Are you caught in the never-ending cycle of payday loans, desperately seeking a way out? Well, look no further! In this article, we will guide you on how to break free from the payday loan trap and regain control of your finances. Breaking the cycle can be challenging, but with a strategic plan and a determination to succeed, you can overcome this burden. So, let’s dive into the practical steps you can take to escape the clutches of a payday loan cycle once and for all.

How to Get Out of a Payday Loan Cycle

Introduction

Payday loans can offer quick cash in times of financial need, but they often come with high interest rates and fees. This can easily trap borrowers in a cycle of debt, where they are constantly taking out new loans to repay the old ones. If you find yourself caught in this payday loan cycle, it’s important to take action and break free from the cycle. In this article, we will explore various strategies and steps you can take to get out of a payday loan cycle and regain control over your finances.

Understanding the Payday Loan Cycle

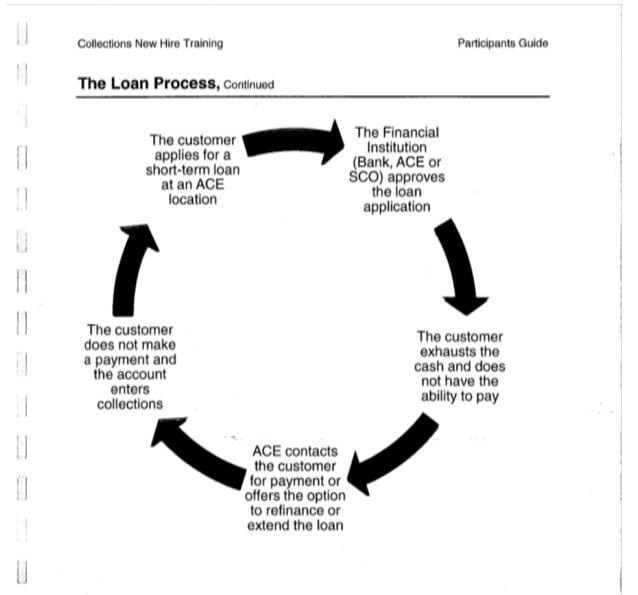

Before we dive into the steps to break free from the payday loan cycle, let’s take a closer look at how this cycle typically works. Payday loans are designed to be short-term loans, meant to be repaid within a few weeks. However, due to their high interest rates and fees, many borrowers find it difficult to pay off the loan in full by the due date. As a result, they often end up renewing or rolling over the loan, incurring additional fees and interest charges.

The payday loan cycle tends to follow this pattern:

1. Borrower takes out a payday loan to cover an immediate financial need.

2. Borrower fails to repay the loan in full by the due date.

3. Lender offers an option to roll over the loan, extending the repayment period.

4. Borrower pays a fee to roll over the loan, but still cannot repay the full amount.

5. The cycle continues, with the borrower taking out new loans to repay the old ones, accumulating more debt in the process.

Assess Your Financial Situation

To break free from the payday loan cycle, it’s essential to start by assessing your current financial situation. This will help you understand where your money is going, identify any unnecessary expenses, and create a realistic budget. Here are some steps you can take:

1. Track Your Income and Expenses

Start by tracking your income and expenses for a month. Make note of every dollar you earn and every dollar you spend. This will give you a clear picture of your spending habits and where you can potentially make changes.

2. Analyze Your Spending

Once you have tracked your income and expenses, take a close look at your spending patterns. Identify any non-essential expenses that you can cut back on or eliminate completely. This could include dining out, entertainment subscriptions, or impulse purchases.

3. Create a Budget

Based on your income and expenses analysis, create a realistic budget that prioritizes essential expenses such as rent, utilities, groceries, and transportation. Allocate a certain amount towards debt repayment, including your payday loans.

Contact Your Lenders

Once you have a clear understanding of your financial situation, it’s time to reach out to your payday loan lenders. Communication is key in breaking free from the payday loan cycle. Here’s what you can do:

1. Assess Loan Terms and Repayment Options

Review the terms and conditions of your payday loans to understand the repayment options available to you. Some lenders may offer extended repayment plans or debt consolidation options. Assess the feasibility of these options based on your budget and financial capabilities.

2. Negotiate with Lenders

Contact each payday loan lender and explain your financial situation. Be honest about your inability to repay the loans in full and propose a repayment plan that fits your budget. Request a lower interest rate or waiver of additional fees to make repayment more manageable.

3. Consider Debt Consolidation

If negotiating with individual lenders proves challenging, consider consolidating your payday loans into a single loan with a lower interest rate. Debt consolidation can simplify your repayment process by combining all your debts into one monthly payment.

Explore Alternative Financing Options

Breaking free from the payday loan cycle may require exploring alternative financing options. Here are a few alternatives to consider:

1. Personal Loan

If you have a good credit score, you may qualify for a personal loan from a bank or credit union. Personal loans often come with lower interest rates and longer repayment terms, making them a viable option to pay off your payday loans.

2. Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers with individual investors willing to lend money. These loans often have more flexible terms and lower interest rates compared to payday loans. However, they may still require a credit check and a stable income.

3. Credit Counseling

Consider seeking help from a nonprofit credit counseling agency. They can provide guidance on managing debt, creating a budget, and negotiating with creditors. Credit counselors can also help you develop a debt management plan to repay your payday loans and other debts.

Implement Financial Strategies

To break free from the payday loan cycle, it’s crucial to implement sound financial strategies. Here are a few strategies to consider:

1. Build an Emergency Fund

Establishing an emergency fund can provide a financial cushion and prevent future reliance on payday loans. Start by setting aside a small amount each month until you have saved enough to cover unexpected expenses.

2. Increase Your Income

Explore opportunities to increase your income, such as taking on a part-time job or freelancing. The additional income can be used to pay off your payday loans faster and reduce your reliance on them in the future.

3. Seek Financial Education

Educate yourself on personal finance and money management. Attend workshops, read books, or take online courses to improve your financial literacy. The more you know about managing money, the better equipped you’ll be to break free from the payday loan cycle and maintain financial stability.

Breaking free from a payday loan cycle is not an easy task, but with determination, discipline, and a thorough understanding of your financial situation, you can regain control over your finances. Assess your financial situation, communicate with your lenders, explore alternative financing options, and implement sound financial strategies. Remember, seeking help from credit counselors or financial experts is always a wise decision. By taking these steps, you can pave the way towards a debt-free future and financial well-being.

8 Ways to Get Out of a Bad Payday Loan

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I break out of the payday loan cycle?

To break out of the payday loan cycle, you can follow these steps:

- 1. Evaluate your current financial situation.

- 2. Create a realistic budget to prioritize expenses.

- 3. Contact your payday lender to discuss repayment options.

- 4. Consider debt consolidation or personal loans as alternatives.

- 5. Seek financial counseling for guidance and support.

2. What are the consequences of being trapped in a payday loan cycle?

If you find yourself trapped in a payday loan cycle, you may face the following consequences:

- 1. High interest rates and additional fees.

- 2. Negative impact on credit score.

- 3. Continuous debt accumulation.

- 4. Difficulty meeting other financial obligations.

- 5. Increased financial stress and emotional burden.

3. Can I negotiate with payday lenders to reduce my debt?

Yes, it is possible to negotiate with payday lenders to reduce your debt. You can contact your lender to discuss repayment options or request a payment plan that suits your financial situation. It’s important to communicate openly and honestly with your lender to find a mutually beneficial solution.

4. Should I consider debt consolidation to get out of a payday loan cycle?

Debt consolidation can be a helpful option to break free from the payday loan cycle. By combining multiple debts into a single loan with a lower interest rate, you can simplify your repayment process and potentially save money. However, it’s important to thoroughly research and consider the terms and conditions of the consolidation loan before making a decision.

5. How long does it usually take to get out of a payday loan cycle?

The time it takes to break out of a payday loan cycle varies depending on individual circumstances. It can take weeks, months, or even longer to fully repay the debt and regain financial stability. It’s crucial to stay committed to your repayment plan and actively work towards your goal of becoming debt-free.

6. Can I get professional help to get out of a payday loan cycle?

Absolutely. Seeking professional help, such as financial counseling services, can provide valuable guidance and support in getting out of a payday loan cycle. These professionals can assist you in creating a realistic budget, negotiating with lenders, exploring debt relief options, and developing a long-term financial plan.

7. Are there any alternatives to payday loans?

Yes, there are alternatives to payday loans that can help you avoid getting trapped in a cycle of debt. Some alternatives include:

- 1. Personal loans from banks or credit unions.

- 2. Borrowing from family or friends.

- 3. Credit card cash advances (if used responsibly).

- 4. Exploring government assistance programs.

8. How can I prevent myself from falling into the payday loan cycle again?

To prevent falling into the payday loan cycle again, you can take the following proactive steps:

- 1. Build an emergency fund to cover unexpected expenses.

- 2. Improve your financial literacy and money management skills.

- 3. Establish a budget and stick to it.

- 4. Avoid unnecessary debt and live within your means.

- 5. Explore other credit options before resorting to payday loans.

Final Thoughts

To break free from the payday loan cycle, take these steps: 1. Assess your financial situation honestly and create a budget. 2. Prioritize your debts and create a repayment plan. 3. Consider debt consolidation or negotiation to lower interest rates. 4. Explore alternative sources of income or seek financial assistance. 5. Avoid taking out new payday loans. 6. Stay committed to your repayment plan and track your progress regularly. By implementing these strategies and being proactive, you can successfully escape the payday loan cycle and regain control of your finances. Don’t let payday loans continue to burden you; take action and get out of the cycle today.