Are you a student burdened with debt? Wondering how to manage debts while studying? Well, fret not! In this article, we will provide you with practical tips and strategies to navigate through your financial obligations while pursuing your education. From budgeting wisely to exploring part-time job opportunities, we have got you covered. So, if you are ready to take control of your finances and achieve peace of mind, keep reading. Let’s dive into the world of debt management for students!

How to Manage Debts While Studying

Introduction

Managing debts while studying can be a challenging task, but with the right strategies and financial planning, it is possible to stay on top of your finances and avoid unnecessary stress. This comprehensive guide will provide you with practical tips and advice on how to effectively manage your debts while pursuing your education.

Understanding Your Debt Situation

Before diving into debt management strategies, it’s important to have a clear understanding of your current debt situation. Assessing your debts will help you create a realistic plan to manage them. Here’s what you need to do:

- Make a list of all your debts: Write down the name of each lender, the outstanding balance, interest rates, and the minimum monthly payments.

- Know your credit score: Check your credit score to get a sense of your overall creditworthiness. This will help you understand the interest rates you may qualify for when seeking assistance.

- Review your repayment terms: Familiarize yourself with the terms and conditions of your loans, including any grace periods, deferment options, or potential penalties.

Creating a Budget

One of the most effective ways to manage your debts while studying is by creating a budget that caters to both your educational expenses and debt repayments. Here’s a step-by-step process to help you create an effective budget:

1. Determine Your Income

Take stock of all your income sources, including part-time jobs, scholarships, grants, or financial support from family. Knowing how much money you have coming in each month will form the foundation of your budget.

2. Track Your Expenses

Keep a record of all your expenses for at least a month. Categorize them into essential expenses (housing, utilities, food) and discretionary expenses (entertainment, dining out). This will help you identify areas where you can cut back and save money.

3. Prioritize Your Debt Repayments

List your debts in order of priority. Start by paying off debts with the highest interest rates to minimize the overall amount you’ll have to repay. Make sure to meet the minimum monthly payments on all your debts to avoid penalties.

4. Allocate Financial Resources

Now that you have determined your income, tracked your expenses, and prioritized your debts, allocate a portion of your monthly income towards debt repayments. Ensure that it is a realistic amount that you can afford without compromising your basic needs.

5. Cut Back on Unnecessary Expenses

Identify areas where you can reduce your expenses. Opt for homemade meals instead of eating out, use public transportation, cut down on non-essential subscriptions, and find free or low-cost alternatives for entertainment.

6. Seek Additional Income Opportunities

Consider taking on part-time jobs, freelance work, or gig economy opportunities to supplement your income. Use the additional funds solely for debt repayment purposes to expedite the pay-off process.

7. Review and Adjust Your Budget Regularly

Revisit your budget periodically to ensure it aligns with your changing financial situation. Adjust your spending and debt repayment strategies accordingly to stay on track.

Exploring Debt Management Options

While managing debts on your own is commendable, sometimes seeking professional assistance or exploring alternative options can provide added support. Here are some debt management options to consider:

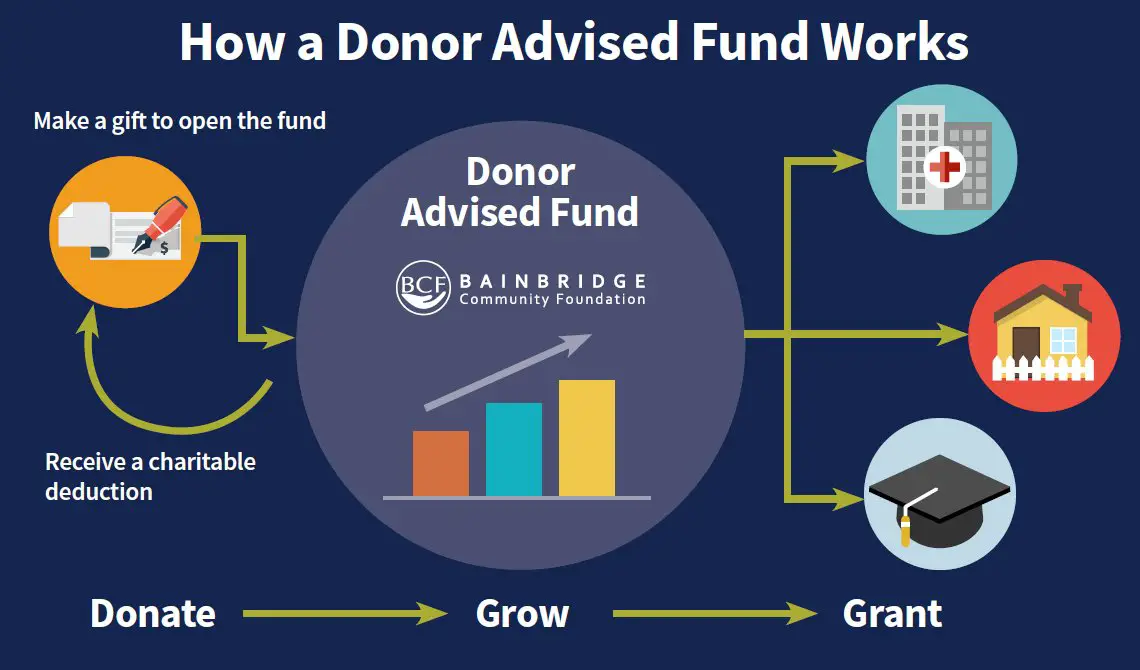

1. Debt Consolidation

Debt consolidation involves combining multiple debts into one loan with a lower interest rate. This can simplify your repayment process and potentially save you money in interest payments. Research different consolidation options and compare interest rates and terms before making a decision.

2. Refinancing Student Loans

If you have student loans, refinancing might be an option worth exploring. By refinancing, you can potentially secure a lower interest rate, reduce your monthly payments, or change your repayment terms to better suit your financial situation.

3. Student Loan Forgiveness Programs

Investigate whether you qualify for any student loan forgiveness programs. These programs forgive a portion or all of your student loan debt in exchange for fulfilling certain criteria, such as working in a specific field or serving in certain communities.

4. Credit Counseling

Consider seeking credit counseling services from reputable non-profit organizations. Credit counselors can provide guidance on debt management, budgeting, and negotiating with lenders. They may help you create a debt repayment plan and provide ongoing support.

5. Negotiating with Lenders

If you’re struggling to meet your debt obligations, reach out to your lenders and explain your situation. Many lenders are willing to work with you to establish more affordable repayment plans, reduce interest rates, or provide temporary forbearance options.

Staying Financially Responsible

In addition to the strategies mentioned above, it’s crucial to develop good financial habits to ensure long-term debt management success. Here are some tips to help you stay financially responsible:

1. Avoid Taking on New Debt

While it might be tempting to apply for new credit cards or loans, try to avoid taking on additional debt while you’re still studying. Focus on repaying existing debts before considering new financial commitments.

2. Build an Emergency Fund

Set aside a portion of your income to build an emergency fund. Having savings to rely on during unexpected situations can prevent you from going further into debt.

3. Seek Financial Education

Take advantage of resources available to improve your financial literacy. Attend workshops, read books on personal finance, or take online courses that can empower you with invaluable knowledge on managing money effectively.

4. Establish and Maintain Good Credit

Pay your bills on time, keep your credit utilization low, and avoid unnecessary credit inquiries. Building a good credit history will benefit you in the long run and open doors to more favorable financial opportunities.

Successfully managing debts while studying requires careful planning, budgeting, and a proactive approach. By understanding your debt situation, creating a budget, exploring debt management options, and staying financially responsible, you can alleviate the stress of debt and focus on your education. Remember, managing debt is a journey, and with perseverance and discipline, you can achieve financial stability.

Easy Steps To Get Out Of Debt, According To A Certified Financial Planner

Frequently Asked Questions

Frequently Asked Questions (FAQs)

Question 1: How can I manage debts while studying?

One way to manage debts while studying is to create a budget and track your expenses. By understanding where your money goes, you can prioritize your spending and allocate funds towards debt repayment. Additionally, you can consider part-time employment to increase your income and cover your expenses.

Question 2: Should I take out student loans to cover all my expenses?

It depends on your individual circumstances and financial goals. While student loans can help finance your education, it’s advisable to only borrow what you need and explore other options such as scholarships, grants, or part-time work to minimize debt. Remember to consider the interest rates and repayment terms before taking on any loan.

Question 3: What if I have multiple debts while studying?

If you have multiple debts, it can be helpful to prioritize them based on interest rates and repayment terms. Paying off higher interest debts first can save you money in the long run. Consider consolidating your debts into a single loan with a lower interest rate to simplify repayment.

Question 4: How do I negotiate with creditors to manage my debts?

When negotiating with creditors, it’s important to be proactive and honest about your situation. Communicate your financial difficulties and explore options such as reduced interest rates, extended repayment periods, or debt settlement plans. Many creditors are willing to work with you if you demonstrate a genuine commitment to repay your debts.

Question 5: Can budgeting tools and apps help me manage my debts?

Yes, budgeting tools and apps can be valuable in managing debts while studying. These tools allow you to track your income, expenses, and debt repayments in real-time. By visualizing your financial situation and setting financial goals, you can make informed decisions and stay on track with your debt management strategy.

Question 6: What are some strategies to reduce expenses while studying?

To reduce expenses while studying, you can consider various strategies such as cooking meals at home instead of eating out, using public transportation or carpooling instead of owning a car, renting textbooks instead of buying them, and exploring free or discounted entertainment options. These small adjustments can add up and help you save money.

Question 7: Is it advisable to use credit cards while studying?

Using credit cards while studying can be convenient, but it’s important to use them responsibly. Stick to a budget and pay off the balance in full each month to avoid accumulating high-interest debt. Consider using credit cards that offer rewards or cashback programs to make the most of your purchases.

Question 8: Should I seek professional advice for managing my debts while studying?

Seeking professional advice can be beneficial if you’re struggling to manage your debts while studying. Credit counseling agencies or financial advisors can provide guidance on budgeting, debt consolidation, and repayment strategies tailored to your specific situation. They can help you navigate complex financial decisions and find the best path towards debt management and financial stability.

Final Thoughts

Managing debts while studying can be challenging, but with some careful planning and discipline, it is possible to stay on top of your financial obligations. Start by creating a budget that includes all your expenses and prioritize debt payments. Look for ways to cut costs, such as cooking at home instead of eating out or using public transportation instead of owning a car. Consider part-time work or freelance opportunities to generate additional income. When it comes to loans, explore options for deferment or flexible repayment plans. By being proactive and mindful of your spending, you can effectively manage debts while studying.