Looking to invest in tax-free bonds? Look no further! In this article, we will guide you through the process of investing in tax-free bonds, helping you make informed decisions to maximize your returns. Wondering about the benefits and mechanics of tax-free bonds? Curious about the risks involved? We’ve got you covered. Whether you’re a seasoned investor or new to the world of bonds, we’ll walk you through the steps to ensure you can confidently navigate the world of tax-free bonds and make the most of your investment. Let’s get started on your journey to financial success!

How to Invest in Tax-Free Bonds

Investing in tax-free bonds can be a smart way to earn income while minimizing your tax liability. Tax-free bonds, also known as municipal bonds, are issued by state and local governments to fund public projects. These bonds offer many advantages, including tax-free interest payments and the potential for steady income. If you’re interested in investing in tax-free bonds, this guide will provide you with the information you need to get started.

What Are Tax-Free Bonds?

Tax-free bonds are debt instruments issued by state and local governments. These bonds are used to finance various projects, such as building schools, hospitals, roads, and other public infrastructure. When you invest in a tax-free bond, you are essentially lending money to the government entity that issued the bond. In return, the government pays you interest on the bond, typically semi-annually, until the bond matures.

The main advantage of tax-free bonds is that the interest payments you receive are exempt from federal income taxes. In some cases, the interest may also be exempt from state and local taxes, depending on where you live and the bond issuer. This tax advantage makes tax-free bonds an attractive investment option for individuals in higher tax brackets who are looking to minimize their tax liability.

Types of Tax-Free Bonds

Tax-free bonds can be categorized into two main types: general obligation bonds and revenue bonds.

1. General Obligation Bonds

General obligation bonds are backed by the full faith and credit of the issuing government entity. This means that the government pledges its taxing power to repay the bondholders. These bonds are considered less risky because they are backed by the government’s ability to raise taxes if necessary. However, they may offer a lower interest rate compared to revenue bonds.

2. Revenue Bonds

Revenue bonds are backed by the revenue generated by a specific project or source. For example, a revenue bond may be issued to finance a toll road, and the bond repayment will come from the tolls collected on that road. The interest rates on revenue bonds are typically higher than general obligation bonds because they carry a higher level of risk. The bondholders rely on the success of the project to receive their interest payments and principal repayment.

Benefits of Investing in Tax-Free Bonds

Investing in tax-free bonds can offer several benefits:

- Tax advantages: The most significant benefit of tax-free bonds is the tax-free interest payments. This can help you keep more of your investment income and potentially lower your overall tax liability.

- Steady income: Tax-free bonds typically offer a fixed interest rate, providing you with a steady income stream. This can be especially appealing for retirees or individuals seeking a predictable cash flow.

- Lower risk: Tax-free bonds issued by government entities are generally considered less risky compared to corporate bonds. This is because governments have the power to raise taxes, which enhances their ability to repay their debt obligations.

- Portfolio diversification: Adding tax-free bonds to your investment portfolio can help diversify your holdings. Bonds tend to have a lower correlation with stocks, which can potentially reduce the overall volatility of your portfolio.

How to Invest in Tax-Free Bonds

To invest in tax-free bonds, follow these steps:

1. Determine your investment goals and risk tolerance

Before investing in tax-free bonds, it’s important to assess your investment goals and risk tolerance. Consider your financial objectives, time horizon, and comfort level with market fluctuations. Understanding your investment profile will help you determine the appropriate allocation of tax-free bonds in your portfolio.

2. Research various bond issuers

Once you’ve established your investment goals, research different bond issuers to find suitable options. Municipal bonds are issued by various state and local governments, and each issuer may have different credit ratings and interest rates. Consider factors such as the financial stability of the issuer, the purpose of the bond, and the interest rate offered.

3. Evaluate bond ratings

Credit ratings provide an assessment of a bond issuer’s ability to repay its debt obligations. Ratings are assigned by independent credit rating agencies, such as Standard & Poor’s, Moody’s, and Fitch. Bonds with higher credit ratings indicate a lower default risk but may offer lower interest rates. Evaluate the credit ratings of the bonds you’re considering to make an informed investment decision.

4. Determine the bond maturity

Tax-free bonds have a specific maturity date, which is the date when the principal amount is repaid to the bondholder. Bond maturities can range from a few months to several decades. Consider your investment horizon and financial needs when selecting bonds with different maturities. Shorter-term bonds provide quicker access to your investment principal, while longer-term bonds offer potentially higher interest rates.

5. Calculate potential tax savings

Estimate the potential tax savings from investing in tax-free bonds. Compare the tax-free interest rate offered by the bond to the taxable interest rate of a similar bond. Calculate the tax-equivalent yield to determine the taxable interest rate that would provide the same after-tax return as the tax-free bond. This comparison can help you assess the tax benefits of investing in tax-free bonds.

6. Place an order through a broker

To invest in tax-free bonds, you’ll need a brokerage account. Choose a reputable brokerage firm that offers a wide selection of tax-free bonds. Consult with your broker to discuss your investment goals and the specific bonds you’re interested in. Place an order to purchase the bonds, taking into consideration factors such as the minimum investment amount and any transaction fees.

7. Monitor your investments

Once you’ve invested in tax-free bonds, it’s essential to monitor your investments regularly. Stay updated on the financial health of the bond issuers and any changes in credit ratings. Keep track of interest payments and ensure that they are credited to your account correctly. Regularly reviewing your investment portfolio will help you make informed decisions about holding or selling your tax-free bonds.

Remember that investing in any security, including tax-free bonds, carries risks. The value of bonds can fluctuate based on changes in interest rates and the creditworthiness of the issuer. It’s always advisable to consult with a financial advisor before making any investment decisions.

In conclusion, tax-free bonds offer an attractive investment option for individuals seeking steady income and tax advantages. By conducting thorough research, evaluating bond issuers and ratings, and understanding your investment goals, you can make informed decisions to invest in tax-free bonds. Keep in mind the potential tax savings and regularly monitor your investments to maximize the benefits of this investment strategy.

Ultimate Guide to Tax Free Investments

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are tax-free bonds?

Tax-free bonds are issued by government-backed entities to raise funds for various projects. The interest income earned from these bonds is exempt from income tax, making them an attractive investment option for individuals seeking tax-free returns.

How can I invest in tax-free bonds?

To invest in tax-free bonds, you can follow these steps:

1. Identify the issuing authority: Check for government entities or infrastructure companies that issue tax-free bonds.

2. Open a demat account: If you don’t have one, open a dematerialized account with a registered depository participant.

3. Choose the right bond: Research and select the tax-free bond issuer that suits your investment goals and risk appetite.

4. Place an order: Contact your broker or use an online trading platform to place an order for the tax-free bonds you wish to invest in.

5. Provide necessary documents: Submit the required documents, such as KYC details and investment application form, as per the instructions provided by the issuer or broker.

6. Make the payment: Transfer the investment amount to the designated account. Payment methods could include net banking, NEFT, RTGS, or cheque.

7. Receive allotment and holding statement: Once your investment is allocated, you will receive an allotment advice and holding statement from the issuer.

What is the minimum investment amount for tax-free bonds?

The minimum investment amount for tax-free bonds may vary depending on the issuer. It is advisable to check the specific details provided by the issuing authority or the financial institution through which you plan to invest. Generally, the minimum investment amount can range from Rs. 1,000 to Rs. 10,000.

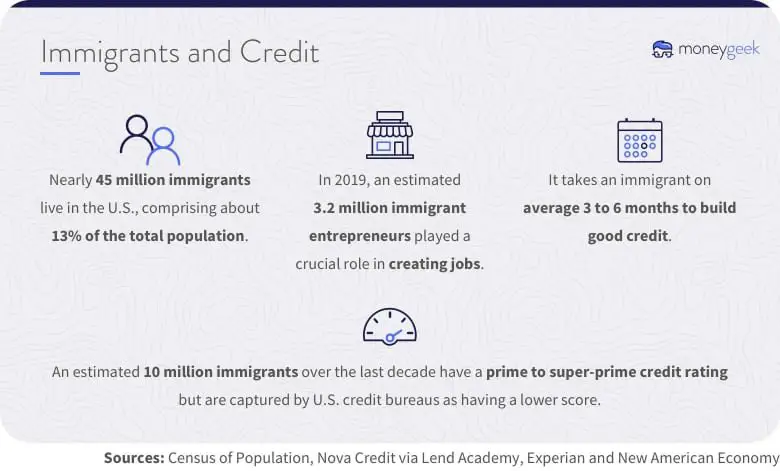

Are tax-free bonds suitable for all types of investors?

Tax-free bonds are suitable for investors who fall in higher tax brackets and are looking for tax-efficient investment options. These bonds are particularly attractive for individuals seeking a regular stream of tax-free income. However, it is recommended that you consult with a financial advisor to assess if tax-free bonds align with your investment goals and risk tolerance.

What is the tenure of tax-free bonds?

The tenure of tax-free bonds can vary from issuer to issuer. Typically, tax-free bonds have long tenures ranging from 10 years to 20 years. Some issuers may also offer bonds with shorter tenures. It is essential to review the specific terms and conditions provided by the issuer before making an investment decision.

Can NRIs (Non-Resident Indians) invest in tax-free bonds?

Yes, NRIs are eligible to invest in tax-free bonds, subject to the rules and regulations set by the Reserve Bank of India (RBI). NRIs can invest in these bonds through the NRE (Non-Resident External) or NRO (Non-Resident Ordinary) accounts. It is advisable to consult with a financial advisor or a tax consultant to understand the implications and any restrictions that may apply.

What are the risks associated with investing in tax-free bonds?

While tax-free bonds are generally considered low-risk investments, it is important to be aware of certain risks:

– Interest rate risk: The value of bonds can be affected by changes in interest rates. If interest rates rise, the market value of existing bonds may decrease.

– Credit risk: There is always a risk of default by the issuer. It is recommended to evaluate the credit rating and financial health of the issuer before investing.

– Liquidity risk: Tax-free bonds may have lower liquidity compared to other investment options. It is advisable to consider the liquidity requirements before investing a significant amount.

How is the interest from tax-free bonds taxed?

The interest income received from tax-free bonds is exempt from income tax. This means that you do not have to pay tax on the interest earned. However, it is essential to note that any capital gains generated from the sale of tax-free bonds within a specific period may attract tax liability. It is advisable to consult with a tax advisor to understand the tax implications specific to your situation.

Final Thoughts

Investing in tax-free bonds can be a smart move for individuals seeking to maximize their investment returns while minimizing taxable income. These bonds offer attractive tax advantages, as the interest earned is exempt from federal income tax, and in some cases, state and local taxes as well. To invest in tax-free bonds, start by selecting a reputable brokerage or financial institution that offers these bonds. Conduct thorough research to understand the issuer’s creditworthiness and the bond’s maturity date. Consider diversifying your bond portfolio to reduce risk and consult with a financial advisor to ensure your investment aligns with your financial goals. With careful planning and informed decision-making, you can make the most of tax-free bonds and potentially enhance your investment portfolio.