Managing finances during an unpaid internship can be challenging, but it’s not impossible. With a strategic approach and a bit of creativity, you can make the most of your limited resources without sacrificing your financial stability. In this article, we’ll explore practical tips and solutions on how to manage finances during an unpaid internship. From budgeting wisely to finding alternative income streams, we’ve got you covered. So, if you’re ready to tackle this financial hurdle head-on, let’s dive in and navigate the world of unpaid internships together.

How to Manage Finances During an Unpaid Internship

An unpaid internship can provide valuable experience and networking opportunities, but it also presents financial challenges. Managing your finances during this period requires careful planning and smart decision-making. In this article, we will explore various strategies and tips to help you navigate the financial hurdles of an unpaid internship.

Create a Budget

One of the most important steps in managing your finances during an unpaid internship is creating a budget. A budget will help you track your income and expenses, enabling you to make informed decisions about your spending habits. Here’s how you can create a budget:

- Evaluate your income: Take stock of any income you have during the internship, such as part-time job earnings, savings, or financial support from family.

- Identify your expenses: Make a list of all your expenses, including rent, utilities, groceries, transportation, and personal expenses.

- Differentiate between needs and wants: Prioritize your expenses and identify items that are essential versus those that can be trimmed or eliminated.

- Set spending limits: Allocate a specific amount of money to each expense category to ensure you stay within your means.

Minimize Living Expenses

During an unpaid internship, it’s essential to find ways to minimize your living expenses. By adopting frugal habits and making conscious choices, you can stretch your limited budget further. Consider the following strategies:

- Housing: Look for affordable housing options, such as sharing an apartment with roommates or subletting a room. Consider proximity to your internship location to save on transportation costs.

- Utilities: Limit your utility usage by being mindful of electricity, water, and gas consumption. Unplug electronics when not in use and opt for energy-efficient appliances.

- Groceries: Plan your meals, make a shopping list, and buy groceries in bulk to save money. Cooking at home and packing lunches instead of eating out can significantly reduce expenses.

- Transportation: Explore cost-effective transportation options, such as public transportation or carpooling. Walk or bike whenever feasible to save on commuting costs.

- Entertainment: Seek free or low-cost entertainment options, such as attending community events, exploring parks, or utilizing student discounts.

Supplement Your Income

While your internship may be unpaid, there are still ways to supplement your income and alleviate financial strain. Consider the following opportunities to earn extra money:

- Part-time job: Look for part-time job opportunities that can fit alongside your internship schedule. Retail, food service, or freelance work can provide additional income.

- Online freelancing: Explore online platforms where you can offer your skills and services as a freelancer. Writing, graphic design, or virtual assistance are popular options.

- Tutoring or teaching: If you excel in a particular subject area, consider offering tutoring services to students. You can also explore opportunities to teach a class or workshop in your field of expertise.

- Sell unwanted items: Declutter your living space and sell items you no longer need. Online platforms or local consignment stores can help you turn your belongings into cash.

Seek Financial Assistance

Various organizations and programs provide financial assistance specifically for interns. Investigate the following resources to determine if you qualify for any support:

- Internship grants and scholarships: Some organizations offer grants or scholarships to help cover expenses related to unpaid internships. Research and apply for these opportunities.

- Internship stipends: Certain internships may offer stipends or reimbursements for specific costs, such as transportation or meals. Inquire with your internship provider and see if such options are available.

- Financial aid or scholarships: If you are a student, consult your school’s financial aid office to explore any additional resources or scholarships for interns.

- Community resources: Local organizations or charities might have programs aimed at supporting individuals experiencing financial hardships during internships. Reach out and inquire about potential assistance.

Build a Network and Seek Mentorship

Networking and mentorship can be valuable assets during your unpaid internship. Building connections with professionals in your field can open doors to potential job opportunities or helpful advice regarding financial management. Consider the following steps:

- Attend industry events: Participate in networking events, industry conferences, or workshops related to your field. Engage with professionals and make meaningful connections.

- Seek mentorship opportunities: Reach out to experienced professionals in your field and express your interest in establishing a mentor/mentee relationship. Mentors can provide guidance regarding career and financial decisions.

- Join professional associations: Become a member of industry-specific professional associations or online communities. These platforms often offer resources, job boards, and networking opportunities.

- Utilize social media: Leverage platforms like LinkedIn to connect with professionals and join industry-related groups. Actively engage in discussions and showcase your knowledge and skills.

Invest in Personal and Professional Development

During your unpaid internship, capitalize on the opportunity to invest in your personal and professional development. By acquiring new skills and experiences, you can enhance your employability and financial prospects in the long run. Consider the following avenues:

- Online courses and certifications: Explore online platforms that offer courses or certifications in your field of interest. These can enhance your skills and make you more competitive in the job market.

- Volunteer work: Seek volunteer opportunities related to your field. Not only will this provide valuable experience, but it may also lead to paid job offers or recommendations.

- Side projects: Dedicate time to personal side projects or creative endeavors that align with your career goals. This can showcase your abilities and potentially attract paid opportunities.

- Professional development seminars: Attend workshops or seminars focused on career development and financial literacy. Look for free or low-cost options in your area.

Remember, managing finances during an unpaid internship can be challenging, but with careful planning, smart decision-making, and resourcefulness, you can successfully navigate this period while building valuable skills and connections for your future career.

We need to talk about unpaid internships

Frequently Asked Questions

Frequently Asked Questions (FAQs)

Question 1: What are some effective ways to manage finances during an unpaid internship?

During an unpaid internship, there are several strategies you can employ to manage your finances:

- Creating a budget and tracking your expenses

- Minimizing unnecessary spending

- Seeking part-time employment or freelance work

- Exploring internship grants or scholarships

- Utilizing public transportation or carpooling to save on commuting costs

Question 2: How can I minimize expenses while interning without pay?

To minimize expenses during an unpaid internship, consider the following:

- Avoiding eating out frequently and opting for homemade meals

- Limiting entertainment expenses and finding free or low-cost activities

- Comparing prices and seeking discounts when shopping for necessities

- Sharing living costs with roommates, if applicable

- Using free resources, such as libraries and online educational platforms, for personal and professional development

Question 3: Are there any financial assistance programs available for unpaid interns?

Yes, some organizations offer financial assistance programs specifically for unpaid interns. Research for internship grants, scholarships, or stipends that may be available in your field or through professional associations. Additionally, consider reaching out to local community organizations or non-profits that support young professionals to see if they offer any financial assistance programs.

Question 4: How can I supplement my income during an unpaid internship?

Supplementing your income while interning without pay can be essential. Some options to consider include:

- Taking on a part-time job or freelance work

- Offering your skills or services on platforms like freelancing websites or tutoring

- Participating in paid surveys or market research studies online

- Selling unwanted items through online marketplaces

- Exploring gig economy opportunities, such as food delivery or pet sitting

Question 5: How can I build good financial habits during my unpaid internship?

Building good financial habits during an unpaid internship can set you up for success. Consider these practices:

- Creating and sticking to a budget

- Setting financial goals and regularly tracking your progress

- Establishing an emergency fund for unexpected expenses

- Researching personal finance and investment strategies

- Developing a habit of saving money, even in small increments

Question 6: Are there any tools or apps that can help me manage my finances?

Yes, there are various tools and apps available to assist with financial management. Some popular options include:

- Budgeting apps like Mint, YNAB, or PocketGuard

- Expense tracker apps such as Expensify or Wally

- Investment and retirement planning apps like Acorns or Betterment

- Bill payment apps such as Prism or BillTracker

- Receipt scanning apps like Receipt Hog or Fetch Rewards

Question 7: How can networking help me manage my finances during an unpaid internship?

Networking can play a vital role in managing your finances during an unpaid internship. By expanding your professional network, you increase your chances of learning about job opportunities or side gigs that can supplement your income. Additionally, networking can provide access to mentors or industry professionals who can offer valuable financial advice and guidance.

Question 8: What are some free resources for financial education?

Several reliable sources provide free financial education. Consider utilizing:

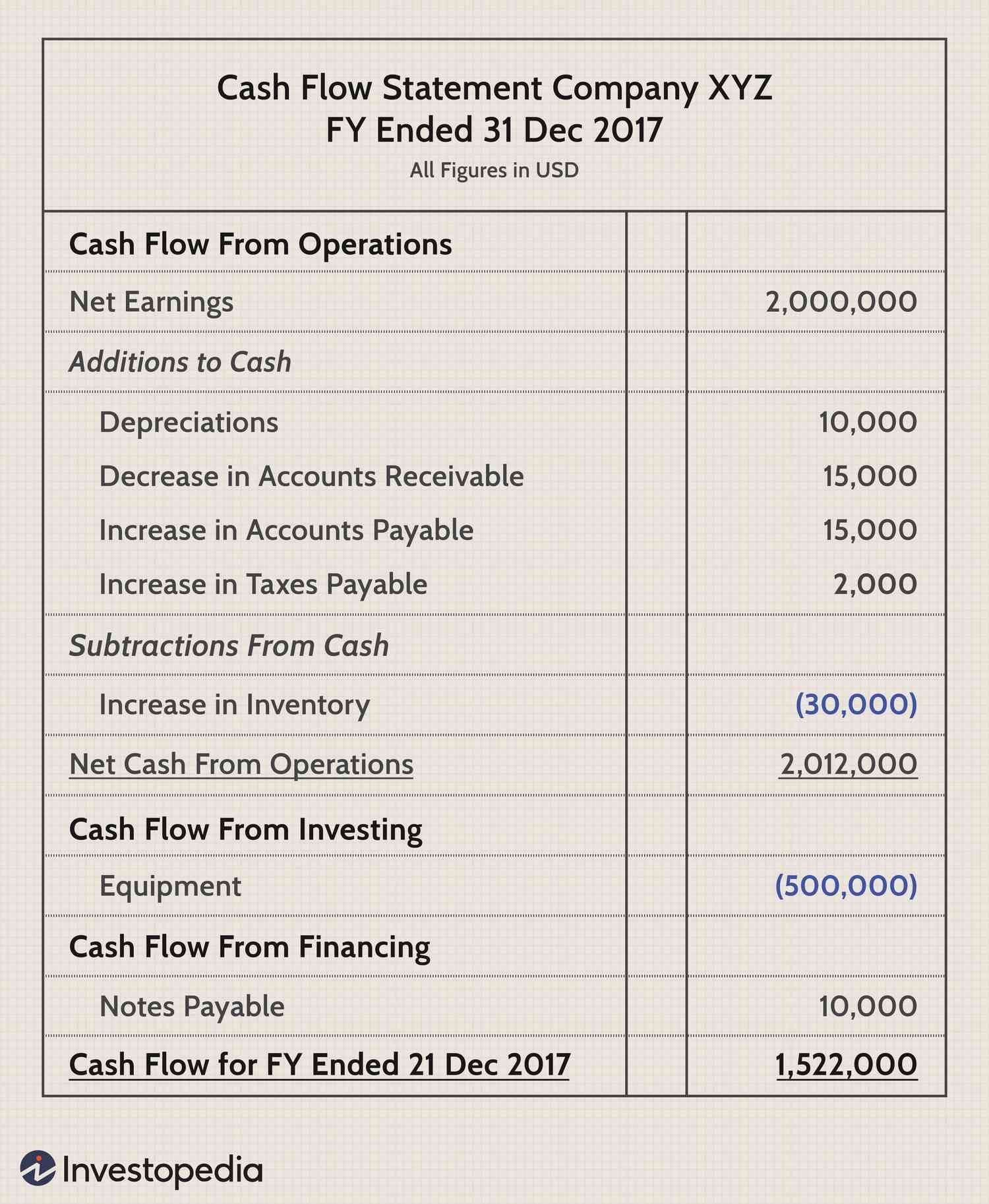

- Online platforms like Khan Academy, Investopedia, or Udemy’s free courses

- Podcasts focused on personal finance, such as “The Dave Ramsey Show” or “ChooseFI”

- Financial literacy blogs or websites offering tips and advice

- Webinars or workshops provided by financial institutions or non-profit organizations

- Local community events or seminars on personal finance topics

Final Thoughts

Managing finances during an unpaid internship can be challenging, but with careful planning and smart strategies, it is possible to navigate this period successfully. Firstly, creating a budget and tracking expenses is crucial. This allows you to prioritize essential expenses and cut back on non-essential items. Secondly, exploring part-time job opportunities or freelance work can provide additional income to support your financial needs. Additionally, seeking out grants, scholarships, or financial aid specific to internships can help alleviate some of the financial burden. Lastly, developing good saving habits and seeking advice from mentors or financial professionals can provide valuable insights on how to manage finances effectively during an unpaid internship. By implementing these strategies, you can make the most of your internship experience without compromising your financial stability.