Struggling with healthcare costs without insurance? Don’t worry, there are ways to navigate this challenging situation and still receive the care you need. In this blog article, we will guide you through practical solutions for managing healthcare expenses without the safety net of insurance. Whether you are seeking tips on negotiating medical bills, finding affordable alternatives, or accessing assistance programs, we’ve got you covered. So, let’s dive into the world of healthcare costs without insurance and discover how to navigate this complex landscape.

How to Navigate Healthcare Costs Without Insurance

In today’s world, healthcare costs can be astronomical. For those who find themselves without insurance coverage, it can be even more daunting to face these expenses head-on. However, with the right strategies and knowledge, it is possible to navigate healthcare costs without insurance and still receive the care you need. In this article, we will explore various ways to go about managing healthcare costs without insurance, from negotiating with healthcare providers to exploring alternative options and resources.

1. Negotiate with Healthcare Providers

One of the first steps to take when facing healthcare costs without insurance is to negotiate with healthcare providers. Although it may feel intimidating, many providers are willing to work with patients to find a more affordable solution. Here are a few tips for navigating this negotiation process:

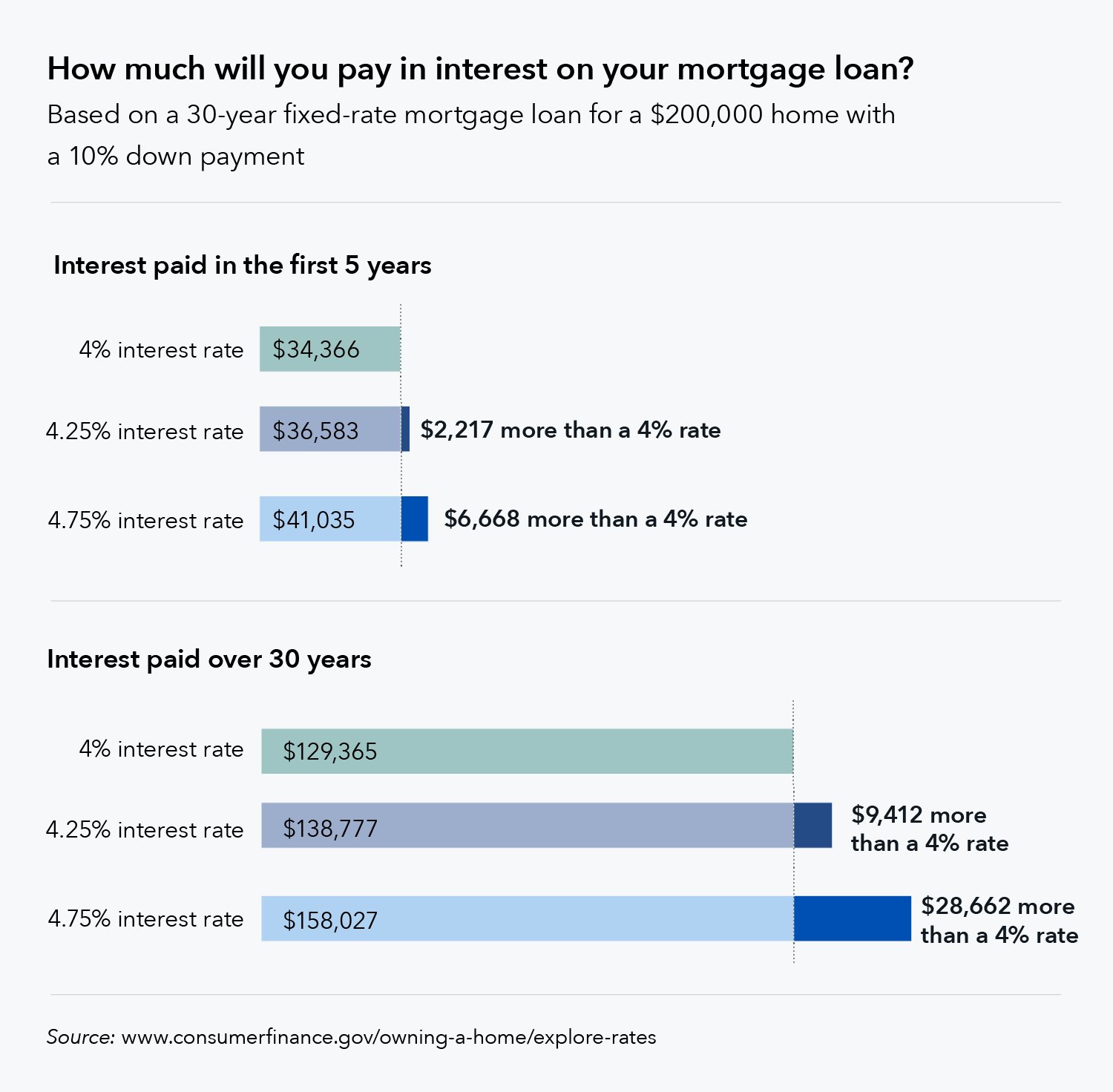

- Research and compare prices: Before discussing costs with a healthcare provider, do some research and find out what other providers in your area charge for similar services. This information will give you leverage in negotiations.

- Seek financial assistance programs: Many healthcare providers offer financial assistance programs for uninsured patients. These programs can help reduce or even eliminate the cost of care.

- Ask for a payment plan: If the total cost of your care is still unaffordable, ask the provider if they offer payment plans. This will allow you to spread out the payments over a period of time.

- Consider cash discounts: Some healthcare providers offer cash discounts for patients who pay upfront. Inquire about this option during your negotiations.

- Be open and honest: When discussing costs with your healthcare provider, be open and honest about your financial situation. They may be more willing to work with you if they understand your circumstances.

2. Explore Alternative Healthcare Options

When you don’t have insurance, it’s essential to explore alternative healthcare options that may be more affordable. Here are a few alternatives to consider:

a) Community Health Centers

Community health centers are nonprofit healthcare facilities that offer services to individuals and families who lack insurance coverage. These centers provide a wide range of healthcare services, including primary care, dental care, and mental health services, at reduced costs based on a sliding fee scale. To find a community health center near you, visit the Health Resources and Services Administration’s website.

b) Free or Low-Cost Clinics

Free or low-cost clinics are another option to consider for receiving healthcare services without insurance. These clinics often operate on a volunteer basis and provide basic medical care, screenings, and some prescription medications at little to no cost. Some clinics may have income requirements, so it’s important to inquire about eligibility before seeking care.

c) Telemedicine

Telemedicine has become increasingly popular, especially with the rise of digital health platforms. Through telemedicine, you can consult with healthcare professionals remotely via video or phone calls. This option is often more affordable than in-person visits and allows you to receive medical advice, prescriptions, and even some diagnostic services without leaving your home. Do some research to find reputable telemedicine providers in your area.

3. Utilize Prescription Assistance Programs

Prescription medications can be a significant expense, but there are resources available to help reduce these costs:

- Pharmacy discount programs: Many pharmacies offer discount programs that can significantly lower the cost of prescription medications. Look into these programs and compare prices to find the best deals.

- Manufacturer assistance programs: Some pharmaceutical companies have assistance programs that provide medications at reduced prices or even for free. Check the websites of medication manufacturers or contact them directly to inquire about available assistance programs.

- Prescription assistance websites: Online prescription assistance websites, such as GoodRx, can help you find the lowest prices for medications in your area. These websites often provide coupons and discounts that you can use at participating pharmacies.

4. Practice Preventive Care

Prevention is key when it comes to managing healthcare costs. By practicing preventive care, you can reduce the likelihood of developing costly health issues or catching them early when they are easier and less expensive to treat. Here are a few ways to prioritize preventive care without insurance:

- Maintain a healthy lifestyle: Focus on eating a balanced diet, exercising regularly, getting enough sleep, and managing stress. These lifestyle choices can significantly impact your overall health and reduce the likelihood of developing chronic conditions.

- Take advantage of free screenings: Many communities offer free or low-cost health screenings for conditions such as diabetes, high blood pressure, and cancer. Stay informed about these opportunities and take advantage of them when available.

- Stay up to date with vaccinations: Vaccinations are a crucial aspect of preventive care. Research which vaccinations are recommended for your age group and try to receive them at affordable or free clinics if possible.

5. Research Medical Tourism

Medical tourism is a growing trend that involves traveling to other countries for medical procedures at a fraction of the cost compared to the United States. While this option may not be feasible for everyone, it’s worth exploring if you require a costly medical procedure. However, it’s important to research the reputation and credentials of healthcare providers in the destination country, as well as any potential risks involved in traveling for medical care.

6. Consider Health Sharing Programs

Health sharing programs, also known as healthcare sharing ministries, are alternative options to traditional health insurance. These programs operate on the basis of members pooling their resources to cover each other’s healthcare costs. While not insurance in the traditional sense, health sharing programs can provide financial assistance for eligible medical expenses. It’s crucial to thoroughly research and understand the terms, limitations, and requirements of any health sharing program before joining.

Navigating healthcare costs without insurance can be challenging, but it’s not impossible. By employing strategies such as negotiating with healthcare providers, exploring alternative healthcare options, utilizing prescription assistance programs, practicing preventive care, considering medical tourism, and researching health sharing programs, you can find ways to manage and reduce your healthcare expenses. Remember to always stay proactive, informed, and proactive in seeking out resources and assistance to ensure you receive the care you need without being overwhelmed by excessive costs.

How much emergency room costs without a US insurance

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I navigate healthcare costs without insurance?

Without insurance, there are several strategies you can employ to navigate healthcare costs:

2. Are there any government programs available to help with healthcare costs for uninsured individuals?

Yes, there are government programs like Medicaid and the Children’s Health Insurance Program (CHIP) that provide assistance to eligible individuals and families.

3. Can I negotiate the cost of medical procedures and services?

Yes, you can try negotiating the cost of medical procedures and services with healthcare providers. It is often worth discussing payment plans, discounts, or even seeking out lower-cost alternatives.

4. How can I find affordable healthcare providers and facilities?

To find affordable healthcare providers and facilities, you can utilize online resources, community health clinics, or seek recommendations from local organizations or social services.

5. What are some alternatives to traditional healthcare services?

Alternative options include utilizing telemedicine services, visiting walk-in clinics, or exploring free or low-cost health screenings and events in your community.

6. How can I best manage prescription medication costs without insurance?

There are several ways to manage prescription medication costs without insurance. These include using generic medications, exploring patient assistance programs, and comparing prices at different pharmacies.

7. Are there any organizations or charities that provide financial assistance for healthcare expenses?

Yes, there are organizations and charities that offer financial assistance for healthcare expenses. Research local and national resources that may be available to you.

8. What steps can I take to prevent high healthcare costs in the first place?

To prevent high healthcare costs, focus on preventive care, maintain a healthy lifestyle, research and understand your insurance options, and stay knowledgeable about available healthcare resources in your community.

Final Thoughts

Navigating healthcare costs without insurance can be challenging, but there are several strategies you can employ to manage your expenses effectively. Firstly, research and compare prices for medical services to ensure you are getting the best deal. Secondly, negotiate with healthcare providers to potentially lower the overall cost of your medical bills. Additionally, explore alternative options such as community health clinics or telemedicine services that offer more affordable or even free healthcare. Lastly, consider enrolling in prescription discount programs or utilizing generic medications to save on prescription costs. By being proactive and resourceful, you can navigate healthcare costs without insurance and prioritize your well-being.