Losing a job can be a challenging and overwhelming experience. Suddenly, your regular source of income vanishes, leaving you questioning how to handle finances after losing a job. But worry not! In this article, we will guide you through practical steps and effective strategies to navigate this difficult situation. From budgeting wisely to exploring alternative income sources, we’ve got you covered. Let’s dive right in and discover how to handle finances after losing a job, ensuring a more secure and stable financial future.

How to Handle Finances After Losing a Job

Introduction

Losing a job can be a challenging and stressful experience. Apart from the emotional toll, it also brings financial uncertainty. However, with proper planning and smart financial management, you can navigate this difficult period and regain stability. In this article, we will provide you with practical strategies and advice on how to handle your finances after losing a job.

Create a Budget

One of the first steps you should take after losing a job is to create a realistic budget. This will help you assess your financial situation and identify areas where you can cut back on expenses. Here’s how to go about it:

1. Evaluate Your Income and Expenses

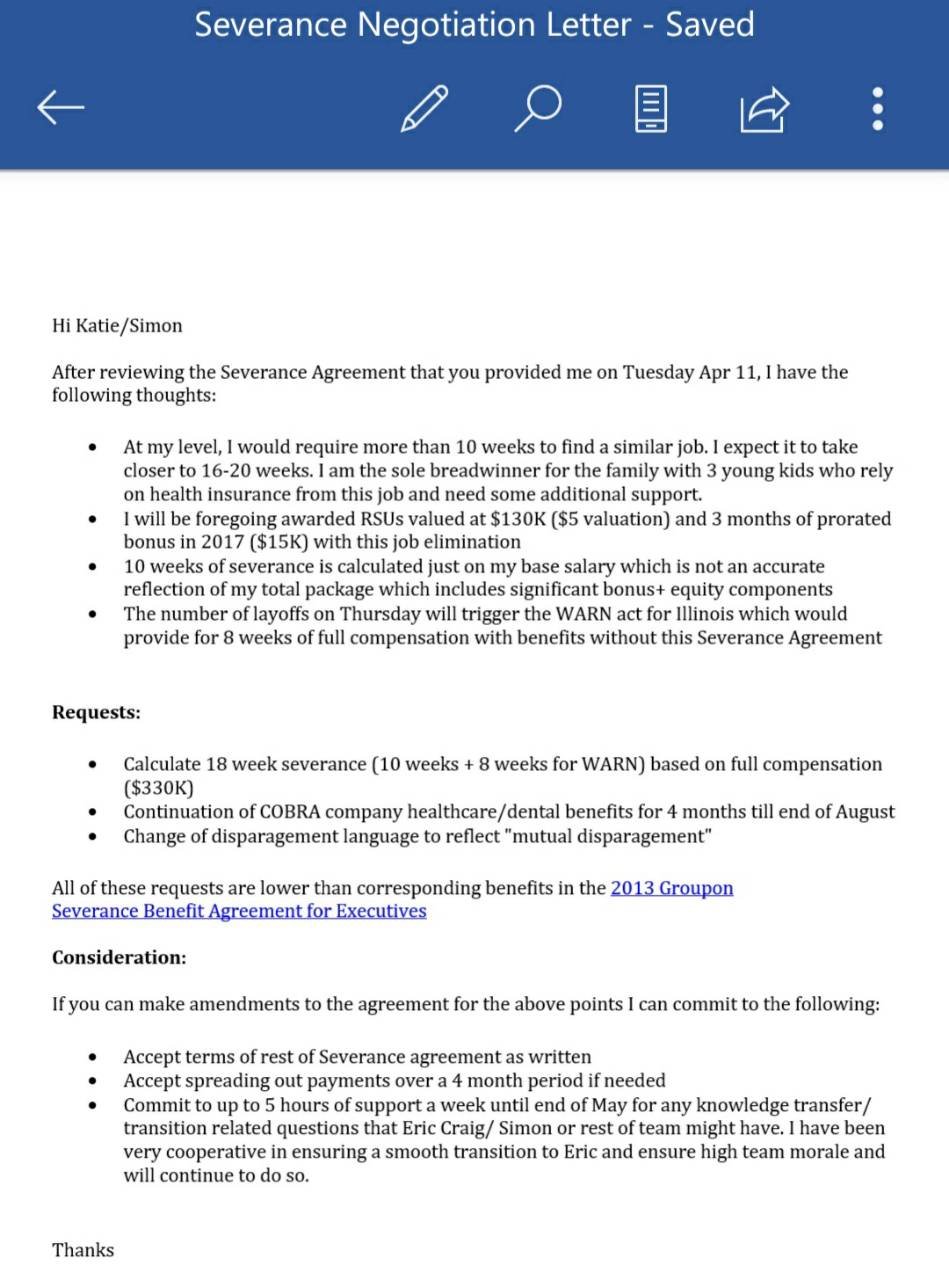

Start by listing all your sources of income, such as unemployment benefits, severance packages, or savings. Then, make a comprehensive list of your monthly expenses, including rent or mortgage payments, utilities, groceries, transportation costs, and any outstanding debts.

2. Prioritize Essential Expenses

Once you have identified your expenses, categorize them into essential and non-essential. Essential expenses are those you cannot live without, such as housing, utilities, and food. Non-essential expenses include entertainment, dining out, and subscriptions. Prioritize your essential expenses to ensure they are covered first.

3. Reduce Non-Essential Expenses

Look for areas where you can cut back on non-essential expenses. Consider canceling or downgrading subscriptions, eating out less frequently, and finding alternative ways to entertain yourself that don’t require spending money. Every little saving can add up and help stretch your resources during this time.

4. Negotiate with Creditors

If you have outstanding debts, contact your creditors and explain your situation. Many lenders offer hardship programs or temporary relief options that can lower your monthly payments or interest rates. Take advantage of these programs to ease your financial burden while you search for new employment.

Explore Financial Assistance Programs

During unemployment, you may be eligible for various financial assistance programs that can provide temporary support. Here are some options to consider:

1. Unemployment Benefits

Depending on your country and state, you may be entitled to unemployment benefits. These benefits are designed to provide financial assistance to individuals who have lost their job through no fault of their own. Check with your local unemployment office to understand the eligibility criteria and application process.

2. Government Assistance Programs

Government assistance programs can provide additional support during this difficult time. These programs vary by region but may include food assistance, healthcare subsidies, rental assistance, or utility bill discounts. Research and find out what programs you may qualify for and how to apply.

3. Non-Profit Organizations

Non-profit organizations and charities often offer financial aid to individuals facing unemployment. They may provide assistance with basic needs, such as food, clothing, and housing. Research local organizations in your area and reach out to them for support.

Optimize Your Job Search

Finding a new job is crucial to regaining financial stability. To maximize your chances of success, consider the following strategies:

1. Update Your Resume and Online Profiles

Tailor your resume to highlight your skills and experience relevant to the positions you are applying for. Be sure to update your LinkedIn profile and other online platforms to showcase your professional background. Use keywords and phrases commonly used in your industry to increase your visibility to potential employers.

2. Network

Reach out to your professional network for job leads and recommendations. Attend industry events, join professional associations, and connect with people in your field. Networking can open doors to hidden job opportunities and help you stand out from other candidates.

3. Expand Your Skill Set

Consider using your time between jobs to acquire new skills or enhance existing ones. Take online courses, attend workshops, or pursue certifications that are relevant to your industry. This not only increases your value as a job candidate but also shows potential employers your dedication to professional growth.

4. Be Open to New Opportunities

While it’s important to focus on finding a job in your field, be open to exploring new opportunities outside your comfort zone. Consider temporary or part-time employment while you search for a permanent position. This can provide a steady income stream and help bridge the gap until you secure a job in your desired field.

Manage Your Debt

When you lose a job, managing your debt becomes crucial to maintaining financial stability. Here are some strategies to help you handle your debt successfully:

1. Prioritize Debt Payments

Evaluate your outstanding debts and prioritize them based on interest rates and penalties. Focus on paying off high-interest debts first, as they can quickly accumulate and become even more challenging to manage. Make minimum payments on all debts to avoid penalties and allocate any extra funds towards the debt with the highest interest rate.

2. Contact Creditors for Assistance

If you struggle to make debt payments, it’s important to contact your creditors and explain your situation. They may be willing to work out a temporary payment plan or offer alternative arrangements. Ignoring your debts will only exacerbate the problem, so open communication is essential.

3. Explore Debt Consolidation or Refinancing

Debt consolidation or refinancing can help simplify your debt payments and potentially lower your interest rates. Consolidating multiple debts into a single loan or refinancing existing loans may result in more manageable monthly payments. However, be cautious and thoroughly research the terms and conditions before pursuing this option.

4. Seek Professional Help if Needed

If your debt situation feels overwhelming, consider reaching out to a credit counseling agency or financial advisor. They can provide expert guidance on managing your debts, negotiating with creditors, and developing a personalized debt repayment plan. Professional help can relieve stress and ensure you make informed decisions about your finances.

Losing a job can be a distressing experience, but with careful planning and proactive financial management, you can weather the storm. By creating a budget, exploring financial assistance programs, optimizing your job search, and managing your debt, you can regain control of your finances and set a solid foundation for future success. Remember, this period may be temporary, and with resilience and determination, you can bounce back stronger than ever.

Make Budget Cuts With Me After Job Loss

Frequently Asked Questions

Frequently Asked Questions (FAQs)

Q: How can I handle my finances after losing a job?

A: After losing a job, it’s important to take immediate action to manage your finances effectively. Here are some steps you can take:

Q: What should I do if I lose my job?

A: If you lose your job, it’s essential to assess your financial situation and create a budget. Cut unnecessary expenses, prioritize necessary payments, and consider applying for unemployment benefits if eligible.

Q: How can I reduce my spending during this time?

A: To minimize your expenses, consider cutting back on non-essential items, such as dining out or entertainment. Look for ways to save on essential costs, like groceries and utilities, by comparing prices and using coupons or discounts.

Q: Should I dip into my savings after losing my job?

A: It’s generally advisable to use your savings as a last resort. However, if you have an emergency fund, it can help cover essential expenses until you find a new job. Assess your financial situation carefully before deciding to use your savings.

Q: How can I generate extra income while unemployed?

A: Explore alternative sources of income, such as freelance work, part-time jobs, or gig economy opportunities. You can also consider selling unused items or offering services in your area of expertise.

Q: Is it possible to negotiate or lower my monthly bills?

A: Yes, it’s worth reaching out to your service providers to negotiate lower rates or explore more affordable options. They may offer temporary relief or suggest alternative payment plans that suit your current financial situation.

Q: How can I manage my debt after losing a job?

A: If you have debt, contact your creditors and explain your situation. They may be able to offer temporary relief options such as reduced payments or interest rates. Creating a debt repayment plan based on your new financial circumstances is crucial.

Q: What government assistance programs are available for the unemployed?

A: Government assistance programs like unemployment benefits and food stamps can provide temporary financial support. Research and apply for programs that you may be eligible for to ease the burden while you search for a new job.

Q: How can I maintain a positive mindset during this difficult financial phase?

A: Losing a job can be challenging, but maintaining a positive mindset is important. Focus on your strengths, set realistic goals, and surround yourself with a supportive network. Taking care of your mental and physical well-being is crucial during this time.

Final Thoughts

Handling finances after losing a job can be challenging, but with careful planning and proactive steps, it is possible to navigate this difficult situation. The first step is to assess your current financial situation and create a realistic budget. Cut back on unnecessary expenses and prioritize essential bills. Explore potential sources of income, such as freelancing or part-time work, to supplement your savings. Consider applying for unemployment benefits or seeking financial assistance programs. It’s crucial to communicate with lenders and creditors to discuss possible payment arrangements or deferments. Finally, explore opportunities to enhance your skills and network to increase your chances of finding a new job. By taking these proactive measures, you can effectively handle finances after losing a job.