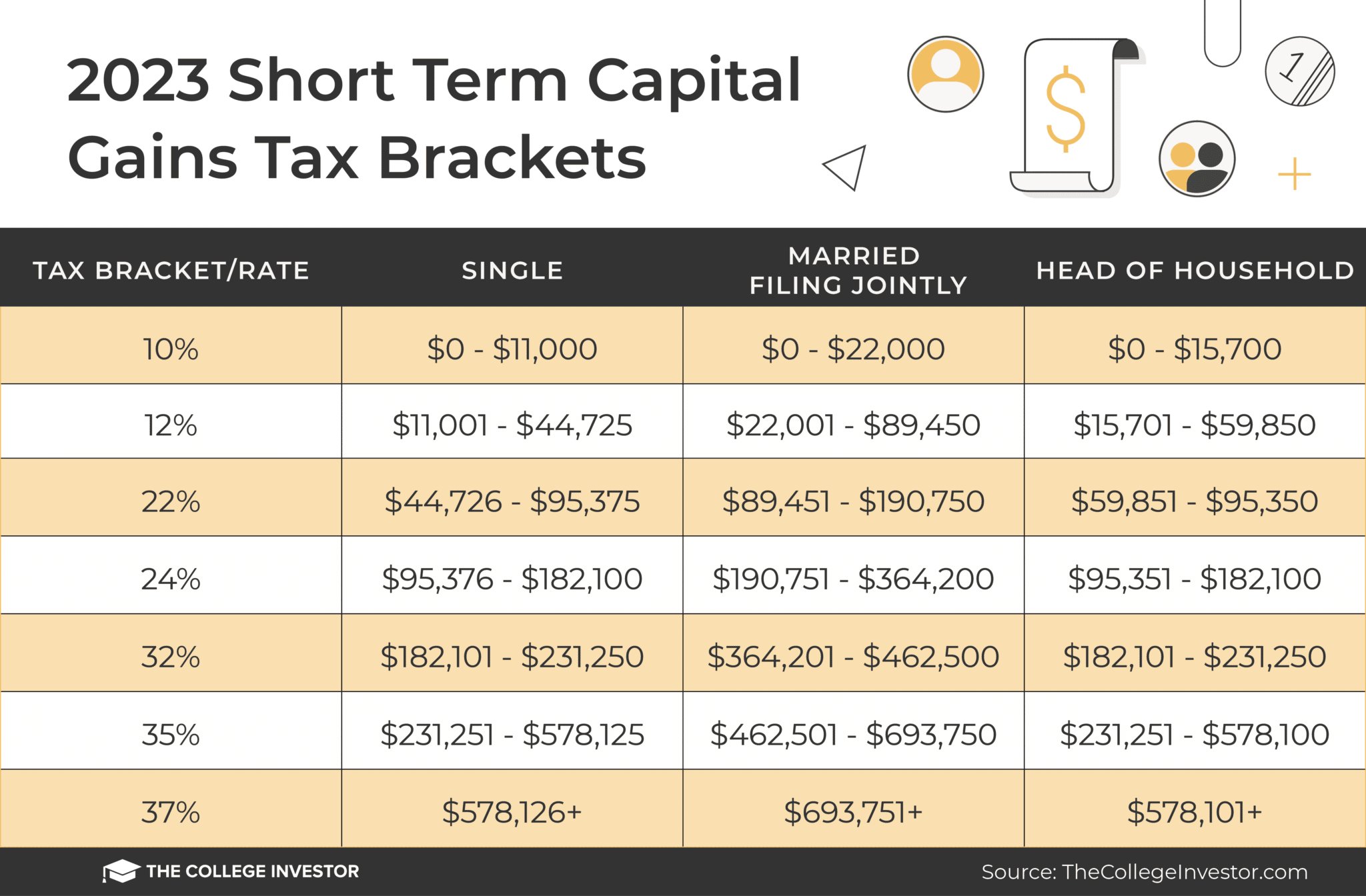

One of the key principles in surviving a market downturn is diversification. This strategy involves spreading your investment portfolio across different asset classes, sectors, and geographical regions. By diversifying, you minimize the potential impact of a single investment or sector’s poor performance. Here’s how you can diversify your investments effectively:

- Allocate across different asset classes: Consider investing in a mix of stocks, bonds, real estate, and even alternative investments like commodities or precious metals.

- Spread across sectors: Invest in companies from various sectors, such as technology, healthcare, finance, and consumer goods.

- Explore international markets: Consider investing in international stocks or funds to reduce exposure to a single country’s market.

- Rebalance your portfolio: Regularly review and rebalance your investments to maintain the desired asset allocation.

3. Avoid Emotional Investing

During a market downturn, emotions can run high, leading to impulsive investment decisions. It’s crucial to avoid emotional investing and stick to a well-thought-out strategy. Here are a few tips to help you stay calm and rational during turbulent times:

- Focus on the long-term: Remember that market downturns are temporary, and over the long run, markets tend to recover and grow.

- Don’t try to time the market: It’s nearly impossible to predict market movements accurately. Instead, stay invested and avoid panic selling.

- Consult a financial advisor: Seek guidance from a trusted financial advisor who can provide objective advice and help you stay focused on your long-term goals.

4. Reduce Debt and Manage Expenses

In times of economic uncertainty, minimizing debt and managing expenses become even more critical. Here are some steps you can take to reduce debt and control your spending:

- Create a budget: Track your income and expenses to gain a clear understanding of where your money is going. Identify areas where you can cut back.

- Pay off high-interest debt first: Prioritize paying off debts with high-interest rates, such as credit cards or personal loans.

- Consider refinancing loans: If interest rates are lower than what you’re currently paying, refinancing your loans can help reduce monthly payments.

- Avoid taking on new debt: During a market downturn, it’s best to avoid taking on new debts unless absolutely necessary.

5. Explore Additional Income Sources

Having multiple sources of income can provide a safety net during a market downturn. Here are a few ideas to generate additional income:

- Start a side hustle: Identify your skills or hobbies and explore ways to monetize them. This could include freelance work or starting a small business.

- Rent out assets: If you have extra space or assets like a spare room, a car, or even equipment, consider renting them out to generate passive income.

- Invest in dividend-paying stocks: Dividend stocks can provide a regular stream of income, even during market downturns.

- Explore part-time or remote work: Look for opportunities to work part-time or remotely to supplement your main source of income.

6. Stay Informed and Educate Yourself

Knowledge is power when it comes to navigating through a market downturn. Stay informed about current economic trends and financial news. Educate yourself on personal finance and investment strategies. Here are a few ways to stay informed and expand your knowledge:

- Follow reputable financial news sources: Read reliable financial publications, websites, and blogs to stay updated on market developments.

- Attend webinars and seminars: Many financial institutions and experts offer free webinars and seminars to help individuals navigate through market downturns.

- Read books on personal finance: There are plenty of informative books that can provide valuable insights and tips on managing your finances during difficult times.

- Join online communities: Engage with online communities or forums where you can learn from others’ experiences and share your knowledge.

Surviving a market downturn requires careful planning, discipline, and a long-term perspective. By building an emergency fund, diversifying your investments, avoiding emotional decisions, reducing debt, exploring additional income sources, and staying informed, you can navigate through the challenging times and safeguard your financial well-being. Remember, market downturns are part of the economic cycle, and with the right strategies in place, you can weather the storm and come out stronger on the other side.

A Recession Worse Than 2008? – How To Survive & Thrive The Next Economic Crisis | Peter Schiff

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I financially survive a market downturn?

During a market downturn, it is essential to take certain steps to protect your finances. First, evaluate your investments and consider diversifying your portfolio to minimize risks. Additionally, focus on long-term investing rather than short-term gains. It’s also wise to maintain an emergency fund to cover unexpected expenses during tough times.

2. What should I do with my investments during a market downturn?

When facing a market downturn, it’s generally recommended to avoid making impulsive decisions. Instead, consider consulting with a financial advisor who can assess your investments and provide guidance based on your financial goals. Typically, it is advisable to stay invested and ride out the downturn, as markets tend to recover over time.

3. Should I continue investing during a market downturn?

Continuing to invest during a market downturn can be a wise decision, especially if you have a long-term investment strategy. This approach allows you to take advantage of lower stock prices, potentially increasing your returns when the market eventually recovers.

4. What steps can I take to reduce financial stress during a market downturn?

To reduce financial stress during a market downturn, it’s crucial to focus on controlling what you can. This includes creating a budget to manage your expenses, cutting back on non-essential spending, and prioritizing debt repayment. Additionally, maintaining open communication with your loved ones about your financial situation can provide a support system during challenging times.

5. How can I protect my retirement savings during a market downturn?

Protecting your retirement savings during a market downturn requires a combination of patience and careful planning. To minimize losses, consider diversifying your retirement portfolio and adjusting your asset allocation based on your risk tolerance. It’s also essential to regularly review and rebalance your investments to ensure they align with your long-term goals.

6. What are some alternative investments I can consider during a market downturn?

During a market downturn, alternative investments that are less affected by stock market fluctuations can be worth considering. These may include bonds, real estate investment trusts (REITs), commodities, or even peer-to-peer lending platforms. However, it’s crucial to thoroughly research and understand the risks associated with these options before investing.

7. Is it a good time to buy stocks during a market downturn?

Buying stocks during a market downturn can present opportunities for long-term investors. However, it’s essential to carefully research and choose stocks of fundamentally sound companies with a strong track record. It is also recommended to invest gradually rather than making a lump-sum investment, which can help mitigate risks.

8. How long does a market downturn typically last?

The duration of a market downturn can vary widely and is influenced by various factors, such as the underlying economic conditions and the cause of the downturn. While some downturns may last a few months, others can extend for several years. It’s important to remember that historical data shows that markets have always recovered and eventually trended upward over the long term.

Final Thoughts

In conclusion, effective financial survival during a market downturn requires careful planning and strategic decision-making. First and foremost, cultivating a diversified investment portfolio is crucial, ensuring that your assets are not all dependent on a single sector or asset class. Secondly, building an emergency fund to cover essential expenses during uncertain times provides a safety net. Additionally, staying informed and educated about market trends and seeking professional financial advice can help navigate the complex landscape. By implementing these strategies and adapting to changes, individuals can enhance their ability to weather market downturns and protect their financial well-being successfully. So, when it comes to how to financially survive a market downturn, proactive preparation and prudent decision-making are key.