Trying to manage finances as a single parent can often feel like an uphill battle. But worry not! We have some practical tips and solutions to help you navigate this challenge with ease. Whether it’s budgeting effectively, finding ways to save money, or ensuring a stable financial future for yourself and your children, we’ve got your back. So, how to manage finances as a single parent? Let’s dive right in!

How to Manage Finances as a Single Parent

Being a single parent comes with its own set of challenges, and one of the most significant ones is managing finances. Balancing the responsibilities of parenting, work, and finances can seem overwhelming at times. However, with a strategic approach and some helpful tips, it is possible to navigate this journey successfully. In this article, we will explore various aspects of managing finances as a single parent, including budgeting, saving, finding additional sources of income, and seeking financial assistance when needed.

Create a Realistic Budget

One of the first steps towards managing your finances as a single parent is to create a realistic budget. Knowing exactly where your money is going and how much you have available can help you make informed financial decisions. Here are some essential steps to create an effective budget:

- Track Your Expenses: Start by tracking your expenses for a month. This will give you a clear picture of where your money is being spent and help you identify areas where you can cut back.

- Estimate Your Income: Calculate your total monthly income, including wages, child support, government benefits, and any other sources of income.

- Identify Essential Expenses: List all your essential expenses, such as mortgage or rent, utilities, groceries, transportation, and child-related expenses.

- Account for Debt Payments: If you have any outstanding debts or loans, include the monthly payments in your budget.

- Allocate Funds for Savings: Set aside a portion of your income for savings. Even a small amount can add up over time and serve as a safety net in case of emergencies.

- Adjust and Prioritize: Review your expenses and income, and make adjustments if necessary. Prioritize your spending to ensure that your essential needs are met.

Creating a budget will provide you with a clear roadmap for managing your finances in a way that aligns with your income and obligations.

Save Strategically

Saving money as a single parent may seem challenging, but with proper planning and discipline, it is possible to build a financial cushion for you and your children. Here are some tips for saving strategically:

- Automate Savings: Set up an automatic transfer from your checking account to a dedicated savings account. This way, you won’t have to rely on willpower to save.

- Start an Emergency Fund: Aim to save at least three to six months’ worth of living expenses in an emergency fund. This can provide a financial safety net during unexpected circumstances.

- Reduce Discretionary Expenses: Identify areas where you can cut back on discretionary expenses, such as eating out or entertainment. Redirect the saved money towards your savings goals.

- Shop Smart: Look for discounts, compare prices, and consider buying second-hand items whenever possible. Small savings can add up significantly over time.

- Involve Your Children: Teach your children the value of money and involve them in saving efforts. Encourage them to contribute a portion of their allowance or earnings towards a shared financial goal.

By adopting these strategies, you can gradually build a financial safety net and work towards a more secure financial future for you and your family.

Explore Additional Income Sources

As a single parent, finding additional sources of income can help ease financial stress and provide more security. While juggling parenting responsibilities, it may not always be feasible to take on a second job. Here are some alternative ways to generate extra income:

- Freelancing or Side Gigs: If you have a skill or expertise, consider freelancing or taking up side gigs in your spare time. This can help you earn additional income without committing to a traditional second job.

- Rent Out a Room: If you have an extra room or space in your home, consider renting it out to generate rental income. This arrangement can also provide an opportunity for shared responsibilities and support.

- Monetize a Hobby: Explore ways to monetize your hobbies or interests. Whether it’s crafting, writing, or photography, there may be opportunities to sell your creations or services.

- Online Surveys or Microtasks: Participating in online surveys or completing microtasks can be a flexible way to earn some extra money during your free time.

- Childcare Services: If you have the skills and capacity, offering childcare services to other parents in your community can be a way to earn additional income while staying at home with your own children.

Remember to assess your available time and resources before committing to any additional income-generating activities. Finding the right balance is crucial to maintain a healthy work-life-parenting equilibrium.

Seek Financial Assistance and Support

Single parents often face financial hurdles, and seeking financial assistance or support is not something to be ashamed of. There are various resources available that can provide assistance during difficult times. Here are a few options to consider:

- Government Programs: Research government programs that provide financial assistance to single parents. These programs may include cash benefits, healthcare benefits, and childcare subsidies.

- Non-Profit Organizations: Non-profit organizations and charities often offer financial support to single parents facing challenges. Explore local resources and reach out for assistance.

- Community Support: Seek support from your local community, such as food banks, clothing drives, or community-based initiatives that assist single parents.

- Child Support: If you are entitled to child support, make sure you understand the legal process and receive the appropriate financial support from the other parent.

- Financial Counseling: Consider seeking professional financial counseling to help you manage your finances and navigate challenging situations.

Remember, asking for help is a sign of strength and determination to provide the best possible life for your children. Take advantage of the available resources and support networks to ease your financial burden.

Managing finances as a single parent requires careful planning, discipline, and resourcefulness. By creating a realistic budget, saving strategically, exploring additional income sources, and seeking financial assistance when needed, you can navigate the challenges with confidence. Remember to prioritize self-care and seek support from family, friends, and community organizations. With determination and resilience, you can provide a stable and secure financial future for your family.

HOW I BUDGET AS A SINGLE MOM | HOW TO SAVE MONEY

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I manage my finances as a single parent?

Managing finances as a single parent can be challenging, but with proper planning and strategies, it is possible. Here are some tips to help you:

What are some budgeting techniques I can use?

Creating a budget is essential to manage your finances effectively. Some budgeting techniques you can use include:

How can I save money as a single parent?

Saving money is crucial to build a secure financial future for you and your child. Here are some ways to save money as a single parent:

Is it necessary to have an emergency fund?

Yes, having an emergency fund is crucial for unexpected expenses that may arise. It provides a safety net and helps you avoid going into debt. Try to save at least three to six months’ worth of living expenses.

Should I consider seeking financial assistance?

If you are struggling financially as a single parent, you may consider seeking financial assistance. There are various government programs, grants, and non-profit organizations that provide support to single parents in need.

How can I manage debt effectively?

Managing debt is important to maintain financial stability. Here are some strategies to help you manage debt as a single parent:

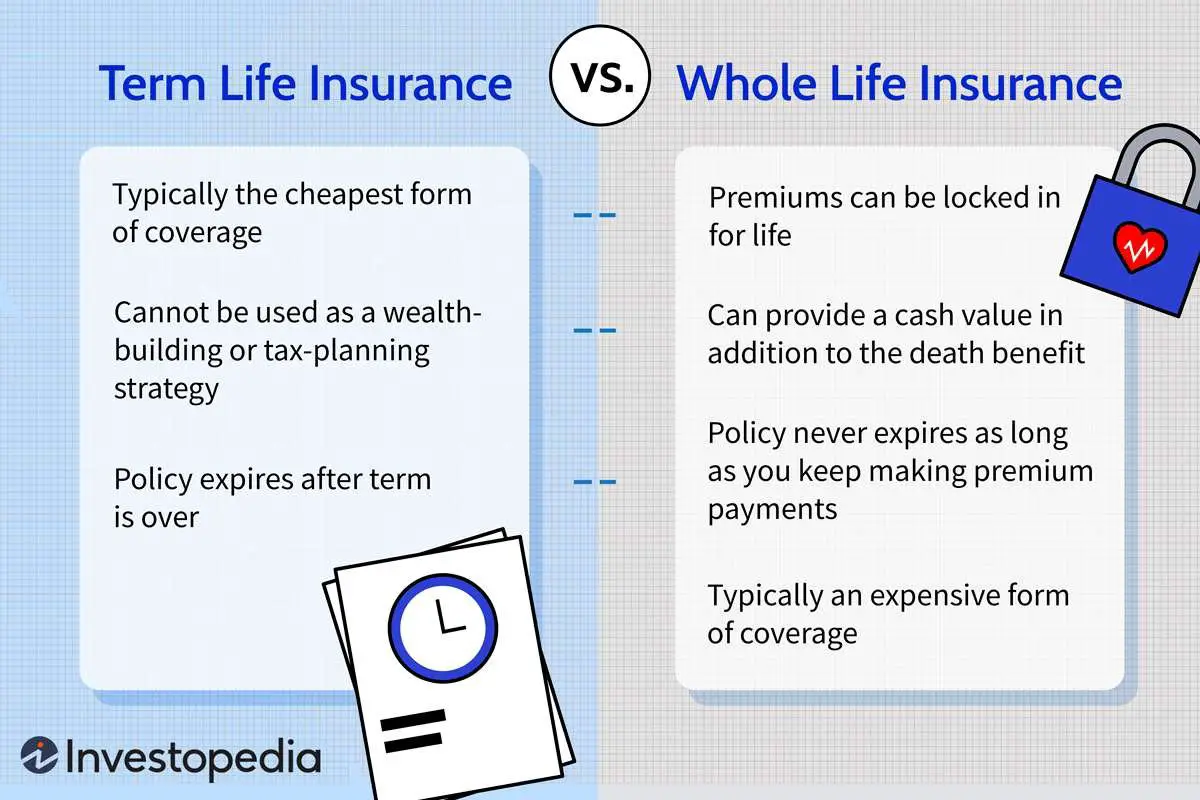

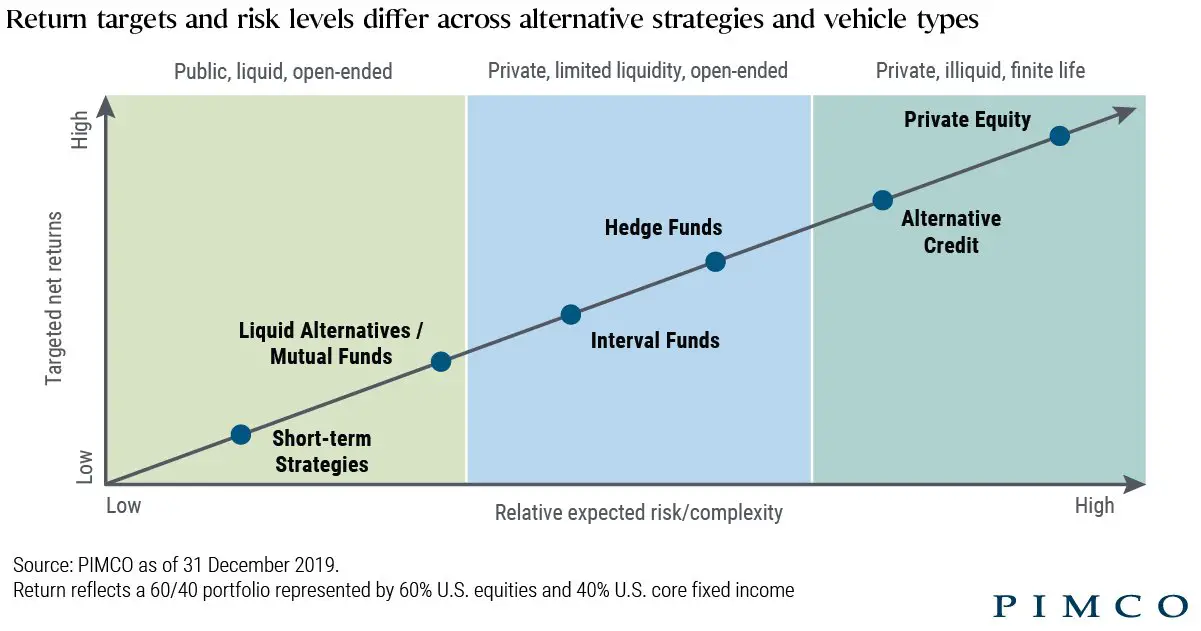

Is it advisable to invest as a single parent?

Investing can be a wise decision to grow your wealth over time. However, it is essential to have a solid financial foundation before considering investments. Ensure you have an emergency fund, pay off high-interest debts, and have a good understanding of the investment options available.

What should I prioritize when managing finances as a single parent?

When managing finances as a single parent, it is important to prioritize the following:

Final Thoughts

Managing finances as a single parent can be challenging, but with the right strategies, it is possible to achieve financial stability. Start by creating a budget that includes all your expenses and income. Cut unnecessary costs and prioritize essential expenses. Look for ways to increase your income, such as taking on a part-time job or freelancing. Build an emergency fund to handle unexpected expenses. Take advantage of government assistance programs and seek out community resources for additional support. Consider investing in your child’s education and future by starting a savings account. By following these tips, you can successfully manage your finances as a single parent.