Managing money as a college freshman can be a daunting task, but fear not! In this article, we will explore practical and effective strategies to help you navigate the financial challenges that come with being a first-year student. From creating a budget to finding ways to save on textbooks, we’ve got you covered. So, if you’re wondering how to manage money as a college freshman, look no further! Let’s dive in and discover some valuable tips that will set you on the path to financial success.

How to Manage Money as a College Freshman

As a college freshman, managing your money effectively is crucial for your financial well-being. It’s a time when you’ll be faced with new financial responsibilities and decisions. By developing good money management habits from the start, you can set yourself up for financial success throughout your college years and beyond. In this article, we’ll provide you with practical tips and strategies to help you navigate the world of personal finance as a college freshman.

Create a Budget

One of the first steps to managing your money as a college freshman is creating a budget. A budget helps you understand your income and expenses, allowing you to make informed decisions about your spending. Here’s how you can create a budget:

- Track Your Income: Start by determining how much money you have coming in each month. This can include income from part-time jobs, scholarships, allowances, or contributions from your parents.

- Estimate Your Expenses: Make a list of all your expenses, including tuition, textbooks, housing, utilities, transportation, groceries, and entertainment. Be realistic about your spending habits.

- Set Financial Goals: Determine what you want to achieve financially. It could be saving for a spring break trip, paying off student loans, or building an emergency fund.

- Allocate Your Income: Divide your income into different categories based on your expenses and financial goals. Aim to spend less than you earn.

- Track Your Spending: Regularly monitor your expenses and compare them to your budget. This will help you identify areas where you can cut back and save more.

Save Money on Textbooks

Textbooks can eat up a significant portion of your budget. However, there are several ways to save money on textbooks:

- Buy Used or Rent: Instead of purchasing new textbooks, consider buying used copies or renting them. Online platforms like Amazon, Chegg, and CampusBooks offer affordable options.

- Utilize the Library: Check if your college library has the textbooks you need. Many libraries offer short-term rentals or allow you to make photocopies of the pages you require.

- Share with Peers: Coordinate with classmates and split the cost of textbooks. You can take turns using the book or photocopy the necessary chapters.

- Look for Digital Alternatives: Explore digital textbooks or e-books, which are often cheaper than printed versions. Websites like Project Gutenberg and OpenStax offer free online textbooks.

Manage Your Meal Plan

Food expenses can quickly add up, especially if you’re relying on a meal plan or eating out frequently. Here are some tips to manage your meal plan effectively:

- Understand Your Meal Plan: Familiarize yourself with the details of your meal plan. Know the number of meals and dining dollars you have, as well as any restrictions or expiration dates.

- Cook in Your Dorm or Apartment: Instead of eating out, consider cooking your meals. Invest in essential kitchen appliances like a microwave, mini-fridge, and hot plate to prepare simple and affordable dishes.

- Meal Prep: Plan your meals in advance and batch cook. This can help you save time and money by minimizing waste and avoiding impulse purchases.

- Take Advantage of Campus Events: Many colleges organize free or low-cost events that include food. Attend these events to enjoy a meal while socializing with fellow students.

- Be Mindful of Eating Out: While it’s fun to dine out occasionally, eating out frequently can strain your budget. Limit eating out to special occasions or when you have dining dollars to spare.

Minimize Transportation Costs

Transportation expenses can take a significant chunk out of your budget. Here’s how you can minimize transportation costs:

- Use Public Transportation: Take advantage of any discounted or free public transportation services offered to students. Use buses, trains, or subways to get around campus and explore the city.

- Carpool with Peers: Coordinate with classmates who live in the same area and share rides to campus. Carpooling not only saves money on fuel but also reduces carbon emissions.

- Invest in a Bike: If your campus is bike-friendly, consider investing in a bike. It’s a cost-effective and environmentally friendly mode of transportation.

- Walk: Whenever possible, choose to walk instead of taking transportation. It’s not only free but also a great way to stay active.

Save on Entertainment

College life is full of opportunities for entertainment and socializing. However, it’s essential to manage your entertainment expenses wisely. Here are some tips to save on entertainment:

- Utilize Student Discounts: Take advantage of student discounts offered by local businesses, movie theaters, museums, and entertainment venues. Always carry your student ID to avail of these discounts.

- Explore Free Activities: Look for free events and activities happening on and off-campus. Attend club meetings, join intramural sports teams, or participate in community service projects.

- Plan Ahead for Parties: If you enjoy hosting or attending parties, plan them in advance. Create a budget for food, drinks, and decorations to avoid overspending.

- Use Streaming Services: Instead of spending money on cable TV or going to the movies, consider subscribing to streaming services like Netflix, Hulu, or Amazon Prime, which offer a wide range of entertainment options at an affordable price.

Exercise Smart Shopping Habits

Developing smart shopping habits can help you make the most of your money. Consider the following tips:

- Shop with a List: Before heading to the grocery store or shopping mall, create a list of the items you need. Stick to the list and avoid impulse purchases.

- Compare Prices: Use price comparison websites or apps to compare prices before making a purchase. Look for the best deals and discounts.

- Avoid Credit Card Debt: If you have a credit card, use it responsibly. Pay off the balance in full each month to avoid high interest rates and accumulating debt.

- Shop at Thrift Stores: Explore thrift stores or consignment shops for affordable clothing and household items. You can find unique items at a fraction of the cost.

- Buy Generic Brands: Consider purchasing generic or store-brand products instead of name brands. Often, they offer similar quality at a lower price.

By implementing these strategies and making conscious choices about your spending, you can effectively manage your money as a college freshman. Remember, developing good financial habits now will set you up for a lifetime of financial success.

What I Stopped Buying As a College Student | money saving & finance tips

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I effectively manage my money as a college freshman?

As a college freshman, it’s crucial to develop good money management habits. Here are some tips to help you effectively manage your finances:

How do I create a budget as a college freshman?

Creating a budget is an essential step in managing your money. Start by listing your sources of income and all your expenses. Allocate a specific amount for each category, such as tuition fees, textbooks, food, transportation, and entertainment. Make sure to track your expenses regularly to stay within your budget.

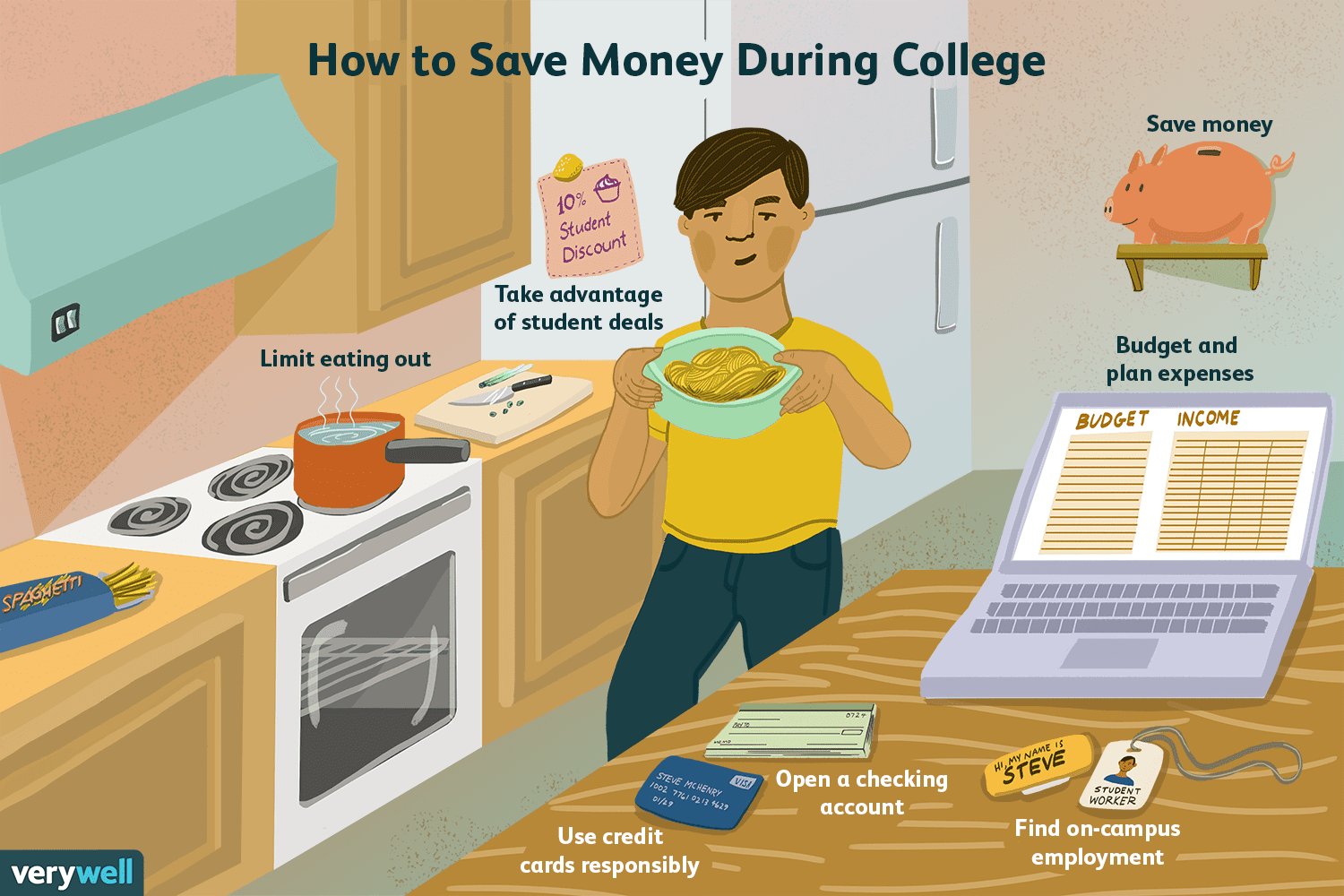

What can I do to save money as a college freshman?

Saving money in college can be challenging but not impossible. You can start by cutting down on unnecessary expenses like eating out or buying expensive coffees. Look for student discounts or second-hand textbooks. Cook your meals instead of relying on takeout. Every small saving can add up over time.

Is it important to track my expenses?

Yes, tracking your expenses is crucial to understand your spending habits and identify areas where you can cut costs. You can use mobile apps or budgeting tools to help you track your expenses easily. By keeping track of your spending, you’ll be more aware of where your money is going and be able to make necessary adjustments.

What are some ways to increase my income as a college freshman?

As a college freshman, your options to increase your income may be limited. However, you can look for part-time job opportunities on or off-campus. Consider freelancing or tutoring if you have skills that can be monetized. Additionally, you can explore scholarship programs or apply for financial aid.

How can I avoid unnecessary debt as a college freshman?

To avoid unnecessary debt, it’s essential to spend wisely and live within your means. Consider borrowing student loans only if necessary and keep track of the amounts borrowed. Take advantage of scholarships, grants, and work-study programs to reduce your reliance on loans. Prioritize needs over wants to avoid accumulating excessive debt.

What should I do if I encounter unexpected expenses as a college freshman?

Unexpected expenses can arise at any time, and it’s important to be prepared. Start building an emergency fund by setting aside a small portion of your income regularly. If you encounter unexpected expenses, explore options like reaching out to your college’s financial aid office, seeking help from family, or considering short-term loan options with caution.

How can I manage my credit card usage responsibly as a college freshman?

If you have a credit card as a college freshman, it’s crucial to use it responsibly. Only charge what you can afford to pay off in full each month to avoid accumulating high-interest debt. Pay your bills on time to maintain a good credit score. Use credit cards for emergencies or necessary expenses and avoid impulsive spending.

Final Thoughts

Managing money as a college freshman can be challenging, but with proper planning and discipline, it is possible to navigate this new phase of life successfully. Start by creating a budget to track your expenses and prioritize your spending. Take advantage of student discounts and look for ways to save money on textbooks and meals. Avoid unnecessary credit card debt by using cash or a debit card instead. Additionally, consider finding part-time jobs or freelance opportunities to supplement your income. By adopting these strategies, you can effectively manage your finances and set a strong foundation for future financial success as a college freshman.