Looking to get the most out of your tax return this year? Well, you’re in luck! In this article, we will show you how to maximize tax return benefits and keep more money in your pocket. From utilizing deductions and credits to understanding tax brackets and contributions, we’ve got you covered. So, whether you’re a seasoned taxpayer or new to the game, keep reading to learn valuable tips and strategies that will help you make the most of tax season. Don’t miss out on the opportunity to enhance your financial situation – let’s dive in and discover how to maximize tax return benefits!

How to Maximize Tax Return Benefits

Paying taxes is inevitable, but did you know that there are numerous strategies you can employ to maximize your tax return benefits? By understanding the tax system and taking advantage of available deductions, credits, and exemptions, you can potentially reduce your tax liability and increase your tax refund. In this comprehensive guide, we will explore various tips and techniques that can help you make the most of your tax return benefits.

1. Understand the Tax Basics

Before diving into specific strategies, it’s crucial to have a solid understanding of the tax system. This knowledge will empower you to make informed decisions regarding your taxes. Here are some essential tax concepts to grasp:

- Taxable income: This is the amount of income subject to tax after subtracting any deductions or exemptions.

- Tax deductions: These are expenses or deductions that can reduce your taxable income, potentially resulting in a lower tax bill.

- Tax credits: Unlike deductions, tax credits directly reduce the amount of tax owed.

- Tax brackets: Tax rates vary based on different income levels. Understanding which tax bracket you fall into will help you plan your finances accordingly.

Now that we have covered the basics, let’s explore some practical strategies to maximize your tax return benefits.

2. Contribute to Retirement Accounts

Contributing to retirement accounts can be an excellent long-term investment strategy while also providing tax benefits. Consider the following options:

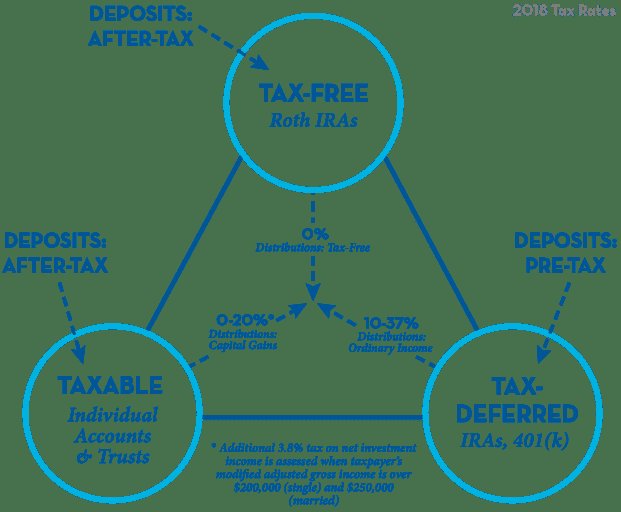

- Traditional IRA: Contributions to a Traditional Individual Retirement Account (IRA) are tax-deductible, which means they reduce your taxable income for the year. Additionally, earnings grow tax-deferred until you withdraw the funds during retirement.

- Roth IRA: Contributions to a Roth IRA are not tax-deductible, but qualified withdrawals in retirement are tax-free. This can provide significant tax advantages in the future.

- 401(k) or similar employer-sponsored plans: Contributing to a 401(k) or other employer-sponsored retirement plan allows you to defer taxes on your contributions, effectively lowering your taxable income for the year.

By taking advantage of these retirement accounts, you not only save for the future but also reduce your tax liability in the present.

3. Optimize Your Deductions

Deductions can substantially reduce your taxable income, so it’s essential to identify and take advantage of all the deductions you qualify for. Here are several deductions to consider:

- Standard deduction: The standard deduction is a predetermined amount that reduces your taxable income. If your eligible deductions exceed the standard deduction, itemizing your deductions may be more beneficial.

- Itemized deductions: Itemizing deductions allows you to deduct specific expenses, such as mortgage interest, property taxes, state and local taxes, medical expenses, and charitable contributions. Carefully evaluate whether your itemized deductions surpass the standard deduction.

- Educational expenses: If you or your dependents are pursuing higher education, you may be eligible for education-related deductions or credits, such as the Lifetime Learning Credit or the American Opportunity Credit.

- Medical expenses: Deducting qualified medical expenses can be beneficial if they exceed a certain percentage of your adjusted gross income (AGI). Keep track of medical bills, including health insurance premiums, prescription costs, and out-of-pocket expenses.

- State and local taxes: Depending on where you live, deducting state and local income taxes or sales taxes can make a substantial difference in your tax liability.

- Charitable contributions: Donating to qualified charities not only supports causes you believe in but can also result in tax deductions. Keep records of all charitable contributions, including cash donations, goods, or volunteer mileage.

By optimizing your deductions, you can potentially lower your taxable income and increase your tax refund.

4. Leverage Tax Credits

Unlike deductions, which reduce your taxable income, tax credits directly reduce the amount of tax you owe. Here are some valuable tax credits to take advantage of:

- Child Tax Credit: If you have qualifying children under the age of 17, you may be eligible for the Child Tax Credit, which reduces your tax bill by a specified amount per child.

- Earned Income Tax Credit (EITC): The EITC is designed to assist low-to-moderate-income individuals and families. It can provide a significant refund, even if you owe no taxes.

- Education credits: If you are pursuing higher education or paying for your dependent’s education, explore education-related tax credits, such as the American Opportunity Credit and the Lifetime Learning Credit.

- Energy-efficient home improvements: Making energy-efficient improvements to your home, such as installing solar panels or energy-efficient windows, can make you eligible for tax credits.

By leveraging applicable tax credits, you can potentially reduce your tax liability and increase your refund.

5. Keep Accurate Records

Maintaining accurate records is crucial to ensure you maximize your tax return benefits. Proper documentation helps you claim all eligible deductions, credits, and exemptions. Here are some best practices for record-keeping:

- Income records: Keep records of all your income sources, such as W-2s, 1099s, and investment statements.

- Expense records: Maintain receipts, invoices, and relevant documents for deductions, such as medical expenses, charitable contributions, and business expenses.

- Bank and investment statements: Keep a record of bank statements, investment statements, and any other financial documentation that may impact your taxes.

- Documentation of major life events: Significant life events, such as marriage, divorce, or the birth or adoption of a child, can affect your tax situation. Keep records of these events and any related documentation.

By organizing your financial records, you can ensure that you claim all the tax benefits you are entitled to.

6. Deduct Business Expenses

If you are self-employed or a small business owner, it is essential to maximize your business-related deductions. Deductible expenses can significantly reduce your taxable income. Here are some common business deductions to consider:

- Home office deduction: If you have a dedicated space in your home used exclusively for business purposes, you may be eligible for a home office deduction.

- Business supplies and equipment: Deduct expenses for supplies, equipment, software, and other materials necessary for your business.

- Travel and transportation: Keep track of business-related travel expenses, including mileage, airfare, hotel stays, and meals.

- Health insurance premiums: If you are self-employed, you may be able to deduct the cost of health insurance premiums for yourself, your spouse, and your dependents.

- Professional services: Deduct fees paid to professionals such as accountants or lawyers, as well as expenses related to marketing and advertising.

Consult with a tax professional or utilize tax software specifically designed for small businesses to ensure you maximize your deductions and accurately report your business expenses.

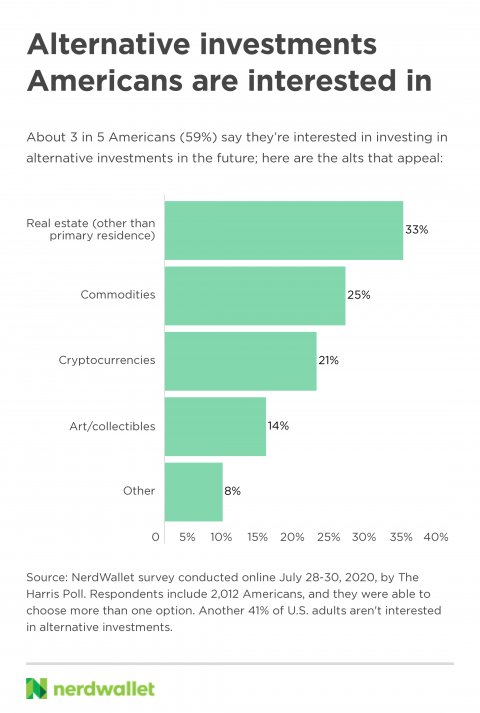

7. Consider Tax Loss Harvesting

If you have experienced investment losses, you can use a strategy called tax loss harvesting to offset your gains. Tax loss harvesting involves selling investments that have declined in value to generate capital losses, which can be used to offset taxable capital gains. By “harvesting” losses, you can potentially reduce your tax liability. However, it’s essential to consult with a financial advisor or tax professional to understand the complexities and limitations of this strategy.

8. Stay Informed and Seek Professional Help

The tax code is continuously evolving, and tax laws change periodically. To maximize your tax return benefits, it’s crucial to stay informed about new regulations, deductions, and credits that may apply to your specific situation. Consider the following approaches:

- Do-it-yourself tax software: High-quality tax software can guide you through the process and help you identify potential deductions and credits.

- Professional tax preparers: If your tax situation is complex or you prefer professional assistance, consider hiring a certified public accountant (CPA) or a tax preparer to ensure your taxes are filed accurately.

- Tax resources: Utilize reputable tax resources, such as the Internal Revenue Service (IRS) website or tax publications, to stay informed about changes in the tax code.

By staying informed and seeking professional help when needed, you can optimize your tax return benefits and avoid costly mistakes.

Maximizing your tax return benefits requires careful planning, strategic decision-making, and staying informed about the tax code. By understanding the tax basics, optimizing deductions and credits, contributing to retirement accounts, keeping accurate records, and considering professional assistance, you can potentially reduce your tax liability, increase your refund, and achieve financial peace of mind. Take advantage of the various strategies discussed in this guide, and make the most of your tax return benefits.

Remember, taxes are a complex topic, and everyone’s tax situation is unique. The information provided in this article is for informational purposes only and should not be considered as personalized tax advice. Consult with a tax professional or the IRS for guidance specific to your circumstances.

9 HUGE Tax Write Offs for Individuals (EVERYONE can use these)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I maximize my tax return benefits?

To maximize your tax return benefits, consider the following strategies:

– Ensure you claim all eligible deductions and credits.

– Keep track of your expenses and receipts throughout the year.

– Contribute to tax-advantaged retirement accounts.

– Make use of tax-efficient investment strategies.

– Consider consulting with a tax professional for personalized advice.

2. Are there any specific deductions or credits I should be aware of to maximize my tax return benefits?

Yes, there are several deductions and credits that can help maximize your tax return benefits, such as:

– Education-related deductions or credits

– Mortgage interest deduction

– Child tax credit

– Earned Income Tax Credit (EITC)

– Healthcare-related deductions or credits

3. Should I itemize my deductions or take the standard deduction to maximize my tax return benefits?

It depends on your specific financial situation. If your itemized deductions exceed the standard deduction amount, it may be beneficial to itemize. However, if your itemized deductions are lower, taking the standard deduction may be more advantageous. Consider consulting with a tax professional to determine the best approach for your situation.

4. Is it worth hiring a tax professional to maximize my tax return benefits?

Hiring a tax professional can be beneficial if you have a complex tax situation or if you’re unsure about maximizing your tax return benefits on your own. A tax professional can provide personalized advice, help identify deductions and credits you may have missed, and ensure your tax return is accurate and optimized.

5. Can contributing to a retirement account help maximize my tax return benefits?

Yes, contributing to a retirement account, such as a 401(k) or Individual Retirement Account (IRA), can potentially reduce your taxable income. Depending on the type of retirement account, your contributions may be tax-deductible, or you may enjoy tax-free growth on your investments. Consult with a financial advisor or tax professional to explore the retirement account options that best suit your needs.

6. Should I consider tax-efficient investment strategies to maximize my tax return benefits?

Yes, tax-efficient investment strategies can help minimize your tax liability and maximize your tax return benefits. Some strategies include investing in tax-efficient funds, holding investments for longer periods to qualify for long-term capital gains rates, and tax-loss harvesting. Speak with a financial advisor or tax professional to assess the best investment strategies for your financial goals.

7. Are there any tax planning strategies I can implement throughout the year to maximize my tax return benefits?

Absolutely! Here are a few tax planning strategies to consider:

– Keep track of your expenses and receipts for potential deductions.

– Make estimated tax payments if you have self-employment income.

– Contribute to tax-advantaged accounts, such as Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs).

– Continuously educate yourself on changes in tax laws and regulations.

– Regularly review and adjust your financial and investment strategies.

8. What are the risks of trying to maximize tax return benefits?

While it’s important to take advantage of available deductions and credits, it’s essential to ensure compliance with tax laws and regulations. Attempting to maximize tax return benefits by engaging in fraudulent activities or misreporting information can lead to penalties, fines, and legal issues. Always prioritize accuracy and honesty when filing your taxes, and consult a tax professional if you have any concerns or uncertainties.

Final Thoughts

To maximize tax return benefits, there are several strategies you can employ. First, be sure to take advantage of all available deductions and credits that apply to your situation. Keep thorough records and stay organized throughout the year to make the filing process smoother. Consider contributing to retirement accounts, which can provide both tax benefits and help secure your financial future. Additionally, explore options for tax-efficient investments and consult with a tax professional if needed. By implementing these practices and staying proactive, you can optimize your tax return benefits and potentially save more money in the long run. How to maximize tax return benefits should always be at the forefront of your financial planning, and with careful attention and proactive strategies, you can make the most of your tax situation.